Iowa Auditor Agreement - Self-Employed Independent Contractor

Description

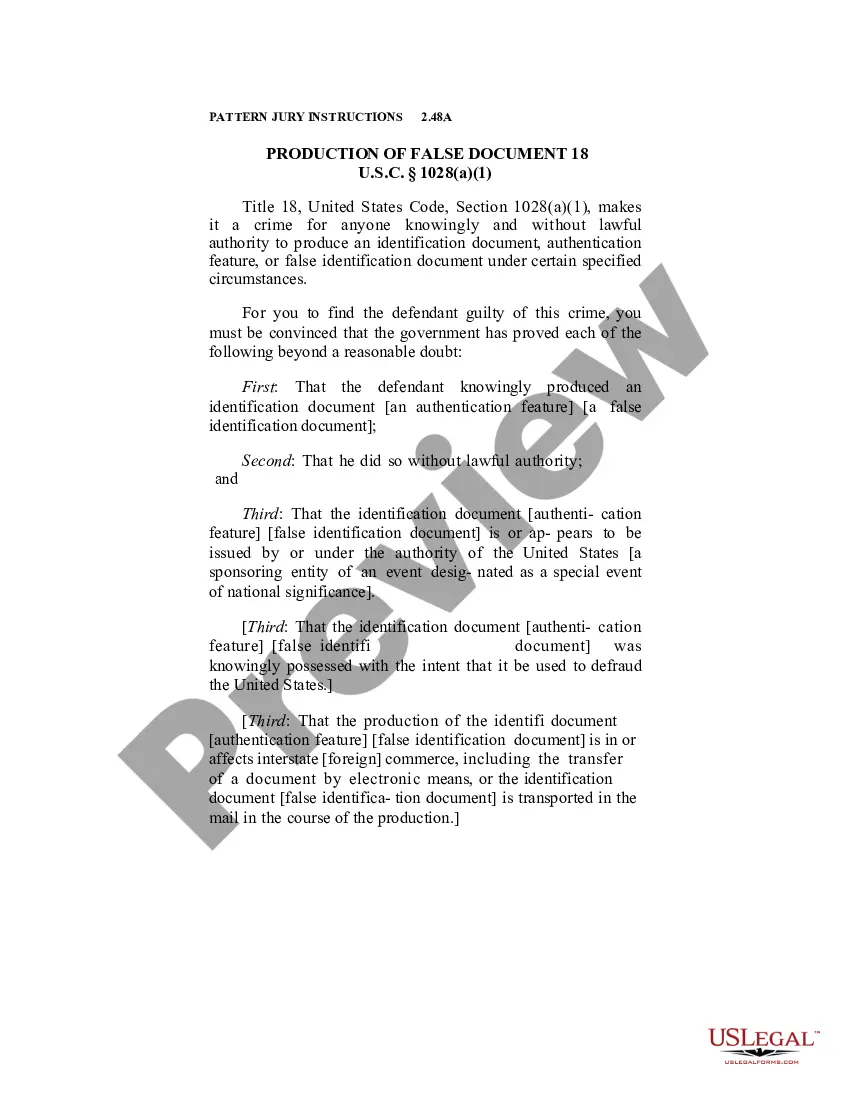

How to fill out Auditor Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal form templates that you can download or print. While using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can locate the most recent versions of forms like the Iowa Auditor Agreement - Self-Employed Independent Contractor in moments.

If you already possess an account, Log In and download the Iowa Auditor Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously obtained forms from the My documents tab of your account.

To use US Legal Forms for the first time, here are simple instructions to get started: Ensure you have selected the correct form for your city/state. Click the Preview button to examine the content of the form. Review the form details to confirm that you have chosen the right form. If the form does not meet your requirements, utilize the Search area at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Buy Now button. Then, choose the payment plan you wish and provide your information to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

- Choose the format and download the form to your device.

- Make edits. Fill in, modify, print, and sign the downloaded Iowa Auditor Agreement - Self-Employed Independent Contractor.

- Every template you add to your account has no expiration date and is yours indefinitely. If you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- Access the Iowa Auditor Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most extensive libraries of legal document templates.

- Utilize a vast number of professional and state-specific templates that meet your business or personal requirements.

