Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock

Description

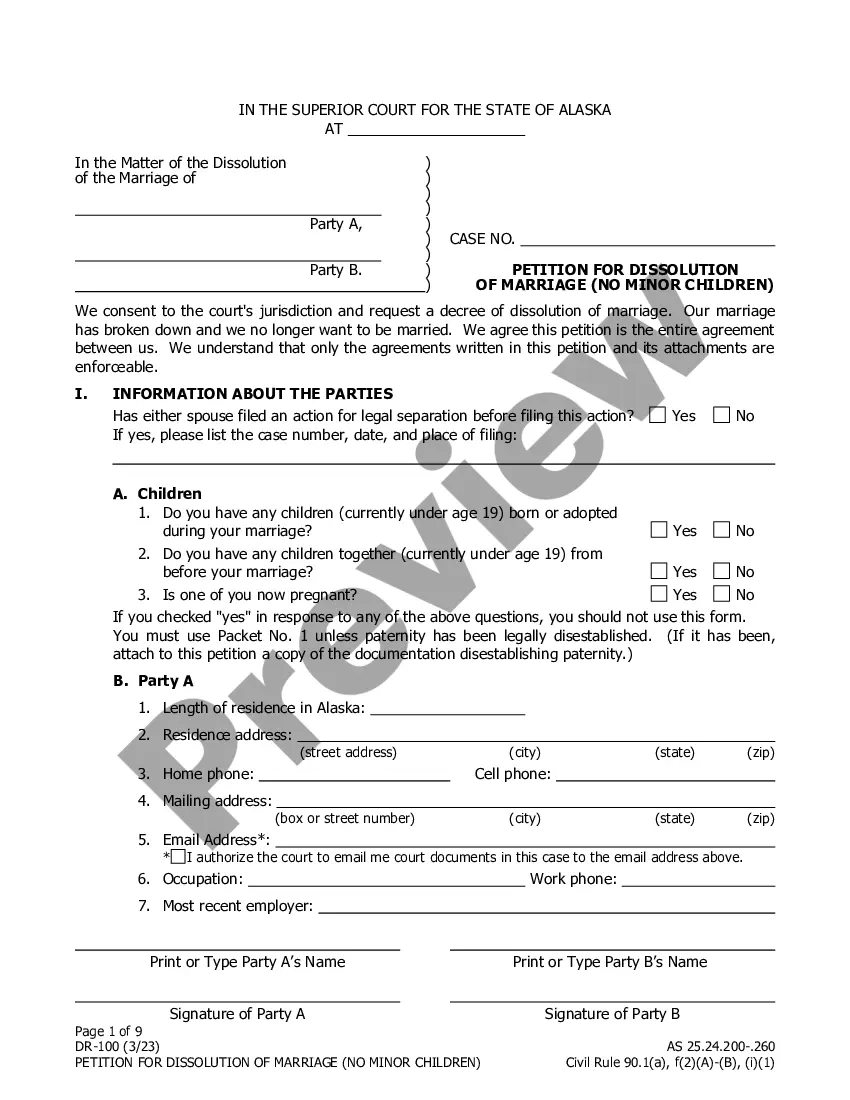

How to fill out Resolution Of Directors Of A Close Corporation Authorizing Redemption Of Stock?

US Legal Forms - one of the largest collections of legal documents in America - offers a broad selection of legal form templates that you can obtain or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms such as the Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock in just minutes.

If you already have a subscription, Log In and retrieve the Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Choose the format and download the form to your device. Edit. Fill out, modify, and print or sign the downloaded Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock.

Each design you upload to your account does not have an expiration date and belongs to you indefinitely. Therefore, if you wish to acquire or print another copy, simply visit the My documents section and click on the form you need.

Access the Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your location/region.

- Click the Review button to examine the form's content.

- Check the description of the form to confirm you have chosen the right one.

- If the form does not suit your needs, use the Search field at the top of the screen to find an alternative.

- If you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then select the payment method you prefer and enter your details to register for an account.

Form popularity

FAQ

A stock redemption is typically treated as a sale rather than a dividend for tax purposes. This classification can result in different tax consequences for both the corporation and the shareholders. A close corporation should handle the redemption in alignment with the Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock for legal and tax compliance. Understanding these nuances can help you make informed decisions regarding share transactions.

The tax treatment for stock redemption in a C corporation can significantly affect shareholders and the corporation alike. Generally, the IRS treats redemptions as sales, subjecting them to capital gains tax. It is vital to understand these tax implications, particularly as they relate to the Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock. Consulting with a tax expert can help you navigate through these considerations effectively.

Redemption of shares occurs when a corporation buys back its own stock from shareholders, leading to a reduction in outstanding shares. This action can affect the ownership structure and financial dynamics of the close corporation. Following the Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock can guide you through this process. It helps maintain a clear record of shareholder ownership changes and enhances corporate governance.

When a close corporation redeems shares, the transaction must be documented appropriately in the financial records. Typically, the corporation records a liability for the redemption amount and reduces equity by the same amount. Accurate accounting for the redemption of shares is crucial for reflecting the true financial position of the company. Ensure you follow the provisions related to the Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock for compliance.

Iowa Code 490.832 relates specifically to the processes involved in the redemption of stock in a close corporation. This code outlines the required procedures for the redemption of shares, ensuring that shareholders are treated fairly. Understanding this regulation can help corporations effectively manage stock transactions and avoid legal pitfalls. Utilizing the Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock can streamline this process.

A director's written resolution is a documented decision made by the board of directors outside of a formal meeting. It allows directors to approve actions, such as the redemption of stock, through a signed written document. Utilizing a written resolution can streamline processes like the Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, ensuring timely and efficient corporate governance.

To issue shares, a corporation requires a director's resolution that specifies the terms and conditions of the new stock issuance. This resolution grants authority to execute the issuance and must comply with both state law and the corporation's bylaws. By following the procedures outlined in an Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, directors can effectively manage share issuance.

A director's resolution is an official record of decisions made by the board of directors during a meeting or through written consent. This resolution serves as documentation of corporate actions, such as authorizing the redemption of stock or other corporate transactions. Properly documenting an Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock can help businesses maintain transparency and accountability.

The main difference between a director's resolution and a shareholder resolution lies in who authorizes the decision. A director's resolution involves the board of directors making decisions on behalf of the corporation, while a shareholder resolution is proposed by shareholders to influence management decisions. Both types of resolutions can play a role in processes like an Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock.

A director's resolution to issue shares is a formal decision made by the board of directors to create and distribute new shares of the corporation's stock. This resolution is necessary for legally recognizing new shareholders and maintaining proper corporate governance. By properly executing an Iowa Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, companies can ensure a smooth process for issuing shares.