Iowa Statement of Current Monthly Income for Use in Chapter 11 - Post 2005

Description

How to fill out Statement Of Current Monthly Income For Use In Chapter 11 - Post 2005?

Finding the right legal papers template can be a struggle. Naturally, there are a variety of themes available on the Internet, but how would you get the legal type you will need? Make use of the US Legal Forms site. The service provides a large number of themes, including the Iowa Statement of Current Monthly Income for Use in Chapter 11 - Post 2005, that you can use for business and private requires. Each of the forms are checked by professionals and meet up with state and federal needs.

When you are presently signed up, log in in your account and click the Down load option to get the Iowa Statement of Current Monthly Income for Use in Chapter 11 - Post 2005. Make use of your account to search through the legal forms you may have acquired formerly. Go to the My Forms tab of your account and acquire one more version of your papers you will need.

When you are a new customer of US Legal Forms, here are basic recommendations that you can stick to:

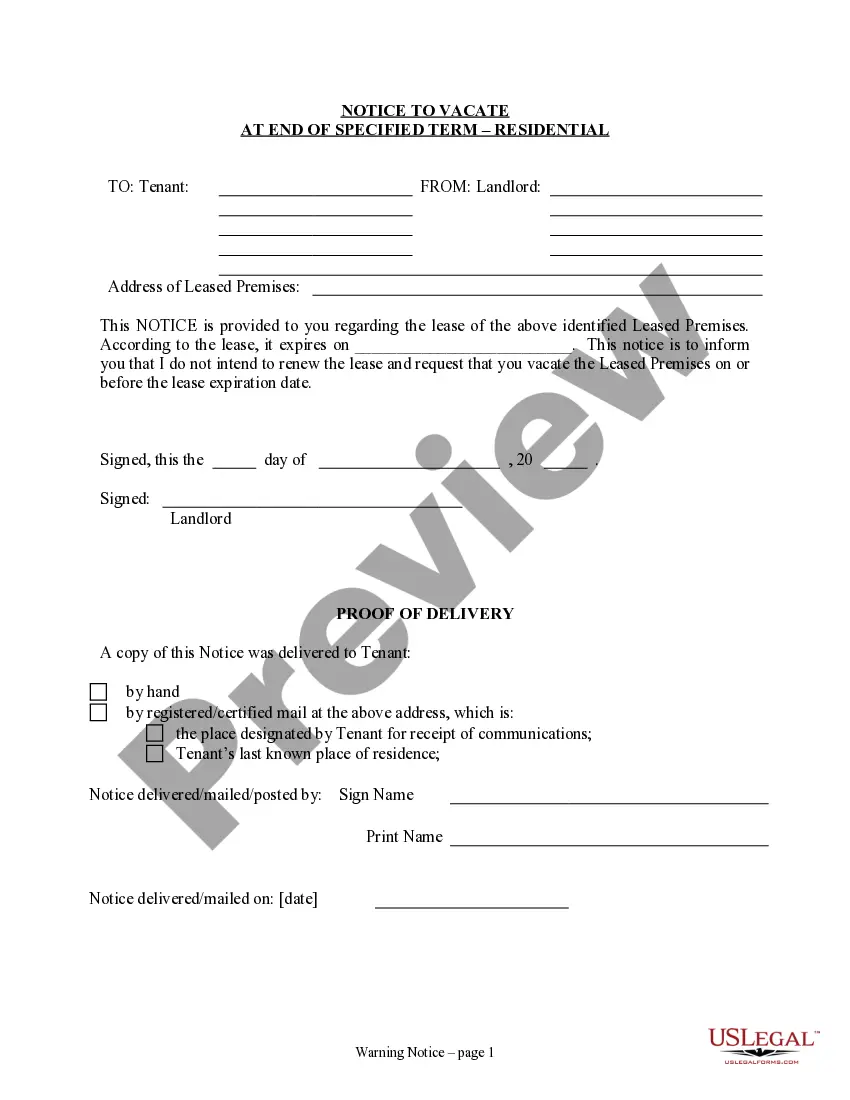

- Initial, be sure you have chosen the right type to your metropolis/area. You can check out the form making use of the Review option and look at the form explanation to make certain this is basically the best for you.

- In case the type is not going to meet up with your preferences, use the Seach discipline to obtain the appropriate type.

- When you are certain that the form would work, click the Get now option to get the type.

- Opt for the costs plan you want and enter the essential details. Create your account and pay for your order with your PayPal account or credit card.

- Pick the document structure and down load the legal papers template in your system.

- Full, change and print out and signal the attained Iowa Statement of Current Monthly Income for Use in Chapter 11 - Post 2005.

US Legal Forms is definitely the most significant collection of legal forms where you can discover different papers themes. Make use of the company to down load skillfully-created paperwork that stick to condition needs.

Form popularity

FAQ

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

The means test is calculated by comparing the debtor's average income for the past six months (current monthly income), annualized, to the median income for households of the same size in the debtor's state of residence.

After subtracting all the allowed expenses from your ?current monthly income,? the balance is your ?disposable income.? If you have no disposable income ? your allowed expenses exceed your ?current monthly income? ? then you've passed the means test.

If income is less than the median for the prior six months and there is no reason to assume it will soon increase, the test is passed, and the Chapter 7 filing can proceed. The vast majority of applicants pass the test on step one. Those who don't, move to step two.

To determine your Chapter 7 bankruptcy income limit, add the last six months of your gross income ? this is what you earned before taxes and other deductions were taken out. Divide that number by six. While that may seem like a waste of time ? why not just take one month instead of adding six, then dividing by six?

Calculation of Current Monthly Income: To begin the means test, debtors calculate their current monthly income, which equates to twice the gross income earned in the six months leading up to the bankruptcy filing.