Iowa Abstract of Title

Description

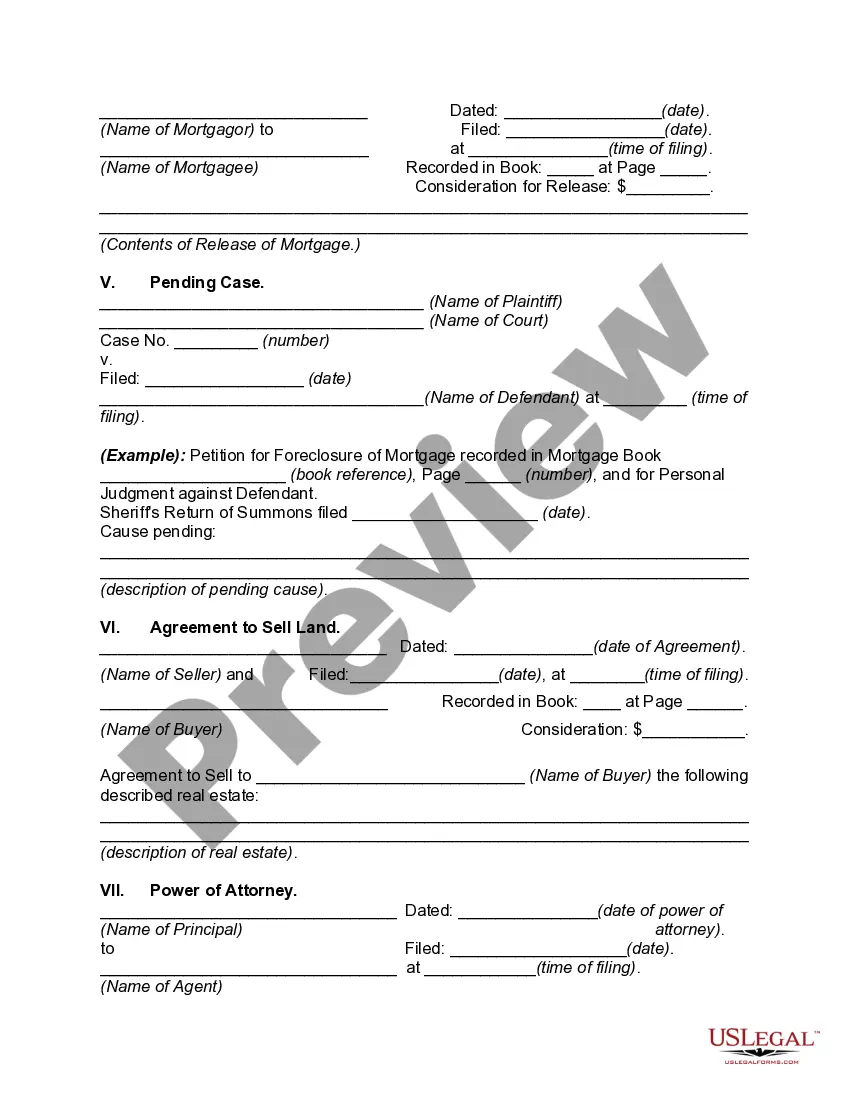

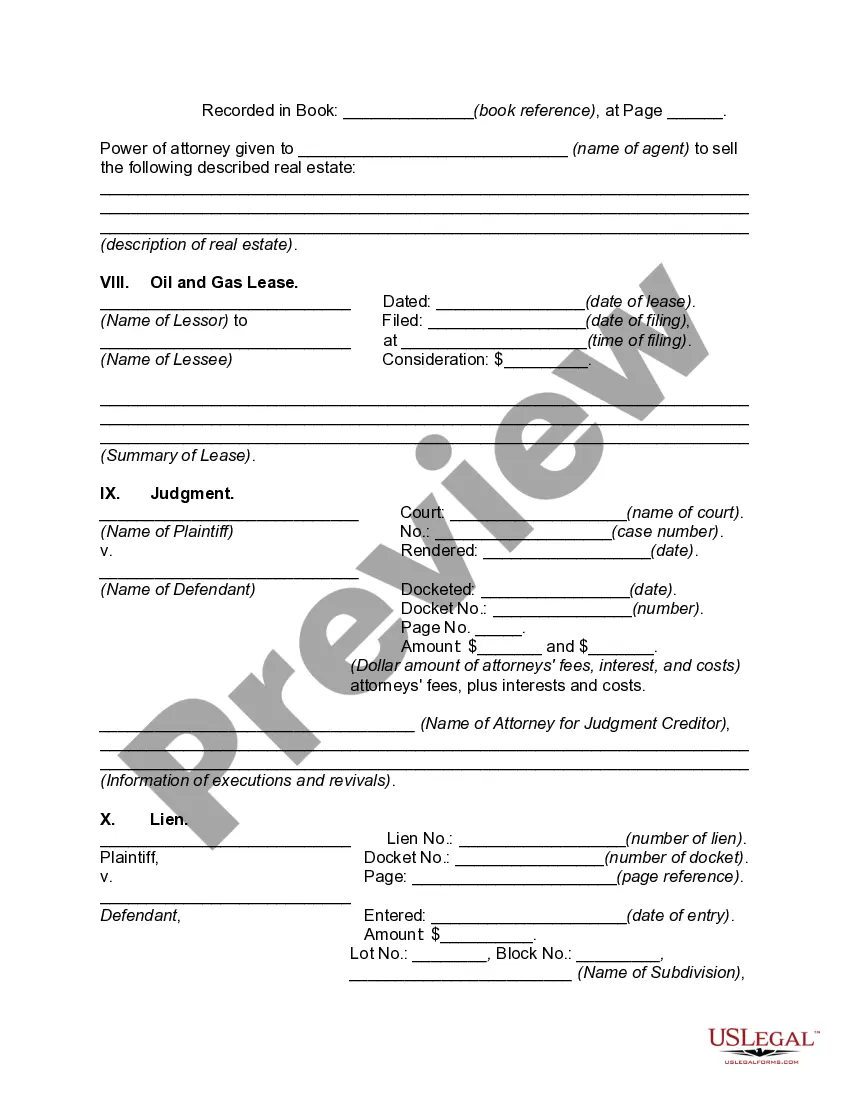

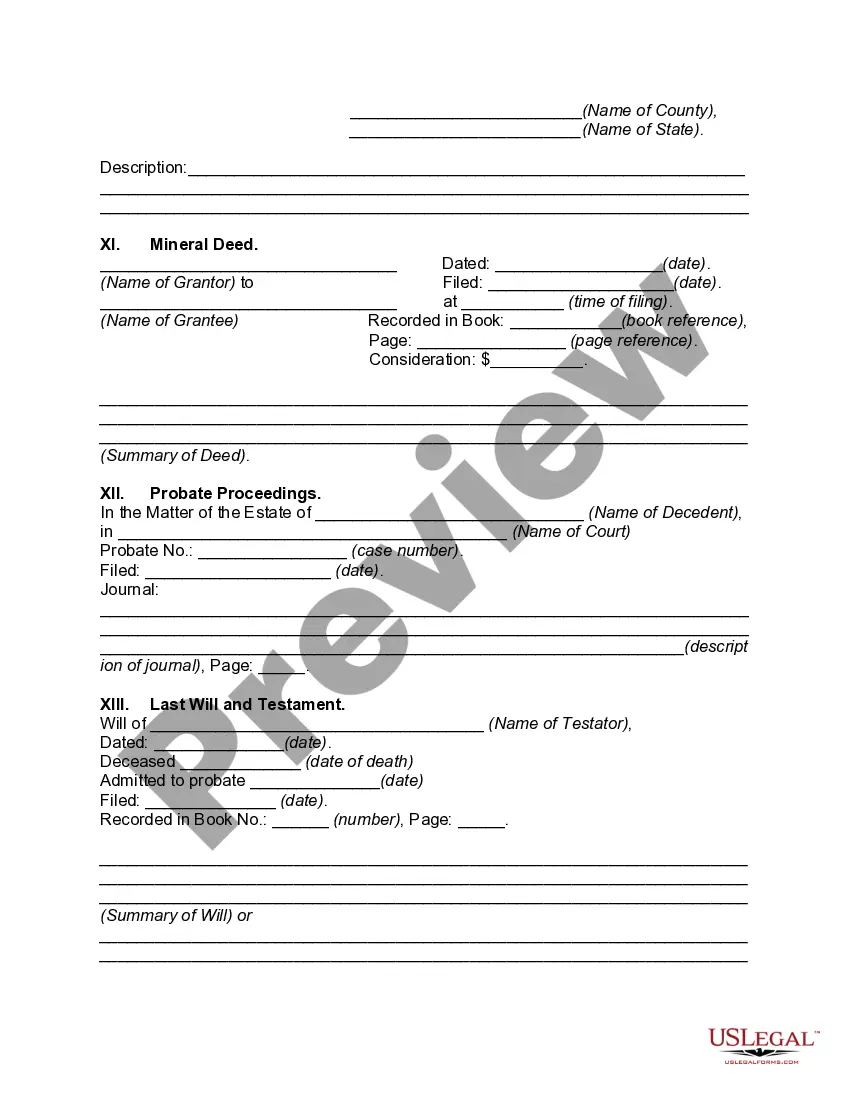

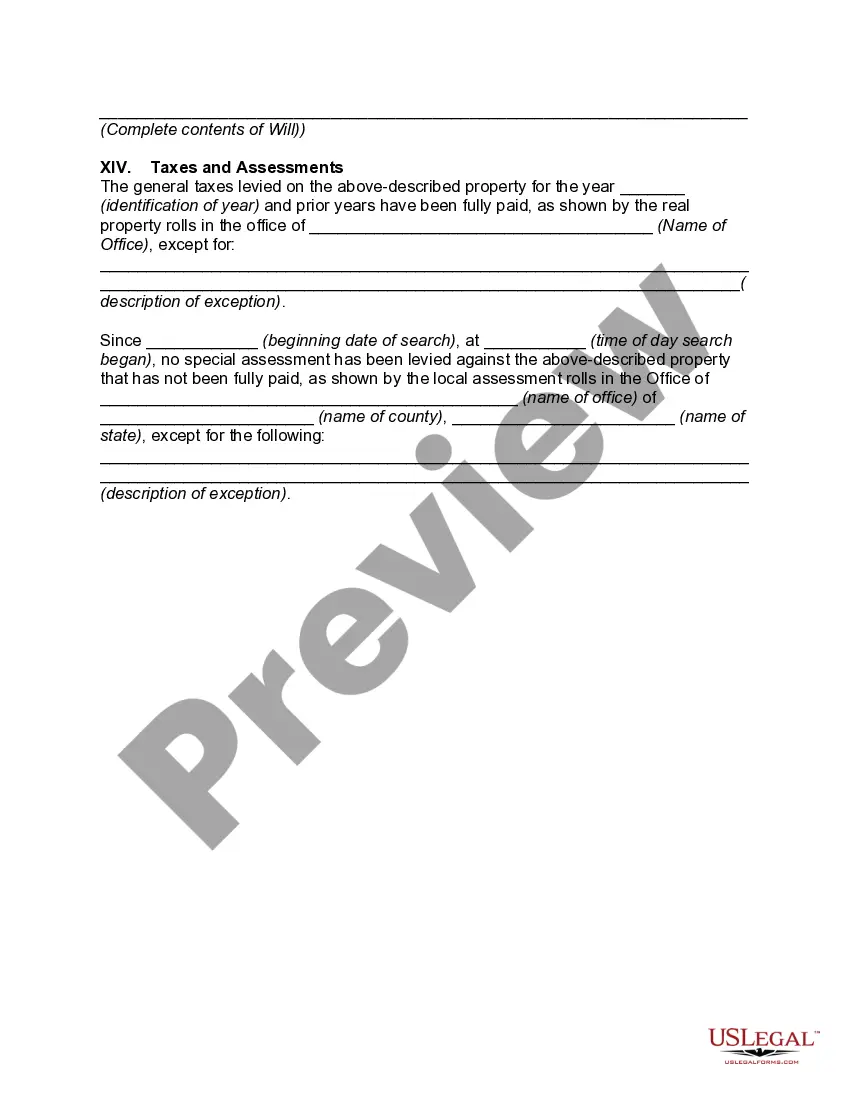

How to fill out Abstract Of Title?

It is achievable to spend hours online trying to locate the official document template that complies with the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that are evaluated by professionals.

You can comfortably obtain or create the Iowa Abstract of Title from our service.

If available, use the Review button to preview the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, modify, print, or sign the Iowa Abstract of Title.

- Each legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your region/city of choice.

- Check the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

An abstract of title summarizes the various instruments and documents affecting the title to real property, whereas title insurance is a comprehensive