Iowa Stockholders' Rights Plan of Datascope Corp.

Description

How to fill out Stockholders' Rights Plan Of Datascope Corp.?

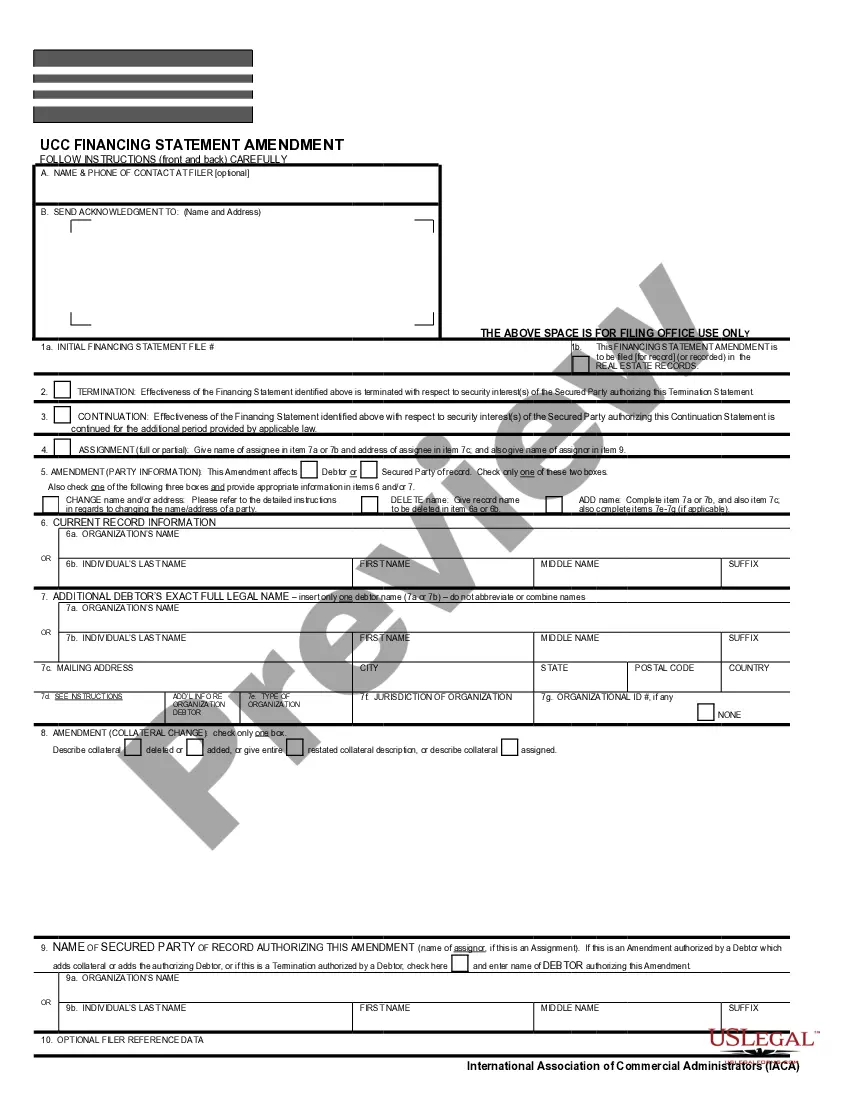

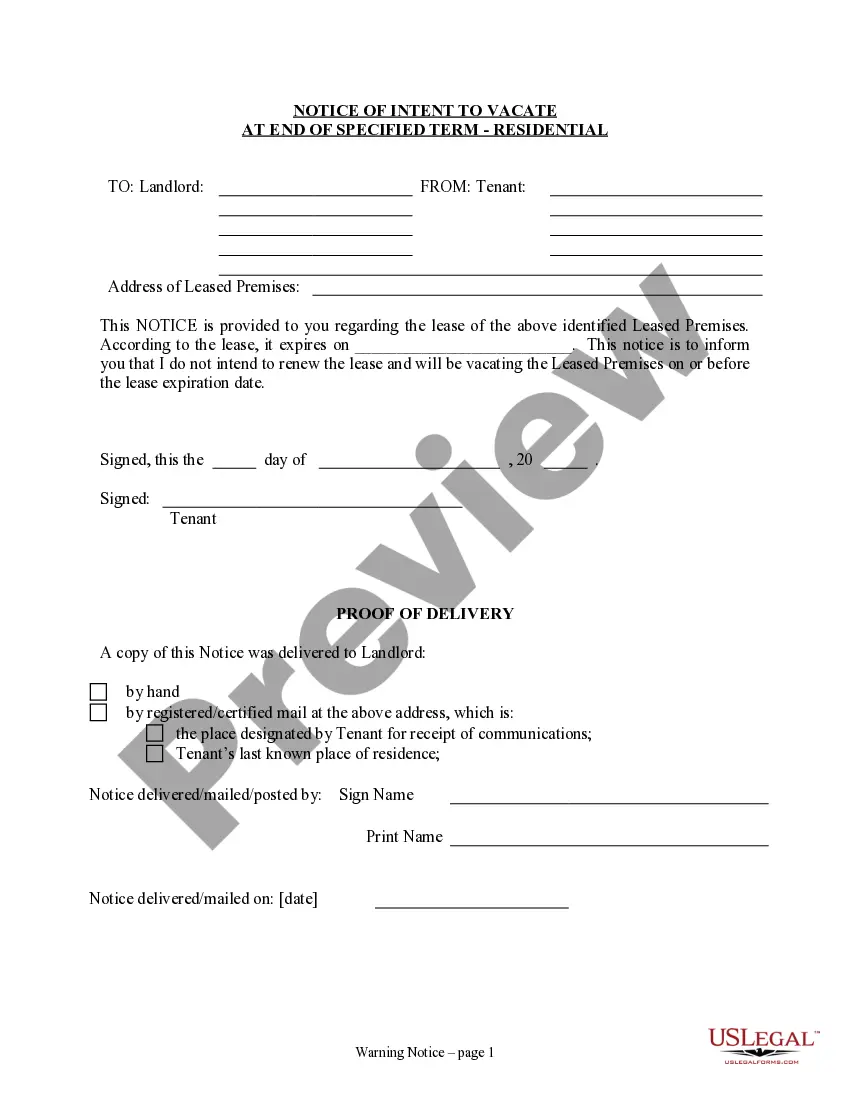

It is possible to commit several hours on-line looking for the authorized papers web template which fits the federal and state needs you need. US Legal Forms supplies thousands of authorized varieties that are examined by experts. You can actually download or produce the Iowa Stockholders' Rights Plan of Datascope Corp. from your service.

If you currently have a US Legal Forms account, you can log in and then click the Down load button. Afterward, you can complete, revise, produce, or indication the Iowa Stockholders' Rights Plan of Datascope Corp.. Every single authorized papers web template you purchase is yours permanently. To have one more copy of the purchased kind, proceed to the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms website the very first time, keep to the simple guidelines listed below:

- Very first, ensure that you have selected the correct papers web template for that state/metropolis of your liking. See the kind explanation to make sure you have selected the appropriate kind. If readily available, utilize the Preview button to check with the papers web template at the same time.

- If you would like discover one more variation in the kind, utilize the Look for discipline to discover the web template that suits you and needs.

- Upon having discovered the web template you need, just click Buy now to proceed.

- Pick the costs prepare you need, type your references, and register for a free account on US Legal Forms.

- Full the purchase. You can utilize your Visa or Mastercard or PayPal account to fund the authorized kind.

- Pick the file format in the papers and download it to the gadget.

- Make modifications to the papers if necessary. It is possible to complete, revise and indication and produce Iowa Stockholders' Rights Plan of Datascope Corp..

Down load and produce thousands of papers templates while using US Legal Forms Internet site, that offers the greatest selection of authorized varieties. Use skilled and state-particular templates to handle your organization or person needs.

