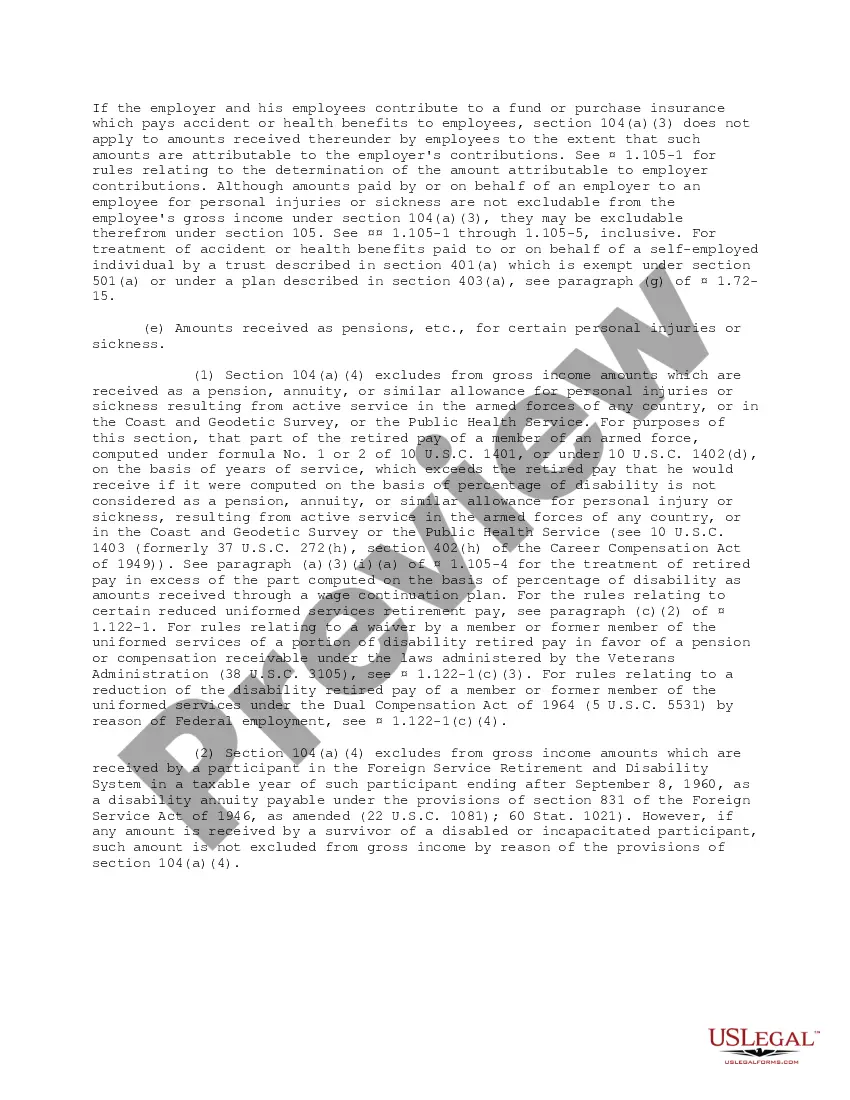

Statutory Guidelines [Appendix A(2) Tres. Reg 104-1] regarding compensation for injuries or sickness under workmen's compensation acts, damages, accident or health insurance, etc. as stated in the guidelines.

Iowa Compensation for Injuries or Sickness Treasury Regulation 104.1

Description

How to fill out Compensation For Injuries Or Sickness Treasury Regulation 104.1?

Choosing the best lawful file web template can be quite a have a problem. Of course, there are a lot of templates accessible on the Internet, but how will you find the lawful kind you want? Make use of the US Legal Forms site. The support delivers 1000s of templates, including the Iowa Compensation for Injuries or Sickness Treasury Regulation 104.1, that you can use for company and personal needs. Every one of the types are checked out by experts and fulfill federal and state needs.

In case you are previously listed, log in in your account and click the Obtain key to have the Iowa Compensation for Injuries or Sickness Treasury Regulation 104.1. Make use of your account to search with the lawful types you may have ordered earlier. Visit the My Forms tab of your account and have an additional copy of the file you want.

In case you are a new user of US Legal Forms, listed here are easy recommendations that you can adhere to:

- Initially, be sure you have selected the right kind for your personal town/state. You are able to examine the shape while using Review key and look at the shape outline to ensure it will be the right one for you.

- In the event the kind fails to fulfill your preferences, use the Seach field to find the right kind.

- When you are certain that the shape is proper, go through the Purchase now key to have the kind.

- Pick the prices plan you would like and enter in the required information. Build your account and pay money for your order with your PayPal account or Visa or Mastercard.

- Choose the data file file format and download the lawful file web template in your device.

- Full, edit and printing and signal the acquired Iowa Compensation for Injuries or Sickness Treasury Regulation 104.1.

US Legal Forms will be the largest local library of lawful types where you can discover numerous file templates. Make use of the service to download appropriately-created papers that adhere to express needs.

Form popularity

FAQ

You should get legal advice urgently if you want to claim compensation. The most common claim in a personal injury case is negligence and the time limit for this is 3 years. This means that court proceedings must be issued within 3 years of you first being aware that you have suffered an injury.

Sec. 104(a)(2) states that damages awarded as part of a settlement or judgment can be excluded from gross income if they are ?on account of personal physical injuries or physical sickness.? Emotional distress is not itself treated as a personal physical injury or physical sickness for this purpose under Sec. 104(a).

(b) Amounts received under workmen's compensation acts. Section 104(a)(1) excludes from gross income amounts which are received by an employee under a workmen's compensation act (such as the Longshoremen's and Harbor Workers' Compensation Act, 33 U.S.C., c.

Emotional distress settlements are also generally not taxable in California, as long as they are related to physical injuries sustained in the same incident. This means that if you receive a settlement for both physical and emotional distress, the entire settlement may still be considered non-taxable.

Section 104(a) provides an exclusion from gross income with respect to certain amounts described in paragraphs (b), (c), (d) and (e) of this section, which are received for personal injuries or sickness, except to the ex- tent that such amounts are attrib- utable to (but not in excess of) deduc- tions allowed under ...

Amendment: Act section 1605(b) of the Small Business Job Protection Act of 1996 (P. L. 104-188) amended Code section 104(a) by striking the last sentence and inserting the following new sentence: "For purposes of paragraph (2), emotional distress shall not be treated as a physical injury or physical sickness.

IRC Section and Treas. For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury. IRC Section 104 explains that gross income does not include damages received on account of personal physical injuries and physical injuries.

Section 104(a)(3) states that except in the case of amounts attributable to (and not in excess of) deductions allowed under ' 213 for any prior taxable year, gross income does not include amounts received through accident or health insurance (or through an arrangement having the effect of accident or health insurance) ...