Iowa Partnership Agreement for Profit Sharing

Description

How to fill out Partnership Agreement For Profit Sharing?

You might spend multiple hours online trying to discover the legal document template that fulfills the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

You can conveniently obtain or generate the Iowa Partnership Agreement for Profit Sharing from my service.

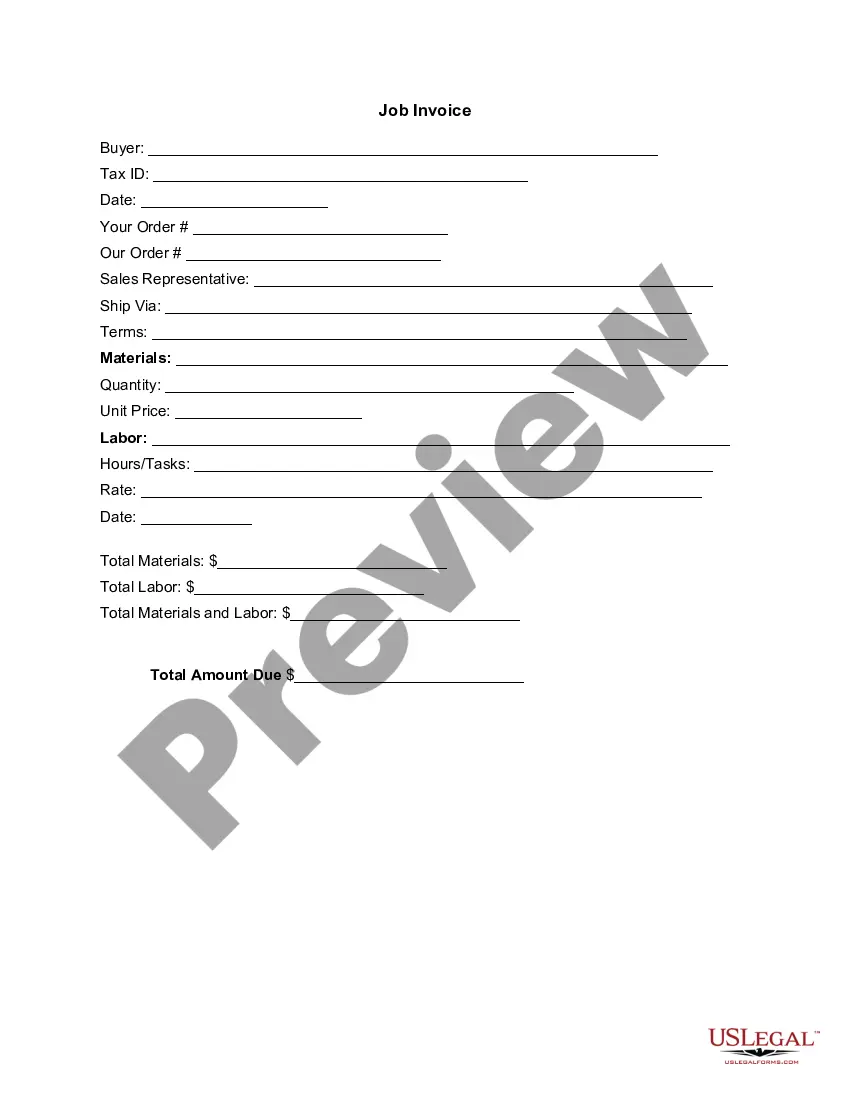

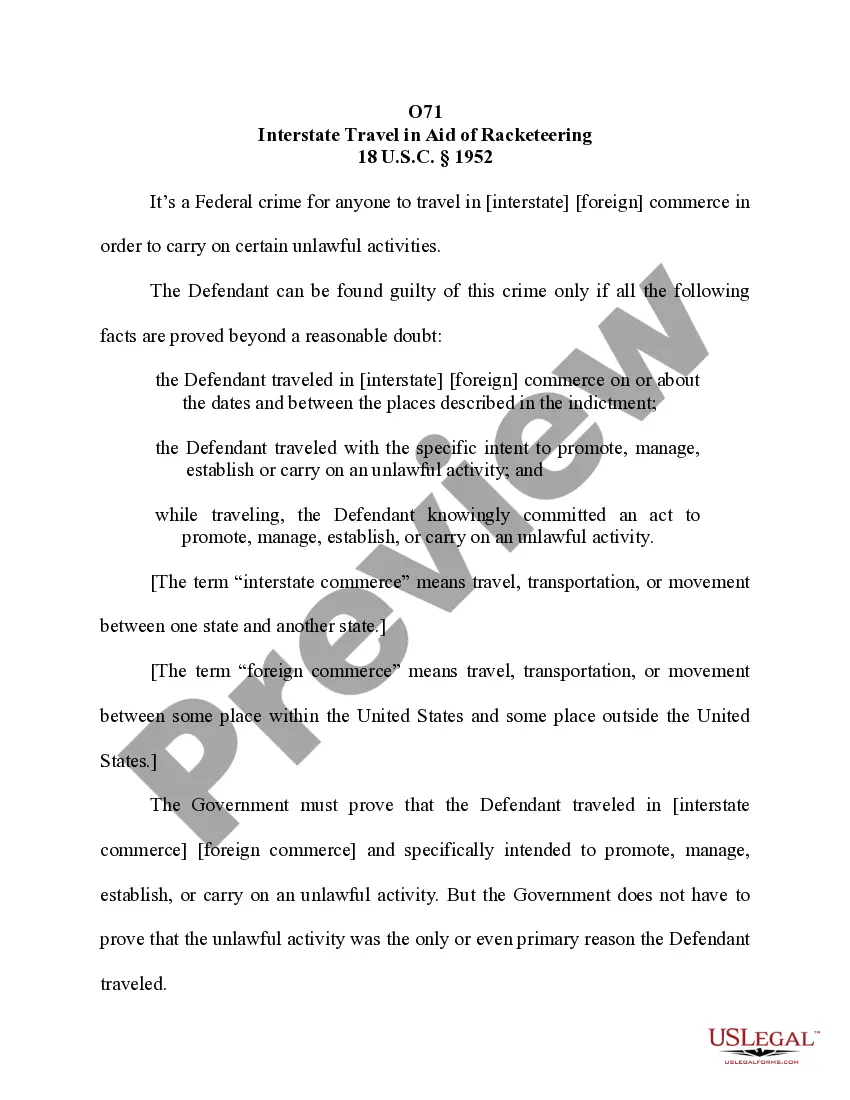

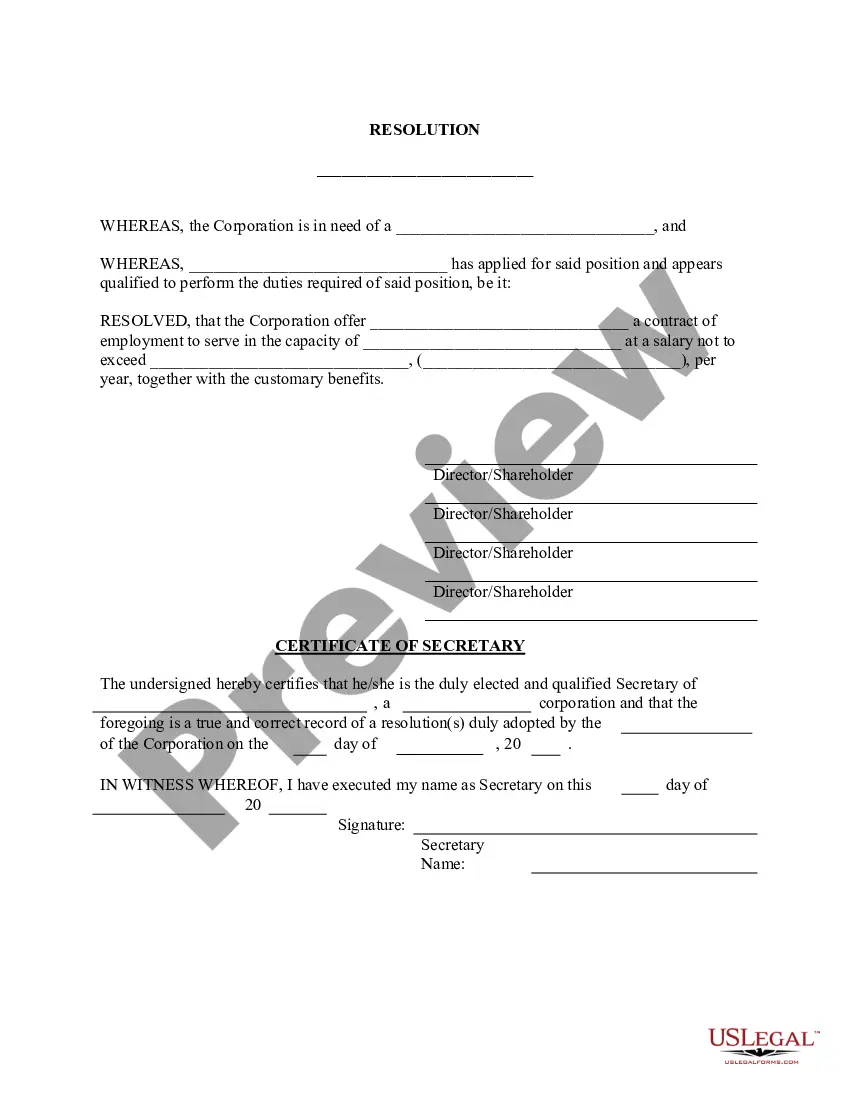

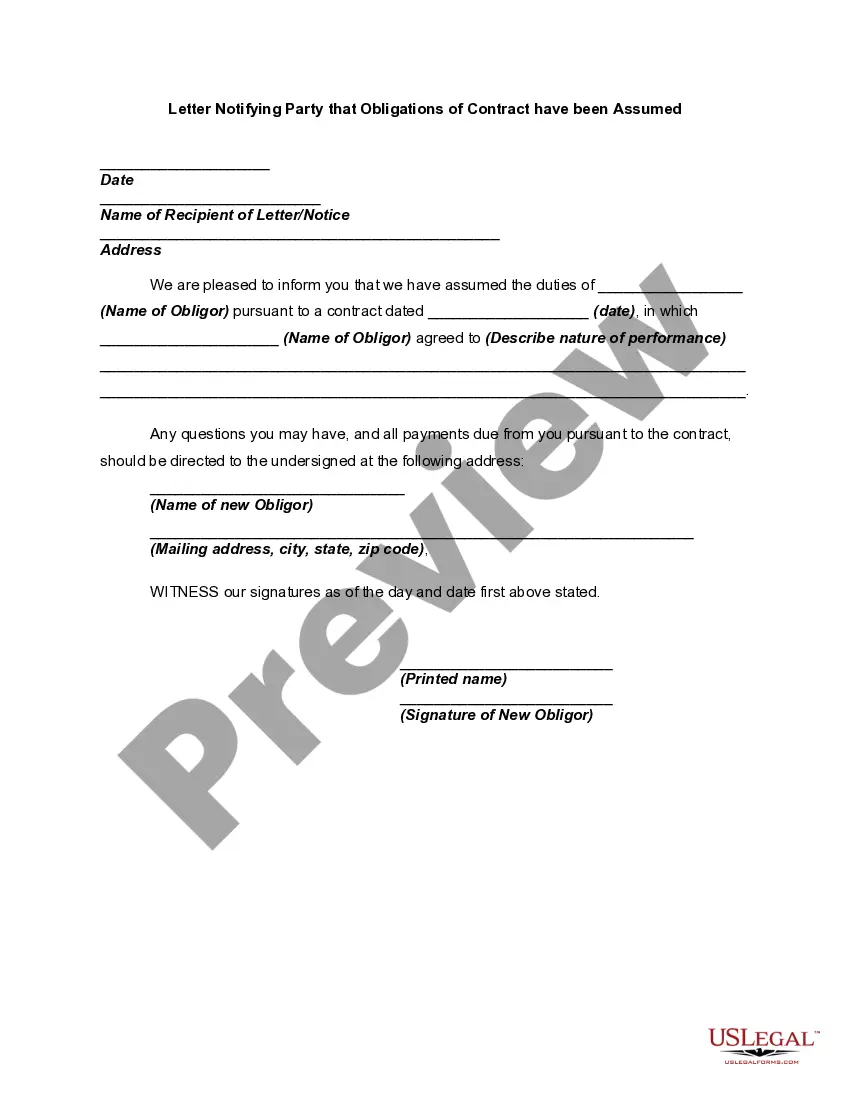

If available, utilize the Preview button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, modify, print, or sign the Iowa Partnership Agreement for Profit Sharing.

- Each legal document template you purchase is yours permanently.

- To retrieve an additional copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, adhere to the simple instructions below.

- First, ensure you have selected the correct document template for the county/town of your choice.

- Review the form details to confirm you have chosen the right template.

Form popularity

FAQ

Suppose A and B invest Rs. x and Rs. y respectively for a year in a business, then at the end of the year: (A's share of profit) : (B's share of profit) = x : y.

