Iowa Partnership Resolution to Sell Property

Description

How to fill out Partnership Resolution To Sell Property?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal form templates available for download or printing.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest forms, such as the Iowa Partnership Resolution to Sell Property, in no time.

Check the form's description to make sure you've chosen the correct one.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you already have a subscription, Log In and access the Iowa Partnership Resolution to Sell Property from your US Legal Forms library.

- The Download button will be available on every form you view.

- You can find all previously downloaded forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure that you have selected the correct form for your city/county.

- Click the Review button to examine the form's content.

Form popularity

FAQ

Iowa Code 558A addresses seller disclosures concerning property conditions. This code requires sellers to inform buyers of any known issues or hazards related to the property. Familiarity with Iowa Code 558A is crucial during the Iowa Partnership Resolution to Sell Property, as it can help avoid disputes and build trust between parties involved in the transaction.

Unless approved by a unanimous Resolution of the Limited Partnership, the Limited Partnership will not engage in any business or activity which is not anticipated by the Purposes, or reasonably incidental to, or gives effect to, the Purposes.

In community property states, including California, spouses and registered domestic partners take title as community property unless they elect otherwise. Each spouse has a half-interest in the property, and equal control over the property's management and use. To sell the property, both spouses must act together.

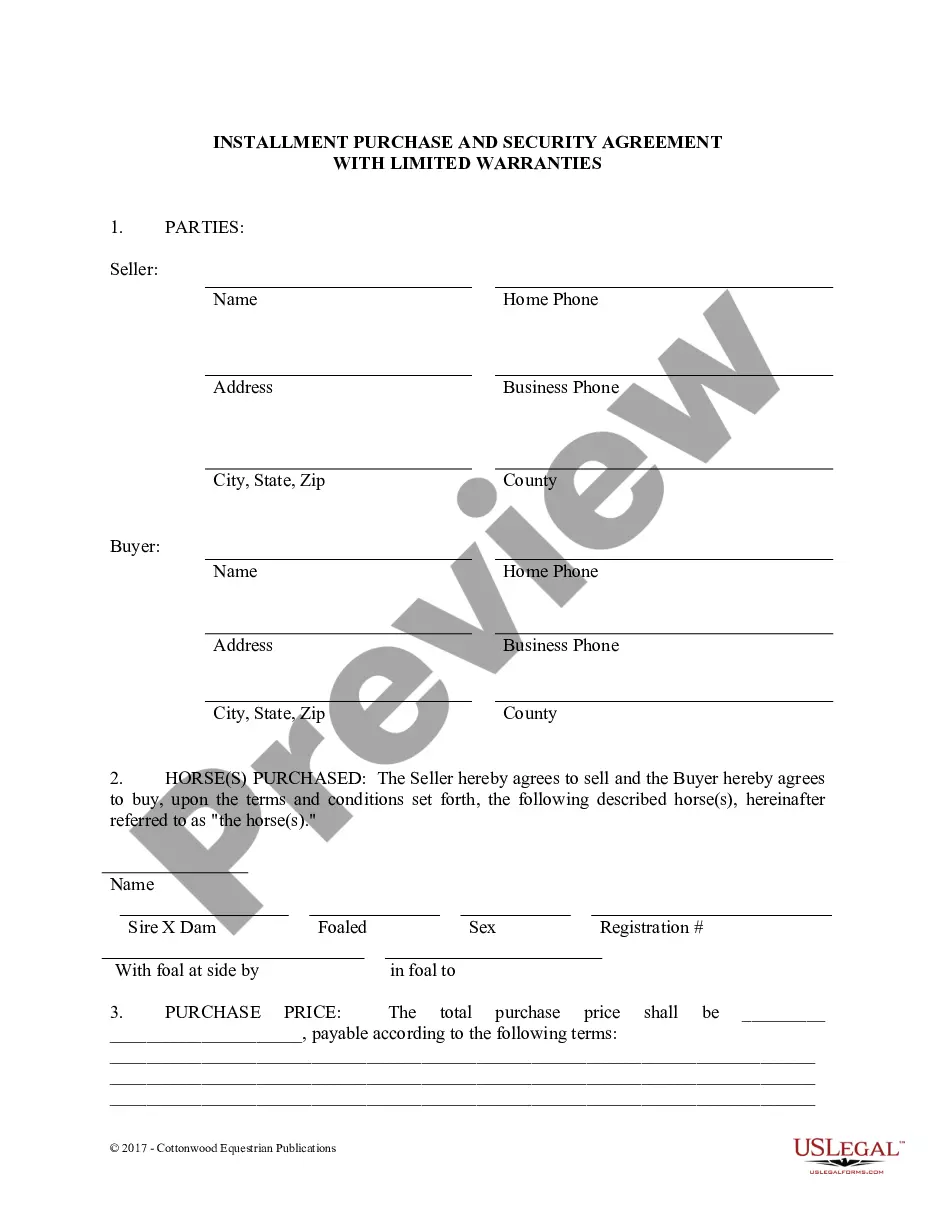

In the event that a company decides to sell its property, it will require a corporate resolution to sell real estate. This is a straightforward document that cites the name of the buyer and the location of the company's property. The location of the real estate sold may be at a street address, section, block, or lot.

In a general partnership, all parties share legal and financial liability equally. The individuals are personally responsible for the debts the partnership takes on. Profits are also shared equally. The specifics of profit sharing will almost certainly be laid out in writing in a partnership agreement.

Helping business owners for over 15 years. Property of a partnership is owned by its tenants, generally referred to as tenants in common or tenants in partnership. As such, the partnership property is considered the property of each of its partners and they each have equal rights to use it.

Partnership resolution definition refers to resolving a dispute between partners in a business partnership. The way certain disputes in partnership will be handled should be spelled out in the partnership agreement.

How to Write a Business Partnership Agreementname of the partnership.goals of the partnership.duration of the partnership.contribution amounts of each partner (cash, property, services, future contributions)ownership interests of each partner (assets)management roles and terms of authority of each partner.More items...

Any property acquired by a firm for the purpose of carrying on its business is a partnership property. Any property acquired by a firm for the purpose of carrying on its business shall be solely used for the purpose of such business and nothing else.

Partnerships typically give general partners the authorization to bind the corporation. In limited partnerships, limited partners may not have the same authority to bind the partnership, but in most instances, partnerships do not need to pass a resolution for the partners to act.