This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Iowa Minimum Royalty Payments

Description

How to fill out Minimum Royalty Payments?

It is possible to invest hours online trying to find the authorized record design that suits the federal and state needs you want. US Legal Forms gives a large number of authorized kinds that happen to be analyzed by professionals. It is simple to acquire or printing the Iowa Minimum Royalty Payments from our service.

If you already have a US Legal Forms profile, it is possible to log in and then click the Acquire key. After that, it is possible to total, change, printing, or indication the Iowa Minimum Royalty Payments. Every single authorized record design you acquire is the one you have eternally. To get an additional copy of the purchased form, proceed to the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms web site for the first time, follow the straightforward instructions under:

- Very first, make sure that you have chosen the correct record design for your state/area of your liking. Browse the form outline to ensure you have selected the right form. If accessible, take advantage of the Review key to check with the record design too.

- In order to find an additional model of your form, take advantage of the Lookup field to get the design that suits you and needs.

- When you have located the design you would like, just click Acquire now to carry on.

- Select the costs plan you would like, type in your credentials, and register for a free account on US Legal Forms.

- Full the financial transaction. You can use your Visa or Mastercard or PayPal profile to pay for the authorized form.

- Select the formatting of your record and acquire it to your device.

- Make adjustments to your record if necessary. It is possible to total, change and indication and printing Iowa Minimum Royalty Payments.

Acquire and printing a large number of record web templates while using US Legal Forms Internet site, that offers the largest variety of authorized kinds. Use skilled and express-specific web templates to deal with your company or person requires.

Form popularity

FAQ

The IA PTE-C Iowa Composite Return is new for tax years beginning on or after January 1, 2022. Iowa Code section 422.16B imposes composite return filing and tax remittance obligations on entities taxed as partnerships, S corporations, estates, or trusts for tax years beginning on or after January 1, 2022.

The composite return must include all nonresident partners, shareholders, employees, or beneficiaries unless the taxpayer can demonstrate which nonresident partners, shareholders, employees, or beneficiaries are filing separate income tax returns because the partner, shareholder, employee or beneficiary has Iowa source ...

Iowa's 2021 Tax Brackets The state standard deductions in 2021 for Iowans are also set to rise slightly: $2,130 for single filers. $2,130 for married taxpayers filing separately. $5,240 for married filing jointly.

On the IA 126, A will report only the wages and interest income earned while an Iowa resident as Iowa-source income. The interest income earned the last half of the year is not considered Iowa-source income since A was no longer an Iowa resident.

The tax rate for the pass-through entity tax is equal to the highest individual income tax rate under Iowa Code section 422.5A (8.53% for 2022 and 6% for 2023). The pass-through entity tax shall be due with the pass-through entity's tax return.

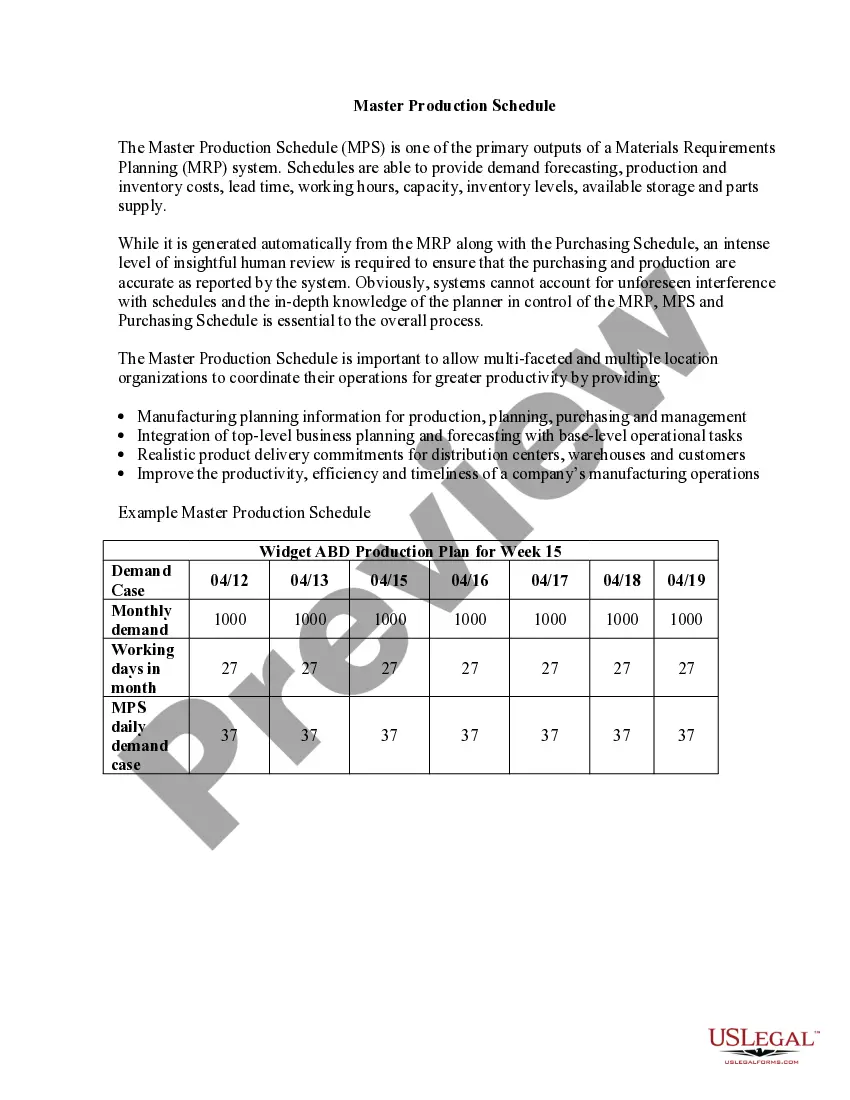

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows

Every individual or married couple filing a joint Iowa return that expects to have a tax liability of $200 or more from income not subject to withholding. Each individual required to make estimated payments must file an estimated payment under his/her name and Social Security Number.

For tax years ending on or after December 31, 2022, an Iowa Partnership Return of Income (IA 1065) or Iowa Income Tax Return for S Corporation (IA 1120S) must be filed electronically using the federal modernized e-file system (MeF) if it meets any one of the following conditions for the tax year: ? The pass-through ...

The table below lists the income tax rates which will be in effect for tax years 2023 through 2026. Beginning in tax year 2026, Iowa will have a flat individual income tax rate of 3.9%. The upper and lower limits of the income tax brackets double for married taxpayers who file a joint return.

The minimum amount (or threshold) of income requiring you to file a federal tax return.