If you want your profit-sharing agreement to be rock solid, here are a few clauses that you must include in it.Profit Sharing. Clearly mention the ratio/percentage in which you will be dividing the profits.Termination.Dispute Resolution.Confidentiality.Obligations.Intellectual Property.Indemnities and Liabilities.

This means that in a partnership there is more than one owner, and the profit is shared between the owners. In a partnership, it is the residual profit which is divided between the partners in the profit and loss sharing ratio.

In a business partnership, you can split the profits any way you want, under one conditionall business partners must be in agreement about profit-sharing. You can choose to split the profits equally, or each partner can receive a different base salary and then the partners will split any remaining profits.

In a partnership, two or more individuals will share the profits and pay income taxes on those profits. A partner's share in a partnership is not necessarily based on the amount each partner has invested in the business, so an owner's share of the business's equity may not be the same as their share of the profits.

A profit sharing agreement is used when two entities work together for the same purpose, typically for a project-based time period. This is commonly referred to as an unincorporated joint venture, whereby the two entities remain as such and do not form a new company for the purpose of the project.

There's no right or wrong way to split partnership profits, only what works for your business. You can decide to pay each partner a base salary and then split any remaining profits equally, or assign a percentage based on the time and resources each person contributes to the company.

Are there rules on how partnerships are run? The only requirement is that in the absence of a written agreement, partners don't draw a salary and share profits and losses equally. Partners have a duty of loyalty to the other partners and must not enrich themselves at the expense of the partnership.

Absent an agreement, the partners will share profits and losses equally. If an agreement exists, partners divide profits based on the terms specified. Any reason can be used as the basis for establishing a profit-sharing ratio, but the two main factors are responsibility and capital contributions.