A subscription is a purchase made by a signed order. A subscription offer should state with certainty the name of the payee, the amount and date of the subscription, any limitations placed on the use of the property contributed, and a clear description of the consideration. To ensure enforceability a subscription should also include a clear recitation of consideration.

Iowa Subscription Agreement with Nonprofit Corporation

Description

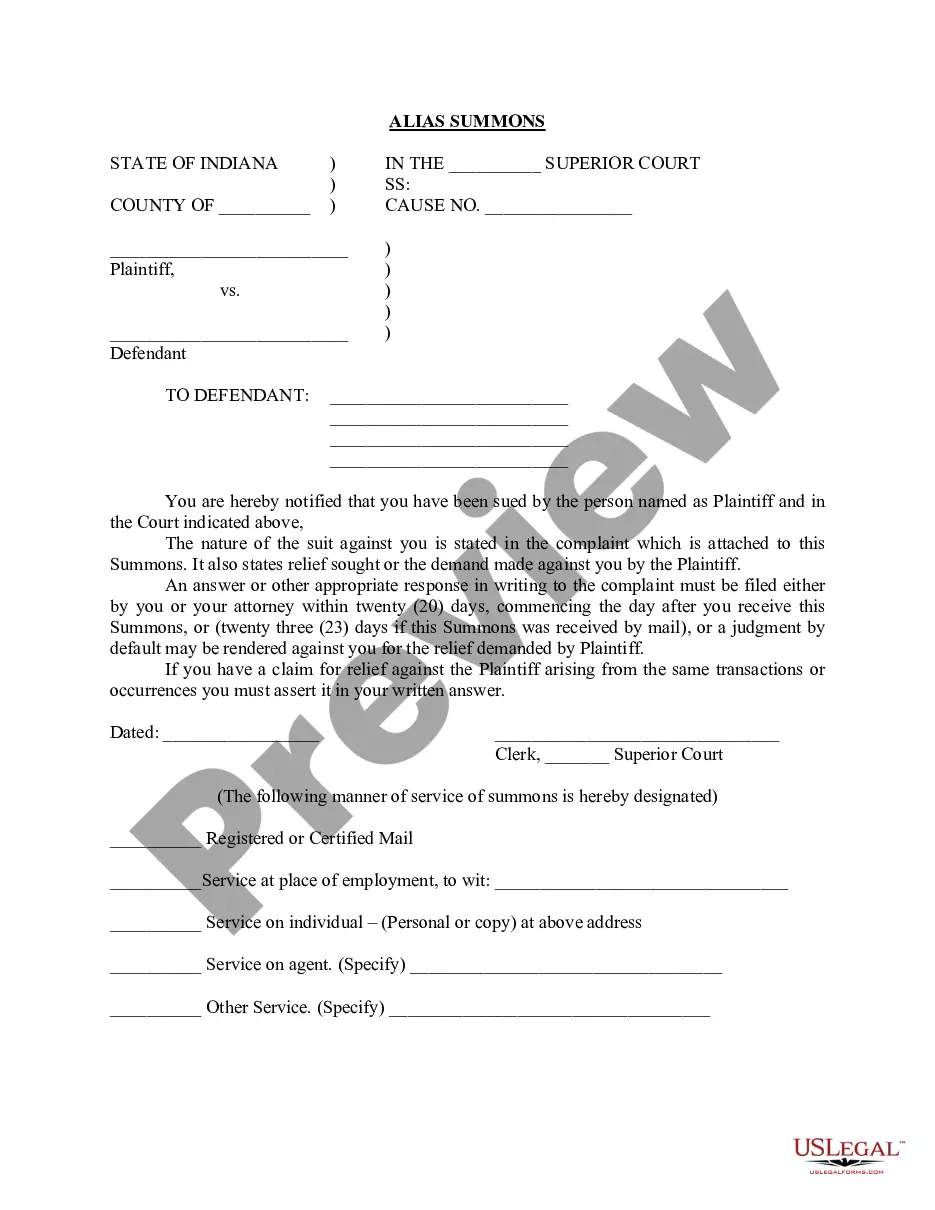

How to fill out Subscription Agreement With Nonprofit Corporation?