Form popularity

FAQ

Yes, having a contract as an independent contractor is crucial for establishing clear expectations and responsibilities. It protects both you and the client by defining the work to be performed, compensation, and deadlines. Without a contract, you may face disputes or misunderstandings. An Iowa Auditor Agreement - Self-Employed Independent Contractor is an excellent tool to formalize your agreements.

The new federal rule focuses on clarifying the classification of workers as independent contractors versus employees. This rule aims to provide guidance on the criteria used to determine worker status, affecting benefits and rights. Being aware of these changes helps independent contractors understand their standing. The Iowa Auditor Agreement - Self-Employed Independent Contractor ensures you follow the latest regulations.

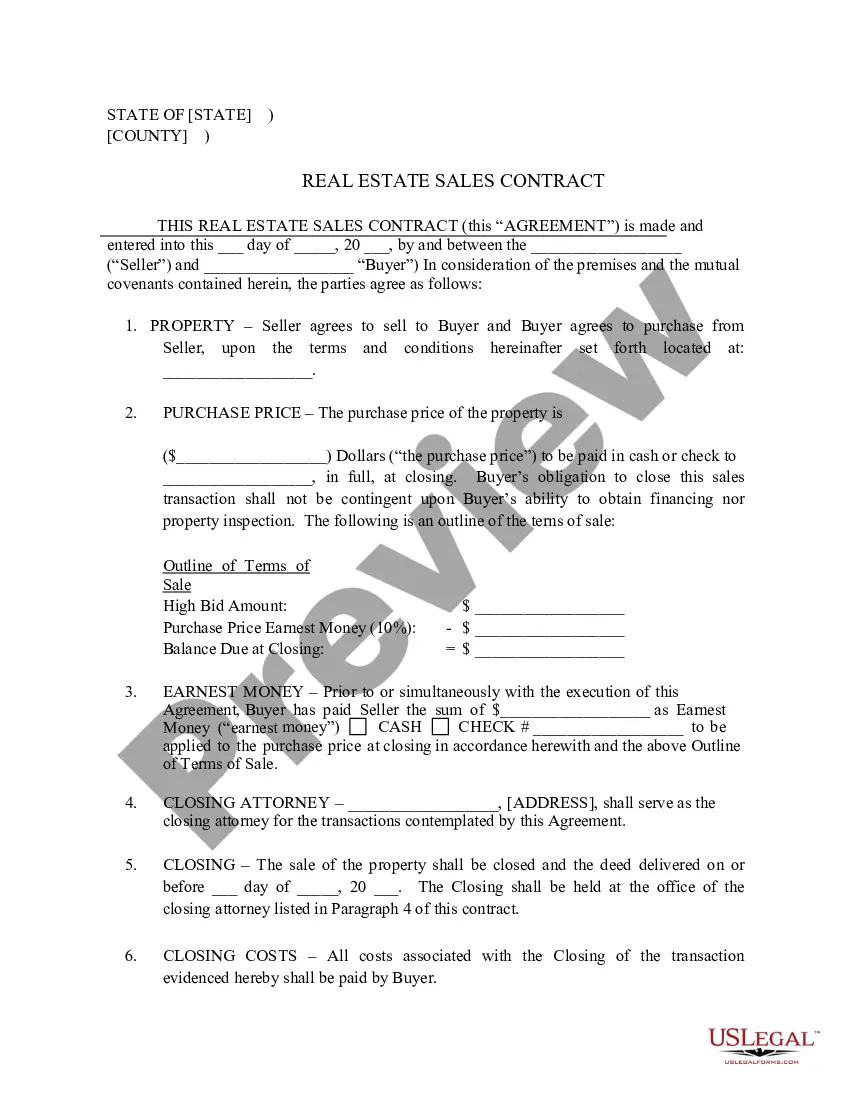

A basic independent contractor agreement outlines the terms of your work relationship with a client. This contract should detail the scope of work, payment terms, and any confidentiality requirements. Such agreements help prevent misunderstandings and protect both parties' interests. Utilizing an Iowa Auditor Agreement - Self-Employed Independent Contractor can streamline these aspects.

