Iowa Hippa Release Form for Insurance

Description

How to fill out Hippa Release Form For Insurance?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast array of legal templates that you can download or print.

By using the website, you can access thousands of forms for commercial and personal needs, categorized by type, state, or keywords. You can quickly find the latest templates such as the Iowa Hippa Release Form for Insurance.

If you have a subscription, Log In to download the Iowa Hippa Release Form for Insurance from the US Legal Forms library. The Download button will appear on each document you view. You can find all previously downloaded forms in the My documents tab of your account.

Select the format and download the document to your device.

Make modifications. Fill out, edit, print, and sign the downloaded Iowa Hippa Release Form for Insurance. Each template added to your account has no expiration date and is yours indefinitely. Therefore, if you need to download or print another copy, simply access the My documents section and click on the form you need. Access the Iowa Hippa Release Form for Insurance through US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

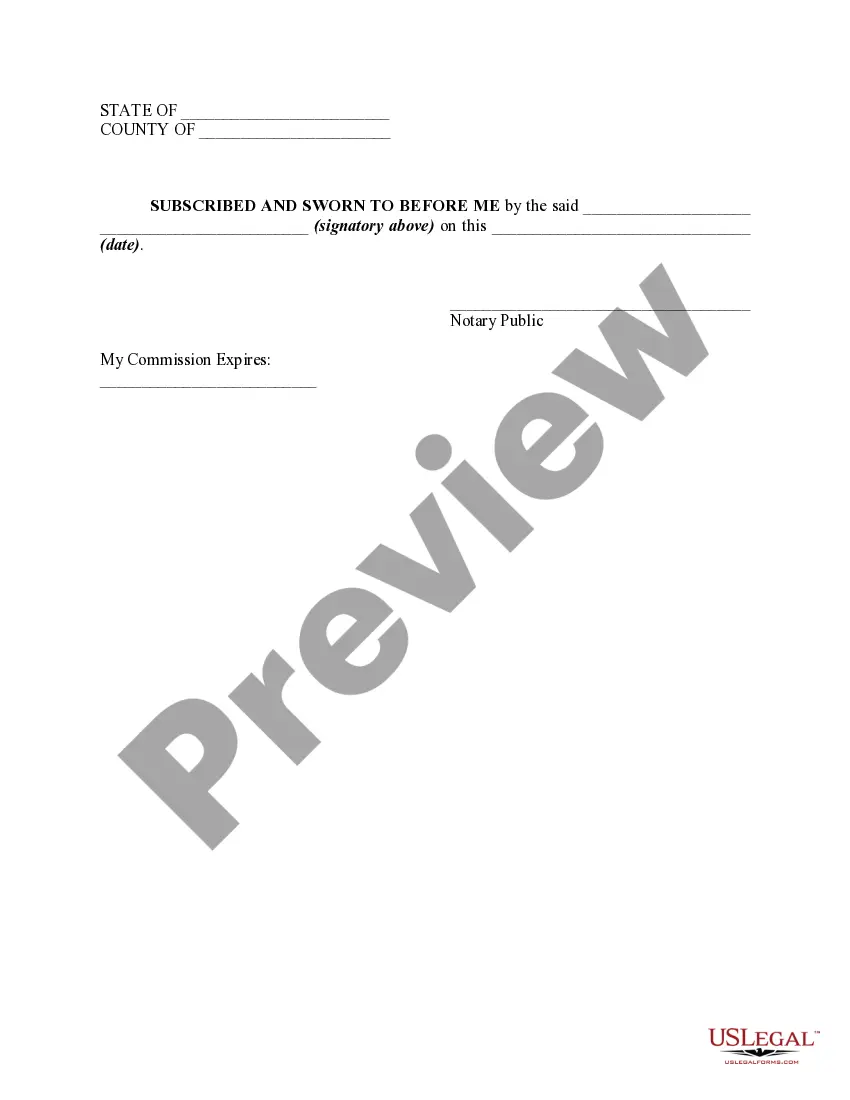

- Ensure you have selected the correct form for your locality. Click on the Preview button to review the form’s content.

- Examine the form description to confirm you have chosen the correct document.

- If the form does not meet your requirements, utilize the Search field at the top of the page to locate a suitable alternative.

- When you are satisfied with the document, validate your choice by clicking the Buy Now button.

- Then, select the payment plan you prefer and provide your details to register for the account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

A HIPAA notice must clearly inform patients about their rights and how their information is used, particularly when using an Iowa Hippa Release Form for Insurance. This notice should include details on who might access or share their health information. It’s also crucial to outline the patient's rights regarding their health records, such as the right to request amendments. Ensuring these requirements are clearly communicated fosters transparency and confidence between providers and patients.

Obtaining HIPAA approval often involves ensuring that your Iowa Hippa Release Form for Insurance meets federal requirements. You can start by completing the form according to guidelines and submitting it to the relevant healthcare provider or insurer for review. It's advisable to verify that they accept your release form to avoid any delays in processing your request. Platforms like US Legal Forms can simplify this process by providing compliant templates.

When utilizing an Iowa Hippa Release Form for Insurance, specific rules govern how information is released. The provider must obtain explicit permission from the patient before sharing any health information. Moreover, the release must be limited to the minimum necessary information to fulfill its purpose. Following these guidelines helps maintain patient privacy and builds trust with providers.

The duration of an Iowa Hippa Release Form for Insurance typically varies based on the specifics outlined in the document. Generally, it remains valid until revoked by the patient, unless a specific expiration date is mentioned. It is important for individuals to understand this timeframe and take action if they wish to revoke the release in the future. Regularly reviewing the form can help patients manage their preferences effectively.

To create an effective Iowa Hippa Release Form for Insurance, you must include specific information. This includes the patient's full name, date of birth, and the names of the individuals or entities that will receive the information. Additionally, the form should clearly describe the type of information being released and outline the purpose of the release. Ensuring that all required details are included can make the process smoother and more compliant.

To create a HIPAA release form, gather necessary information about the patient and the healthcare entity involved. Clearly outline what information will be shared and for what purpose. Our Iowa Hippa Release Form for Insurance is a useful resource, providing an easy and compliant way to create this essential document.

A HIPAA release requires specific identifiers for the patient and healthcare provider, as well as a clear description of the information being disclosed. You must also include the purpose of the release and ensure that the patient provides informed consent through their signature. Our Iowa Hippa Release Form for Insurance satisfies these requirements and simplifies the process.

Yes, HIPAA does cover claims submissions to insurance companies as it regulates the privacy and protection of health information in these circumstances. Insurers may require HIPAA-compliant forms to process claims effectively. Using the Iowa Hippa Release Form for Insurance ensures that you provide proper authorization for the release of necessary information to facilitate your claims.

To create a medical release form, start by gathering essential patient information and defining who will receive the medical records. Specify the types of information being released and the purpose of the release. Our Iowa Hippa Release Form for Insurance can serve as an excellent template to facilitate this process easily.

Yes, HIPAA release forms can be signed electronically, provided that the electronic signatures meet legal standards. This means using secure and compliant digital signature solutions. Our platform offers options for electronically signing the Iowa Hippa Release Form for Insurance, ensuring convenience and security for all parties involved.