This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

Iowa Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Iowa Last Will And Testament With All Property To Trust Called A Pour Over Will?

Access the most extensive collection of legal documents.

US Legal Forms is indeed a platform where you can discover any state-specific file within a few clicks, including the Iowa Legal Last Will and Testament Form with All Property to Trust, commonly referred to as a Pour Over Will.

There’s no need to squander hours searching for a court-acceptable template. Our certified professionals ensure that you receive the latest examples consistently.

Once everything is correct, click Buy Now. After choosing a pricing plan, create your account. Make payment via card or PayPal. Download the template to your computer by clicking on the Download button. That’s it! You should complete the Iowa Legal Last Will and Testament Form with All Property to Trust, referred to as a Pour Over Will, and review it. To ensure accuracy, consult your local legal advisor for assistance. Register and easily browse approximately 85,000 useful forms.

- To utilize the document library, select a subscription plan and create your account.

- If you have already done so, just Log In and then click Download.

- The Iowa Legal Last Will and Testament Form with All Property to Trust, referred to as a Pour Over Will, will automatically be saved in the My documents section (a section for all forms you download on US Legal Forms).

- To register a new account, follow the brief guidelines below.

- If you need to use a state-specific template, make sure to specify the correct state.

- If possible, review the description to understand all the details of the document.