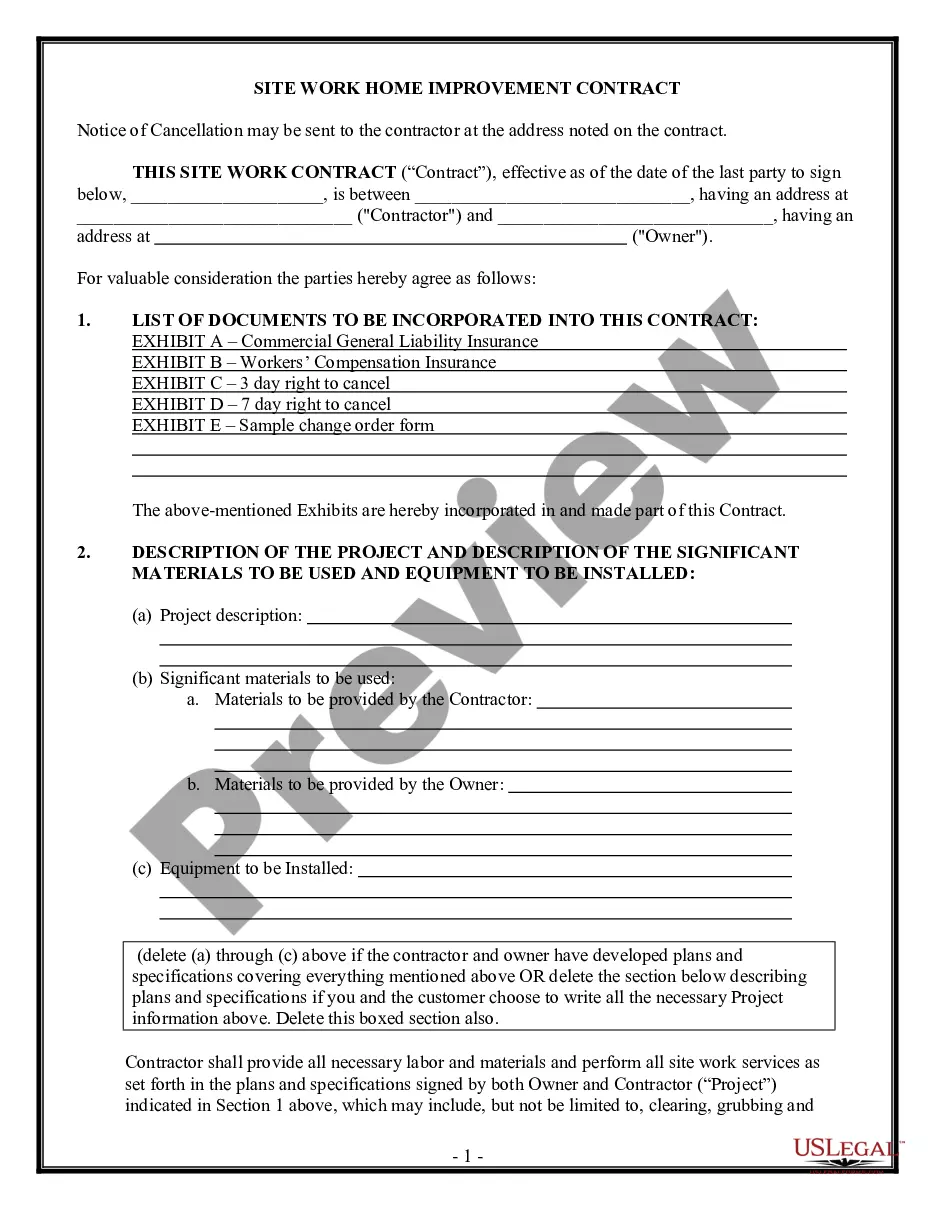

As an independent contractor, you report your income using Schedule C attached to your Form 1040. You will need to keep track of all income and expenses related to your contracting work. Proper documentation is essential to avoid any misunderstandings with tax authorities. The Iowa Auditor Agreement - Self-Employed Independent Contractor may help guide your reporting processes.

Yes, independent contractors are typically subject to self-employment tax. This tax includes both Social Security and Medicare taxes. If you are a self-employed independent contractor, you need to report your earnings accurately to ensure compliance. Learning about the Iowa Auditor Agreement - Self-Employed Independent Contractor can provide clarity on your tax obligations.

