Iowa Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees

Description

How to fill out Model Performance Evaluation - Appraisal Form For Hourly, Exempt, Nonexempt, And Managerial Employees?

Locating the appropriate authorized document template can be a struggle. It goes without saying, there is a wide array of templates accessible online, but how do you acquire the correct version you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Iowa Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees, which can be applied for personal and professional purposes.

All templates are reviewed by specialists and meet state and federal regulations.

If you are a new user of US Legal Forms, here are simple steps you should follow: Ensure you have selected the correct template for your city/county. You can review the document using the Preview button and check the document description to confirm this is the right one for you. If the document does not meet your needs, use the Search field to find the proper template. When you are confident that the document is suitable, click the Get Now button to acquire the template. Choose your desired pricing plan and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the obtained Iowa Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees. US Legal Forms is the finest repository of legal templates where you can discover a variety of document forms. Utilize the service to download professionally crafted paperwork that comply with state standards.

- If you are currently registered, Log In to your account and click the Acquire button to obtain the Iowa Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees.

- Use your account to browse the legal templates you have previously acquired.

- Navigate to the My documents tab of your account and get another copy of the document you need.

Form popularity

FAQ

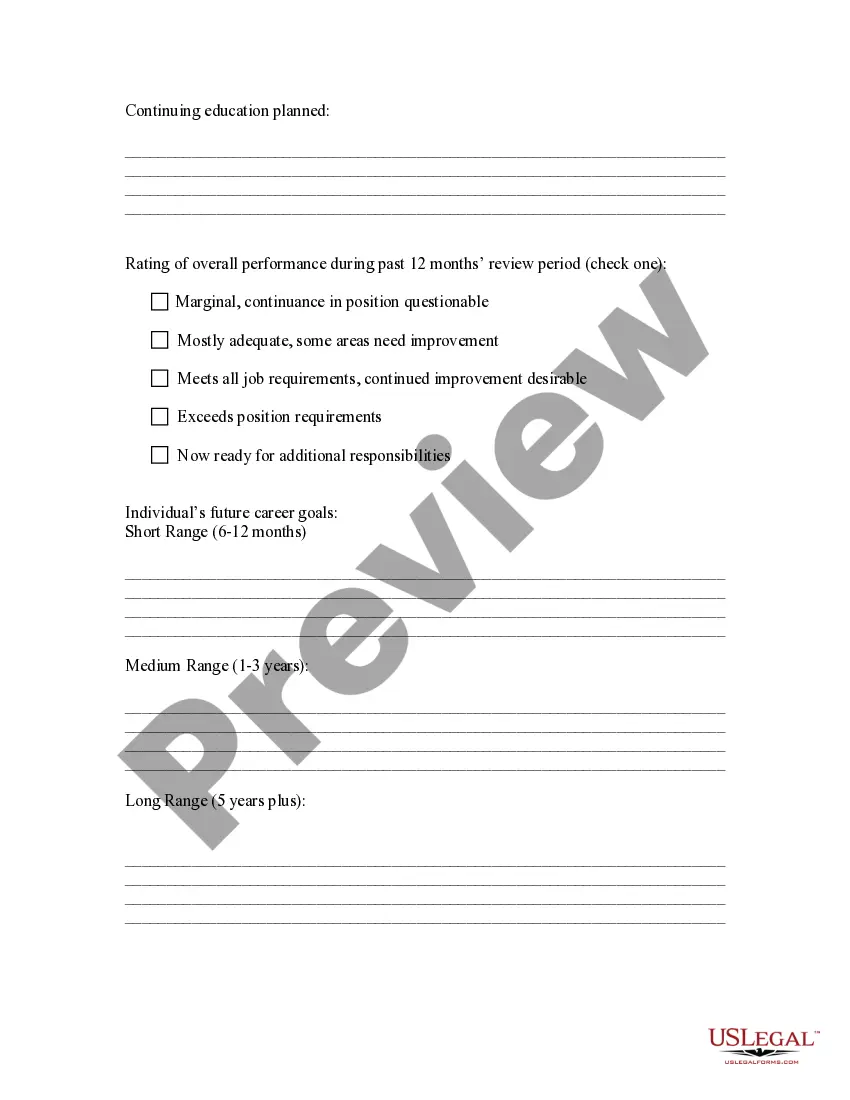

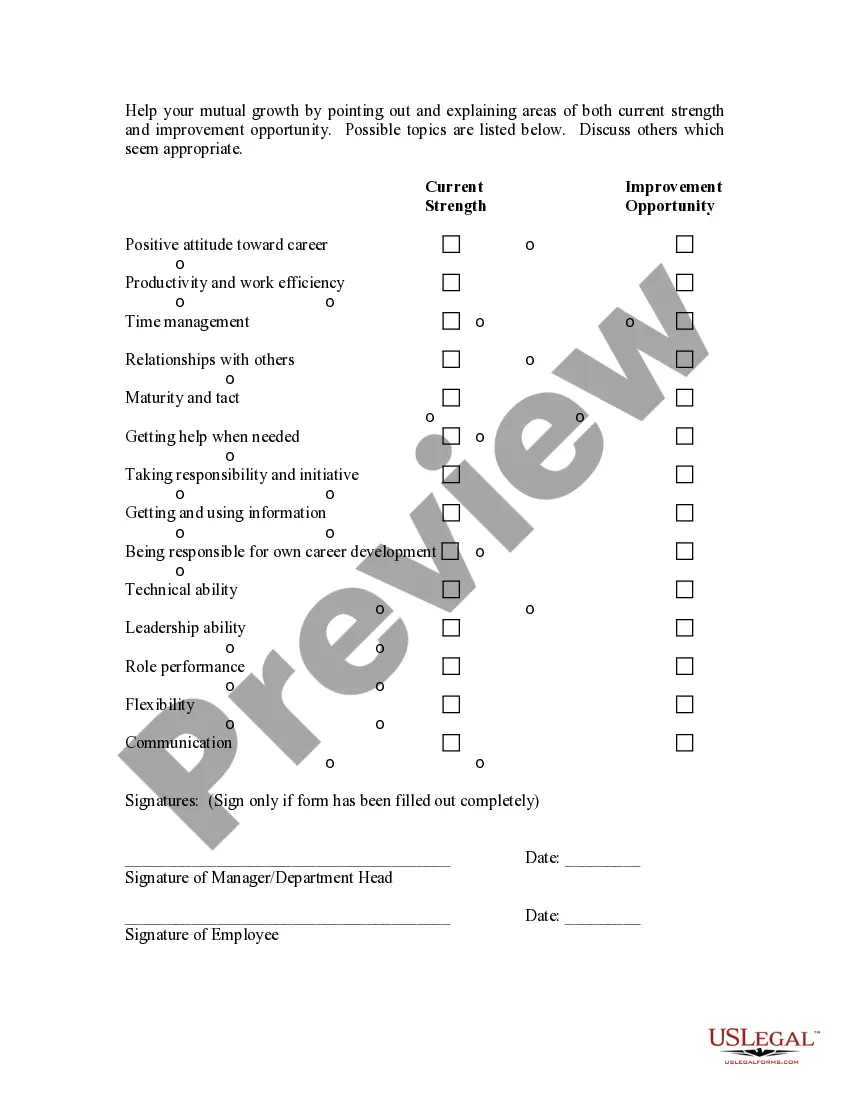

based performance appraisal form measures employee performance against key performance indicators. These indicators provide quantifiable benchmarks aligned with organizational objectives. By adopting the Iowa Model Performance Evaluation Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees, organizations can streamline this process, making performance evaluation objective and focused on results. This promotes accountability and clarity in expectations.