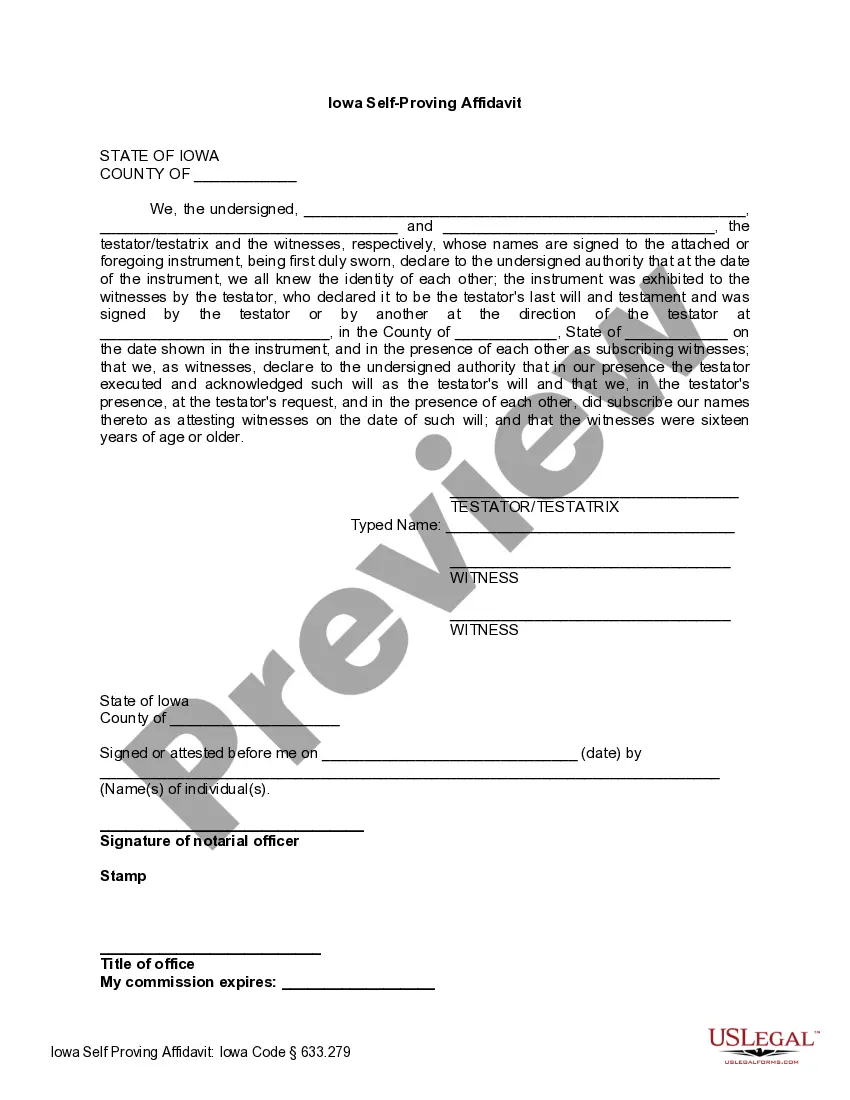

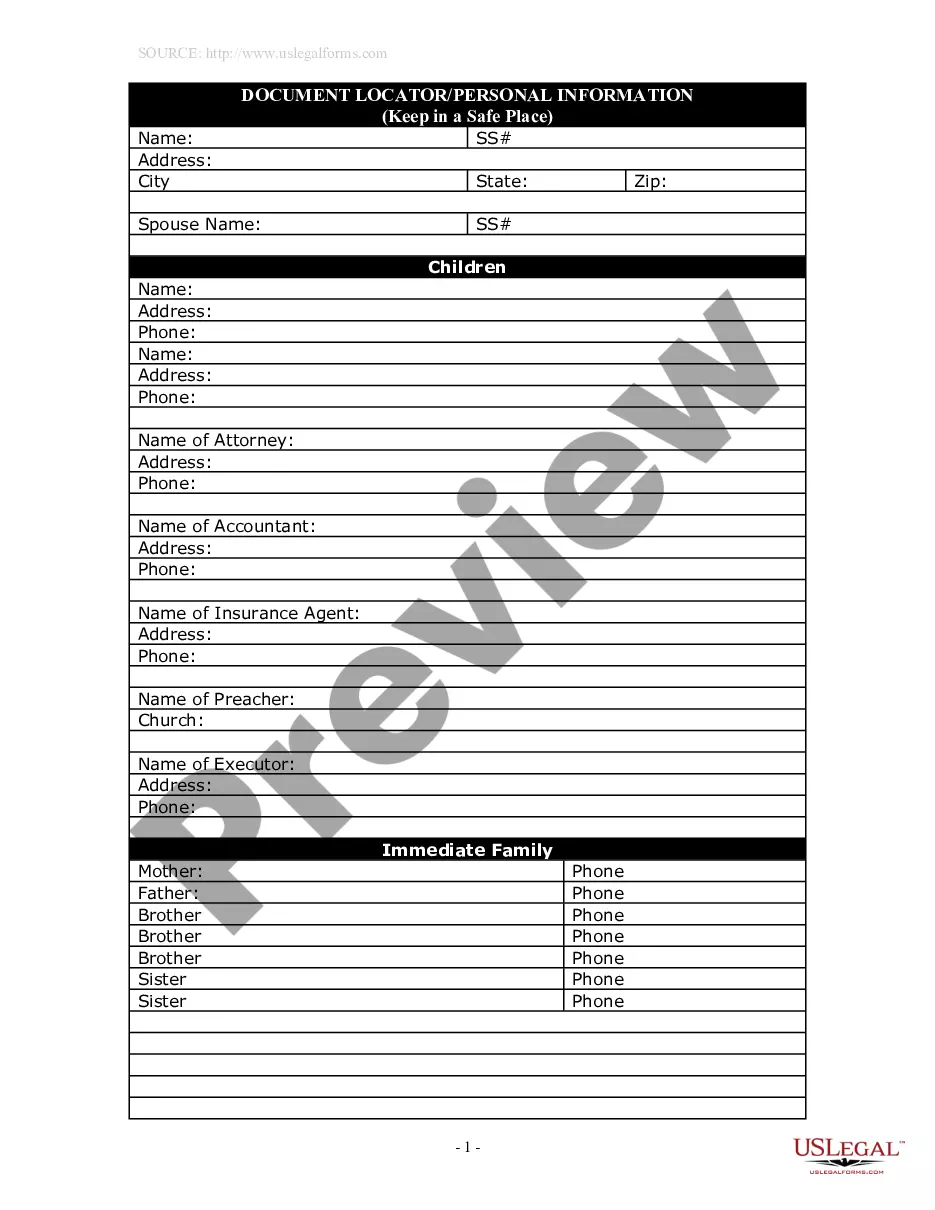

- Utilize the Preview feature if it’s accessible to examine the content of the document.

Form popularity

FAQ

A pour-over will is a testamentary device wherein the writer of a will creates a trust, and decrees in the will that the property in his or her estate at the time of his or her death shall be distributed to the Trustee of the trust.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

A will and a trust are separate legal documents that typically share a common goal of facilitating a unified estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, when there are discrepancies between the two.

If you make a living trust, you might well think that you don't need to also make a will. After all, a living trust basically serves the same purpose as a will: it's a legal document in which you leave your property to whomever you choose.But even if you make a living trust, you should make a will as well.

When people make revocable living trusts to avoid probate, it's common for them to also make what's called a "pour-over will." The will directs that if any property passes through the will at the person's death, it should be transferred to (poured into) the trust, and then distributed to the beneficiaries of the trust.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

Both are useful estate planning devices that serve different purposes, and both can work together to create a complete estate plan. One main difference between a will and a trust is that a will goes into effect only after you die, while a trust takes effect as soon as you create it.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

A Living Trust is a document that allows individual(s), or 'Grantor', to place their assets to the benefit of someone else at their death or incapacitation. Unlike a Will, a Trust does not go through the probate process with the court.