Iowa Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

How to fill out Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

Are you in a position where you require documents for both organization or specific tasks almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn’t easy.

US Legal Forms offers thousands of form templates, such as the Iowa Charitable Trust with Creation Dependent on Eligibility for Tax Exempt Status, which are designed to comply with federal and state requirements.

Select a suitable file format and download your copy.

Find all the document templates you have purchased in the My documents section. You can obtain another copy of the Iowa Charitable Trust with Creation Dependent on Eligibility for Tax Exempt Status at any time, if needed. Click on the desired form to download or print the document template.

Utilize US Legal Forms, the largest selection of legal forms, to save time and reduce errors. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Iowa Charitable Trust with Creation Dependent on Eligibility for Tax Exempt Status template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/region.

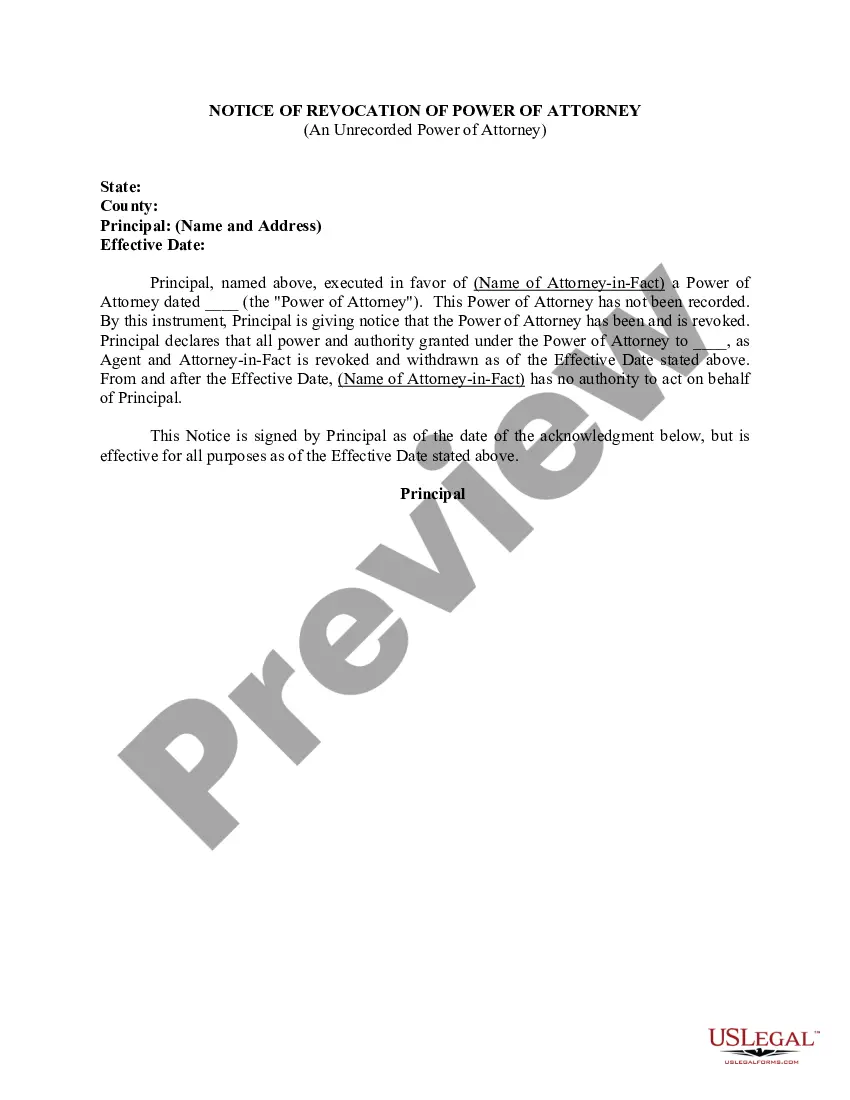

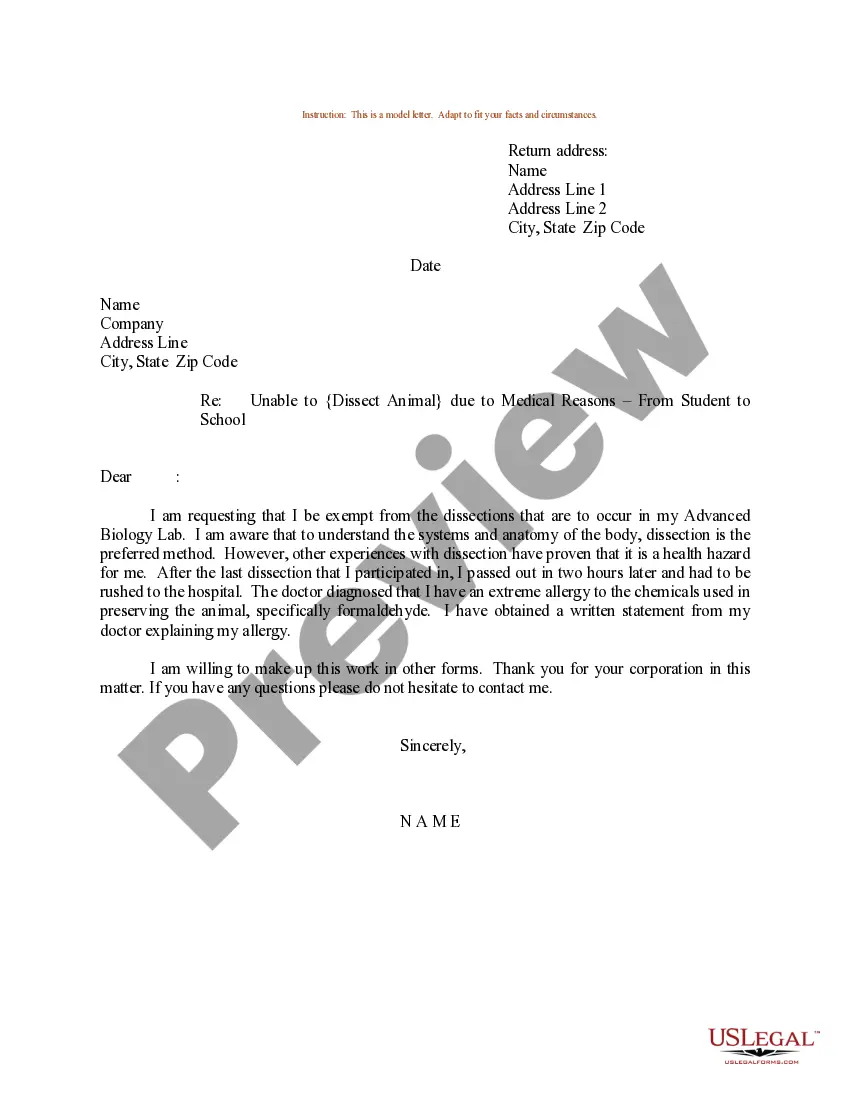

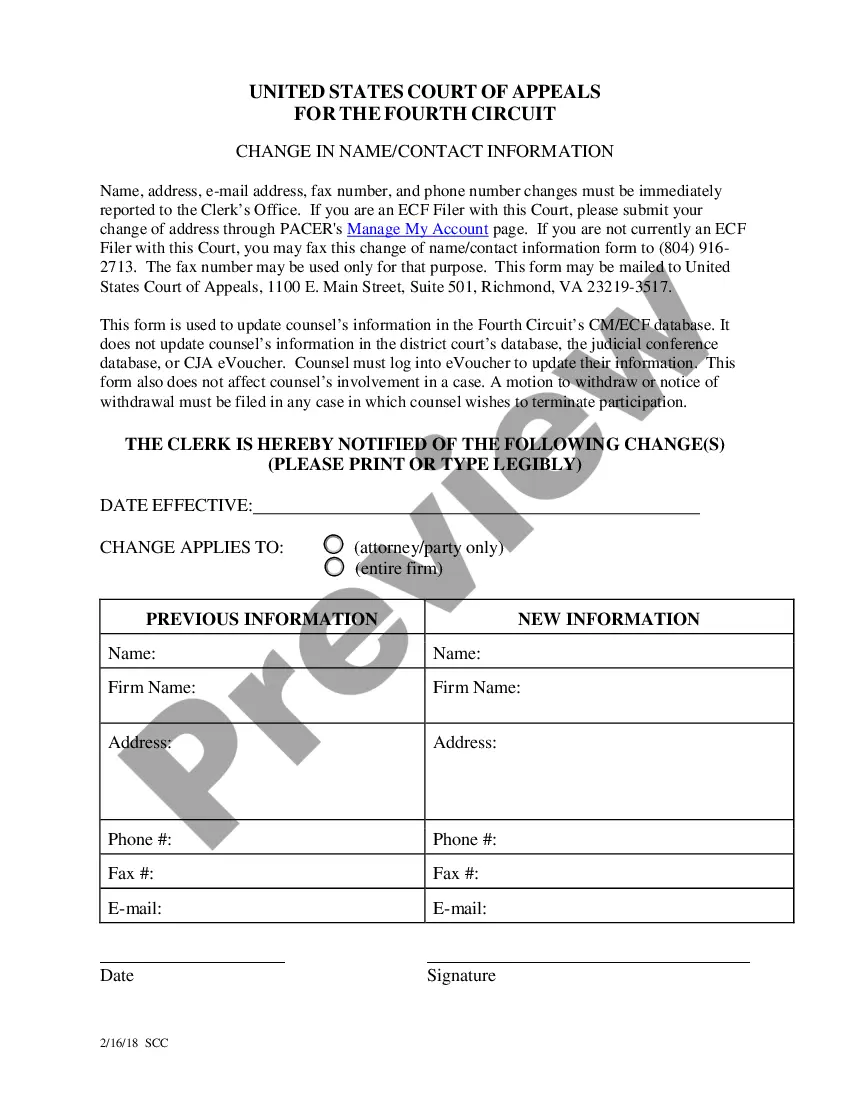

- Utilize the Preview feature to examine the form.

- Check the details to ensure you have chosen the correct form.

