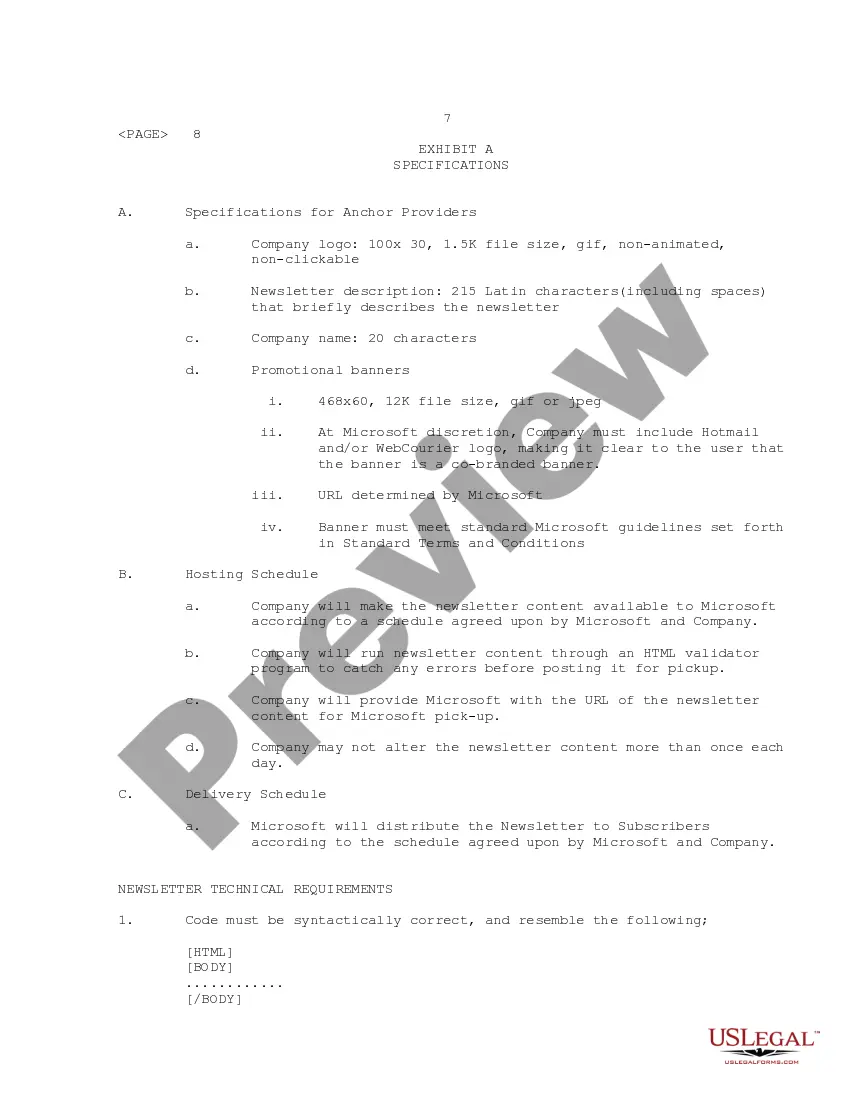

Iowa Anchor Provider Agreement

Description

How to fill out Anchor Provider Agreement?

Are you presently in the placement where you need to have files for sometimes organization or person purposes just about every day time? There are plenty of legitimate papers templates available on the net, but getting ones you can rely on isn`t easy. US Legal Forms delivers 1000s of form templates, such as the Iowa Anchor Provider Agreement, which can be published to satisfy federal and state demands.

In case you are previously familiar with US Legal Forms website and get your account, just log in. Next, you may acquire the Iowa Anchor Provider Agreement web template.

Should you not come with an accounts and would like to start using US Legal Forms, abide by these steps:

- Get the form you will need and make sure it is for the proper town/state.

- Utilize the Review option to check the form.

- Browse the outline to actually have chosen the correct form.

- When the form isn`t what you are seeking, make use of the Research field to get the form that suits you and demands.

- Once you obtain the proper form, simply click Acquire now.

- Pick the costs plan you need, fill in the specified information and facts to produce your account, and purchase the transaction utilizing your PayPal or credit card.

- Choose a handy document structure and acquire your duplicate.

Locate all of the papers templates you may have purchased in the My Forms food selection. You can get a more duplicate of Iowa Anchor Provider Agreement any time, if possible. Just go through the needed form to acquire or printing the papers web template.

Use US Legal Forms, the most extensive selection of legitimate varieties, to save time as well as stay away from blunders. The assistance delivers professionally produced legitimate papers templates which you can use for a range of purposes. Create your account on US Legal Forms and start producing your daily life easier.

Form popularity

FAQ

Iowa Code section 423.3(104) exempts from sales tax specified digital products, prewritten computer software, and certain enumerated services sold or furnished to a commercial enterprise when used exclusively by the commercial enterprise.

(Vehicle repair is a taxable service.) An Iowa resident sends tangible personal property out of state to be repaired. The repair service is not taxable in Iowa.

Sales of tangible personal property in Iowa are subject to sales tax unless exempted by state law. Sales of services are exempt from Iowa sales tax unless taxed by state law. The retailer must add the tax to the price and collect the tax from the purchaser.

The contractor is responsible for paying tax to the supplier on materials.; The contractor does not charge tax to the customer on the labor or materials. Examples of new construction, reconstruction, alteration, expansion, and remodeling activities. Iowa Contractors Guide | Iowa Department of Revenue iowa.gov ? iowa-contractors-guide iowa.gov ? iowa-contractors-guide

Sales of tangible personal property in Iowa are subject to sales tax unless exempted by state law. Sales of services are exempt from Iowa sales tax unless taxed by state law. Iowa Sales and Use Tax Guide iowa.gov ? iowa-sales-and-use-tax-guide iowa.gov ? iowa-sales-and-use-tax-guide

5% Instead of the 6% state sales/use tax (and local option tax where applicable), a 5% state excise tax applies to purchases of certain construction equipment. See the Iowa Contractors Guide for more details. Do contractors pay Iowa sales tax? iowa.gov ? do-contractors-pay-iowa-sales-tax iowa.gov ? do-contractors-pay-iowa-sales-tax

Some customers are exempt from paying sales tax under Iowa law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction. Iowa Sales & Use Tax Guide - Avalara avalara.com ? taxrates ? state-rates ? iowa-sa... avalara.com ? taxrates ? state-rates ? iowa-sa...

Labor is not subject to sales and use tax if performed on or in connection with new construction, reconstruction, alteration, expansion, or remodeling of a building or structure. More information is available in our contractors publication.