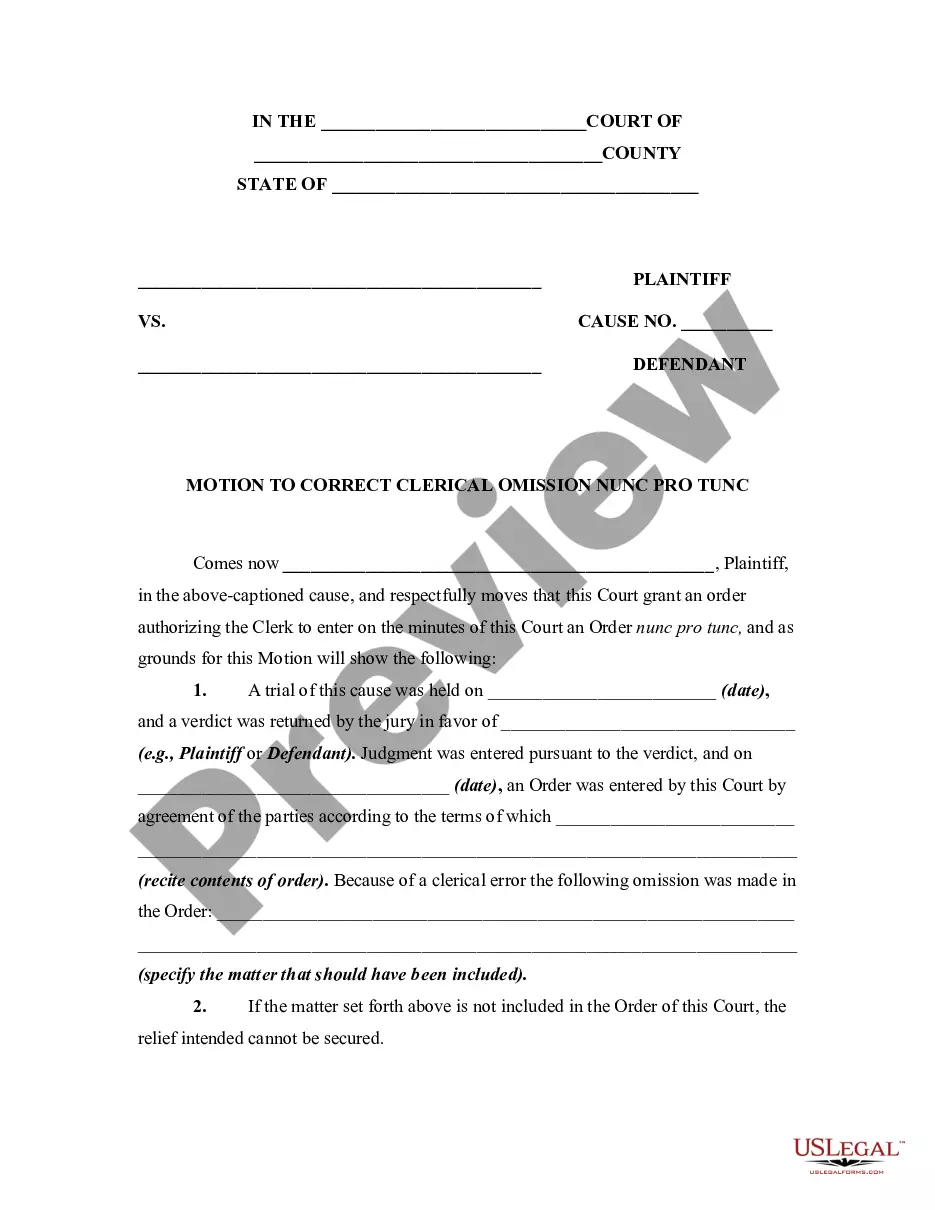

Filling out the Iowa Auditor Agreement - Self-Employed Independent Contractor involves carefully completing each section of the contract. Begin with your personal information and that of the contractor. Next, delineate the project details, payment arrangement, and add any necessary legal clauses to avoid future disputes. Using tools from USLegalForms can help streamline this process.

The Iowa Auditor Agreement - Self-Employed Independent Contractor is a formal contract that defines the working relationship between a contractor and a client in Iowa. This agreement covers the terms of service, payment structure, and conditions for termination. Understanding this agreement is vital for protecting your rights and ensuring clarity in the contractual terms.

When filling out the Iowa Auditor Agreement - Self-Employed Independent Contractor, start by entering your contact information and the contractor's details. Clearly state the services provided, alongside agreed payment terms and deadlines. It's crucial to review the entire document for accuracy before signing. Make use of resources like USLegalForms to find pre-structured forms that can guide you.

