Iowa Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector

Description

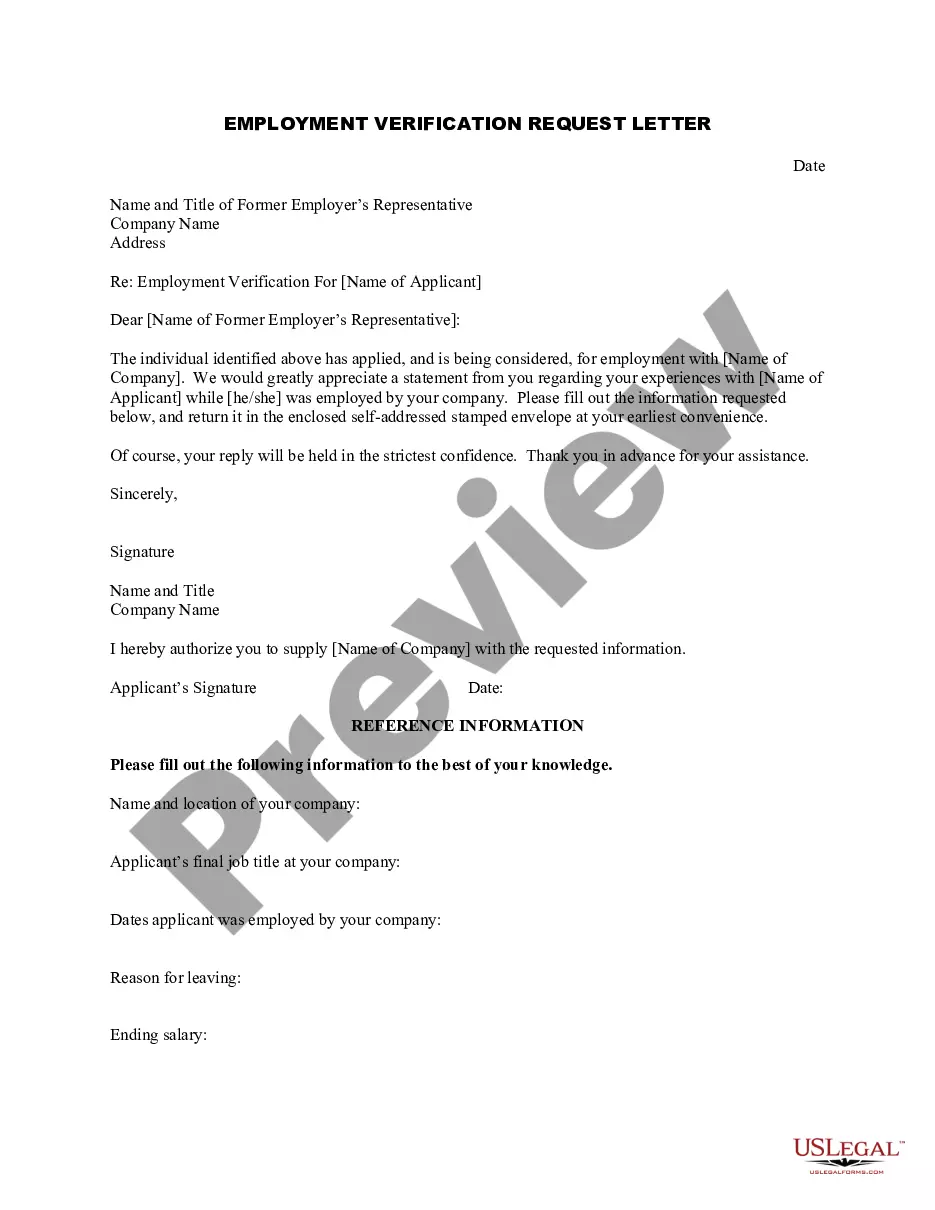

How to fill out Sample Letter For Tax Exemption - Review Of Sample Letter Received From Tax Collector?

