Iowa Business Management Consulting or Consultant Services Agreement - Self-Employed

Description

How to fill out Business Management Consulting Or Consultant Services Agreement - Self-Employed?

Selecting the optimal legal document template can pose a challenge.

It goes without saying that there are numerous templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website.

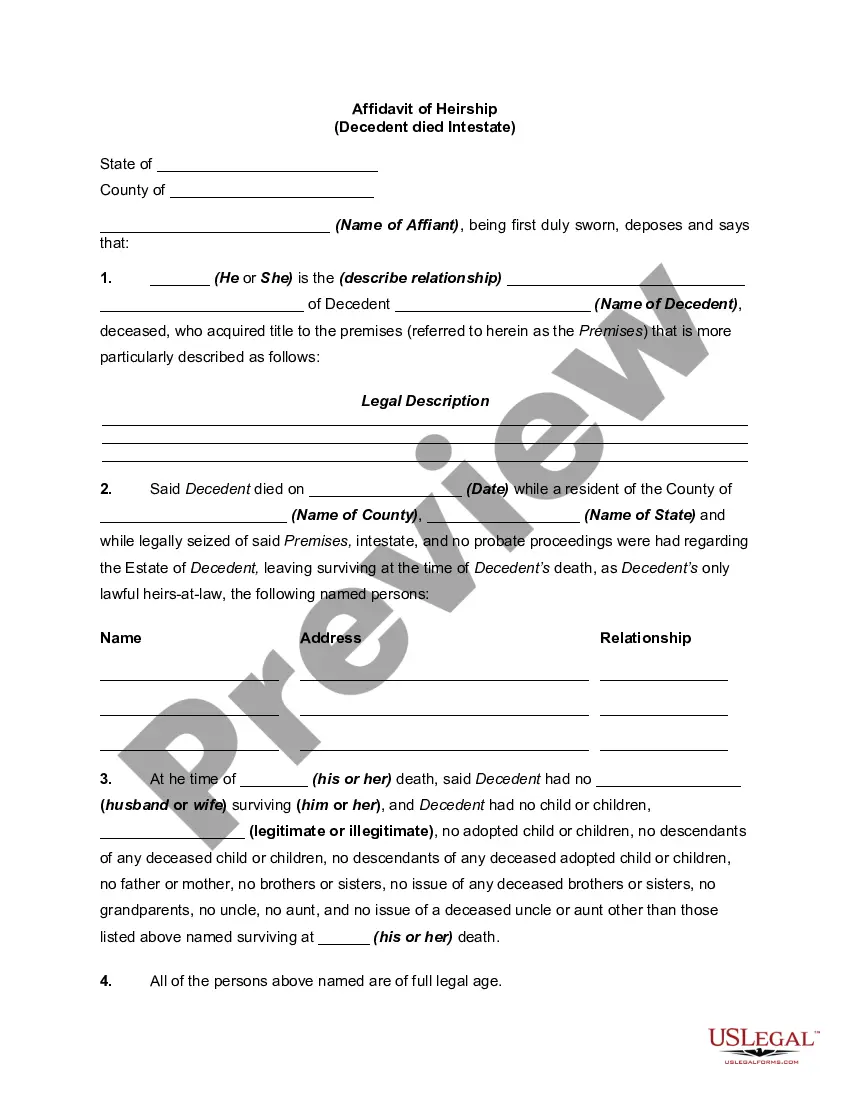

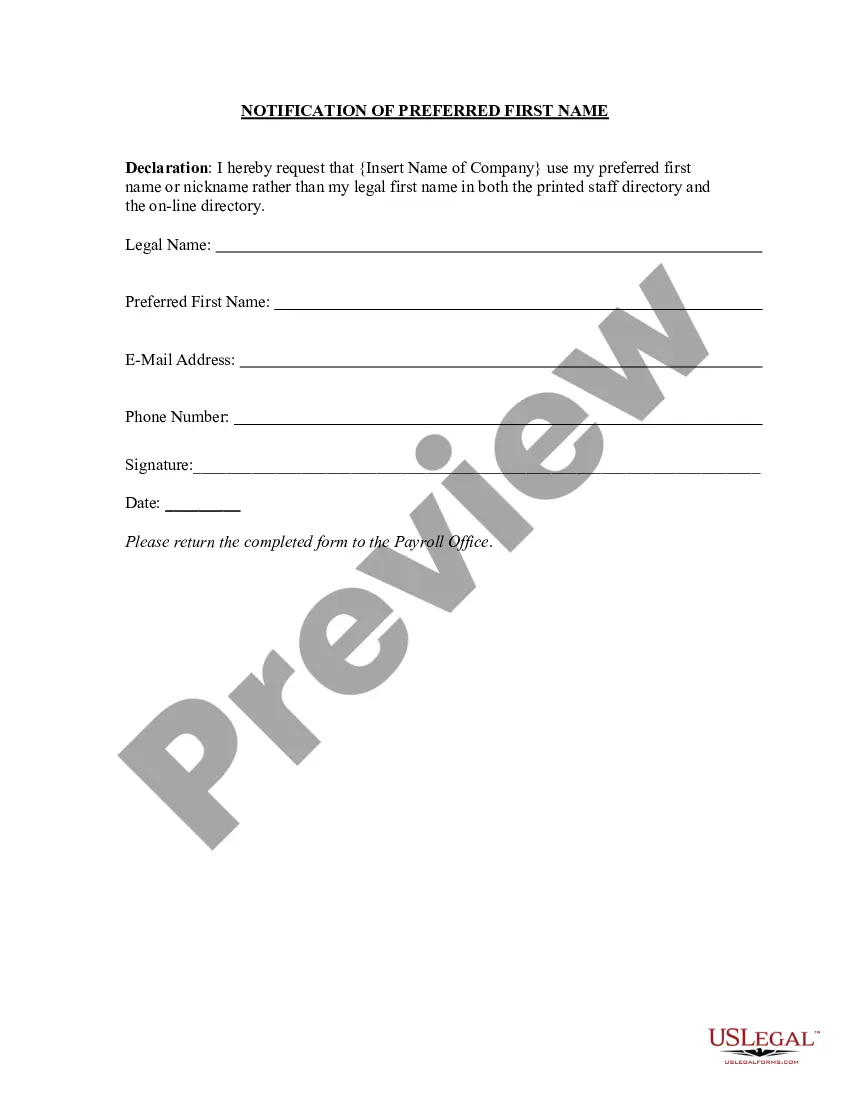

If you are a new user of US Legal Forms, here are simple instructions you should follow: First, ensure you have selected the appropriate form for your city/state. You can preview the document using the Preview button and examine the form details to confirm this is the correct one for you.

- The service offers thousands of templates, such as the Iowa Business Management Consulting or Consultant Services Agreement - Self-Employed, which can be used for business and personal purposes.

- All of the documents are reviewed by experts and conform to federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to obtain the Iowa Business Management Consulting or Consultant Services Agreement - Self-Employed.

- Use your account to search through the legal documents you may have purchased previously.

- Visit the My documents section of your account to retrieve an additional copy of the document you need.

Form popularity

FAQ

Getting an LLC for your consulting business can provide advantages, such as personal liability protection and potential tax benefits. This structure separates your personal assets from your business, reducing risk. If you're engaged in Iowa Business Management Consulting, forming an LLC could enhance your credibility and professionalism in the eyes of clients.

You do not need to set up a formal company to work as a consultant. Many individuals successfully operate as self-employed consultants without an LLC or corporation. However, establishing a business can provide legal protections and may enhance your professional reputation in Iowa Business Management Consulting.

To write a simple consulting agreement, include essential details such as the scope of services, payment terms, and project timelines. Clearly outline the responsibilities of both parties to avoid misunderstandings. Using a Consultant Services Agreement - Self-Employed template from uslegalforms can streamline this process and ensure that all necessary elements are covered.