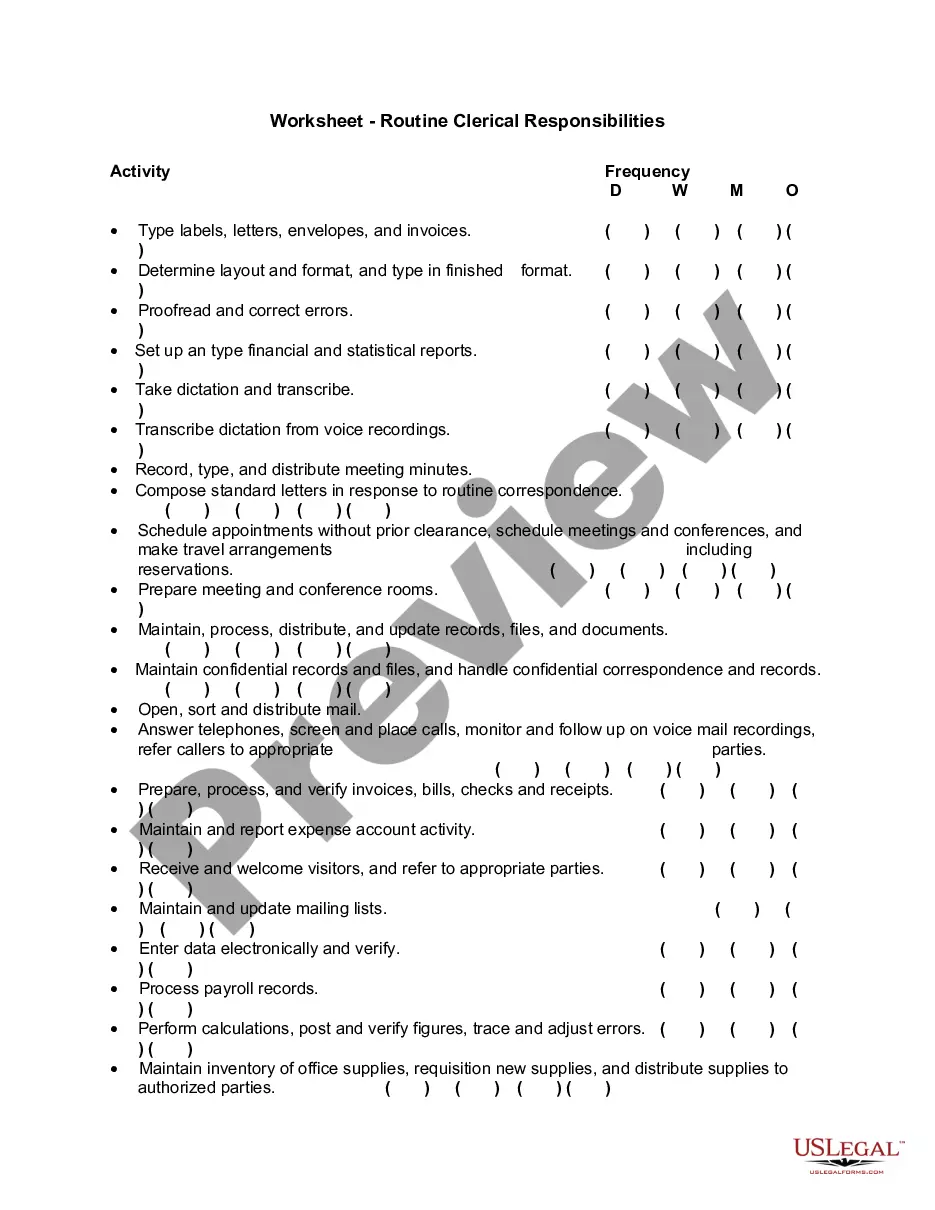

An independent contractor typically needs to complete several forms, including the Iowa Auditor Agreement - Self-Employed Independent Contractor, W-9 tax form for tax identification, and sometimes a business license application. Depending on the type of work, additional permits might be necessary. Be sure to check local regulations to ensure compliance and gather all required documents.

To write an Iowa Auditor Agreement - Self-Employed Independent Contractor, start by clearly defining the roles and responsibilities of both parties. Include the scope of work, payment terms, and project duration. It's essential to outline confidentiality and liability clauses to protect both you and the contractor. Utilizing templates from platforms like USLegalForms can simplify this process.