Iowa Employee News Form

Description

How to fill out Employee News Form?

Selecting the ideal legal document template can be challenging. Of course, there are numerous designs available online, but how do you locate the legal form you need? Utilize the US Legal Forms website. This platform offers a wide array of templates, including the Iowa Employee News Form, which can be used for both professional and personal purposes. All forms are reviewed by specialists and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Iowa Employee News Form. Use your account to search through the legal documents you have previously purchased. Navigate to the My documents section of your account to retrieve another copy of the documents you need.

If you are a new user of US Legal Forms, here are some simple guidelines to follow.

Select the document format and download the legal document template to your device. Complete, edit, print, and sign the obtained Iowa Employee News Form. US Legal Forms is the largest collection of legal documents where you can find various document templates. Utilize the service to download professionally crafted files that meet state requirements.

- First, make sure you have selected the correct form for your city/region.

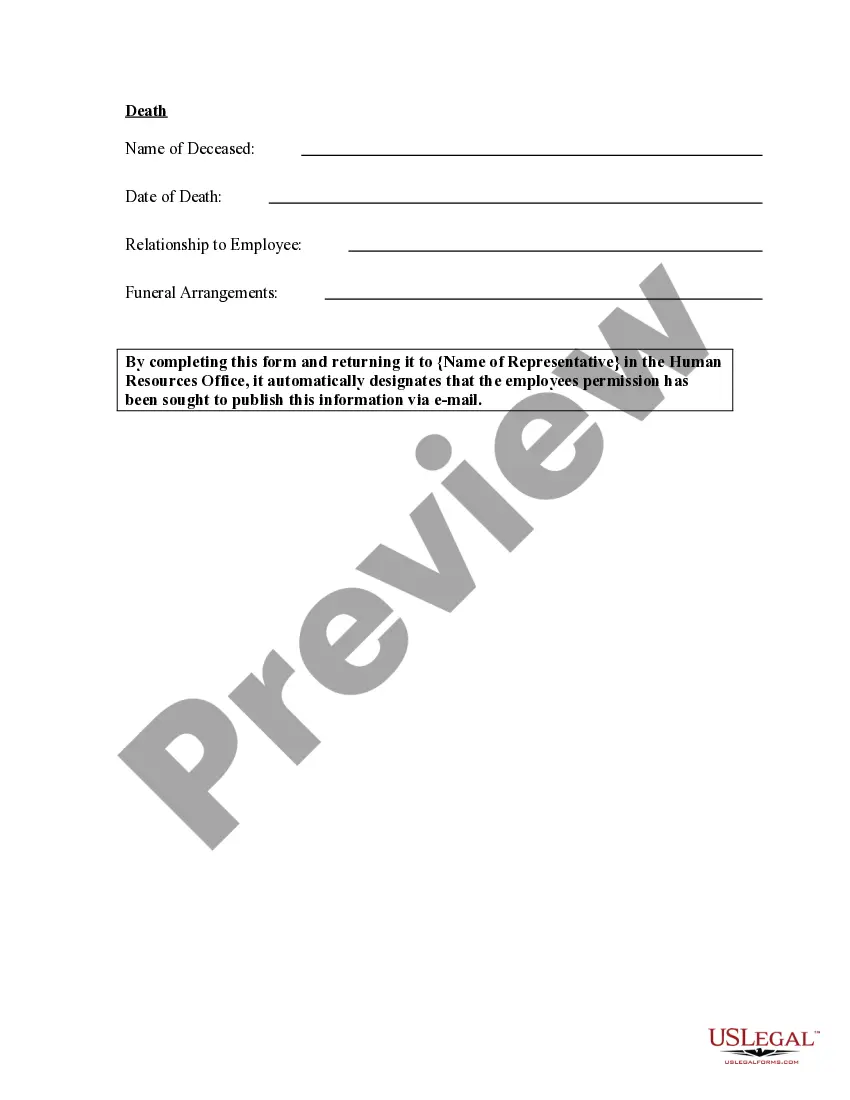

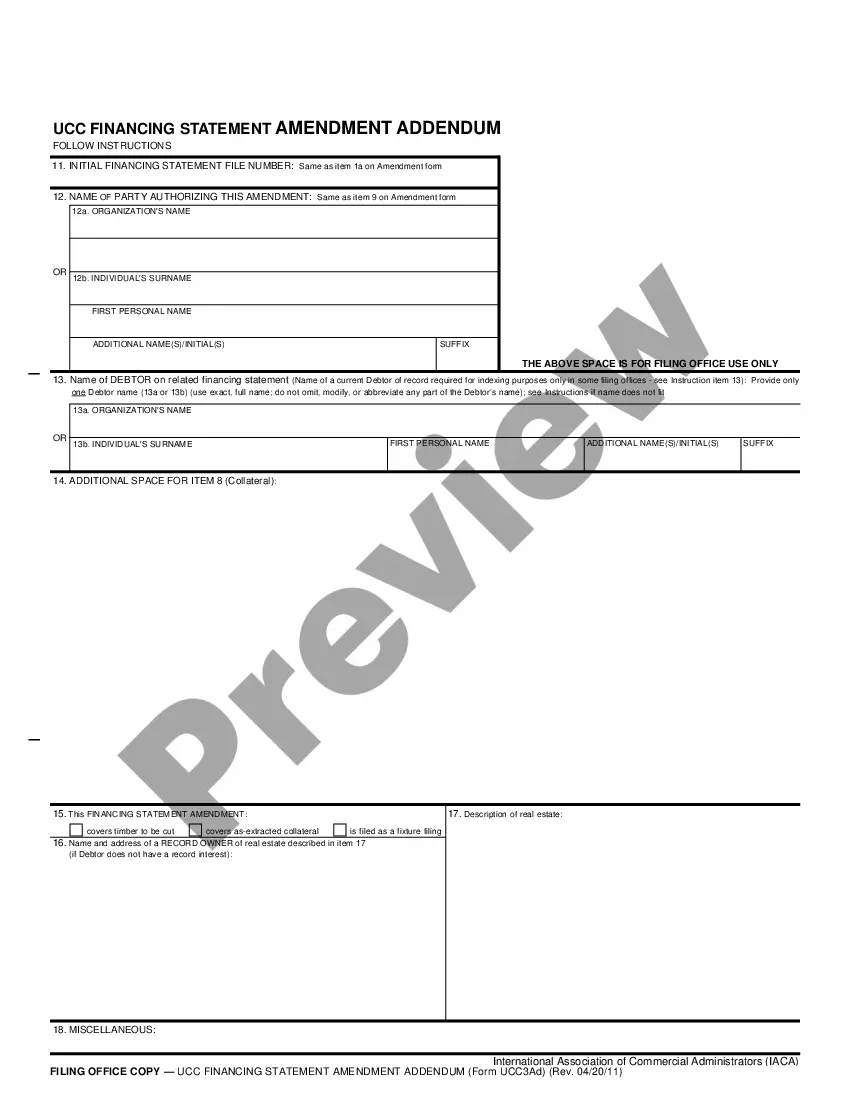

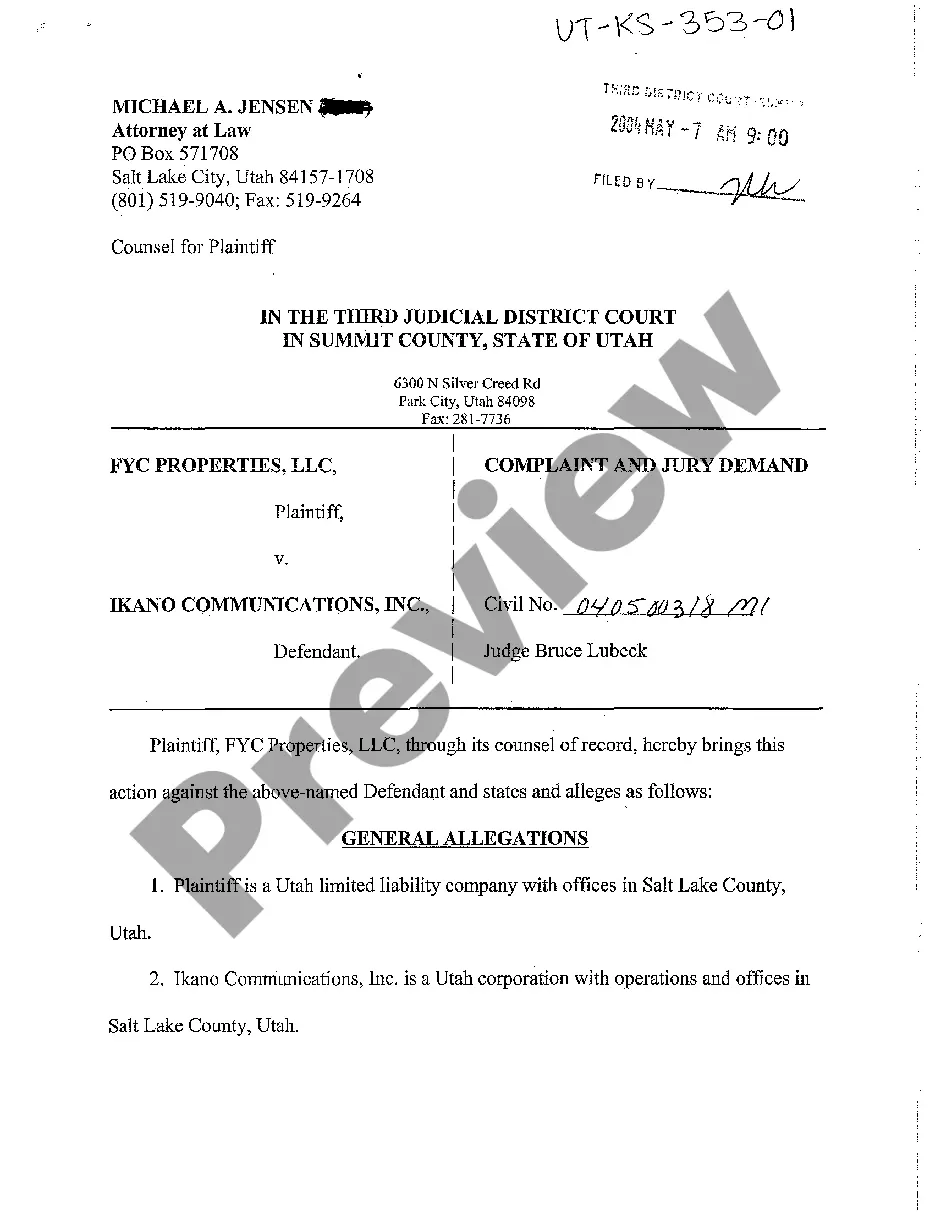

- You can view the document using the Preview button and read the document description to confirm it is suitable for you.

- If the form does not fulfill your requirements, utilize the Search field to find the right document.

- Once you are certain that the form is appropriate, click the Buy Now button to acquire the form.

- Choose the pricing plan you prefer and enter the required information.

- Create your account and pay for your order using your PayPal account or credit card.

Form popularity

FAQ

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

An employer doing business in Iowa who hires or rehires an employee must complete this section. Submit online at . You may also mail this portion of the page to Centralized Employee Registry, PO Box 10322, Des Moines IA 50306-0322; or fax it to 800-759-5881. Please include your FEIN.

Initial hiring documentsJob application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.Job description and performance plan.More items...?

The Department sends a 1099-G (Certain Government Payments) to taxpayers who received an Iowa income tax refund during the year AND who filed a Schedule A (Itemized Deductions) with their federal income tax return in the tax year for which the refund was issued.

Employee's Withholding Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment. If employees claim exemption from income tax withholding, then they must indicate this on their W-4.

Employees fill out a W-4 form to inform employers how much tax to withhold from their paycheck based on filing status, dependents, anticipated tax credits, and deductions. If the form is filled out incorrectly, you may end up owing taxes when you file your return. The IRS simplified the form in 2020.

All new employees for your business must complete a federal Form W-4 and the related Iowa Form IA W-4,Employee Withholding Allowance Certificate.

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

Each employee must file this Iowa W-4 with his/her employer. Do not claim more allowances than necessary or you will not have enough tax withheld. You may file a new W-4 at any time if the number of your allowances increases.

Form W-2 reports taxable wages paid to an employee during a one-year period, along with employment taxes withheld from paychecks for that year. Federal law requires all employers to send employees W-2 statements no matter how low earnings or wages are.