- If the form isn’t what you are looking for, use the Search box to find the form that meets your needs and specifications.

- Once you find the right form, click on Buy now.

- Choose the pricing plan you prefer, enter the required information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

Form popularity

FAQ

No, the general rule is that nonprofits are not exempt from sales tax. Nonprofits that are exempt from federal income tax under 501(c)(3) are automatically exempt from parallel state income tax but not automatically exempt from other state level taxes such as sales, use, and property taxes.

Tax-exempt statusCharities and non-profits are exempt from corporation tax as well as the trustees being exempt from income tax.

A charitable remainder trust is a tax-exempt irrevocable trust designed to reduce the taxable income of individuals. A charitable remainder trust dispenses income to one or more noncharitable beneficiaries for a specified period and then donates the remainder to one or more charitable beneficiaries.

No, the general rule is that nonprofits are not exempt from sales tax. Nonprofits that are exempt from federal income tax under 501(c)(3) are automatically exempt from parallel state income tax but not automatically exempt from other state level taxes such as sales, use, and property taxes.

Sales Tax - Sales Made TO Nonprofit Entities. Nonprofit entities are not automatically exempt from paying sales tax on goods and taxable services, even if they are exempt from state and federal income taxes. Sales tax must be paid unless some other general sales tax exemption applies.

Through tax-exemptions, governments support the work of nonprofits and receive a direct benefit. Nonprofits benefit society. Nonprofits encourage civic involvement, provide information on public policy issues, encourage economic development, and do a host of other things that enrich society and make it more vibrant.

No, the general rule is that nonprofits are not exempt from sales tax. Nonprofits that are exempt from federal income tax under 501(c)(3) are automatically exempt from parallel state income tax but not automatically exempt from other state level taxes such as sales, use, and property taxes.

Sales of tangible personal property in Iowa are subject to sales tax unless exempted by state law. Sales of services are exempt from Iowa sales tax unless taxed by state law. The retailer must add the tax to the price and collect the tax from the purchaser.

However, a charitable trust is not treated as a charitable organization for purposes of exemption from tax. Accordingly, the trust is subject to the excise tax on its investment income under the rules that apply to taxable foundations rather than those that apply to tax-exempt foundations.