Iowa Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

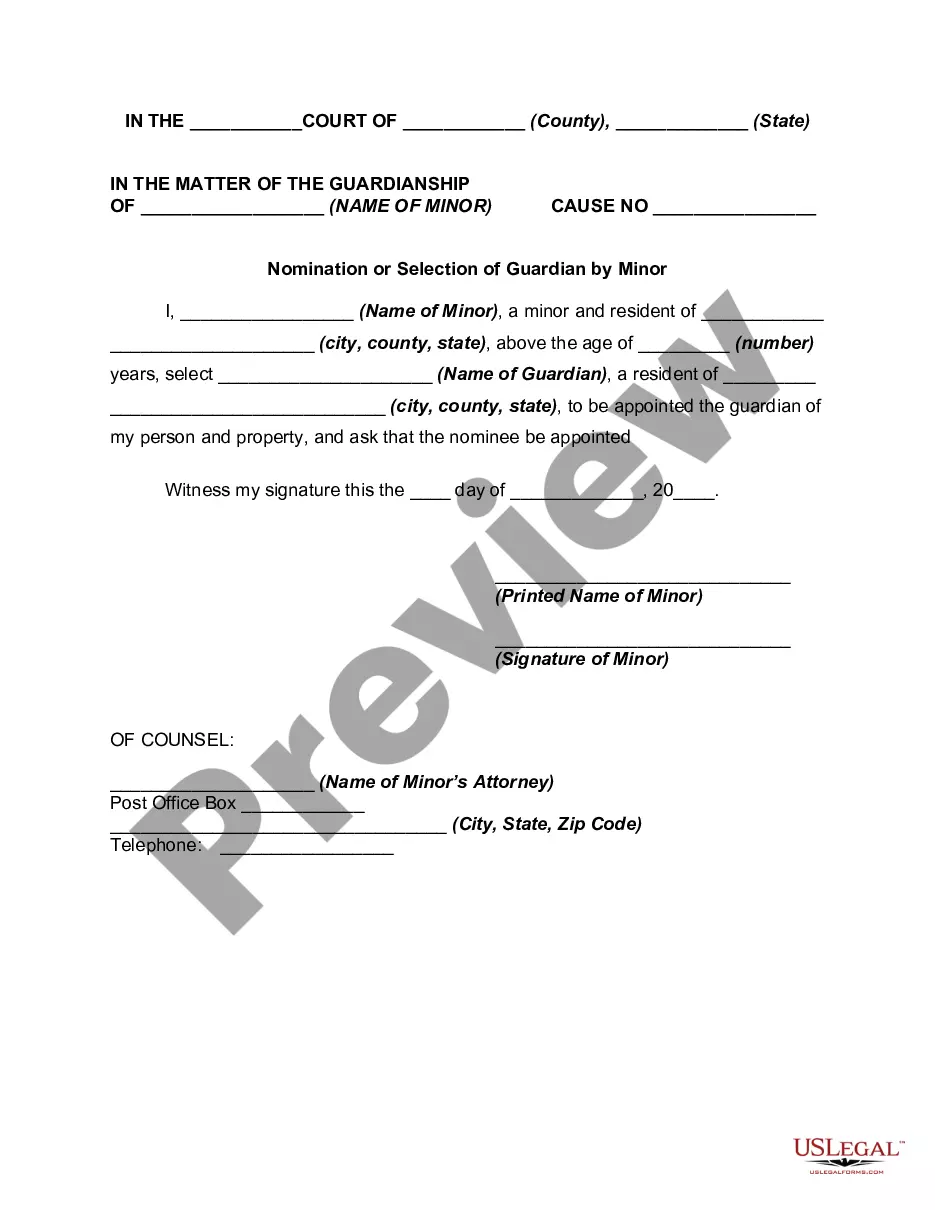

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

US Legal Forms - among the largest libraries of legitimate varieties in America - delivers a variety of legitimate document web templates you may down load or print out. While using site, you may get a large number of varieties for business and personal functions, categorized by types, claims, or keywords and phrases.You will find the newest models of varieties such as the Iowa Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease within minutes.

If you already possess a registration, log in and down load Iowa Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease from your US Legal Forms collection. The Acquire option will show up on every single form you view. You have accessibility to all previously saved varieties within the My Forms tab of your respective account.

If you would like use US Legal Forms initially, listed here are easy instructions to help you get started:

- Ensure you have picked out the best form for the town/region. Click the Review option to analyze the form`s content material. Read the form outline to actually have chosen the proper form.

- When the form does not suit your demands, use the Search industry near the top of the screen to discover the the one that does.

- If you are happy with the form, verify your selection by simply clicking the Buy now option. Then, choose the pricing program you prefer and supply your credentials to sign up to have an account.

- Method the financial transaction. Use your charge card or PayPal account to perform the financial transaction.

- Find the formatting and down load the form on your system.

- Make changes. Complete, revise and print out and indicator the saved Iowa Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

Every single design you included in your money lacks an expiry day and it is the one you have eternally. So, if you wish to down load or print out another copy, just proceed to the My Forms area and then click on the form you want.

Obtain access to the Iowa Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease with US Legal Forms, by far the most considerable collection of legitimate document web templates. Use a large number of professional and condition-specific web templates that fulfill your organization or personal demands and demands.

Form popularity

FAQ

Oil and gas royalties refer to the payments made to the owner of the mineral rights, which are the rights to extract oil and gas from the land. These royalties are typically a percentage of the revenue generated from the production and sale of the oil and gas extracted from the land.

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

It is calculated as follows: Volume X Price ? Deductions ? Taxes X Owner Interest = Your Royalty Payment. Whether you are a mineral owner receiving royalty checks or just wanting to know what your minerals are worth, LandGate knows what they are worth and can market your minerals to get you the most money.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

Royalty Payment Clauses A royalty is agreed upon as a percentage of the lease, minus what was reasonably used in the lessee's production costs. This is stipulated in a Royalty Clause. The royalty is paid by the lessee to the owner of the mineral rights, the lessor in the lease.

1. n. [Oil and Gas Business] Ownership in a share of production, paid to an owner who does not share in the right to explore or develop a lease, or receive bonus or rental payments. It is free of the cost of production, and is deducted from the royalty interest.

In many cases, royalty payments happen once a month, but exactly when and how much artists get paid depends on their individual agreements with their record label or distributor.

Generally, the standard royalty rates for authors is under 10% for traditional publishing and up to 70% with self-publishing.