Iowa Sample Letter for History of Deed of Trust

Description

How to fill out Sample Letter For History Of Deed Of Trust?

Are you within a placement in which you will need documents for both organization or person functions just about every working day? There are tons of legal record themes accessible on the Internet, but finding versions you can trust is not simple. US Legal Forms gives a huge number of form themes, like the Iowa Sample Letter for History of Deed of Trust, which can be published in order to meet federal and state requirements.

When you are already acquainted with US Legal Forms site and have an account, basically log in. Afterward, it is possible to download the Iowa Sample Letter for History of Deed of Trust web template.

Should you not come with an profile and wish to start using US Legal Forms, follow these steps:

- Obtain the form you will need and ensure it is for that appropriate town/region.

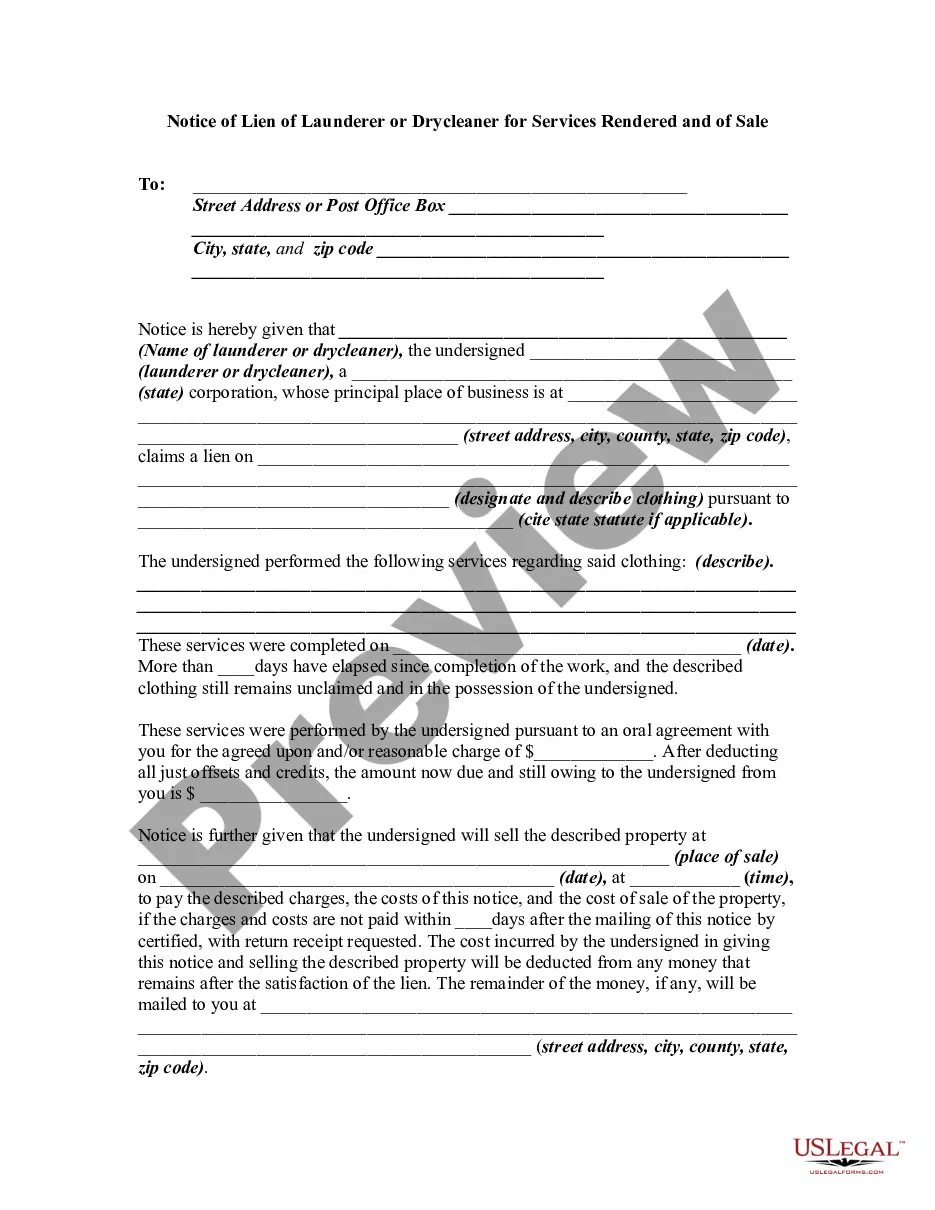

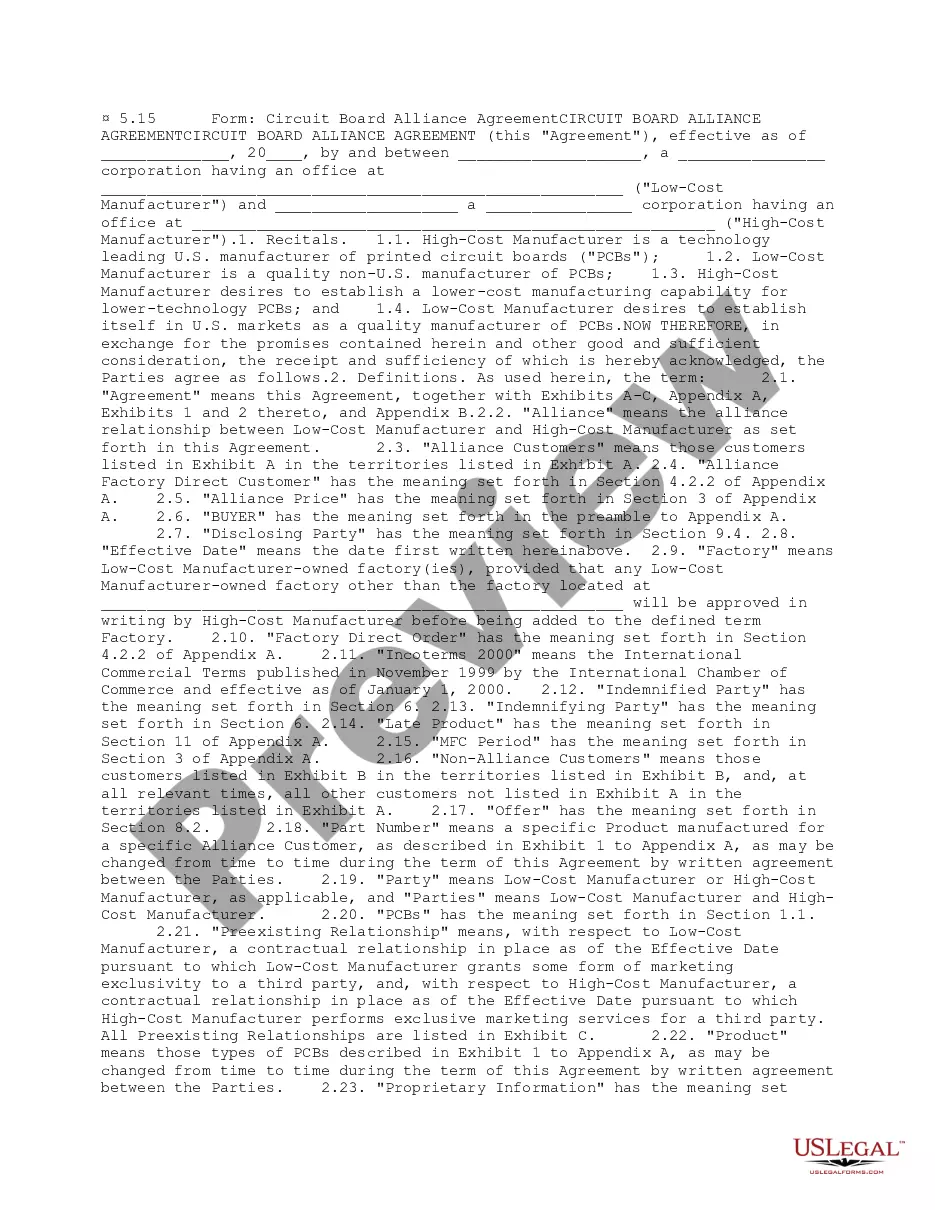

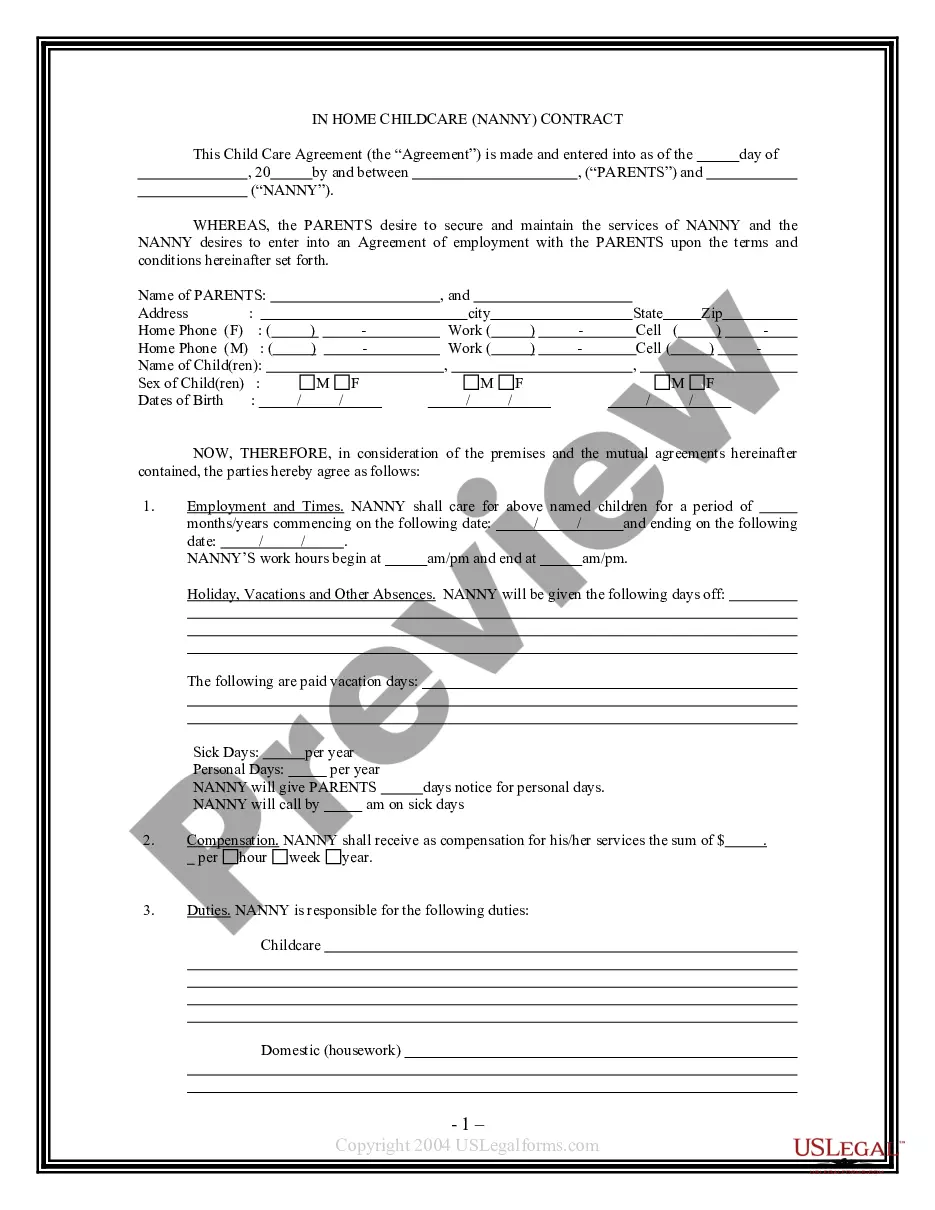

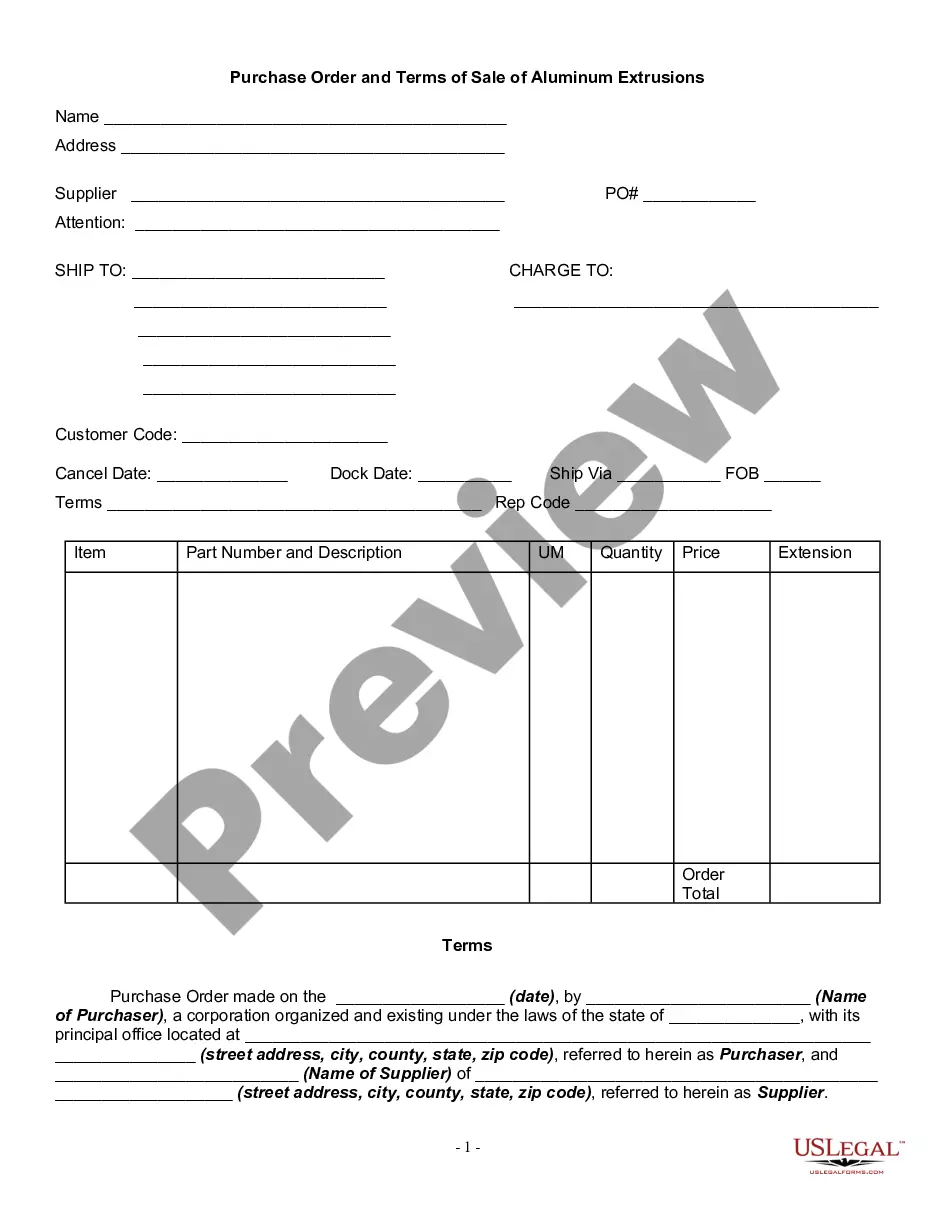

- Utilize the Review switch to review the shape.

- See the description to ensure that you have selected the proper form.

- If the form is not what you`re searching for, use the Research discipline to obtain the form that meets your requirements and requirements.

- When you obtain the appropriate form, click Buy now.

- Select the costs plan you desire, submit the desired info to generate your bank account, and pay for your order making use of your PayPal or credit card.

- Decide on a hassle-free file file format and download your copy.

