Iowa Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.

Description

How to fill out Nonemployee Directors Nonqualified Stock Option Plan Of Cucos, Inc.?

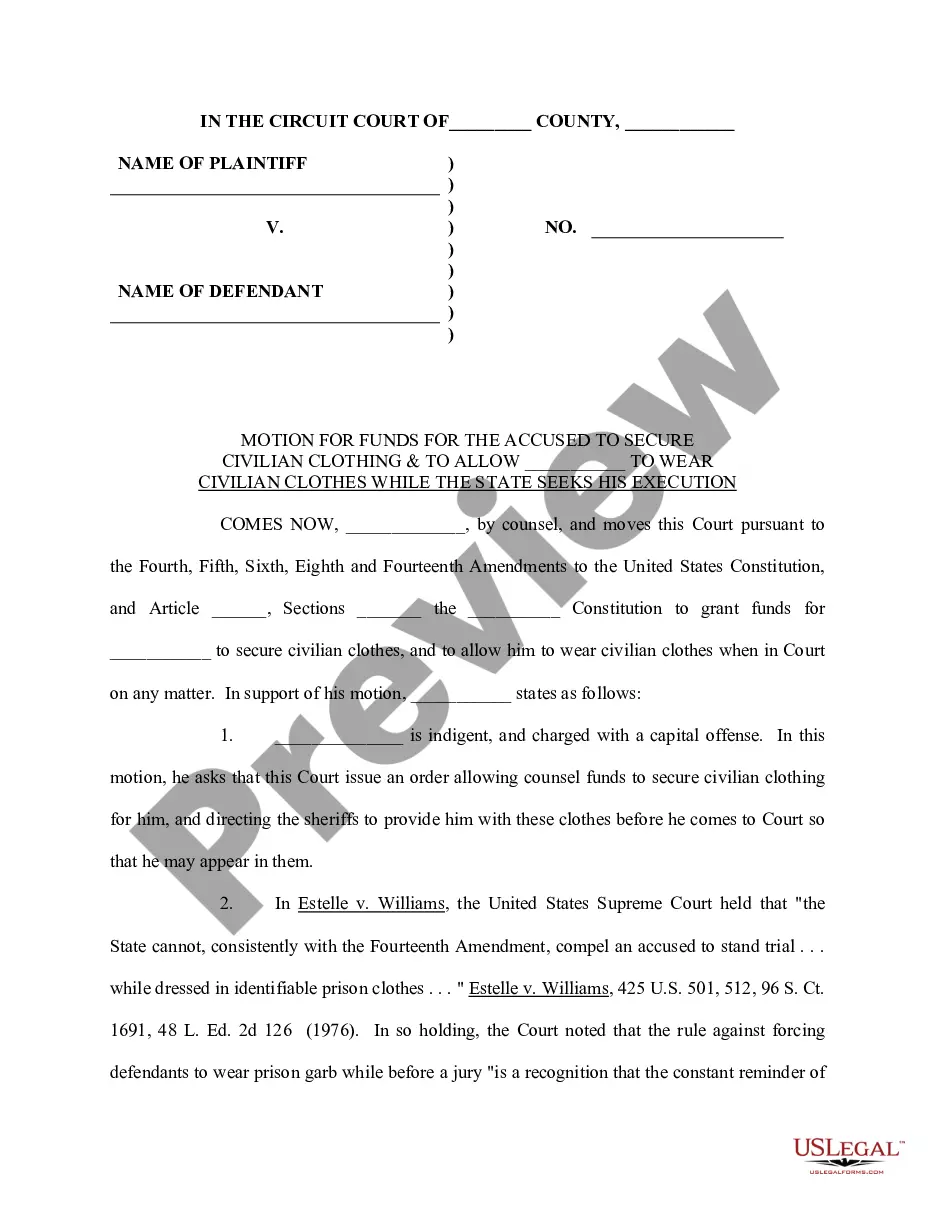

Discovering the right lawful papers template might be a struggle. Of course, there are plenty of templates accessible on the Internet, but how do you discover the lawful kind you want? Use the US Legal Forms internet site. The service offers a huge number of templates, including the Iowa Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc., which can be used for company and private needs. Each of the kinds are inspected by specialists and fulfill state and federal demands.

When you are already registered, log in for your accounts and click the Obtain key to get the Iowa Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.. Make use of your accounts to appear through the lawful kinds you have purchased in the past. Check out the My Forms tab of your respective accounts and obtain one more copy of your papers you want.

When you are a new end user of US Legal Forms, allow me to share simple directions that you should stick to:

- Very first, make sure you have selected the appropriate kind for the city/region. It is possible to check out the shape using the Review key and read the shape description to make sure it is the best for you.

- In case the kind is not going to fulfill your needs, take advantage of the Seach discipline to get the appropriate kind.

- Once you are sure that the shape is suitable, go through the Acquire now key to get the kind.

- Opt for the pricing plan you would like and enter in the needed details. Design your accounts and buy your order utilizing your PayPal accounts or charge card.

- Choose the file structure and obtain the lawful papers template for your device.

- Comprehensive, change and print and sign the attained Iowa Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc..

US Legal Forms is definitely the most significant catalogue of lawful kinds in which you can see a variety of papers templates. Use the company to obtain professionally-created papers that stick to condition demands.

Form popularity

FAQ

Taxation. The main difference between ISOs and NQOs is the way that they are taxed. NSOs are generally taxed as a part of regular compensation under the ordinary federal income tax rate. Qualifying dispositions of ISOs are taxed as capital gains at a generally lower rate.

This discussion centers on nonqualified stock options. The distinction between them lies in their treatment for tax purposes, and the explanation for NSOs is the simpler of the 2: The recipient of an NSO is not taxed at the time the option is granted, and is taxed instead when the option is exercised.

Non-qualified stock options are issued with a vesting schedule. Prior to shares meeting the vesting requirements, the employee has no ability to act on the options. Shares are also issued with an expiration date. This is a date when the shares expire if the employee does not take any action to exercise them.

Form W-2 (or 1099-NEC if you are a nonemployee) Your W-2 (or 1099-NEC) includes the taxable income from your award and, on the W-2, the taxes that have been withheld. This form is provided by your employer. Form 1099-B This IRS form has details about your stock sale and helps you calculate any capital gain/loss.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

What are non-qualified stock options? Non-qualified stock options (NSOs or NQSOs) are a type of stock option that does not qualify for tax-advantaged treatment for the employee like ISOs do. NSOs can also be issued to other non-employee service providers like consultants, advisors, and independent board members.

Non-qualified stock options give employees the right, within a designated timeframe, to buy a set number of shares of their company's shares at a preset price. It may be offered as an alternative form of compensation to workers and also as a means to encourage their loyalty with the company. 1?

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.