This form is used when the Lessor and Lessee desire to amend the description of the Lands subject to the Lease by dividing the Lands into separate tracts, with each separate tract being deemed to be covered by a separate and distinct oil and gas lease even though all of the lands are described in the one Lease.

Iowa Amendment to Oil and Gas Lease to Reduce Annual Rentals

Description

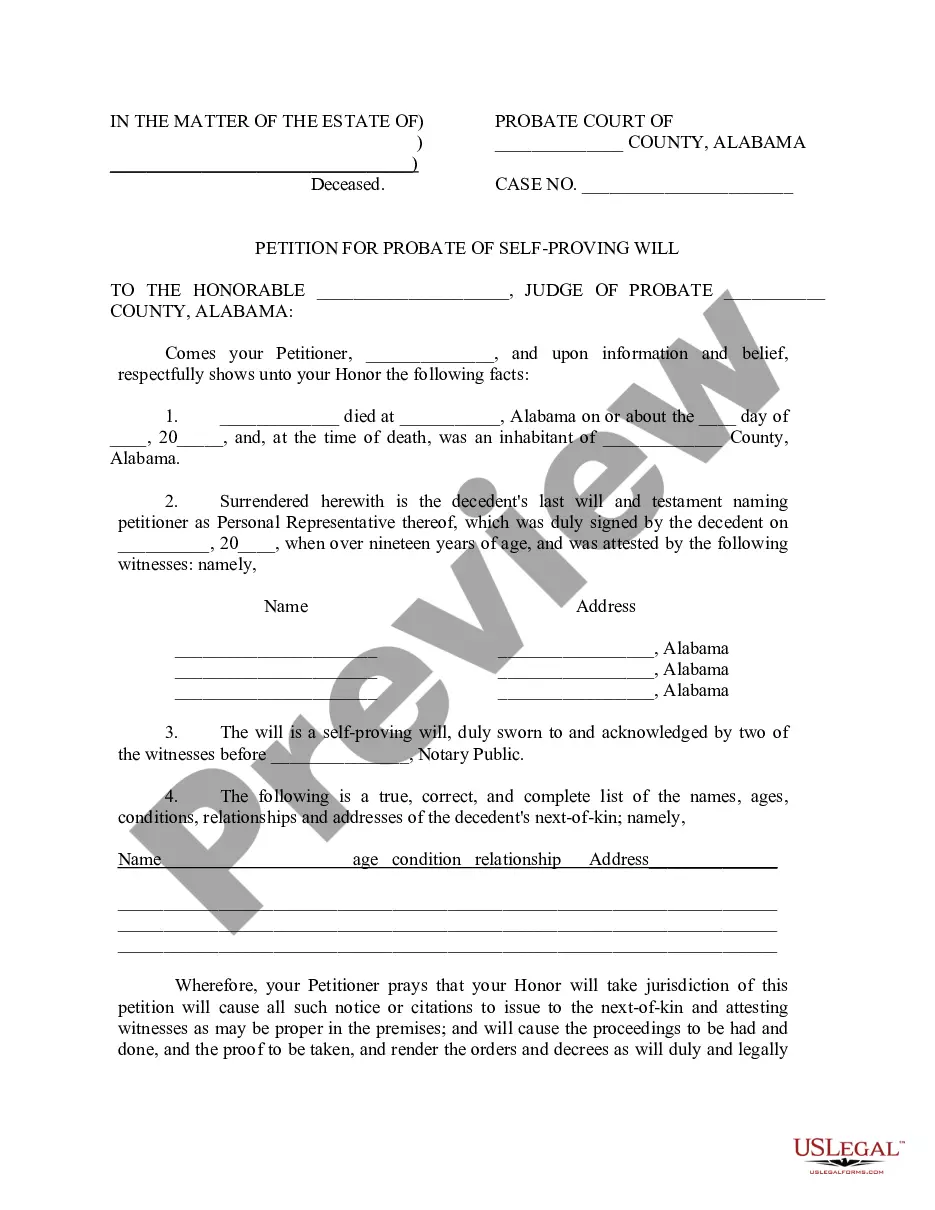

How to fill out Amendment To Oil And Gas Lease To Reduce Annual Rentals?

If you want to comprehensive, down load, or print out authorized record themes, use US Legal Forms, the greatest variety of authorized types, which can be found on the Internet. Use the site`s basic and handy lookup to obtain the papers you need. Different themes for company and specific functions are categorized by groups and says, or keywords. Use US Legal Forms to obtain the Iowa Amendment to Oil and Gas Lease to Reduce Annual Rentals with a handful of clicks.

If you are already a US Legal Forms consumer, log in to the accounts and then click the Down load button to obtain the Iowa Amendment to Oil and Gas Lease to Reduce Annual Rentals. You may also accessibility types you in the past delivered electronically inside the My Forms tab of the accounts.

If you are using US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for the proper area/country.

- Step 2. Make use of the Review option to look over the form`s information. Do not neglect to read through the description.

- Step 3. If you are unsatisfied together with the type, take advantage of the Research area on top of the monitor to get other versions in the authorized type format.

- Step 4. After you have located the shape you need, select the Buy now button. Pick the rates strategy you favor and add your qualifications to register on an accounts.

- Step 5. Approach the deal. You can utilize your bank card or PayPal accounts to finish the deal.

- Step 6. Choose the file format in the authorized type and down load it on your system.

- Step 7. Full, modify and print out or signal the Iowa Amendment to Oil and Gas Lease to Reduce Annual Rentals.

Every authorized record format you purchase is your own eternally. You might have acces to every type you delivered electronically with your acccount. Select the My Forms section and choose a type to print out or down load yet again.

Be competitive and down load, and print out the Iowa Amendment to Oil and Gas Lease to Reduce Annual Rentals with US Legal Forms. There are many professional and state-particular types you may use to your company or specific requirements.

Form popularity

FAQ

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

Savings clauses are the safety nets in most oil and gas leases that keep leases alive in after the primary term and in absence of production. These include continuous drilling, continuous operations, shut-in royalty, force majeure, retained acreage provisions, pooling, Pugh (rolling vs.

Within the lease, a Delay Rental is a yearly payment made to the lessor by the lessee during the primary term of the lease to compensate for drilling that is going to be delayed. This differs from drilling being suspended indefinitely, as discussed previously with Rental payments.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

Is there more than one type of oil and gas lease? Yes, there are three types: a surface use lease, a non-surface use lease, and a dual purpose lease.

Delay Rent means the amount, if any, by which (a) the rent and other charges, including but not limited to any penalty for holding over beyond the Existing Lease Expiration Date, under the Existing Lease for the Delay Period exceeds (b) the rent and other charges payable by Tenant under the Existing Lease immediately ...

A drilling-delay rental clause is a provision in an oil-and-gas lease that allows the lessee to maintain the lease by paying delay rentals instead of starting drilling operations during the primary term.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.