Iowa Sample Letter for Closing of Estate with no Distribution

Description

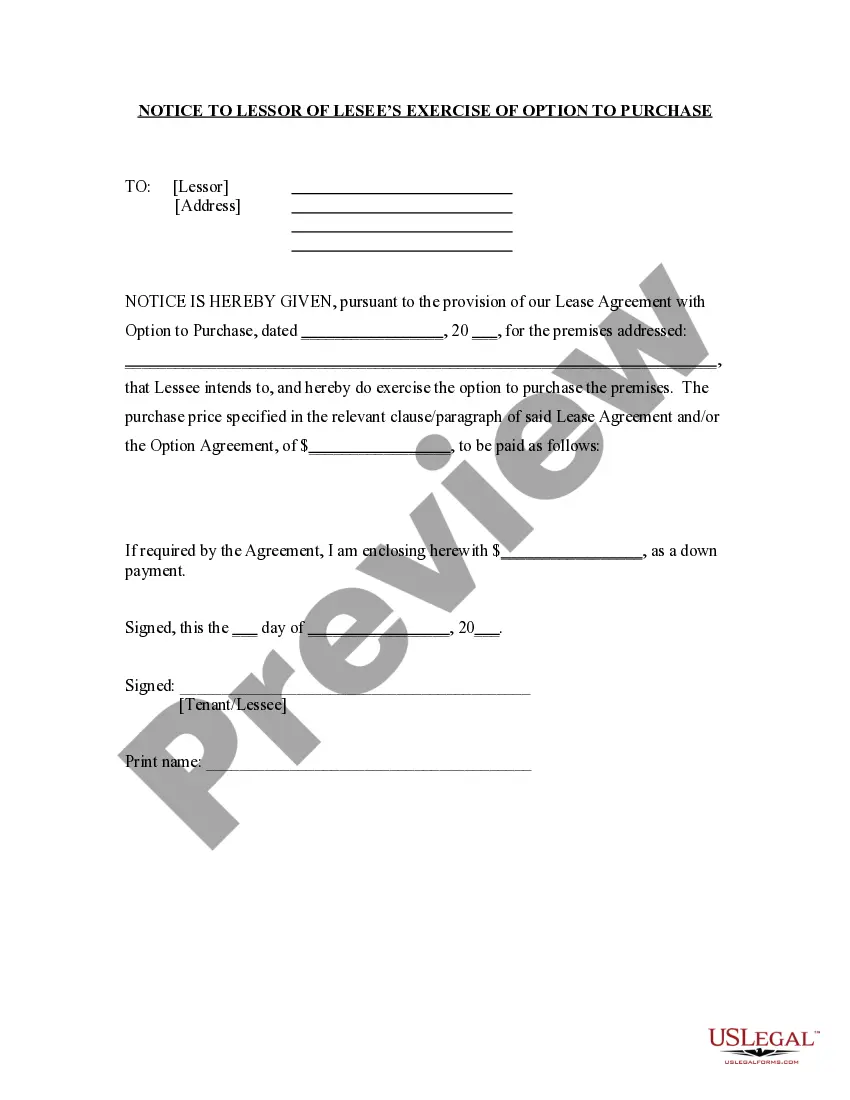

How to fill out Sample Letter For Closing Of Estate With No Distribution?

If you need to complete, download, or printing legal record web templates, use US Legal Forms, the largest variety of legal types, that can be found on-line. Utilize the site`s simple and hassle-free research to find the papers you require. A variety of web templates for organization and person reasons are sorted by groups and suggests, or keywords. Use US Legal Forms to find the Iowa Sample Letter for Closing of Estate with no Distribution in a number of click throughs.

If you are presently a US Legal Forms customer, log in to your bank account and then click the Download key to obtain the Iowa Sample Letter for Closing of Estate with no Distribution. You can even gain access to types you formerly delivered electronically inside the My Forms tab of the bank account.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for that proper area/region.

- Step 2. Take advantage of the Review method to look over the form`s content material. Never overlook to learn the explanation.

- Step 3. If you are unsatisfied together with the type, take advantage of the Lookup field near the top of the screen to get other variations of your legal type template.

- Step 4. When you have located the shape you require, click the Acquire now key. Choose the rates program you choose and add your accreditations to sign up for an bank account.

- Step 5. Procedure the financial transaction. You should use your Мisa or Ьastercard or PayPal bank account to finish the financial transaction.

- Step 6. Choose the formatting of your legal type and download it on your product.

- Step 7. Total, edit and printing or indicator the Iowa Sample Letter for Closing of Estate with no Distribution.

Each and every legal record template you buy is yours forever. You may have acces to every type you delivered electronically within your acccount. Select the My Forms section and select a type to printing or download again.

Contend and download, and printing the Iowa Sample Letter for Closing of Estate with no Distribution with US Legal Forms. There are many specialist and state-specific types you can use for your organization or person needs.

Form popularity

FAQ

If you die without a will in Iowa, your assets will go to your closest relatives under state "intestate succession" laws.

Is Probate Required in Iowa? Most inheritance cases in Iowa will require probate. However, there are a few exceptions, such as having an estate with a value of less than $25,000 that only includes personal property. If you name a beneficiary to your assets, you can also avoid probate.

Iowa probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

Settling an Estate in Iowa The will and a petition for probate is filed with the county court. The court appoints an executor or personal representative and provides them with documents for authority to manage the estate.

When a person dies without a will, Iowa Code provides a surviving spouse with an exclusive right for 20 days to file with the court a petition to initiate administration of the estate. Other heirs in succession, starting with surviving children, if any, have an additional 10 days to file such a petition.

Iowa law requires that an estate be closed within 3 years after the second publication of the notice to creditors, unless a court grants an extension. Even while the estate is still in probate, however, beneficiaries may be able to receive part of their inheritance.

Opening an estate is not required for every deceased person, but it may be necessary to transfer property, pay debts, and obtain tax clearances. Estate and probate matters can be complicated. You should talk to an attorney.