Iowa Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of

Description

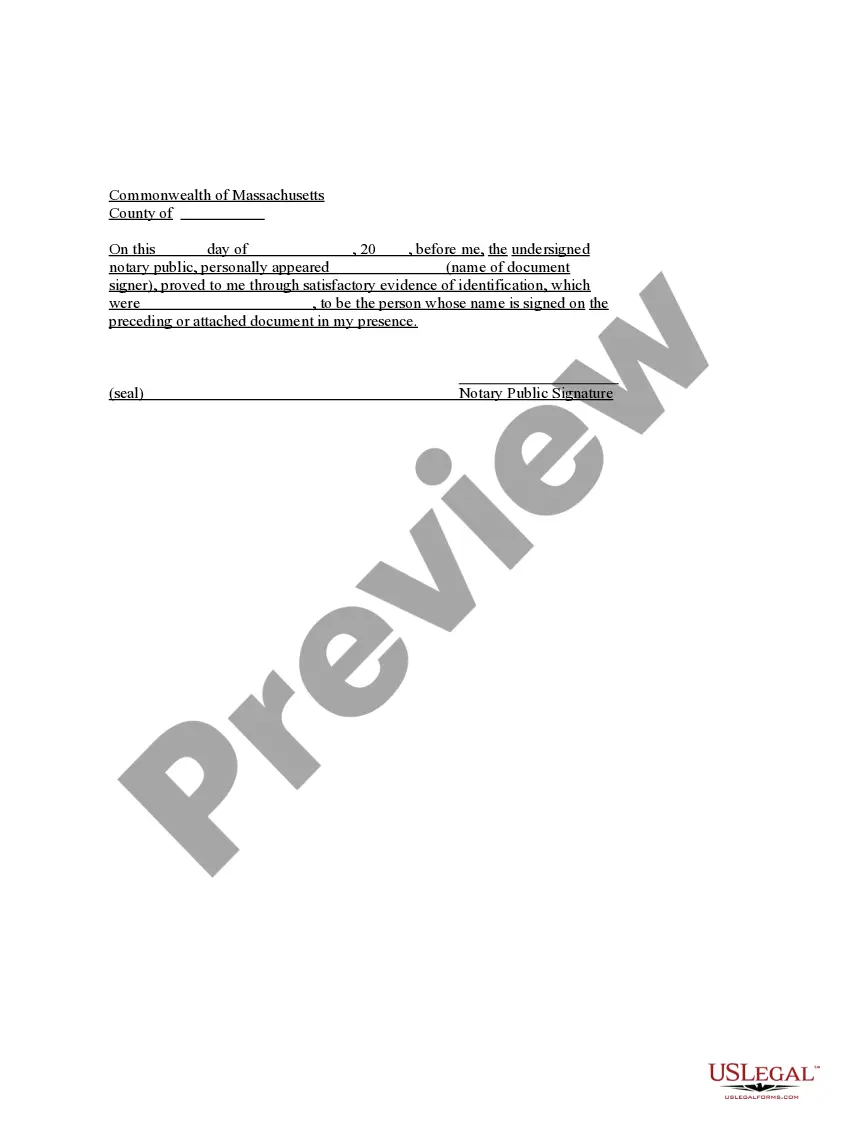

How to fill out Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice Of?

If you wish to complete, down load, or print authorized record web templates, use US Legal Forms, the greatest collection of authorized varieties, which can be found on-line. Take advantage of the site`s basic and handy search to find the papers you want. Various web templates for enterprise and specific uses are categorized by types and claims, or key phrases. Use US Legal Forms to find the Iowa Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of within a number of clicks.

When you are already a US Legal Forms customer, log in for your bank account and click on the Download key to get the Iowa Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of. You can even gain access to varieties you formerly saved inside the My Forms tab of the bank account.

If you work with US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have selected the form for the right metropolis/land.

- Step 2. Take advantage of the Preview option to check out the form`s articles. Do not forget to see the outline.

- Step 3. When you are unhappy using the develop, take advantage of the Lookup industry near the top of the display screen to get other variations from the authorized develop design.

- Step 4. After you have located the form you want, click the Acquire now key. Choose the rates prepare you prefer and add your qualifications to sign up for the bank account.

- Step 5. Process the financial transaction. You should use your charge card or PayPal bank account to finish the financial transaction.

- Step 6. Select the format from the authorized develop and down load it in your product.

- Step 7. Complete, edit and print or indicator the Iowa Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of.

Each authorized record design you get is your own permanently. You possess acces to every single develop you saved inside your acccount. Click on the My Forms portion and choose a develop to print or down load yet again.

Compete and down load, and print the Iowa Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of with US Legal Forms. There are thousands of expert and status-particular varieties you can use to your enterprise or specific requires.

Form popularity

FAQ

Before a judgment is entered you can file a "Demand for Delay of Sale" with the court to delay a sheriff's sale of your home. This can be filed whether or not you file an Answer to the foreclosure petition. The Demand must be in writing and must request that the sheriff's sale be delayed.

On its face, Iowa Code section 654.12A states that ?loans and advances made under the mortgage, up to the maximum amount of credit together with interest thereon, are senior to indebtedness to other creditors under subsequently recorded mortgages.? Iowa Code § 654.12A.

654.20 Foreclosure without redemption ? nonagricultural land. 1. If the mortgaged property is not used for an agricultural purpose as defined in section 535.13, the plaintiff in an action to foreclose a real estate mortgage may include in the petition an election for foreclosure without redemption.

Notice of Default ? Foreclosure starts when your lender records a Notice of Default against your property with the Registrar Recorder's office. The Notice of Default tells you the total amount you owe including missed payments and foreclosure fees.

A borrower can also reinstate the loan after thirty days after the notice of default is received from the mortgage servicer. Another option is to redeem the property. This means you must pay off the full amount of the loan to prevent the foreclosure sale of the property.

This is when you give the deed to your home to the mortgage company, and the mortgage company agrees not to foreclose. A mortgage company may require you to try to sell your home before agreeing to a Deed in Lieu of foreclosure.

There are some states that have a redemption period, which allows the borrower to buy back the property from the bank. In Iowa, if the bank proceeds with a judicial foreclosure with redemption, the borrower has up to a year to redeem the property back from the bank.

State Foreclosure Laws in Iowa For most Iowa foreclosures, the lender files a lawsuit. First, though, the lender has to mail a notice of default and right to cure at least 30 days (45 days for agricultural properties) before filing the suit. (Iowa Code § 654.2D, Iowa Code § 654.2A).