The primary difference in status between exempt and non-exempt employees is their eligibility for overtime. Under federal law, that status is determined by the Fair Labor Standards Act (FLSA). Exempt employees are not entitled to overtime, while non-exempt employees are.

To classify an employee's FLSA status, you must answer three questions covering the following areas:Salary basis: Does the employee earn a salary?Salary level: How much does the employee earn per week or year?More items...?

When you fill the form:Be honest and critical. Analyze your failures and mention the reasons for it.Keep the words minimal.Identify weaknesses.Mention your achievements.Link achievements to the job description and the organization's goals.Set the goals for the next review period.Resolve conflicts and grievances.

Here are a few examples:I always go out of my way to help co-workers.I make sure everyone on my team feels comfortable when exchanging ideas.I look for ways to keep my team on track and make sure important milestones are met.I brainstorm ways to motivate others and freely give praise when performance goals are met.

How to write a self-appraisalHighlight your accomplishments.Gather data to showcase your achievements.Align yourself with the company.Reflect objectively on any mistakes.Set goals.Ask for anything you need to improve.Get a second opinion.

Salary level test. Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

Here's a look at four business writing training guidelines to help both managers and individual employees write relevant and accurate performance appraisal reports.Keep the audience in mind.Stay relevant.Keep track of all achievements.Use specific, measurable, confident language.Document goals.More items...?

Preparing for the Appraisal MeetingReview the employee's performance appraisal for the previous year and goals that were established for the current year.Think of their performance in terms of a SWOT Analysis.Keep notes throughout the year to track their accomplishments and goals they have for the next year.More items...

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.