Iowa Fuel Delivery And Storage Services - Self-Employed

Description

How to fill out Fuel Delivery And Storage Services - Self-Employed?

If you desire to accumulate, retrieve, or produce legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s simple and efficient search to find the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to locate the Iowa Fuel Delivery And Storage Services - Self-Employed with just a few clicks.

Every legal document template you acquire is yours permanently. You will have access to each form you downloaded in your account. Click on the My documents section and choose a form to print or download again.

Stay competitive and download, and print the Iowa Fuel Delivery And Storage Services - Self-Employed with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Iowa Fuel Delivery And Storage Services - Self-Employed.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the appropriate region/state.

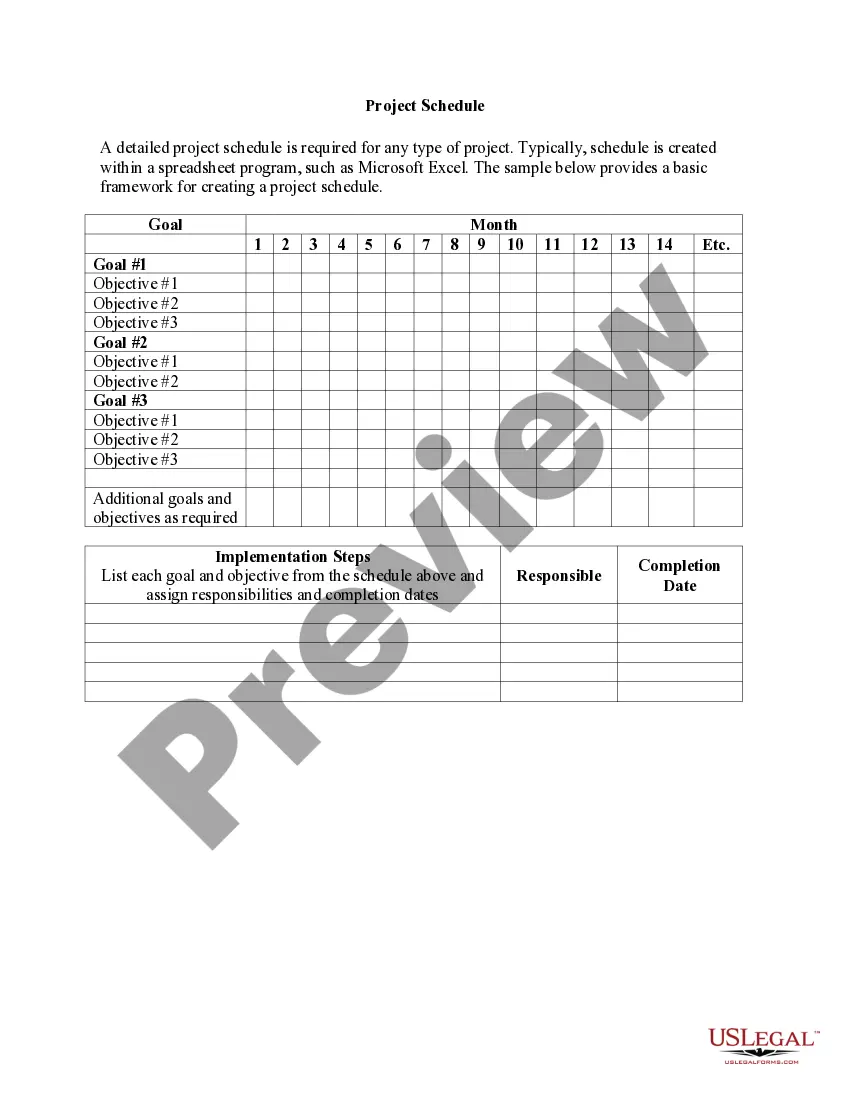

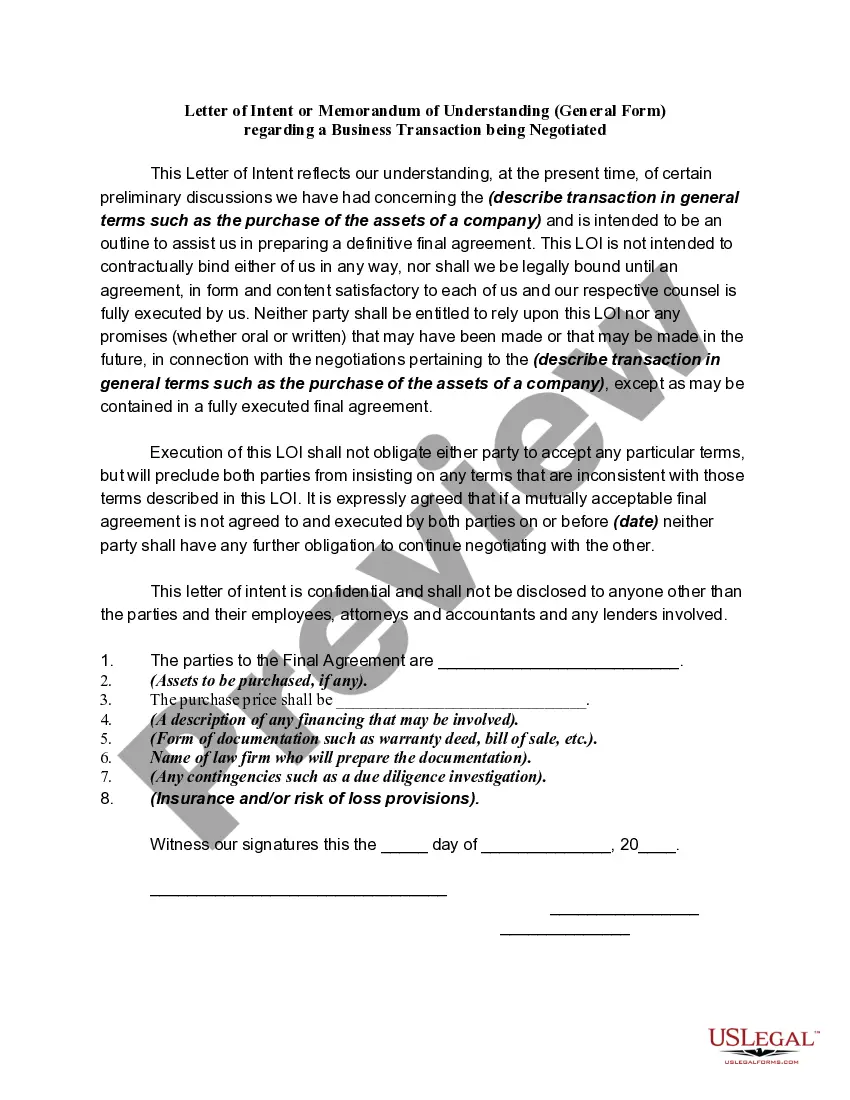

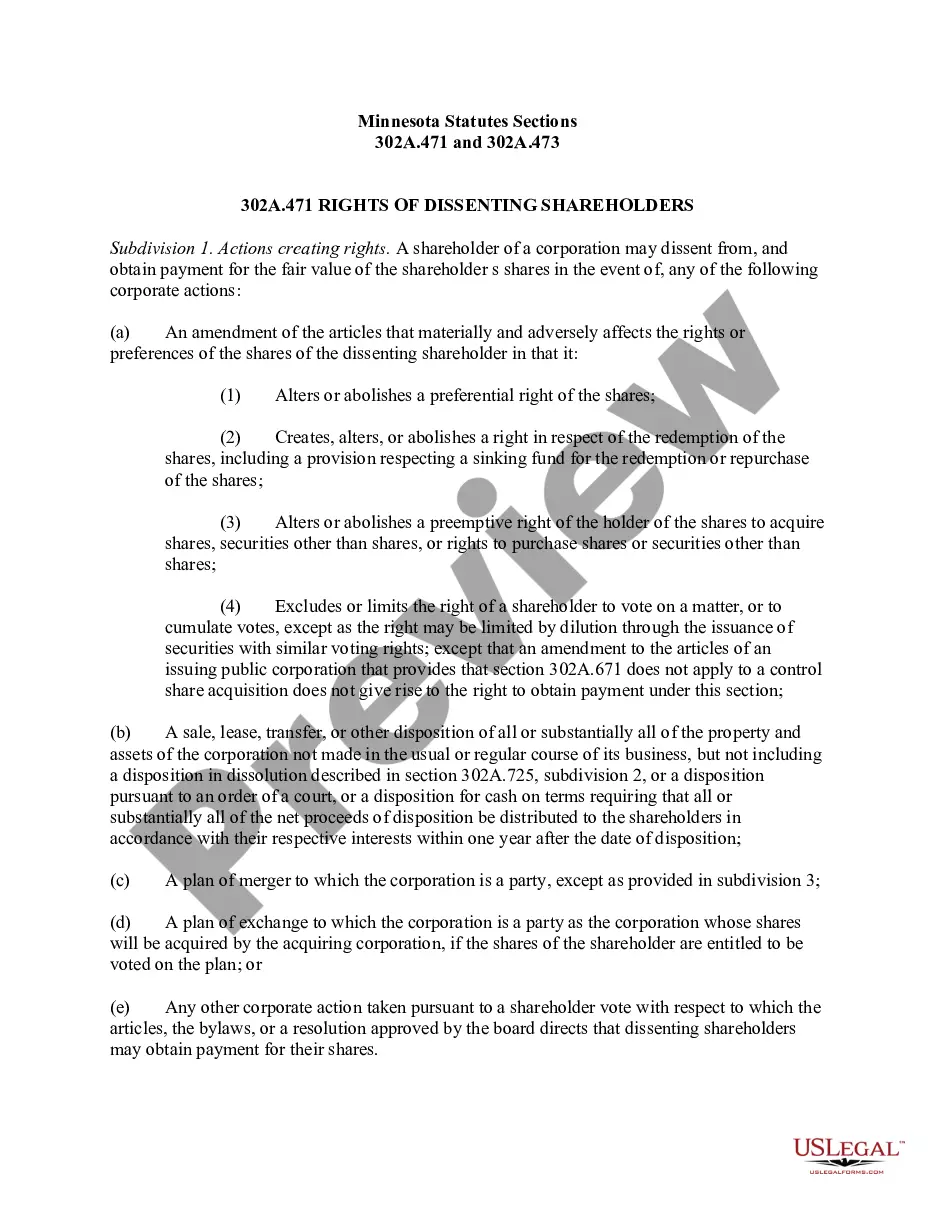

- Step 2. Use the Review feature to browse through the form’s content. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you want, click the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the purchase. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Iowa Fuel Delivery And Storage Services - Self-Employed.

Form popularity

FAQ

In Iowa, the threshold for income before incurring state taxes generally aligns with the federal tax standards. For self-employed individuals offering Iowa Fuel Delivery And Storage Services, it's vital to track your earnings, as any income above the state's exemption amount may lead to a tax liability. You can consult with a tax professional or access resources like USLegalForms for clarity on your specific situation. Understanding your earning potential and tax obligations is crucial for effective financial planning.

