One principal advantage of insurance trusts is that they permit a greater flexibility in investment and distribution than may be effected under settlement options generally included in the policies themselves. Another advantage is that such trusts, like other gifts of insurance policies, may afford substantial estate tax savings.

Iowa Irrevocable Trust Funded by Life Insurance

Description

How to fill out Irrevocable Trust Funded By Life Insurance?

Are you currently in the position where you need documentation for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones isn’t straightforward.

US Legal Forms offers a wide array of template designs, including the Iowa Irrevocable Trust Funded by Life Insurance, which are created to comply with federal and state requirements.

Once you find the correct template, click Acquire now.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Iowa Irrevocable Trust Funded by Life Insurance template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the template you want and ensure it is for the correct city/region.

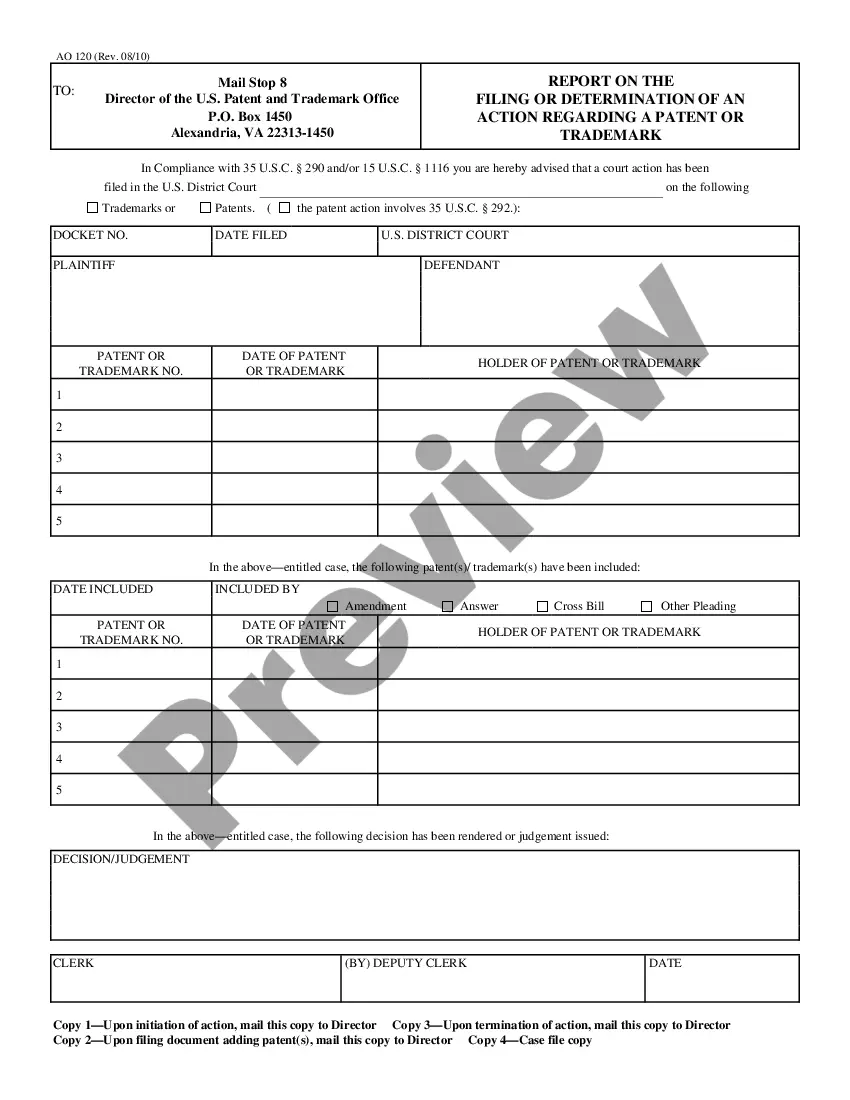

- Utilize the Review button to preview the document.

- Verify the information to ensure you have selected the right template.

- If the template isn’t what you’re looking for, use the Search field to find the document that fits your requirements.

Form popularity

FAQ

To fund an Iowa Irrevocable Trust with life insurance, you first need to create the trust and then transfer ownership of your policy to it. This process helps protect your assets and allows the trust to receive the insurance payout upon your death. Make sure to consult a qualified attorney or financial advisor to ensure the trust is set up correctly. Consider using platforms like US Legal Forms for streamlined processes and resources.

An Iowa Irrevocable Trust Funded by Life Insurance can be an excellent decision for many individuals. This type of trust provides both asset protection and estate tax benefits. By removing life insurance from your taxable estate, it allows your beneficiaries to receive a larger inheritance. Moreover, it ensures that the death benefit is used according to your wishes.

An irrevocable life insurance trust typically needs to file a tax return if it has generated taxable income. In the case of an Iowa Irrevocable Trust Funded by Life Insurance, while the insurance proceeds are generally not taxed, other income earned by the trust may necessitate filing. Ensure that you stay informed about any changes in tax laws to maintain compliance. Consulting with a tax advisor can provide valuable assistance.

Filing a tax return for an irrevocable trust often depends on whether the trust generates taxable income. If your Iowa Irrevocable Trust Funded by Life Insurance produces earnings, it likely needs to file a return. Remember to keep careful records of all income and expenses associated with the trust. Seeking advice from a tax professional can help you understand your obligations.

Yes, you can place life insurance in an Iowa Irrevocable Trust Funded by Life Insurance. This strategy offers several benefits, including protection from creditors and the ability to manage the policy's proceeds effectively. By doing so, you can ensure that your loved ones receive the benefits in a tax-efficient manner. It’s wise to work with a legal expert to navigate this process smoothly.

The IRS treats irrevocable trusts separately from their grantors for tax purposes. This means that an Iowa Irrevocable Trust Funded by Life Insurance can manage its own income and expenses. The trust may need its own tax identification number and must report any earnings. It's essential to understand these rules to avoid any compliance issues.

If your Iowa Irrevocable Trust Funded by Life Insurance generates income, you may need to file a tax return. Generally, if the trust earns revenue, the IRS requires a return. However, since life insurance proceeds are usually not subject to income tax, the need for filing depends on other trust activities. Consider consulting a tax expert to clarify your specific situation.

Certain beneficiaries are exempt from Iowa inheritance tax, including spouses and children of the deceased. Additionally, charitable organizations are not subject to this tax. Creating an Iowa Irrevocable Trust Funded by Life Insurance can also help minimize potential tax burdens for your heirs, making it an essential estate planning tool.

In Iowa, various assets are subject to inheritance tax, including real estate, bank accounts, and life insurance policies owned by the decedent. However, if a life insurance policy is part of an Iowa Irrevocable Trust Funded by Life Insurance, it may not be included in the taxable estate, depending on the ownership structure. Always consult a professional for clarity on specific assets that could affect your inheritance tax obligations.

Yes, life insurance proceeds can be subject to Iowa inheritance tax, especially if the policy is not set up in an Iowa Irrevocable Trust Funded by Life Insurance. If the decedent owned the policy, the proceeds may add to the taxable estate. Understanding the nuances of Iowa inheritance tax laws can help you plan effectively.