Iowa Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

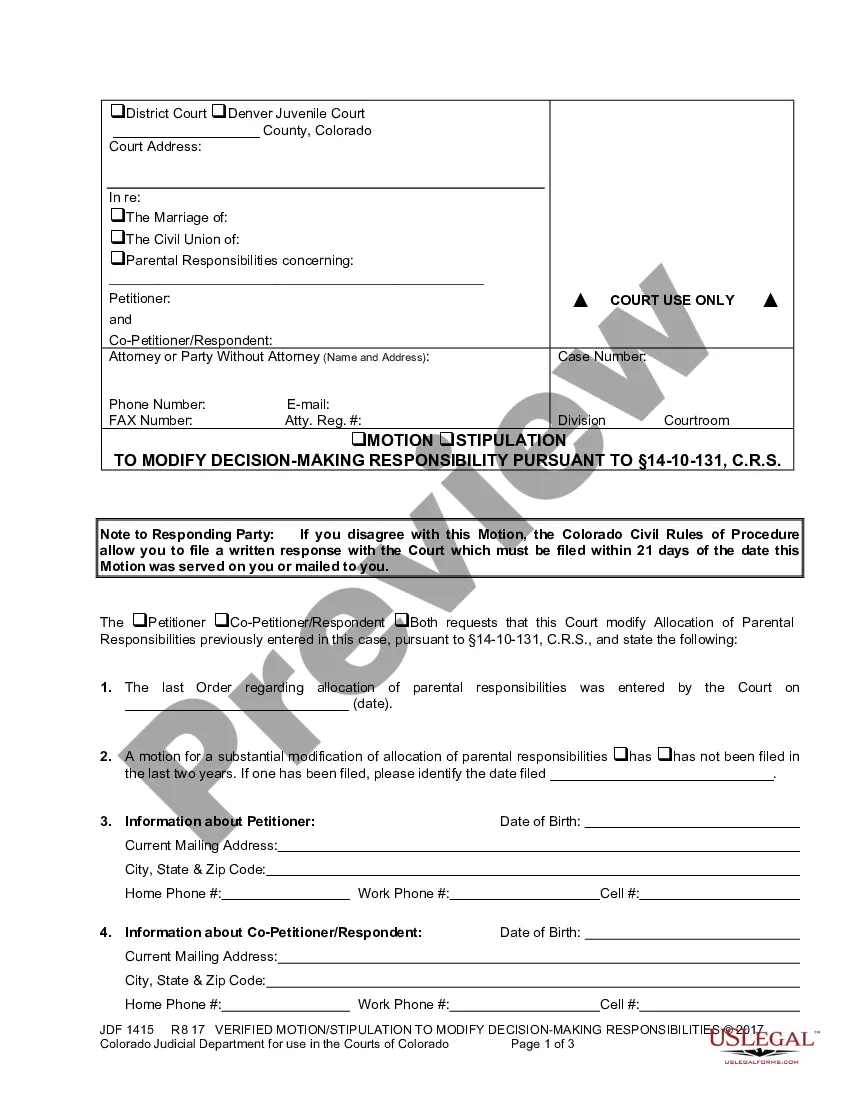

How to fill out Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

Finding the right authorized document template might be a struggle. Of course, there are tons of themes available online, but how can you find the authorized form you require? Utilize the US Legal Forms internet site. The services provides a huge number of themes, such as the Iowa Assignment of Overriding Royalty Interest (No Proportionate Reduction), which you can use for enterprise and private demands. All of the kinds are inspected by specialists and meet up with state and federal requirements.

In case you are already registered, log in for your accounts and click the Download key to get the Iowa Assignment of Overriding Royalty Interest (No Proportionate Reduction). Make use of your accounts to appear through the authorized kinds you might have ordered formerly. Proceed to the My Forms tab of the accounts and have an additional duplicate of the document you require.

In case you are a fresh customer of US Legal Forms, listed here are simple recommendations for you to comply with:

- Initially, be sure you have chosen the appropriate form for the town/area. You can look over the form making use of the Preview key and study the form information to make certain it will be the best for you.

- If the form fails to meet up with your requirements, use the Seach field to find the proper form.

- Once you are sure that the form is acceptable, click on the Get now key to get the form.

- Opt for the prices plan you would like and enter in the needed info. Build your accounts and pay money for your order with your PayPal accounts or Visa or Mastercard.

- Select the document structure and down load the authorized document template for your gadget.

- Full, modify and printing and signal the acquired Iowa Assignment of Overriding Royalty Interest (No Proportionate Reduction).

US Legal Forms will be the biggest local library of authorized kinds for which you can see a variety of document themes. Utilize the service to down load expertly-produced paperwork that comply with status requirements.

Form popularity

FAQ

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

Non-Participating Royalty Interest (NPRI) Unlike a mineral interest owner, the NPRI owner does not have ?executive? rights, meaning they cannot sign an oil and gas lease or participate in the benefits of lease bonus or delay rentals.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

Surface rights are what you own on the surface of the property. These include the space, the buildings and the landscaping. Mineral rights, on the other hand, cover the specific resources beneath the surface. In areas designated for mining, it's common for surface rights and mineral rights to be separate.

Mineral ownership, or mineral rights, are understood to be the property rights to exploit an area for the minerals, gas, or oil it harbors. The four types of mineral ownership are: Mineral Interest ? interest generated after the production of oil and gas after the sale of a deed or a lease.

Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.