Iowa Performance Stock Option Award Agreement of Special Devices, Inc.

Description

How to fill out Performance Stock Option Award Agreement Of Special Devices, Inc.?

Discovering the right legitimate papers web template can be quite a have a problem. Needless to say, there are plenty of themes available online, but how would you discover the legitimate develop you need? Use the US Legal Forms site. The services delivers 1000s of themes, for example the Iowa Performance Stock Option Award Agreement of Special Devices, Inc., which can be used for enterprise and personal demands. All the forms are checked by professionals and meet federal and state demands.

If you are already signed up, log in in your accounts and then click the Obtain option to have the Iowa Performance Stock Option Award Agreement of Special Devices, Inc.. Use your accounts to search throughout the legitimate forms you might have acquired previously. Go to the My Forms tab of your accounts and acquire one more duplicate in the papers you need.

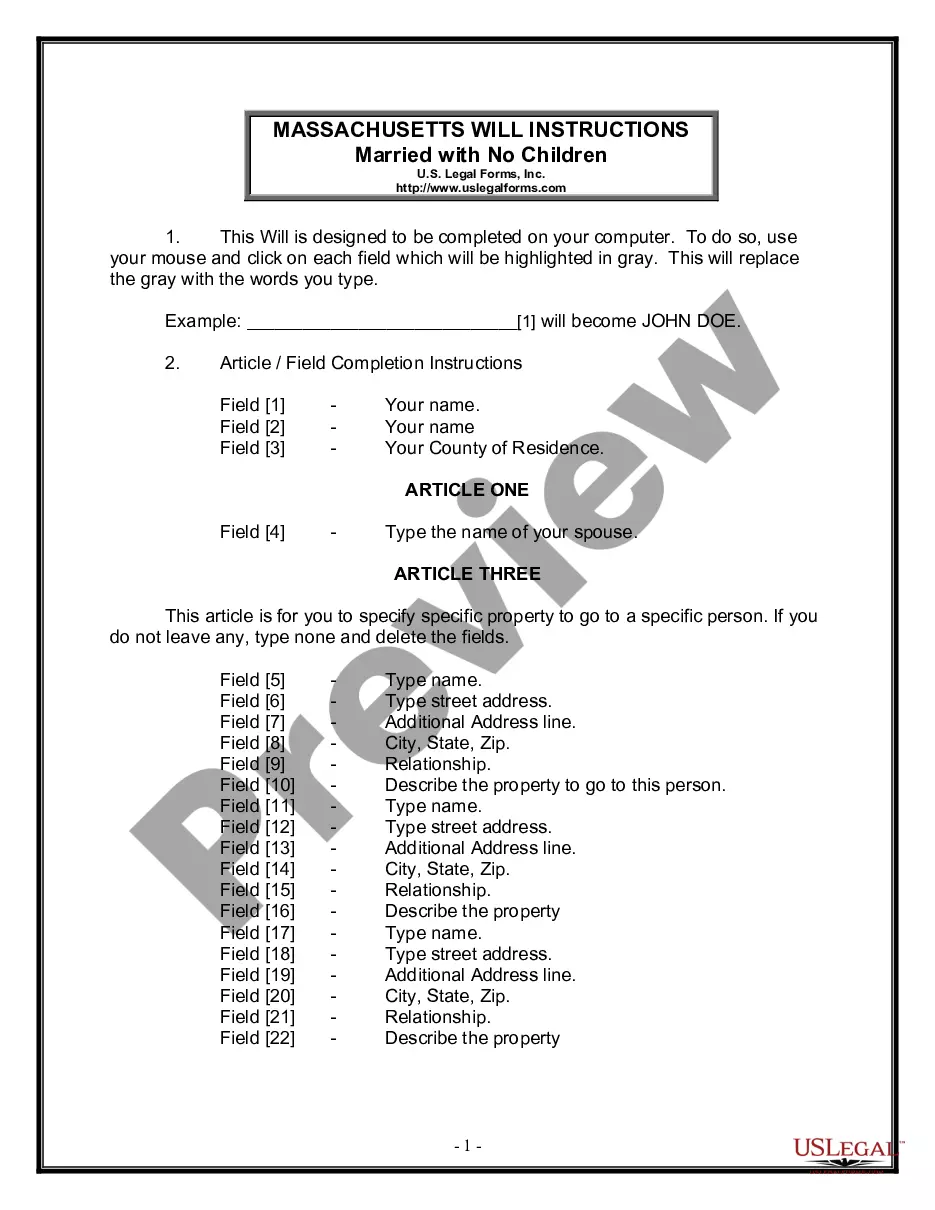

If you are a new end user of US Legal Forms, here are simple guidelines so that you can follow:

- Very first, make sure you have chosen the correct develop to your town/region. You are able to check out the shape making use of the Preview option and read the shape explanation to ensure this is the right one for you.

- If the develop fails to meet your preferences, utilize the Seach area to discover the right develop.

- When you are sure that the shape is acceptable, go through the Get now option to have the develop.

- Pick the rates plan you would like and type in the necessary information and facts. Design your accounts and buy the order utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the data file file format and download the legitimate papers web template in your product.

- Full, change and printing and indication the attained Iowa Performance Stock Option Award Agreement of Special Devices, Inc..

US Legal Forms is the largest library of legitimate forms for which you can see numerous papers themes. Use the company to download appropriately-manufactured paperwork that follow condition demands.

Form popularity

FAQ

What is a stock option grant? Stock option grants are how your company awards stock options. This document usually includes details about: The type of stock options you'll receive (ISOs or NSOs) The number of shares you can purchase.

An option award, or sometimes called a stock option award, is a legal agreement between a company and an employee that gives the employee stock options in the company as a form of compensation or bonus.

What are option agreements? Option grants are how companies award equity to employees. Signing an offer letter isn't enough. The option agreement outlines all the details of an employee's option grant. The option agreement is a more detailed version of an offer letter.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.