A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Iowa Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

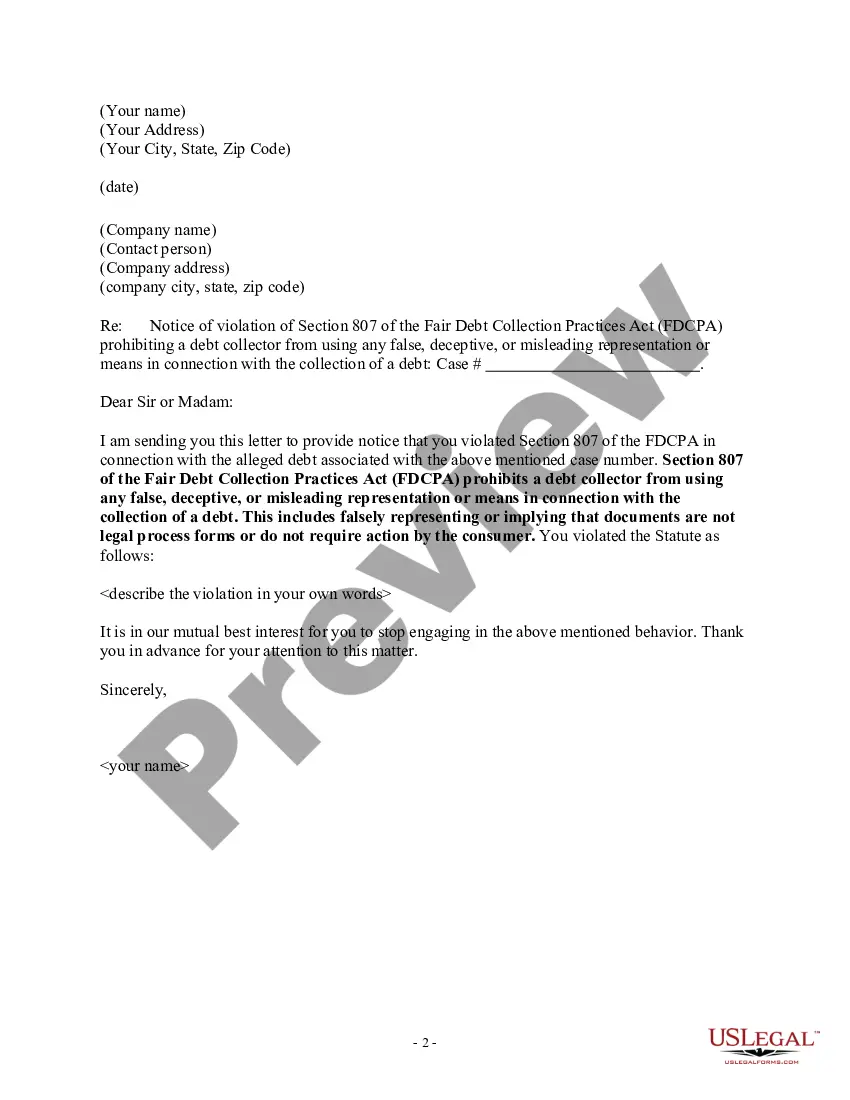

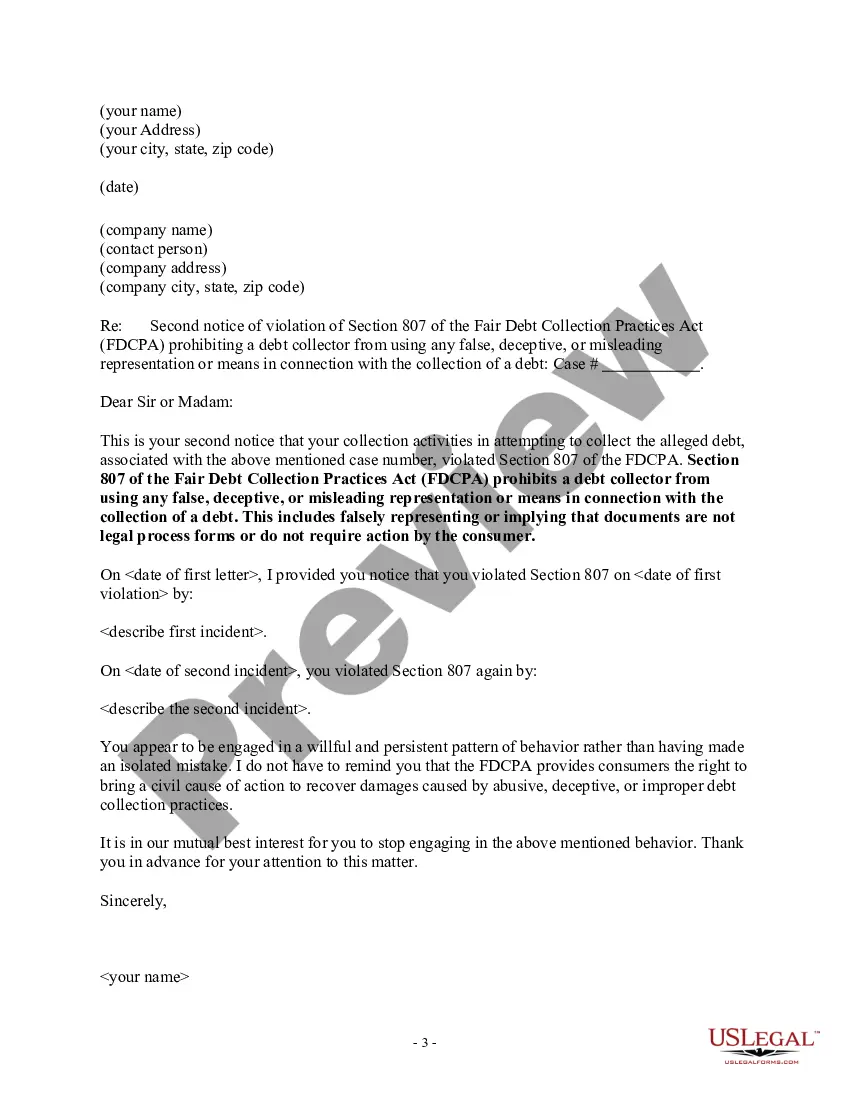

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

You can invest hours online trying to locate the legal document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can download or print the Iowa Notice to Debt Collector - Falsely Representing Documents as Not Legal Process or Do Not Require Action from the service.

If you wish to find another version of the form, make use of the Search field to locate the template that suits your needs and requirements.

- If you already possess a US Legal Forms account, you may Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Iowa Notice to Debt Collector - Falsely Representing Documents as Not Legal Process or Do Not Require Action.

- Every legal document template you purchase is yours for a lifetime.

- To obtain another copy of the purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the right document template for the county/town of your choice.

- Review the form outline to confirm you have chosen the correct form.

- If available, utilize the Preview button to browse through the document template as well.

Form popularity

FAQ

The most common violation of the Fair Debt Collection Practices Act involves using harassing behavior, such as threatening legal action or ongoing communication at odd hours. Collectors often misunderstand the law or choose to ignore it, making such violations widespread. It's vital to familiarize yourself with your rights under the Iowa Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action to recognize these behaviors and take appropriate action.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020

You have the right to be treated fairly by debt collectors. The Fair Debt Collection Practices Act (FDCPA) applies to personal, family, and household debts. This includes money you owe for the purchase of a car, for medical care, or for charge accounts.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

Yes, but the collector must first sue you to get a court order called a garnishment that says it can take money from your paycheck to pay your debts. A collector also can seek a court order to take money from your bank account.

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

One is to report them to the Financial Consumer Protection Department of the BSP (i.e. email consumeraffairs@bsp.gov.ph or call 632-708-7087). Be sure to document all communications with your debt collectors including text messages and e-mails. If you can, record your conversation with their consent.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt.