Iowa Triple Net Lease for Residential Property

Description

How to fill out Triple Net Lease For Residential Property?

If you intend to accumulate, acquire, or print certified document templates, utilize US Legal Forms, the finest collection of legal forms, available online.

Make use of the site’s simple and user-friendly search feature to locate the documents you require.

An array of templates for corporate and personal purposes is organized by categories and states, or keywords. Utilize US Legal Forms to locate the Iowa Triple Net Lease for Residential Property with just a couple of clicks.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Select the My documents section and choose a form to print or download again.

Engage and obtain, and print the Iowa Triple Net Lease for Residential Property with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms customer, Log In to your account and click the Download button to find the Iowa Triple Net Lease for Residential Property.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

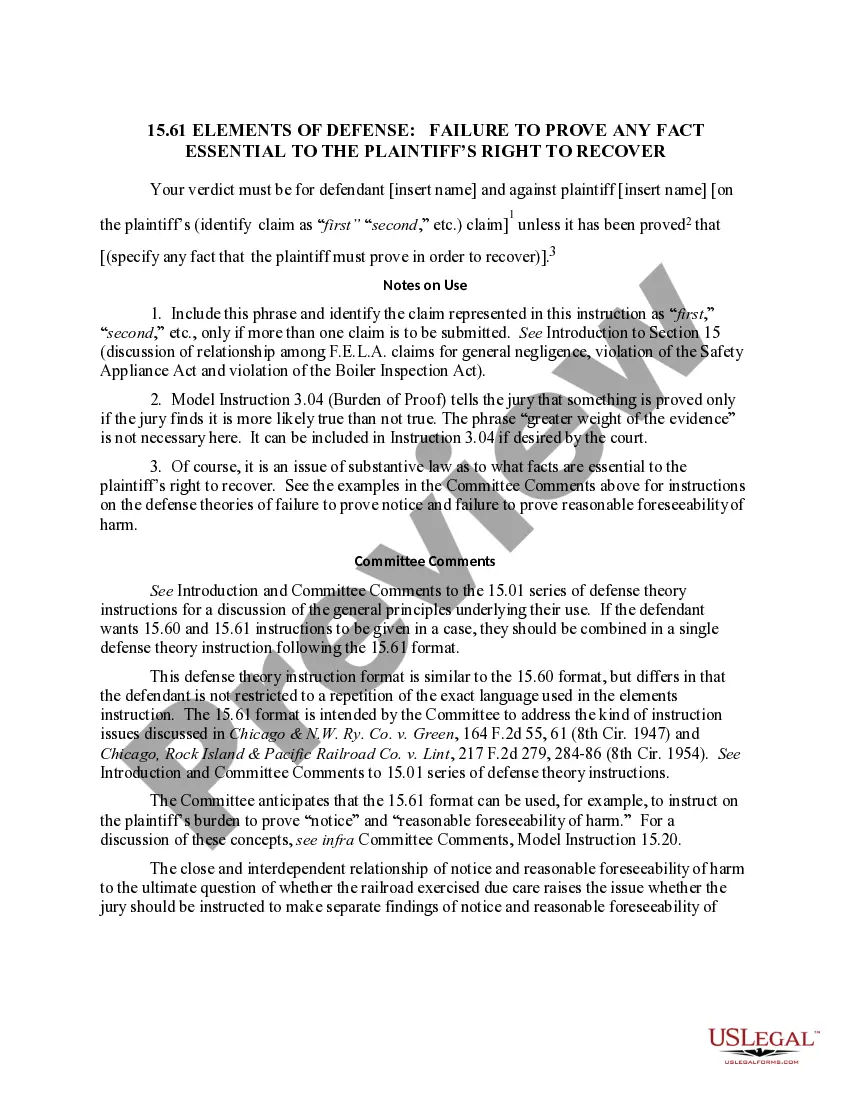

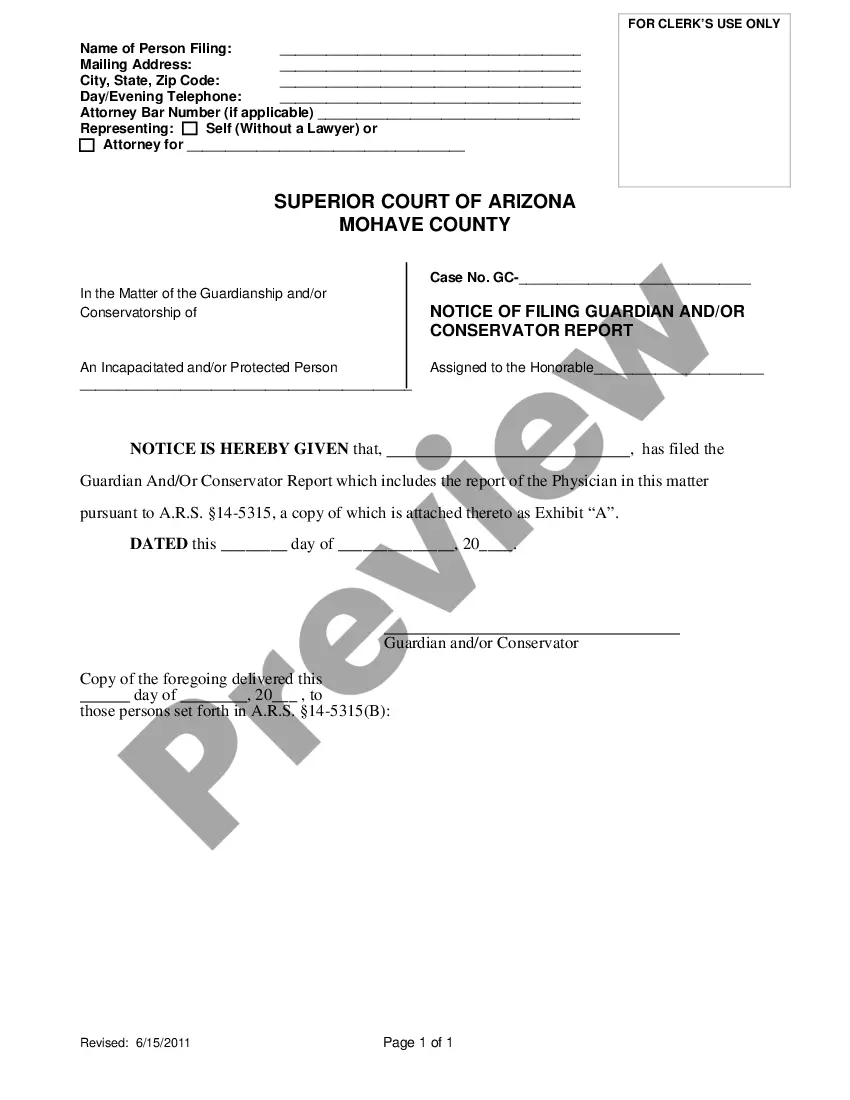

- Step 2. Use the Preview option to review the form's content. Make sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, select the Purchase now option. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Iowa Triple Net Lease for Residential Property.

Form popularity

FAQ

To structure an Iowa Triple Net Lease for Residential Property, you begin by clearly defining the terms between the landlord and tenant. It is essential to specify which expenses, such as property taxes, insurance, and maintenance costs, the tenant will cover. This arrangement provides financial predictability for landlords while offering flexibility to tenants. Using a platform like uslegalforms can help you draft a comprehensive lease agreement that meets local regulations and protects both parties' interests.

Calculating triple net leases involves determining the base rent and estimating the additional expenses that tenants will cover. Factors to consider include property taxes, insurance rates, and maintenance costs, often dividing these by the leasable square footage. The total rent for the tenant consists of the base rent plus the prorated share of these expenses. For a seamless experience, you can utilize tools available on the US Legal Forms platform that simplify this process for Iowa Triple Net Lease for Residential Property.

When you see $20 NNN, it refers to a rental rate of $20 per square foot per year with the triple net lease parameters. In other words, the tenant pays the base rent of $20 along with their share of property taxes, insurance, and maintenance costs. This structure ensures that landlords can maintain a fixed income while passing some operational expenses to the tenant. For real estate transactions, the US Legal Forms platform can help you understand these terms and their implications better.