Form popularity

FAQ

Yes, poison pills strategies allow shareholders to enjoy immediate profits when they purchase new stock at a discount. However, poison pills result in diluted stock values, so if shareholders want to maintain proportionate ownership in the company, they must buy additional stock to keep up.

Often called a shareholder rights plan, it is meant to frustrate creeping acquisitions of control, in which the acquirer seeks to accumulate a controlling or dominant stake piecemeal without negotiating with the board or offering the same deal to every shareholder.

Other Examples of Poison Pills Upon learning that Icahn had acquired a 10% stake in the company, Netflix immediately went on the defensive. Any attempt to buy a large equity position in Netflix without board approval would result in flooding the market with new shares, making any stake attempt very expensive.

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, a claim to dividends, the right to inspect corporate documents, and the right to sue for wrongful acts. Investors should thoroughly research the corporate governance policies of the companies they invest in.

What is a shareholder rights plan? Shareholder rights plans, also known as poison pills, are a takeover defense tool often used to prevent the escalation of a hostile/unsolicited offer by keeping an investor from accumulating a large ownership stake.

A poison pill is designed to discourage a major acquisition of shares and a company's hostile takeover by an individual or entity. Once activated, the strategy allows shareholders, with the exception of the acquiring party, to buy additional shares of company stock at a highly discounted price.

The three basic shareholder rights are: the right to vote, the right to receive dividends, and the right to the corporation's remaining assets upon dissolution or winding-up. Where a corporation only has one class of shares, the three basic rights must attach to that class.

For example, if a company had nine directors, then three directors would be up for re-election each year, with a three-year term. This would present a potential acquirer with the position of having a hostile board for at least a year after the first election.