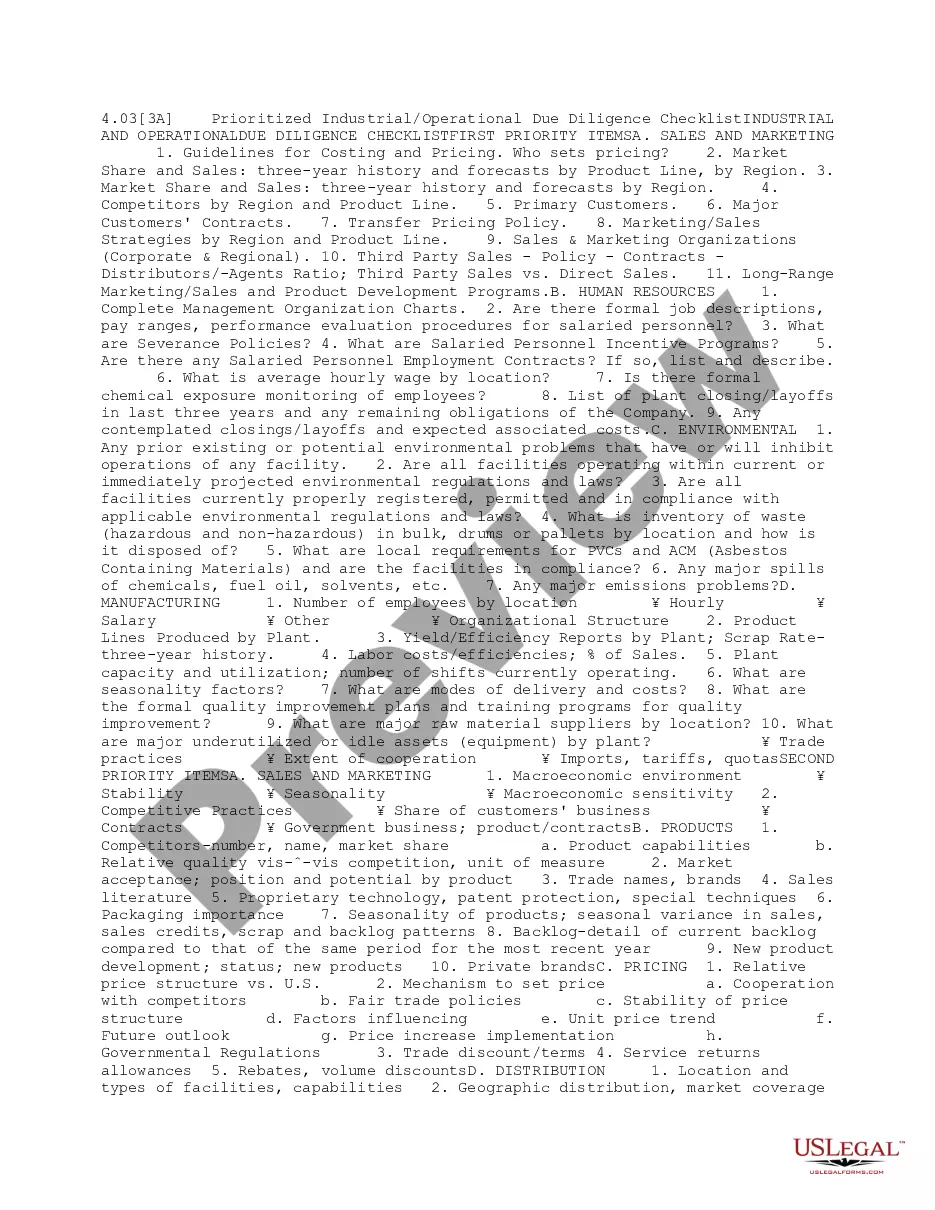

This checklist provides a general idea of the documents and information that will be necessary for a due diligence investigation for acquiring on-going operations for assets or stocks.