Locate all the record themes you have bought in the My Forms food list. You can obtain a additional copy of Iowa Sample Letter for History of Deed of Trust any time, if possible. Just click the required form to download or print out the record web template.

Use US Legal Forms, the most considerable collection of legal kinds, in order to save time and avoid blunders. The support gives expertly manufactured legal record themes which can be used for a selection of functions. Produce an account on US Legal Forms and start generating your lifestyle a little easier.

Form popularity

FAQ

An Iowa deed of trust is a document that appoints a trustee who will hold a property title until a borrower (the property owner) has repaid a loan to a lender. The borrower retains the use and enjoyment of the property, while the trustee is given legal ownership (title).

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

Foreclosure process: Mortgages typically go through a judicial foreclosure process, through your county court system. Deeds of trust use a non-judicial foreclosure process. Length of time to foreclose: Mortgage foreclosures usually take significantly longer than non-judicial foreclosures with a deed of trust.

What is the advantage of a deed of trust over a mortgage? A deed of trust has a crucial advantage over a mortgage from the lender's point of view. If the borrower defaults on the loan, then the trustee has the power to foreclose on the property on behalf of the beneficiary.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.

This is when you give the deed to your home to the mortgage company, and the mortgage company agrees not to foreclose. A mortgage company may require you to try to sell your home before agreeing to a Deed in Lieu of foreclosure.

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.