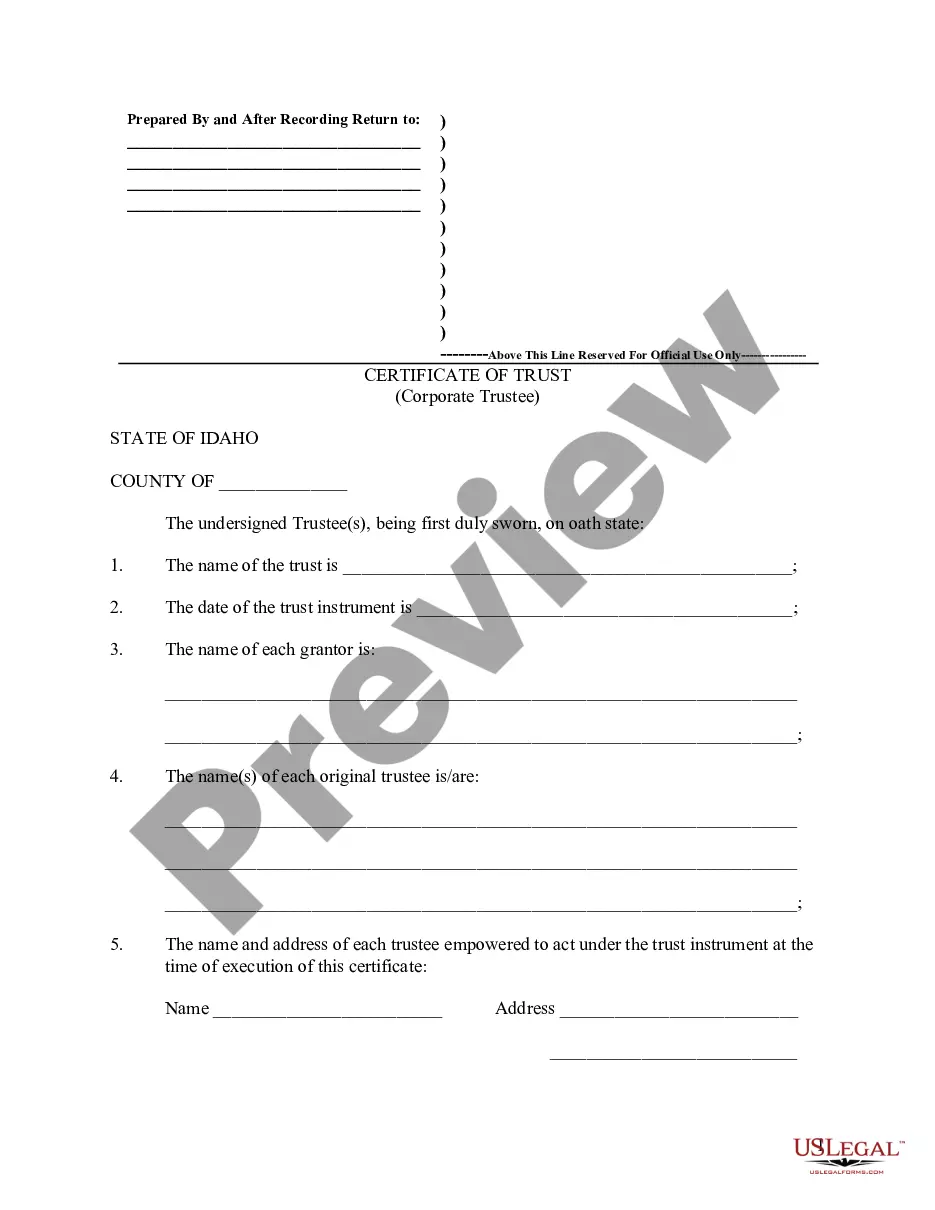

Idaho Certificate of Trust by Individual

Description

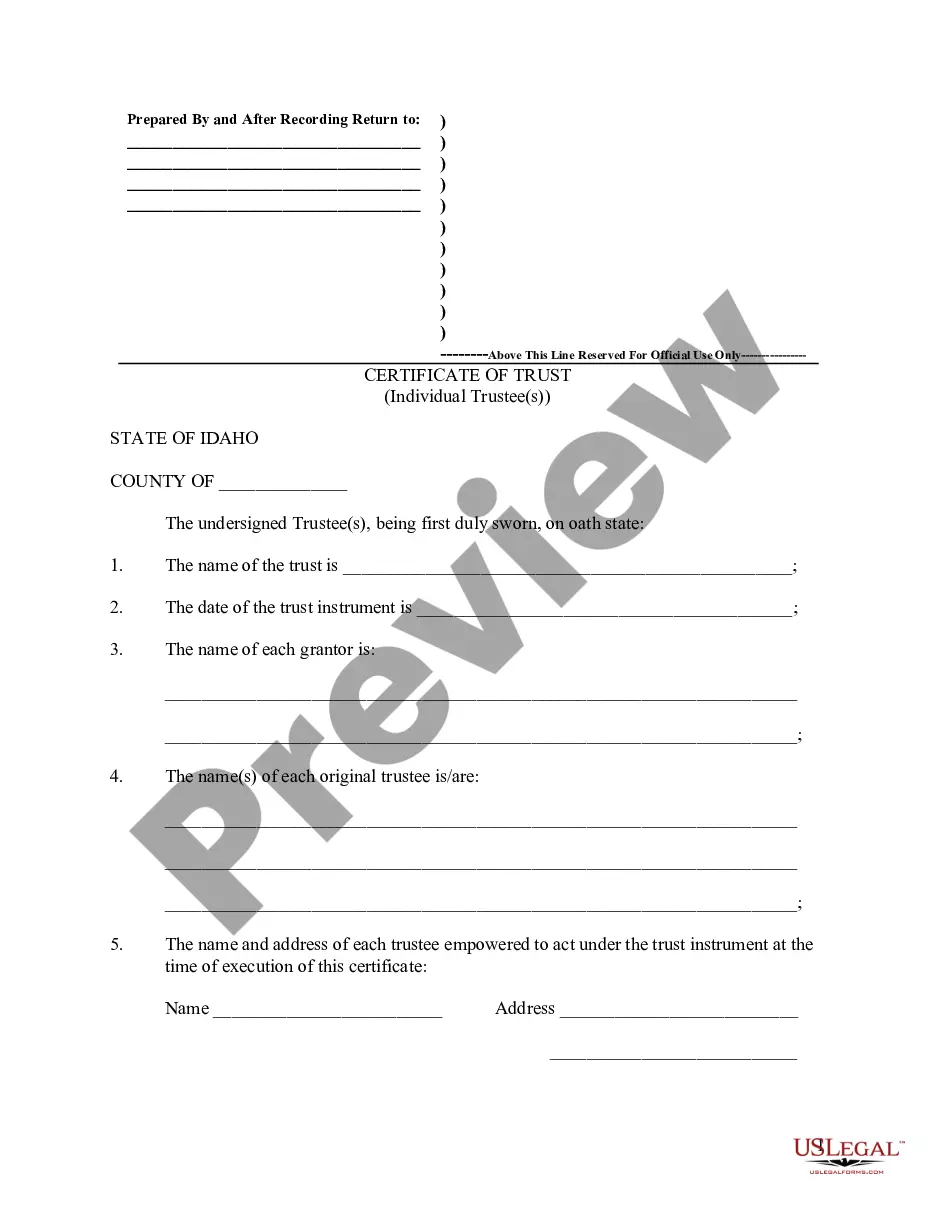

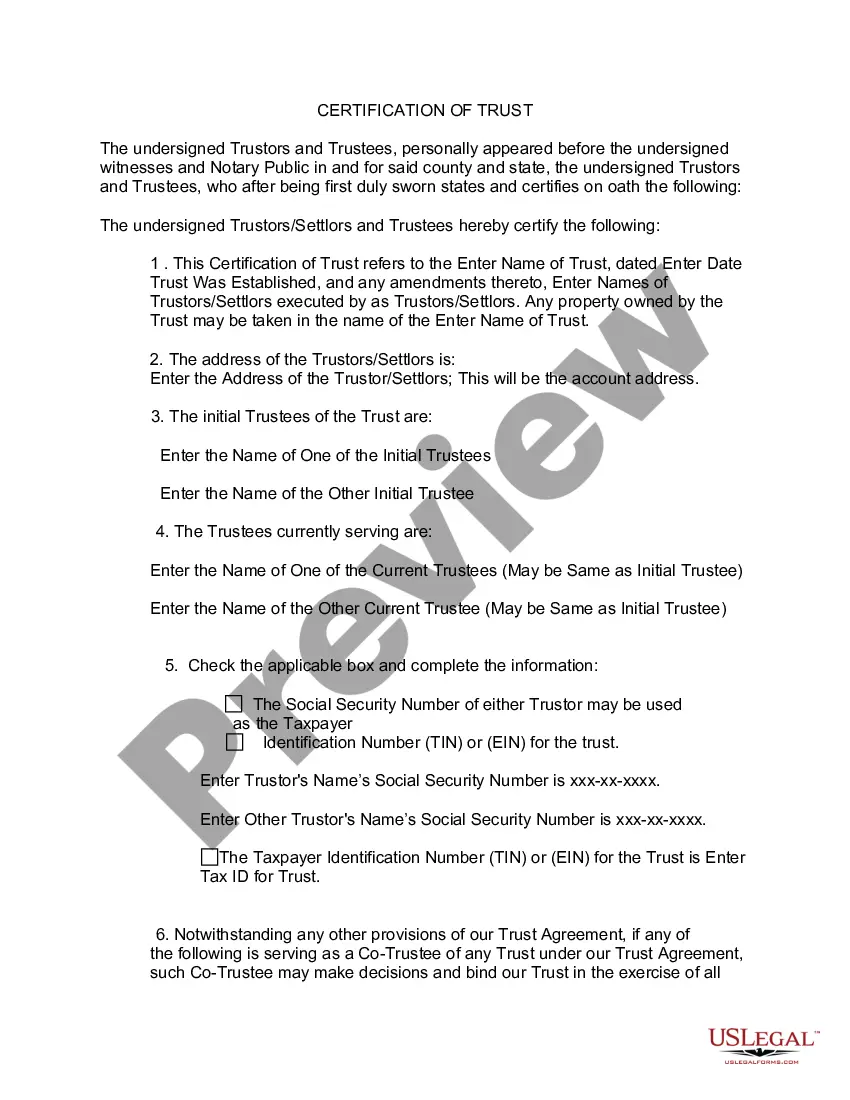

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

How to fill out Idaho Certificate Of Trust By Individual?

Obtain the most extensive directory of approved forms. US Legal Forms is essentially a platform where you can discover any state-specific template in just a few clicks, such as Idaho Certificate of Trust by Individual instances.

No need to waste hours of your time hunting for a court-acceptable template. Our expert team guarantees you receive current templates at all times.

To utilize the document library, choose a subscription and create your account. If you have already registered, just Log In and hit the Download button. The Idaho Certificate of Trust by Individual file will be promptly saved in the My documents tab (a section for all forms you store on US Legal Forms).

That's all! You need to complete the Idaho Certificate of Trust by Individual template and check out. To ensure everything is accurate, consult your local legal advisor for assistance. Sign up and easily discover over 85,000 useful templates.

- If you're about to use a state-specific document, be sure to specify the accurate state.

- If possible, review the description to understand all the details of the form.

- Utilize the Preview option if it's offered to verify the document's details.

- If everything is correct, click on the Buy Now button.

- After selecting a pricing plan, set up an account.

- Make payment via credit card or PayPal.

- Download the document to your computer by clicking Download.