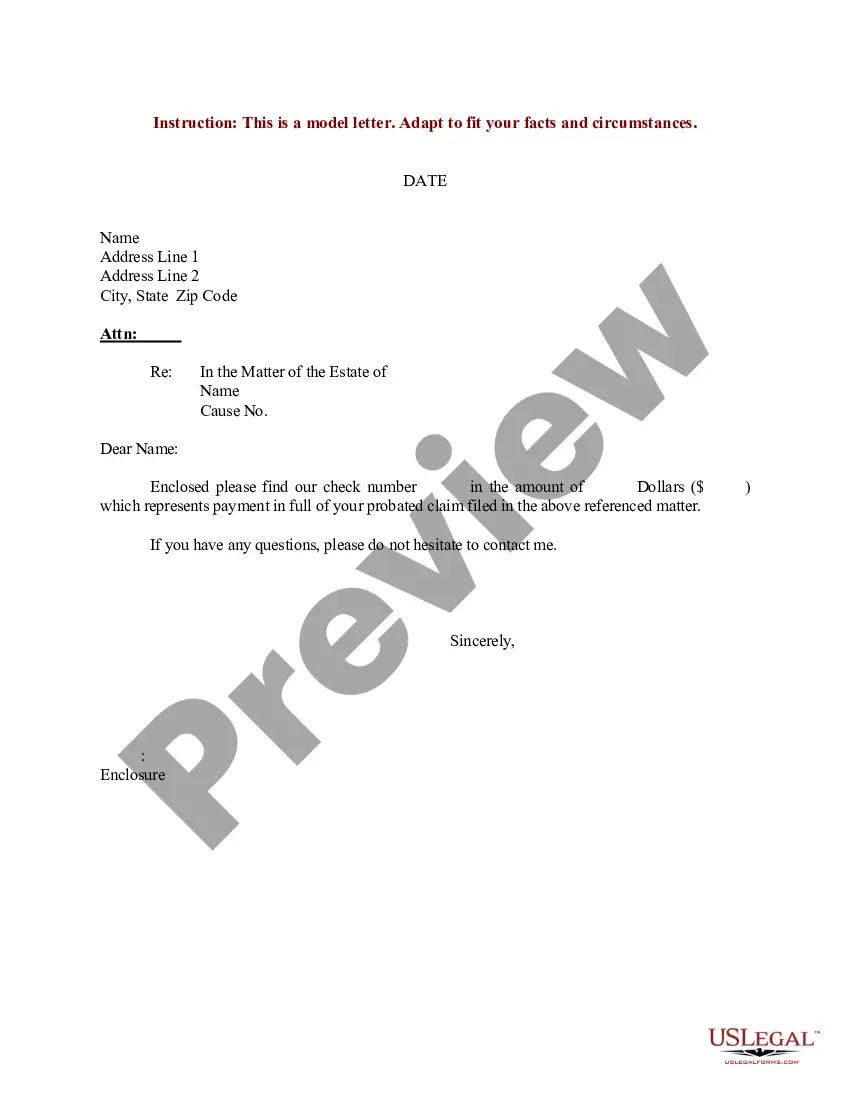

US Legal Forms - among the largest libraries of authorized varieties in the USA - provides a variety of authorized papers templates you may obtain or printing. Utilizing the site, you may get 1000s of varieties for business and individual purposes, sorted by types, says, or keywords and phrases.You will discover the latest versions of varieties like the Iowa Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector in seconds.

If you already have a monthly subscription, log in and obtain Iowa Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector through the US Legal Forms catalogue. The Obtain button will appear on each and every develop you view. You get access to all in the past saved varieties inside the My Forms tab of your accounts.

If you want to use US Legal Forms the very first time, listed below are easy instructions to help you started out:

- Be sure to have selected the correct develop for your town/area. Go through the Preview button to examine the form`s articles. Look at the develop outline to ensure that you have selected the correct develop.

- When the develop doesn`t fit your requirements, make use of the Search discipline at the top of the monitor to discover the one which does.

- If you are satisfied with the form, validate your choice by visiting the Acquire now button. Then, pick the pricing plan you favor and provide your credentials to sign up for an accounts.

- Procedure the deal. Make use of your charge card or PayPal accounts to complete the deal.

- Choose the structure and obtain the form on the device.

- Make changes. Fill out, revise and printing and indication the saved Iowa Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector.

Every design you included in your bank account does not have an expiration day and it is yours for a long time. So, in order to obtain or printing yet another version, just proceed to the My Forms segment and click on on the develop you will need.

Get access to the Iowa Sample Letter for Tax Exemption - Review of Sample Letter Received from Tax Collector with US Legal Forms, by far the most comprehensive catalogue of authorized papers templates. Use 1000s of specialist and express-distinct templates that satisfy your business or individual requirements and requirements.

Form popularity

FAQ

Iowans age 65 or older are eligible for a property tax exemption worth $3,250 for the assessment year beginning Jan. 1, 2023. In subsequent years, the exemption doubles to $6,500. Exemptions are a reduction in the taxable value of the property, not a direct reduction of how much property taxes a homeowner pays.

Age 65 or older Iowans age 65 or older are eligible for a property tax exemption worth $3,250 for the assessment year beginning Jan. 1, 2023. In subsequent years, the exemption doubles to $6,500. Exemptions are a reduction in the taxable value of the property, not a direct reduction of how much property taxes a homeowner pays. Iowans 65 and older and veterans can now apply for new property tax cuts desmoinesregister.com ? politics ? 2023/05/17 desmoinesregister.com ? politics ? 2023/05/17

When you buy a home, you can apply for a homestead credit. You apply for the credit once and the tax credit continues as long as you remain eligible by owning and occupying the property as your homestead.

To be eligible, a homeowner must occupy the homestead any 6 months out of the year, but must reside there on July 1. This exemption is a reduction of the taxable value of their property amounting to a maximum $4,850 or the amount which does not allow the taxable value to be less than 0. What is a Homestead Tax Credit? | Floyd County, IA - Official Website floydcoia.org ? What-is-a-Homestead-Tax-C... floydcoia.org ? What-is-a-Homestead-Tax-C...

Why did the Department send me a letter? We send letters for the following reasons: You have a balance due. We have a question about your tax return. I Got a Letter | Iowa Department Of Revenue iowa.gov ? i-got-a-letter iowa.gov ? i-got-a-letter

You may claim a $40 personal exemption credit even if you are claimed as a dependent on another person's Iowa return. If you were 65 or older on or before January 1, 2023, you may take an additional personal credit.

This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this certificate as proof that exemption has been properly claimed. The certificate must be complete to be accepted by the seller. Iowa Sales Tax Exemption Certificate mwatoday.com ? Sales_Tax_Exempt_Form mwatoday.com ? Sales_Tax_Exempt_Form

The Homestead Credit is calculated by dividing the homestead credit value by 1,000 and multiplying by the Consolidated Tax Levy Rate. That amount may then be reduced by the county to the same amount at which the State of Iowa has approved funding.