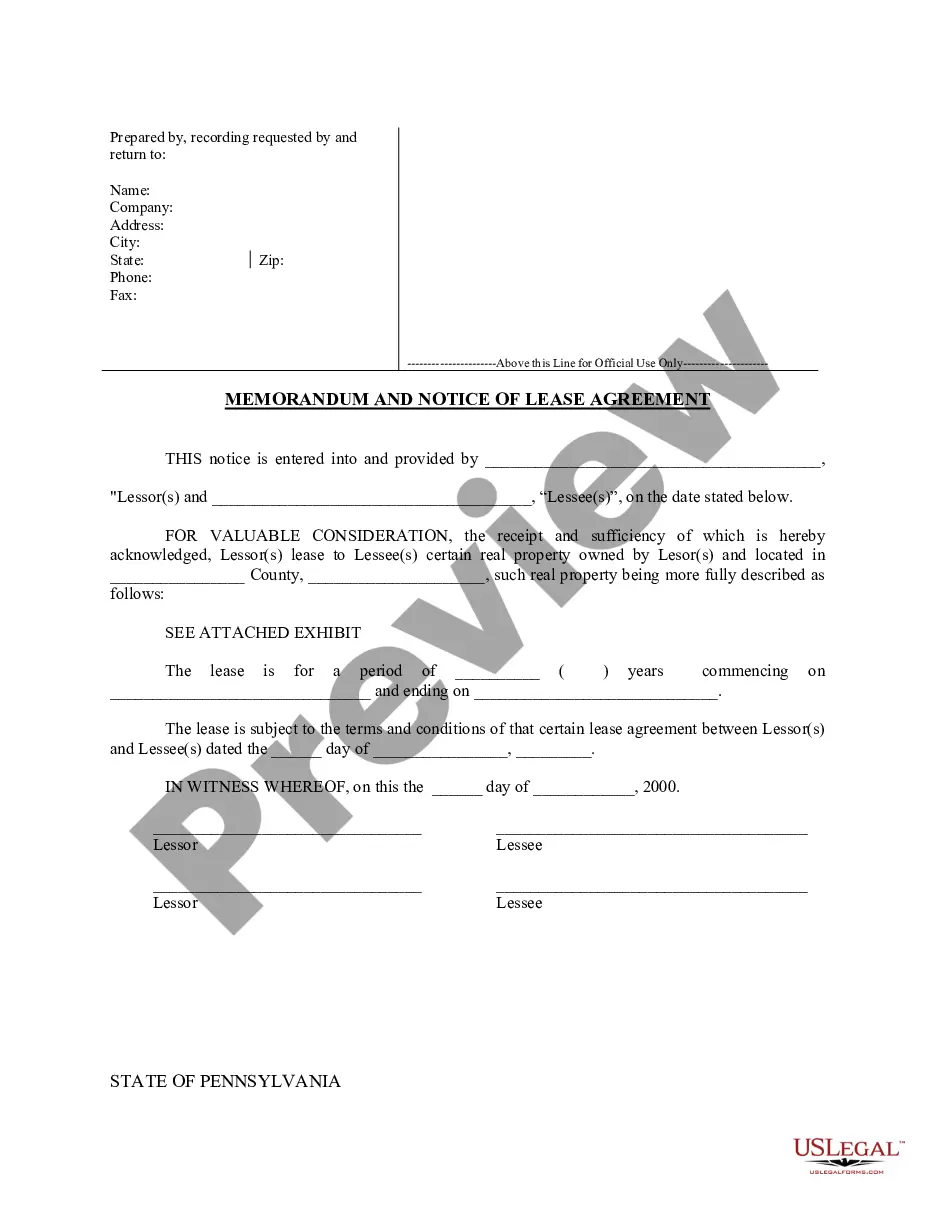

This form is a Letter To a New Employer from a previous employer of a new hire that advises the new company of the former employee's ongoing nondisclosure obligations toward his former employer with regard to highly sensitive and confidential business information and proprietary technology. Additionally, it requests that the new employer verify that the former employee will not be placed in a job position that will risk disclosure of the company's protected information.

Iowa Letter To New Employer

Description

How to fill out Letter To New Employer?

Are you presently in the place where you will need documents for possibly company or personal purposes almost every day? There are tons of lawful document templates available online, but getting ones you can trust isn`t simple. US Legal Forms provides a huge number of form templates, like the Iowa Letter To New Employer, which are composed in order to meet state and federal demands.

If you are presently knowledgeable about US Legal Forms web site and have an account, simply log in. Afterward, you may obtain the Iowa Letter To New Employer template.

Unless you offer an accounts and want to begin using US Legal Forms, follow these steps:

- Discover the form you want and ensure it is for the appropriate area/area.

- Take advantage of the Review switch to analyze the form.

- See the description to actually have chosen the correct form.

- In case the form isn`t what you`re trying to find, utilize the Look for industry to discover the form that fits your needs and demands.

- Once you get the appropriate form, just click Purchase now.

- Opt for the prices strategy you would like, fill out the required details to create your money, and purchase an order utilizing your PayPal or charge card.

- Choose a handy data file format and obtain your backup.

Locate all the document templates you possess purchased in the My Forms menus. You can obtain a additional backup of Iowa Letter To New Employer any time, if necessary. Just click the needed form to obtain or printing the document template.

Use US Legal Forms, by far the most substantial selection of lawful forms, in order to save time and steer clear of mistakes. The service provides appropriately created lawful document templates which you can use for a range of purposes. Create an account on US Legal Forms and commence generating your lifestyle a little easier.

Form popularity

FAQ

Employers aren't limited to confirming dates of employment. They can even disclose the circumstances surrounding the end of your employment. Although many employers adhere to confidentiality restrictions as a matter of internal policy, Iowa law recognizes very little in the way of such employment confidentiality.

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

Iowa law requires you to report new hires within 15 days of the date of hire. Federal law requires the reporting of new hires within 20 days.

Iowa income tax is generally required to be withheld in cases where federal income tax is withheld. In situations where no federal income tax is withheld, the receiver of the payment may choose to have Iowa withholding taken out. Withholding on nonwage income may be made at a rate of 5 percent.

Why did the Department send me a letter? We send letters for the following reasons: You have a balance due. We have a question about your tax return.

U.S. States that Require State Tax Withholding Forms Alabama. Arizona. Arkansas. California. Connecticut. District of Columbia. Georgia. Hawaii.

Iowa joins 12 other states that currently do not tax retirement income. These include nine states that don't tax individual income of any kind, as well as Illinois, Mississippi, and Pennsylvania, which do not tax income from 401(k) plans, IRAs, or pensions.

Employers are required by law to withhold employment taxes from their employees. Employment taxes include federal income tax withholding and Social Security and Medicare Taxes.