Iowa Job Offer Letter - Exempt or Nonexempt Position

Description

How to fill out Job Offer Letter - Exempt Or Nonexempt Position?

Are you presently located in a location where you need documents for either business or personal purposes almost every day.

There are numerous document templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms provides thousands of template options, including the Iowa Job Offer Letter - Exempt or Nonexempt Position, which are designed to meet federal and state regulations.

Once you find the appropriate template, click Buy now.

Select the pricing plan you prefer, provide the necessary information to create your account, and process the payment using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Iowa Job Offer Letter - Exempt or Nonexempt Position template.

- If you don’t have an account and wish to use US Legal Forms, follow these steps.

- Find the template you require and ensure it is for your correct city/state.

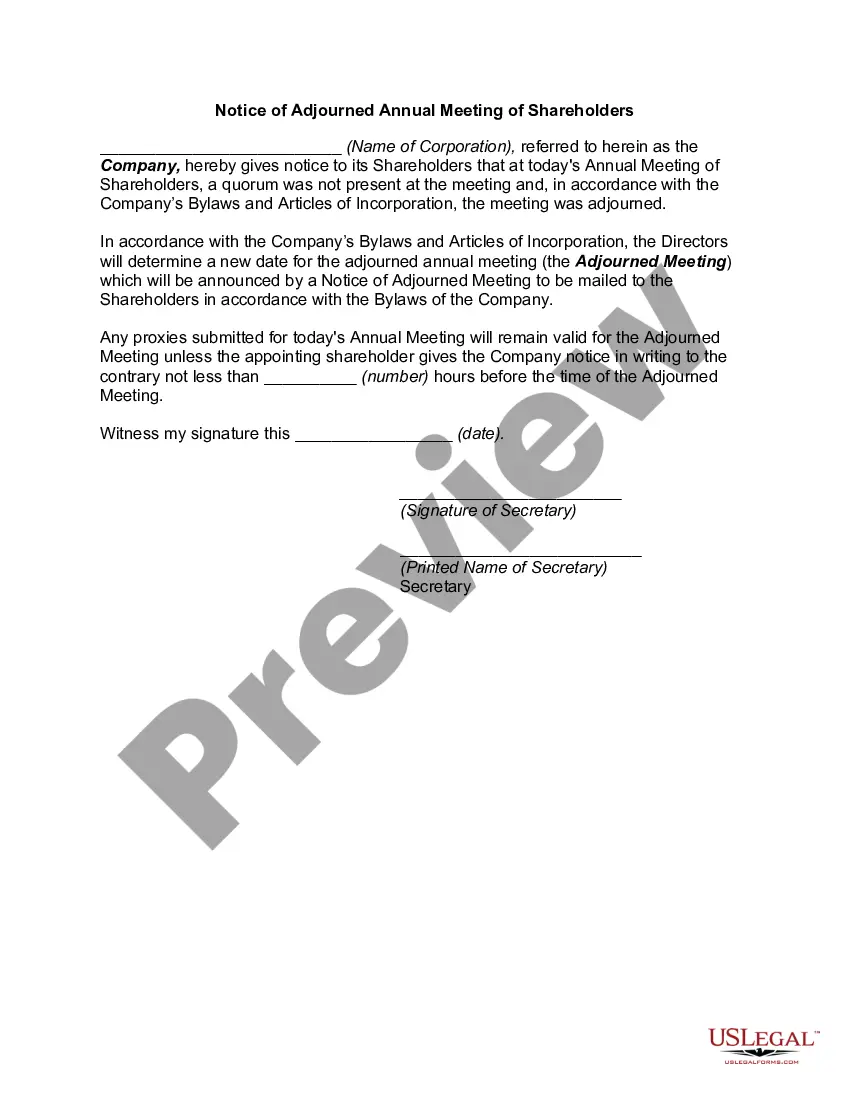

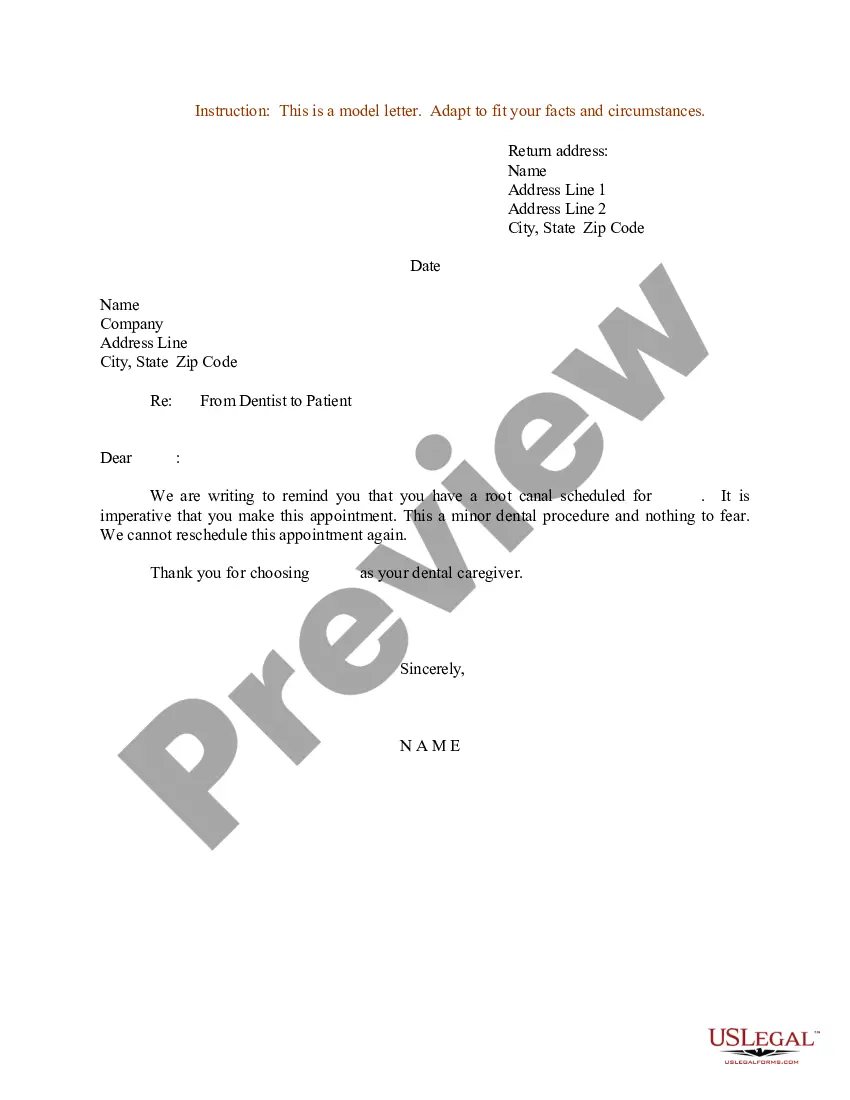

- Utilize the Review option to examine the document.

- Check the description to confirm you have selected the correct template.

- If the template isn’t what you need, use the Search field to locate a template that meets your needs.

Form popularity

FAQ

The difference between exempt and non-exempt positions in Iowa lies in job duties, salary levels, and overtime eligibility. Exempt positions generally include executive, administrative, and professional roles that meet specific criteria under state and federal law, while non-exempt roles include most hourly jobs. If you are preparing an Iowa Job Offer Letter - Exempt or Nonexempt Position, ensure you clearly define the role and its classification.

In Iowa, the overtime law mandates that nonexempt employees must receive time and a half for hours worked beyond 40 in a workweek. When organizing your Iowa Job Offer Letter - Exempt or Nonexempt Position, it's crucial to clarify the employee's classification. Misclassifying an employee can lead to significant legal repercussions. For a clear understanding and guidance, consider using uslegalforms, which can provide templates specifically tailored for Iowa employment laws.

Exempt/Nonexempt Classification. Offer letters to nonexempt employees should state that they must record their hours worked and they will be paid overtime (as pre-approved by their supervisor), and describe available meal and rest periods.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

Non-exempt Benefits: Overtime Pay Non-exempt employees are compensated for the time they work, not the jobs they complete, so if they work more than 40 hours per week, they make extra money.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

Exempt positions are excluded from minimum wage, overtime regulations, and other rights and protections afforded nonexempt workers. Employers must pay a salary rather than an hourly wage for a position for it to be exempt.

Exempt employees refer to workers in the United States who are not entitled to overtime pay. This simply implies that employers of exempt employees are not bound by law to pay them for any extra hours of work. The federal standard for work hours in the United States is 40 hours per workweek.