To calculate a triple net lease for residential property in Iowa, start with the base rent and then add property expenses such as property taxes, insurance, and maintenance costs. These expenses typically pass through to the tenant, making the net amount the tenant pays reflect not just rent, but these additional costs as well. Using a clear formula helps in understanding your financial obligations better. If you need assistance, the US Legal Forms platform provides valuable resources to guide you through the calculation process.

Triple net leases are most commonly associated with commercial properties, but they can also apply to residential properties. An Iowa Triple Net Lease for Residential Property may be found in single-family homes or multi-unit buildings where tenants have agreed to cover additional expenses. Exploring local listings and consulting real estate professionals can help you find these types of leases.

To find an Iowa Triple Net Lease for Residential Property, start by conducting thorough online research. Utilize real estate websites and consult local agents who specialize in leasing. Networking within local real estate communities can also provide leads on available properties. Consider using platforms like US Legal Forms to find templates and guides for triple net leases.

A lease is often labeled as a triple net lease if it specifies that the tenant is responsible for all operating expenses. In an Iowa Triple Net Lease for Residential Property, you will see terms regarding property taxes, insurance, and maintenance costs outlined in the agreement. Always review the lease terms carefully or consult with a legal expert for clarity.

Triple net leases can be a good option for tenants, depending on their needs. With an Iowa Triple Net Lease for Residential Property, tenants are responsible for property taxes, insurance, and maintenance costs. This arrangement can sometimes lead to lower base rent prices. However, it's important to understand all responsibilities before signing the lease.

To get approved for an Iowa Triple Net Lease for Residential Property, you typically need to demonstrate financial stability. Landlords will often review your credit score, income, and rental history. Providing documentation such as bank statements and proof of employment can strengthen your application. Consider working with experts who can guide you through the approval process.

Triple net leases come with specific risks, including unpredictable increases in operating expenses. Since tenants are responsible for all property-related costs, they may face significant financial strain if repairs are needed or if tax assessments rise. Understanding these risks is crucial when considering an Iowa Triple Net Lease for Residential Property.