Form popularity

FAQ

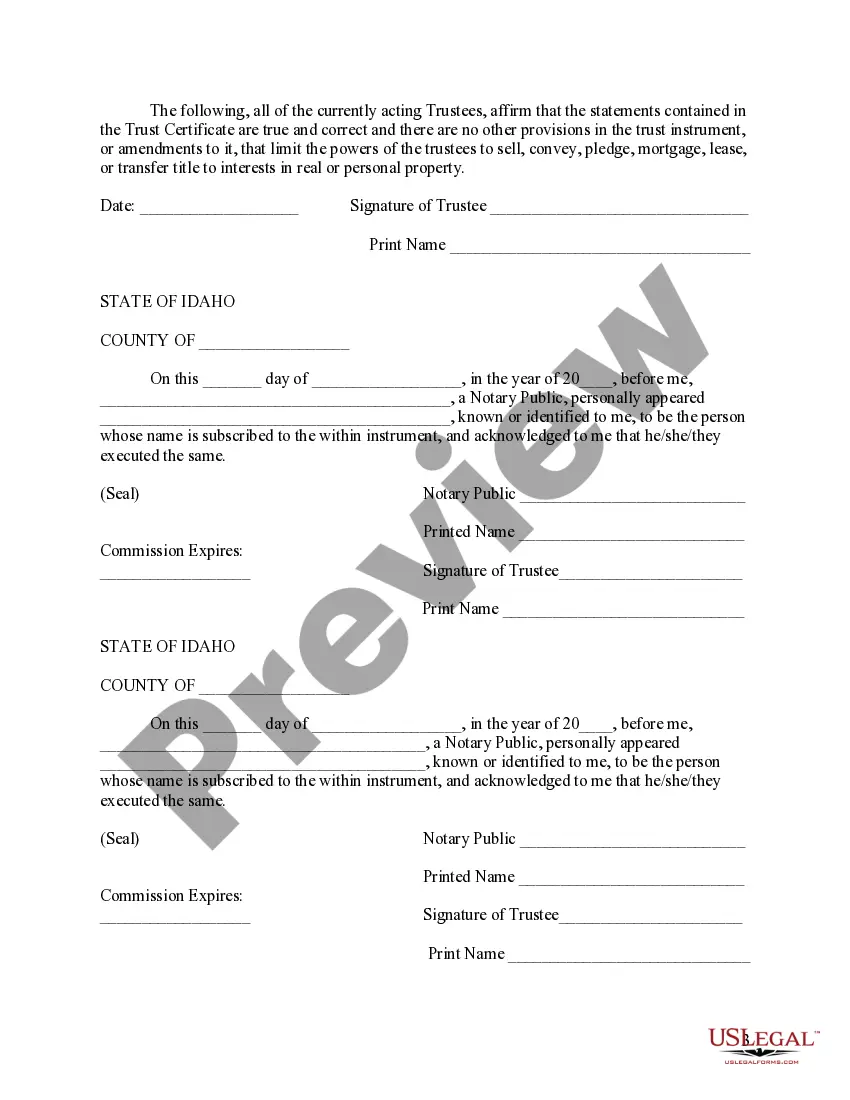

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document. Sign the document in front of a notary public.

Trusts that hold property will, like other trusts, only need to be registered if the trustees incur a liability to tax. Thus, if the property is occupied by a beneficiary and is not income-producing - no requirement for registration will exist unless a taxable event occurs for IHT, CGT or SDLT purposes.

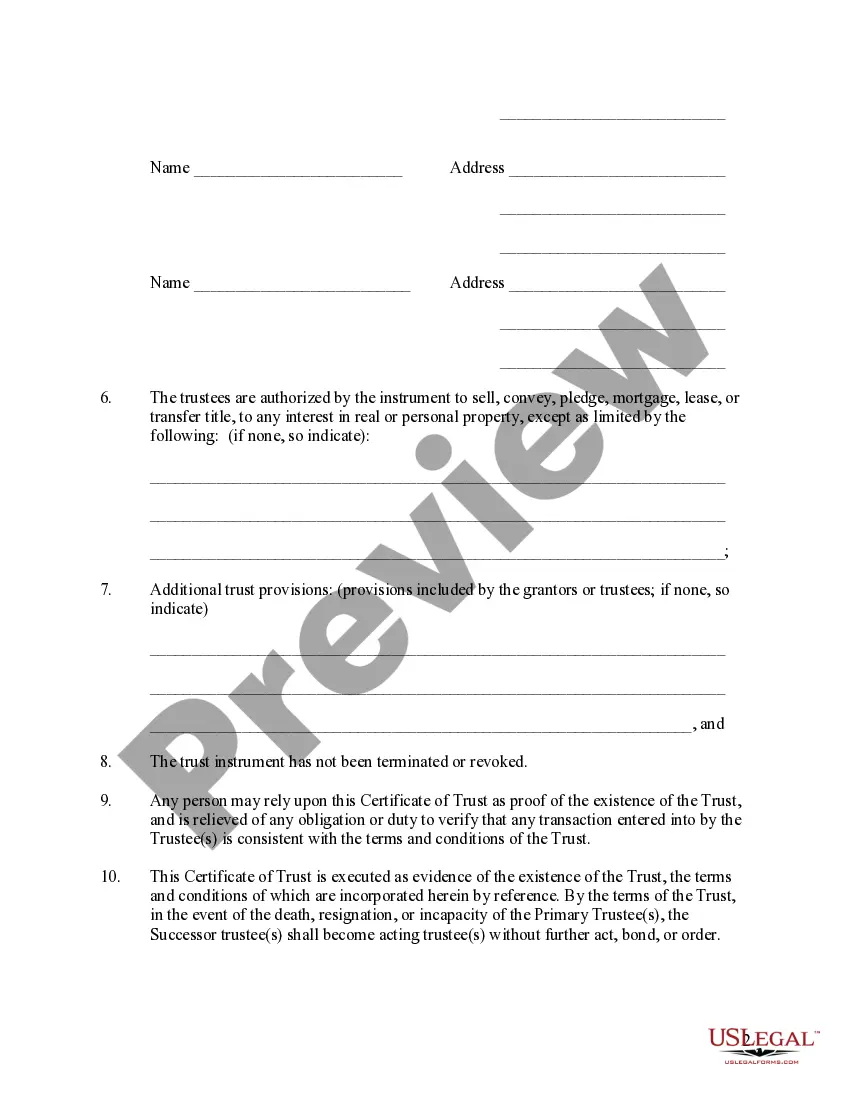

A Memorandum of Trust is a synopsis of a trust that is used when transferring real property into a trust.A Certification of Trust is used in place of the actual trust to open up an account on behalf of a trust at a financial institution.

