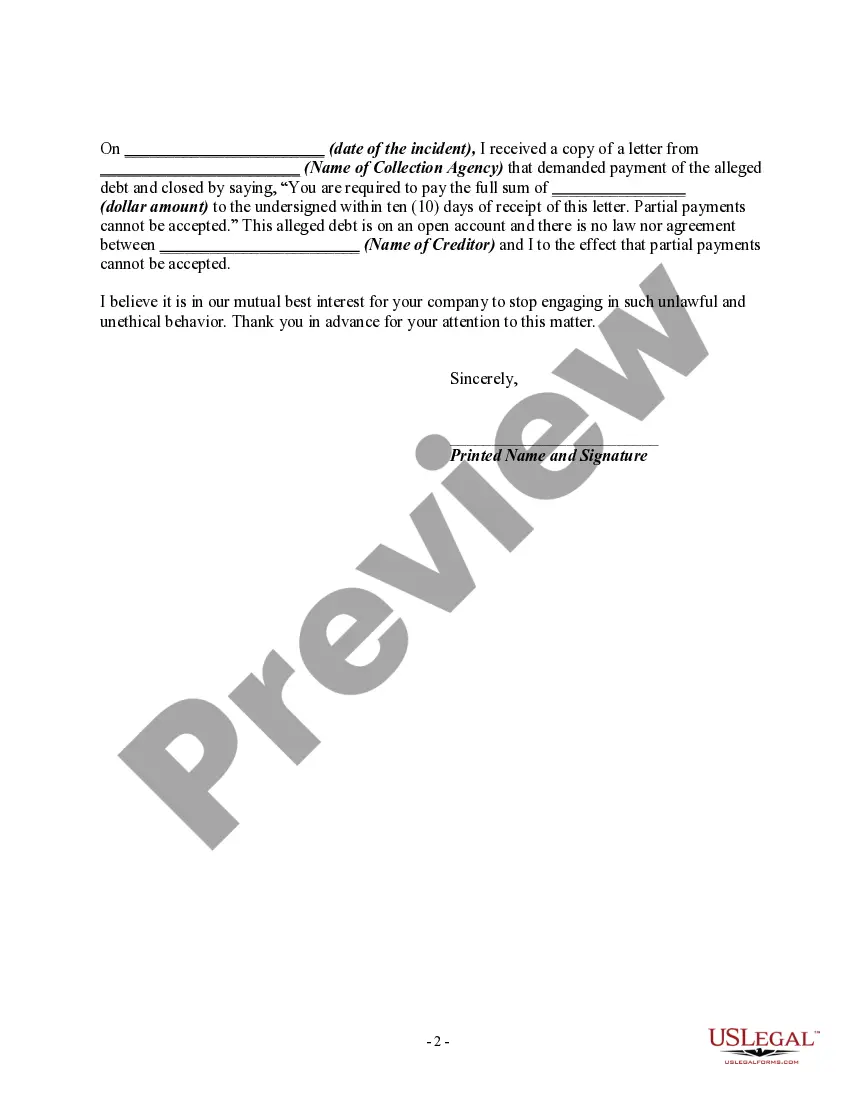

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(10) The use of any false representation or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer."

This would include asserting that the debt collector cannot accept partial payments when they have been authorized.