Iowa Notice of Default on Promissory Note Installment

Description

How to fill out Notice Of Default On Promissory Note Installment?

Are you currently in a situation where you require documents for either business or personal activities almost every day.

There are numerous legal document templates accessible online, but finding forms you can trust isn’t simple.

US Legal Forms offers a vast array of document templates, such as the Iowa Notice of Default on Promissory Note Installment, which are designed to comply with federal and state regulations.

If you find the correct form, click Get now.

Select the pricing plan you prefer, provide the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Iowa Notice of Default on Promissory Note Installment template.

- If you don’t possess an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

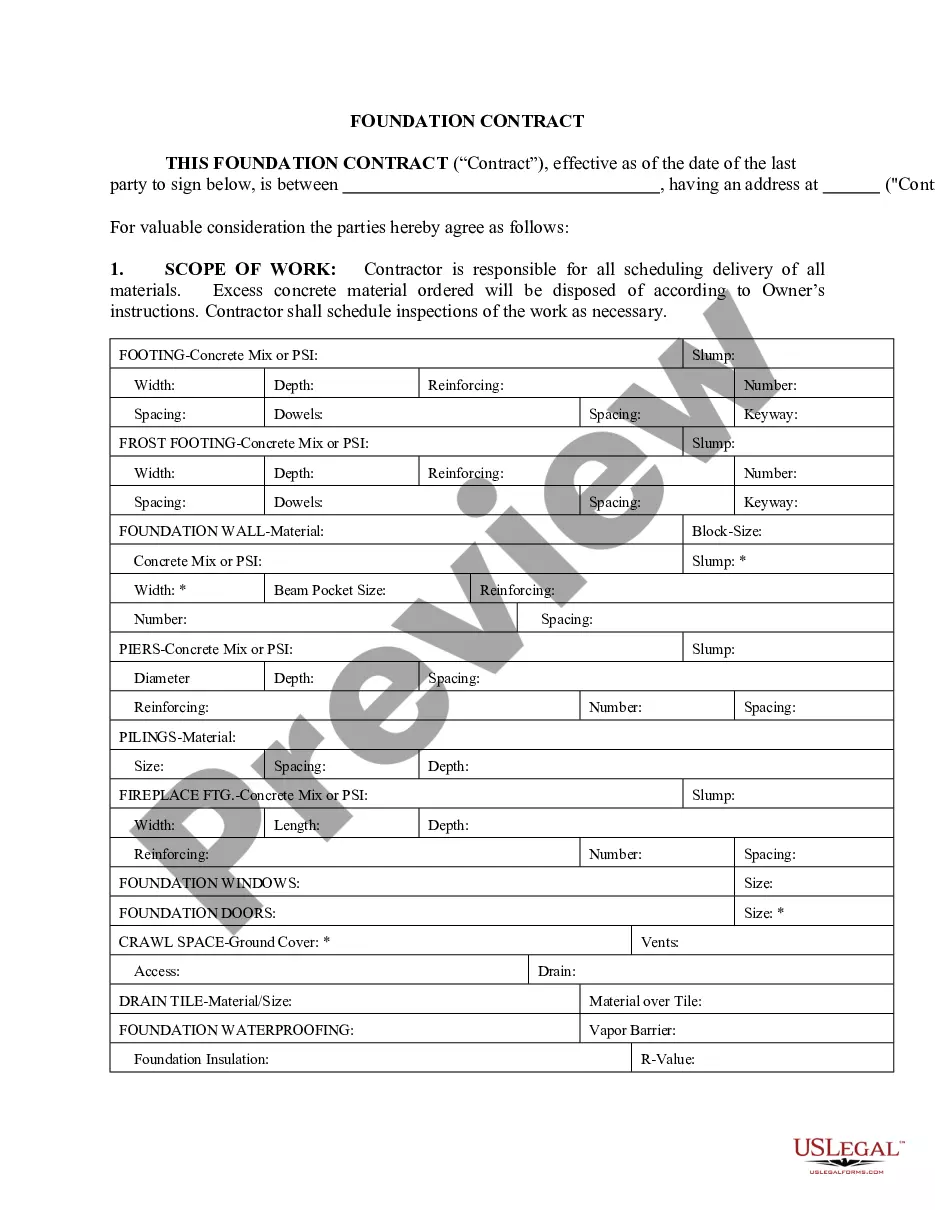

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the right document.

- If the form isn’t what you’re looking for, use the Search section to locate the form that meets your needs and specifications.

Form popularity

FAQ

A debt can become uncollectible in Iowa after it has aged ten years, coinciding with the statute of limitations. Once this period passes, creditors may no longer pursue legal collection efforts. Keeping track of your debts and their timelines is crucial for managing your financial obligations effectively. If you receive a notice related to an Iowa Notice of Default on Promissory Note Installment, consider your options carefully.

In Iowa, a debt generally becomes uncollectible after the statute of limitations expires, which is typically ten years for most debts. After this period, the creditor may lose the legal right to collect the debt. It's essential to monitor your situation to avoid any issues related to an Iowa Notice of Default on Promissory Note Installment. Staying informed helps you take timely action.

To write a notice of default, start by clearly stating the parties involved and reference the specific promissory note. Include details about the default, such as payment dates and amounts due. It's beneficial to be clear about the consequences of continued non-payment. If you need assistance drafting an effective notice, consider using resources from uslegalforms to ensure it meets legal standards.

The statute of limitations for a written contract in Iowa is also ten years. This period is critical as it defines the time frame within which you can initiate legal proceedings. If your case falls under this statute, ensure you are aware of your options. An Iowa Notice of Default on Promissory Note Installment may fit into this context, so understanding your rights is important.

If you default on a promissory note, the lender can take several actions to recover the owed amount. They may initiate a collection process or file a lawsuit against you. It's vital to act quickly if you receive an Iowa Notice of Default on Promissory Note Installment to discuss your options and potentially negotiate a solution.

The statute of limitations on a promissory note in Iowa is generally ten years, similar to contracts. Knowing this timeframe can help you plan your actions. If you think you might need to enforce a promissory note, keep this limit in mind. An Iowa Notice of Default on Promissory Note Installment is often a crucial step before taking action.

In Iowa, the statute of limitations for breach of promissory note is typically ten years. This means that you have ten years from the date of the default to take legal action. If you do not act within this time frame, your ability to enforce the promissory note may be barred. Understanding this timeline is essential if you face a situation involving an Iowa Notice of Default on Promissory Note Installment.

If you receive a default notice, it is vital to understand the implications outlined within that document. This notice may indicate that legal actions could follow if the debt is not addressed immediately. You should respond to the notice and consider discussing your options, including potential negotiations with the lender. Learning about the Iowa Notice of Default on Promissory Note Installment can empower you to take informed steps.

To write a notice of default, begin with identifying the parties involved and outlining the specific terms of the promissory note that have been violated. Clearly state the amount due and the timeframe for remedying the default. Ensure the notice is compliant with Iowa laws, especially when drafting an Iowa Notice of Default on Promissory Note Installment. Accessing templates from uslegalforms can streamline this process.

Receiving a notice of default indicates that the lender is formally declaring your failure to meet the payment terms of the promissory note. This notice serves as a warning that you may face legal action if the situation is not remedied quickly. It's essential to respond promptly and address any issues related to the Iowa Notice of Default on Promissory Note Installment. Seeking assistance from legal resources can help you navigate your options.