Iowa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation

Description

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

How to fill out Buy-Sell Agreement Between Two Shareholders Of Closely Held Corporation?

US Legal Forms - one of the most extensive collections of legal documents in the United States - offers a variety of legal form templates that you can download or create.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest forms, such as the Iowa Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation, in just minutes.

If you already have a subscription, Log In to download the Iowa Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation from your US Legal Forms library. The Download button will appear on every form you view. You can find all previously saved forms in the My documents tab of your account.

Every template you add to your account has no expiration and is yours indefinitely. Therefore, if you want to download or produce another copy, simply go to the My documents area and click on the form you need.

Access the Iowa Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation with US Legal Forms, one of the most substantial libraries of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

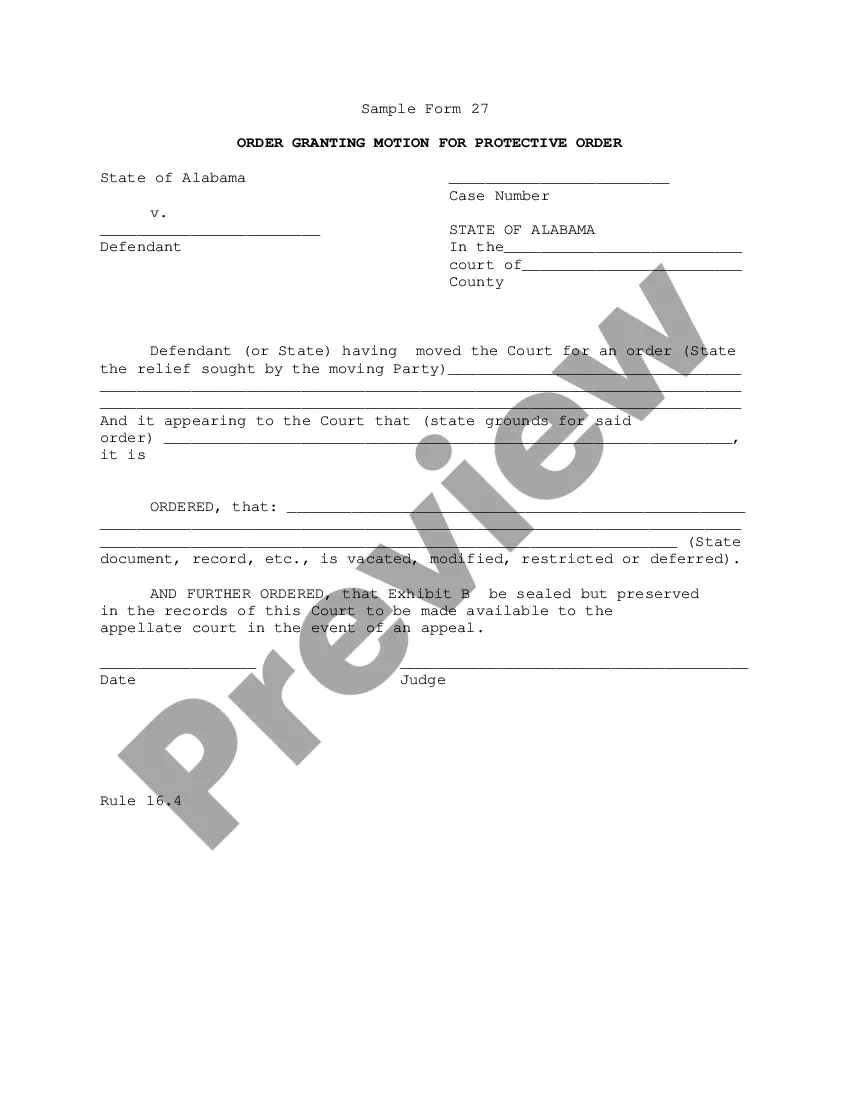

- Ensure you have selected the correct form for your locality/region. Click the Preview button to review the form's details. Check the form description to confirm you have picked the correct form.

- If the form does not suit your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Acquire now button. Then, select your preferred payment option and provide your details to register for an account.

- Process the transaction. Use your Visa or MasterCard or PayPal account to complete the transaction.

- Choose the file format and download the form to your device.

- Make modifications. Fill out, edit, print, and sign the downloaded Iowa Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation.

Form popularity

FAQ

Writing up a shareholder agreement involves drafting a document that reflects the intentions of all shareholders. Start by outlining each shareholder's roles, responsibilities, and ownership stakes, then detail the procedures for dealing with share transfers. An Iowa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation is an excellent tool that can help you create a well-structured agreement.

The basics of a shareholder agreement encompass the identification of the parties involved, the purpose of the agreement, and key terms related to ownership and management. Additionally, it should cover buy-sell provisions and what happens in case of disputes or a shareholder's departure. Establishing an Iowa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation helps clarify these foundational aspects.

A comprehensive shareholder agreement should include sections on share ownership, buy-sell provisions, dispute resolution mechanisms, and voting rights. Furthermore, it should clearly outline the procedures for transferring shares and the responsibilities of shareholders. Incorporating an Iowa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation ensures that all essential elements are addressed.

To write a shareholder agreement, start by clearly defining the roles of each shareholder and their ownership percentages. Include provisions for decision-making, transfer of shares, and what happens if a shareholder wants to exit the business. Utilizing a tailored Iowa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation can simplify this process and ensure legal compliance.

As mentioned earlier, for a shareholders' agreement to be effective and enforceable, all shareholders generally need to agree on its terms. This includes the Iowa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation. When there is consensus among shareholders, it not only strengthens the agreement but also ensures smoother operations. Seeking legal advise can help develop a fair approach that incorporates everyone's input.

When shareholders cannot reach an agreement, it can lead to disputes and potential deadlocks that disrupt corporate operations. In the case of the Iowa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, having a structured process for resolving disagreements is critical. If conflicts persist, mediation or arbitration may be necessary. Utilizing platforms like uslegalforms can help you draft or modify agreements to better manage potential disagreements.

Typically, all shareholders must consent to the provisions of a shareholders' agreement to ensure its validity. In the context of the Iowa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, mutual agreement ensures that every party understands their rights and responsibilities. When all shareholders are on the same page, it reduces potential misunderstandings. For mixed shareholder groups, consider legal guidance to find a consensus.

Shareholder agreements are not legally required for every corporation, but they are highly recommended, especially for closely held corporations. Having an Iowa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation fosters clarity and outlines procedures for ownership transfer. This agreement can prevent conflicts and ensure smooth transitions. By outlining important details, you protect everyone's interests and promote stability.

A shareholders agreement becomes legally binding when it meets certain criteria, such as mutual consent of the parties involved and adherence to state laws. Specifically, the Iowa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation must outline rights, obligations, and responsibilities to be enforceable. Additionally, proper documentation, signatures, and consideration further solidify its binding nature. It's essential to consult with legal experts to ensure all legal standards are met.

In an Iowa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, not all shareholders necessarily need to agree to sell shares. This agreement usually outlines specific conditions and procedures that govern share transfers, allowing shareholders to sell their shares under predefined circumstances. By having clear guidelines, the agreement can prevent disputes and ensure fair transactions among shareholders. Therefore, it is crucial to draft the agreement carefully to reflect the intentions of all parties involved.