You can spend many hours online searching for the valid document format that meets the federal and state requirements you desire.

US Legal Forms offers a vast array of authentic forms that have been reviewed by experts.

You can easily obtain or print the Iowa Subscription Agreement with Nonprofit Corporation from my service.

First, ensure you have chosen the correct document format for your area or city. Check the form description to confirm that you have selected the correct template. If available, utilize the Review button to browse through the document format as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Iowa Subscription Agreement with Nonprofit Corporation.

- Every legal document format you purchase is yours permanently.

- To retrieve an additional copy of a purchased form, visit the My documents section and click the relevant button.

- If you're using the US Legal Forms website for the first time, follow these simple instructions.

Form popularity

FAQ

If you do not file a biennial report in Iowa, your nonprofit corporation may face penalties. This could include fines or loss of good standing, which can affect your ability to conduct business legally. It is vital to keep up with your filings to ensure your Iowa Subscription Agreement with Nonprofit Corporation remains valid. Staying proactive can save you from unnecessary headaches down the road.

A biennial report is not the same as an annual report. In Iowa, nonprofit corporations are required to file a biennial report every two years, while annual reports are filed each year. Understanding the distinction helps ensure compliance with the legal requirements for your Iowa Subscription Agreement with Nonprofit Corporation. Staying on top of these filings can support your organization’s legitimacy and operational success.

An Iowa Subscription Agreement with Nonprofit Corporation streamlines the process of managing member contributions and expectations within the organization. It provides clear terms regarding how members can support the nonprofit financially and how their contributions will be utilized. This clarity fosters trust and encourages collaboration among members. US Legal Forms offers templates and guidance to help you create effective agreements that drive operational efficiency and ensure compliance.

The 33% rule refers to the guideline that nonprofit organizations should allocate no more than one-third of their resources to administrative expenses. This rule helps ensure that a significant portion of funding goes directly to programs and services rather than overhead. Understanding this principle can enhance your nonprofit’s efficiency and effectiveness. By utilizing the Iowa Subscription Agreement with Nonprofit Corporation, you can outline a clear financial structure, and US Legal Forms can help you create a compliant strategy.

One significant disadvantage of a nonprofit corporation is the stringent regulatory oversight it must adhere to. Nonprofit corporations must maintain detailed records, follow specific reporting guidelines, and ensure compliance with both federal and state laws. These requirements can result in higher administrative costs and may be burdensome for small organizations. To navigate these complexities, many organizations rely on the Iowa Subscription Agreement with Nonprofit Corporation to establish clear guidelines, and US Legal Forms offers valuable resources.

To determine if a nonprofit is incorporated, you can check with the state’s Secretary of State office or its online database. Incorporated nonprofits usually have 'Inc.' or 'Corporation' in their official name. Additionally, incorporation involves filing articles of incorporation and complying with state regulations. Understanding the Iowa Subscription Agreement with Nonprofit Corporation can simplify this verification process, and US Legal Forms can assist with necessary documentation.

A nonprofit corporation is a specific legal entity formed to carry out charitable, educational, or other purposes that do not benefit owners financially. In contrast, a nonprofit organization can refer to any group that operates without profit, including informal groups. Importantly, establishing a nonprofit corporation provides limited liability protection to its directors and officers under Iowa law. For clarity about Iowa Subscription Agreement with Nonprofit Corporation, consider using US Legal Forms to guide your formation process.

Churches are typically exempt from Iowa sales tax, as they qualify as nonprofit organizations under state law. This exemption allows them to allocate more funds toward their missions and community services. It’s beneficial to outline such exemptions in an Iowa Subscription Agreement with Nonprofit Corporation to clarify financial expectations.

Yes, a corporation can operate both as a for-profit and nonprofit, often referred to as a hybrid model. However, clear distinctions must be maintained in operations and financial reporting. Consulting an expert when drafting an Iowa Subscription Agreement with Nonprofit Corporation can help navigate these complexities.

Yes, many nonprofits operating in Iowa qualify for tax exemption, similar to those at the federal level. However, they must apply for this status officially through the appropriate state agencies. Having a well-structured Iowa Subscription Agreement with Nonprofit Corporation can aid in the application process, ensuring clarity and compliance.