In Iowa, certain services are considered taxable, including those related to retail sales, repair services, and some types of personal services. If you are self-employed and offer Iowa Fuel Delivery And Storage Services, you may need to collect sales tax from your customers. It's essential to keep detailed records of your services to understand which are taxable. Utilizing platforms like USLegalForms can help guide you through the compliance process.

To fill out an Iowa sales tax exemption certificate, start by providing your business name, address, and tax ID number. Clearly specify the items you are purchasing and the reason for the exemption. This document can be crucial for businesses involved in Iowa Fuel Delivery And Storage Services, as it helps maintain compliance while minimizing costs.

The self-employment tax in Iowa is currently set at 15.3%, which includes Social Security and Medicare taxes. This tax applies to individuals who work for themselves and is calculated based on net earnings. For those in Iowa Fuel Delivery And Storage Services - Self-Employed, it's important to factor this tax into your overall budget and financial planning.

To apply for your IFTA sticker, you must first complete the IFTA application form available through the Iowa DOT. Once your application is processed, you will receive your sticker by mail. This sticker is essential for self-employed individuals utilizing Iowa Fuel Delivery And Storage Services, as it showcases your compliance with state regulations.

The phone number for the Iowa Department of Transportation's IFTA unit is (515) 237-3134. They can provide assistance with any questions regarding IFTA regulations, filing, and compliance. This support can be especially beneficial for self-employed individuals reliant on Iowa Fuel Delivery And Storage Services.

To file fuel taxes in Iowa, gather all necessary information, including your total fuel consumption and applicable taxes. Then, complete the required forms from the Iowa Department of Revenue. Utilizing resources like USLegalForms can simplify the filing process for self-employed individuals engaged in Iowa Fuel Delivery And Storage Services.

To file IFTA in Iowa, you need to complete your IFTA application and maintain proper records of fuel purchases and mileage. Each quarter, you can file your IFTA report online through the Iowa Department of Transportation's website. This process can be streamlined with services like USLegalForms, which helps you organize your documents for Iowa Fuel Delivery And Storage Services - Self-Employed.

The diesel fuel tax in Iowa is currently set at 32 cents per gallon. This tax contributes to essential state and local services, including road maintenance and infrastructure. For self-employed individuals utilizing Iowa Fuel Delivery And Storage Services, understanding this tax is crucial for accurate financial planning. Consider consulting a tax professional if you have specific questions about how this affects your business.

To own a mobile fuel delivery business in Iowa, you will need specific permits and licenses that vary by location and service type. Typically, you will require a fuel transport permit, a business license, and potentially a hazardous materials permit. US Legal Forms can provide you with the legal guidance and necessary forms to ensure compliance with all regulations involved in Iowa Fuel Delivery And Storage Services - Self-Employed.