Yes, it is possible to work as a consultant without forming an LLC. Many self-employed consultants choose to operate as sole proprietors, which can simplify the start-up process. However, forming an LLC can provide additional legal protections and help establish credibility in the field of Iowa Business Management Consulting.

Yes, many business consultants operate as self-employed professionals. As a self-employed consultant, you can manage your own schedule and choose your clients, allowing flexibility in your work life. Engaging in Iowa Business Management Consulting means offering specialized expertise to businesses in need, which can be a rewarding career path.

Yes, a consultant is generally considered self-employed as they operate their own business and offer services independently. This designation gives them the flexibility to choose clients and manage their workload. If you're in the Iowa Business Management Consulting field, establishing clear terms in your Consultant Services Agreement - Self-Employed can set the stage for a successful partnership.

Yes, an independent contractor or consultant can manage employees, depending on the terms of their agreement with the client. However, this often requires clearly defined roles and responsibilities to avoid any confusion. Within Iowa Business Management Consulting projects, it is crucial to establish the extent of your authority in any Consultant Services Agreement - Self-Employed.

employed individual is one who works for themselves rather than for an employer. This status allows you to earn income directly from your clients or customers. In the context of Iowa Business Management Consulting, being selfemployed means you are responsible for your own business decisions and agreements, such as a Consultant Services Agreement SelfEmployed.

Consultants typically operate as service-oriented businesses, providing expert advice and solutions in specific fields. This can include areas such as marketing, finance, or administration. If you're focusing on Iowa Business Management Consulting, you would offer strategic advice to help organizations improve efficiency and effectiveness.

Having a contract as a consultant is highly recommended, as it protects both you and your client. A well-crafted contract outlines the scope of work, payment terms, and other critical details. If you are engaged in Iowa Business Management Consulting, a Consultant Services Agreement - Self-Employed can clarify expectations and prevent misunderstandings.