indemnity contract under which a title insurance company warrants to make good a loss arising through defects in title to real estate or any liens or encumbrances

In Iowa, the abstract of title is a crucial part of all real estate sales. Before you sell your property, you need to have your abstract of title updated and checked for title defects.

An abstract is short for abstract of title. This legal document is absolutely vital in real estate transactions in Iowa. It includes all of the documents that are a part of the public record regarding a particular property.

For a residential transaction, coverage up to $500,000 is just $110 and an additional $1 per thousand over $500,000. Most common endorsements are offered at no charge. For a non-purchase residential transaction such as a refinance or second mortgage, the premium is just $90 for coverage up to $500,000.

In Iowa, the abstract of title is a crucial part of all real estate sales. Before you sell your property, you need to have your abstract of title updated and checked for title defects. To learn more about abstracts, and why you need yours when selling your home in Iowa, read on.

The abstract of title is a brief history of a piece of land, and it is used to determine whether or not there is any kind of claim against a property. The abstract of title includes encumbrances, conveyances, wills, liens, grants and transfers.

An abstract of title summarizes the various instruments and documents affecting the title to real property, whereas title insurance is a comprehensive indemnity contract under which a title insurance company warrants to make good a loss arising through defects in title to real estate or any liens or encumbrances

40 years is the minimum time we must search to create a new abstract. The cost of the abstract is usually paid by the seller because the seller must prove that they legally hold title. This cost can be negotiated when the purchase agreement is written.