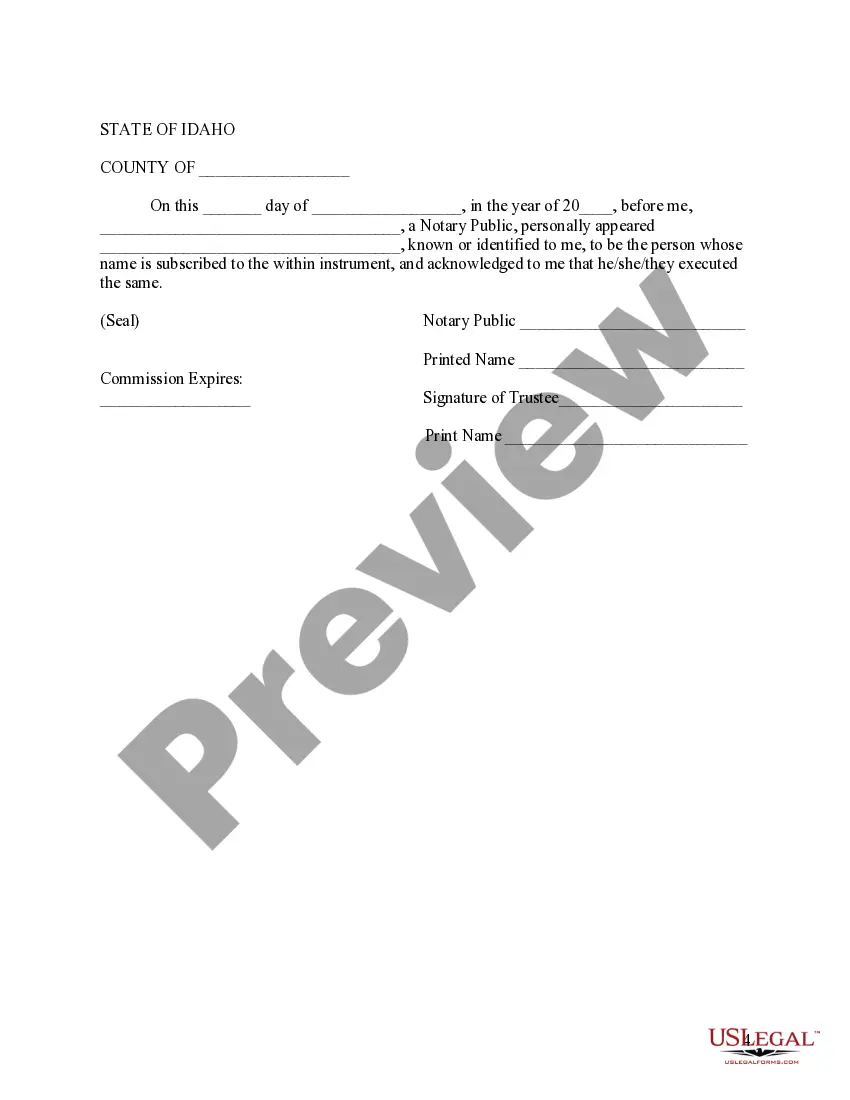

A trust document isn't required to be filed. If you are transferring real estate into a trust, a deed will need oo be filed at the county recorder's office.The declaration will detail the terms and conditions of the living trust, including who will serve as the Trustee.

All UK trusts will have to register whether or not they have tax liabilities. Those trusts which are already registered will have to provide some additional information about their beneficial owners.

California Trust Certificates Law. Delaware Trust Certificates Law. Idaho Trust Certificates Law. Iowa Trust Certificates Law. Minnesota Trust Certificates Law. Mississippi Trust Certificates Law. Nevada Trust Certificates Law. Ohio Trust Certificates Law.

Registration of a living trust doesn't give the court any power over the administration of the trust, unless there's a dispute.To register a revocable living trust, the trustee must file a statement with the court where the trustee resides or keeps trust records.

A Certificate of Trust is recorded in the Official Records of the county in which any trust real property is located. It aids in clearing title to the property. Generally, where the trust owns no real property, there is no need to record a Certificate...

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document. Sign the document in front of a notary public.