Iowa Checklist Due Diligence for Acquiring OnGoing Operations Asset or Stock

Description

How to fill out Checklist Due Diligence For Acquiring OnGoing Operations Asset Or Stock?

You can invest hours online searching for the appropriate legal document template that meets both state and federal requirements you need.

US Legal Forms provides a vast array of legal documents that are evaluated by professionals.

It is easy to download or print the Iowa Checklist Due Diligence for Acquiring Ongoing Operations Asset or Stock from our service.

If available, use the Review button to examine the document template at the same time.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can fill out, modify, print, or sign the Iowa Checklist Due Diligence for Acquiring Ongoing Operations Asset or Stock.

- Each legal document template you purchase is yours permanently.

- To obtain an additional copy of any purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, confirm that you have selected the correct document template for the county/area of your choice.

- Review the form details to ensure you have chosen the right document.

Form popularity

FAQ

The first step in developing a due diligence audit checklist is to identify the key areas of focus relevant to the acquisition. Start by outlining what information is necessary to assess the operational, financial, and legal conditions of the target entity. By utilizing the Iowa Checklist Due Diligence for Acquiring Ongoing Operations Asset or Stock, you can create a structured approach to gather this information effectively. Ensuring that you cover all critical aspects helps in building a robust foundation for the due diligence process.

An acquisition checklist is a comprehensive tool used to guide businesses through the process of acquiring ongoing operations, whether as assets or stock. This checklist outlines essential steps and necessary documentation that must be reviewed to ensure a thorough evaluation. By implementing the Iowa Checklist Due Diligence for Acquiring Ongoing Operations Asset or Stock, you can mitigate risks and streamline the acquisition process. Using such a checklist can help ensure compliance with legal requirements and improve decision-making.

A due diligence checklist is a comprehensive tool that outlines critical steps and documents needed when acquiring a business asset or stock. This checklist ensures you cover all bases, from financial reviews to legal considerations, reducing risks associated with the acquisition. Specifically, the Iowa Checklist Due Diligence for Acquiring OnGoing Operations Asset or Stock offers a structured approach, allowing you to streamline your investigation and planning processes. You can find helpful resources on platforms like USLegalForms to guide you in preparing your due diligence effectively.

A due diligence checklist should include financial records, legal documents, company operations, and market analysis. These elements collectively provide a comprehensive view of the business's health and potential risks. Using the Iowa Checklist Due Diligence for Acquiring OnGoing Operations Asset or Stock can help you ensure you cover all necessary information. By including these critical components, you enhance your chances of making an informed acquisition.

To prepare a due diligence checklist, start by identifying the key areas relevant to your acquisition, such as financials, legal issues, and operational capabilities. Then, break these areas into specific items you need to review. The Iowa Checklist Due Diligence for Acquiring OnGoing Operations Asset or Stock offers a thorough framework to follow. This checklist helps ensure that you will not overlook crucial information.

The 3 P's of due diligence are People, Process, and Product. By focusing on these areas, you can gain a better understanding of the company's value and viability. As you carry out your Iowa Checklist Due Diligence for Acquiring OnGoing Operations Asset or Stock, remember to evaluate how these factors interact with each other. This holistic overview will help ensure you make sound investment choices.

Structuring due diligence involves organizing your review into clear sections: financial analysis, legal considerations, and operational review. Start by identifying the key areas that impact value and risks. Utilizing the Iowa Checklist Due Diligence for Acquiring OnGoing Operations Asset or Stock allows you to systematically cover all important aspects. A well-structured approach can lead to informed decisions and successful acquisitions.

To perform due diligence on a stock, you need to analyze financial statements, review market trends, and assess company management. Gathering this information will provide insights into the stock's potential and risks. The Iowa Checklist Due Diligence for Acquiring OnGoing Operations Asset or Stock can serve as a template to guide you through the essential factors to consider. By staying informed, you can make smarter investment choices.