Iowa Graphic Artist Agreement - Self-Employed Independent Contractor

Description

How to fill out Graphic Artist Agreement - Self-Employed Independent Contractor?

If you require to complete, download, or create valid document templates, utilize US Legal Forms, the largest assortment of valid forms available online.

Employ the site's straightforward and convenient search feature to locate the documents you need.

A wide range of templates for commercial and personal purposes are categorized by groups and states, or keywords. Utilize US Legal Forms to find the Iowa Graphic Artist Agreement - Self-Employed Independent Contractor in just a few clicks.

Each legal document format you purchase is your property for years. You will have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download, and print the Iowa Graphic Artist Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your personal business or individual needs.

- If you are already a US Legal Forms customer, Log Into your account and click on the Acquire button to locate the Iowa Graphic Artist Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview mode to review the content of the form. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other versions of the valid form format.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Process the transaction. You can use your Мisa or Ьastercard or PayPal account to complete the transaction.

- Step 6. Select the format of the valid form and download it to your device.

- Step 7. Complete, modify and print or sign the Iowa Graphic Artist Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Creating an independent contractor agreement involves outlining the services you'll provide, payment terms, and the responsibilities of both parties. Make sure to include details such as project deadlines and ownership of work. To simplify this process, you can use an Iowa Graphic Artist Agreement - Self-Employed Independent Contractor available on the US Legal Forms platform, which provides templates to meet your specific needs.

To receive a 1099 form, an independent contractor must earn $600 or more from a single client in a calendar year. This threshold applies to most services provided by independent contractors. Utilizing an Iowa Graphic Artist Agreement - Self-Employed Independent Contractor can help you track your earnings effectively and ensure compliance with tax regulations.

A basic independent contractor agreement outlines the terms and conditions under which the contractor provides services. This includes payment details, project timelines, and responsibilities. By using an Iowa Graphic Artist Agreement - Self-Employed Independent Contractor, you will have a solid framework that protects both you and the client, fostering a clear understanding of expectations.

The new federal rule on independent contractors aims to clarify the classification criteria to prevent misclassifying workers. This rule emphasizes the need for evidence that independent contractors operate independently from businesses. Familiarizing yourself with an Iowa Graphic Artist Agreement - Self-Employed Independent Contractor can help you align your practices with these regulations.

Yes, an artist can be considered an independent contractor, depending on their work arrangement. Many artists operate as self-employed individuals, accepting projects without being tied to an employer. Using an Iowa Graphic Artist Agreement - Self-Employed Independent Contractor helps outline the terms of your services and rights, ensuring clarity in your professional relationship.

To prove you're an independent contractor, you need to demonstrate that you maintain control over your work. This includes deciding how and when you complete tasks, rather than following strict employer instructions. Having an Iowa Graphic Artist Agreement - Self-Employed Independent Contractor can provide you with documentation that clarifies your independent status and responsibilities.

Many graphic designers choose to work as independent contractors, allowing them more freedom and control over their projects. This status provides the ability to work with multiple clients simultaneously, which often leads to increased income opportunities. Utilizing an Iowa Graphic Artist Agreement - Self-Employed Independent Contractor can streamline this working relationship and clarify expectations.

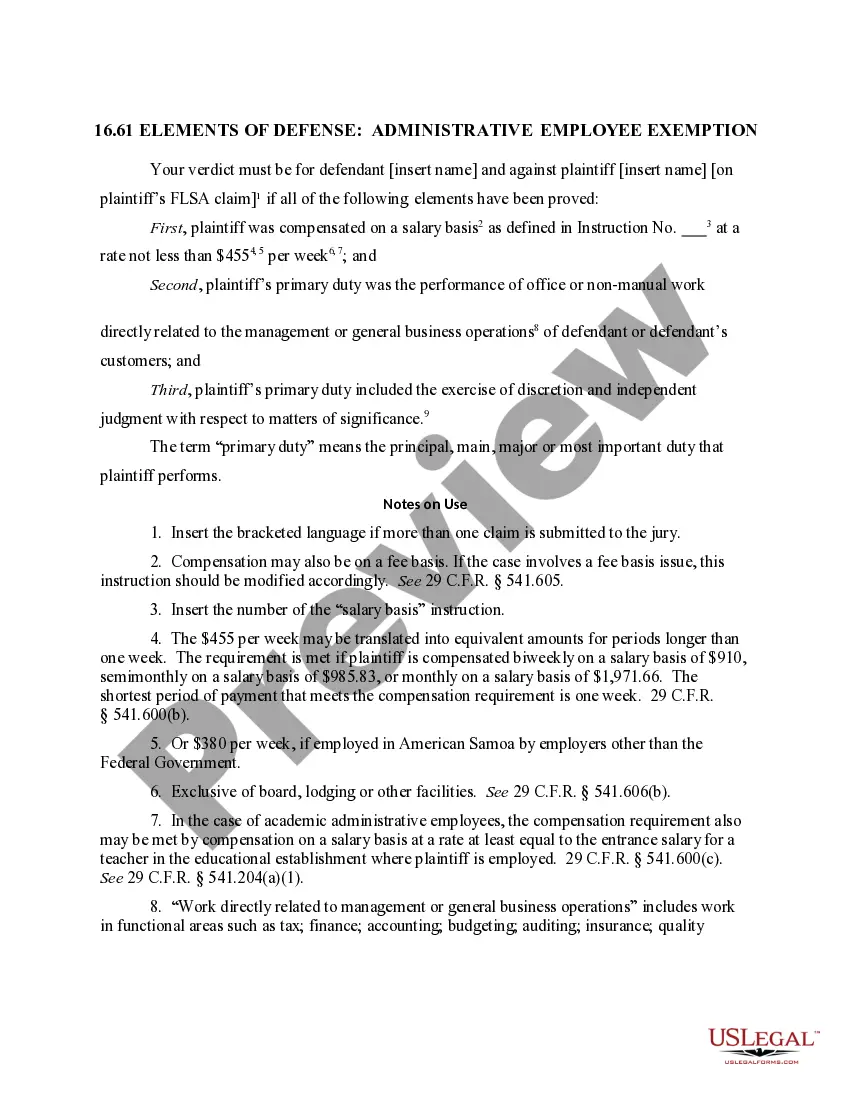

Graphic designers often fall under specific regulations that may classify them as exempt or non-exempt, depending on their work arrangements. If they operate as independent contractors, they have different rights and obligations compared to traditional employees. Understanding this distinction within the context of the Iowa Graphic Artist Agreement - Self-Employed Independent Contractor can be vital for their business structure.

Filling out an independent contractor agreement involves providing essential details such as project scope, deadlines, and payment amounts. Make sure to clearly outline the responsibilities of both parties. When using a template from US Legal Forms, you can easily customize it to suit your specific needs, ensuring compliance with local laws.

An independent contractor typically operates a business based on a specific contract, providing services to clients without being an employee. They maintain control over how and when they complete their work. Understanding this distinction is crucial when utilizing an Iowa Graphic Artist Agreement - Self-Employed Independent Contractor, as it defines your relationship with clients.