Iowa Writ of Replevin or Repossession

Description

How to fill out Writ Of Replevin Or Repossession?

Have you been inside a situation that you will need documents for possibly company or person uses virtually every working day? There are a lot of legitimate file themes available on the net, but locating ones you can depend on isn`t easy. US Legal Forms delivers a huge number of form themes, much like the Iowa Writ of Replevin or Repossession, that are written to meet state and federal needs.

Should you be presently knowledgeable about US Legal Forms site and possess your account, simply log in. Following that, you can acquire the Iowa Writ of Replevin or Repossession template.

Unless you have an profile and need to begin using US Legal Forms, adopt these measures:

- Find the form you need and make sure it is for the appropriate area/region.

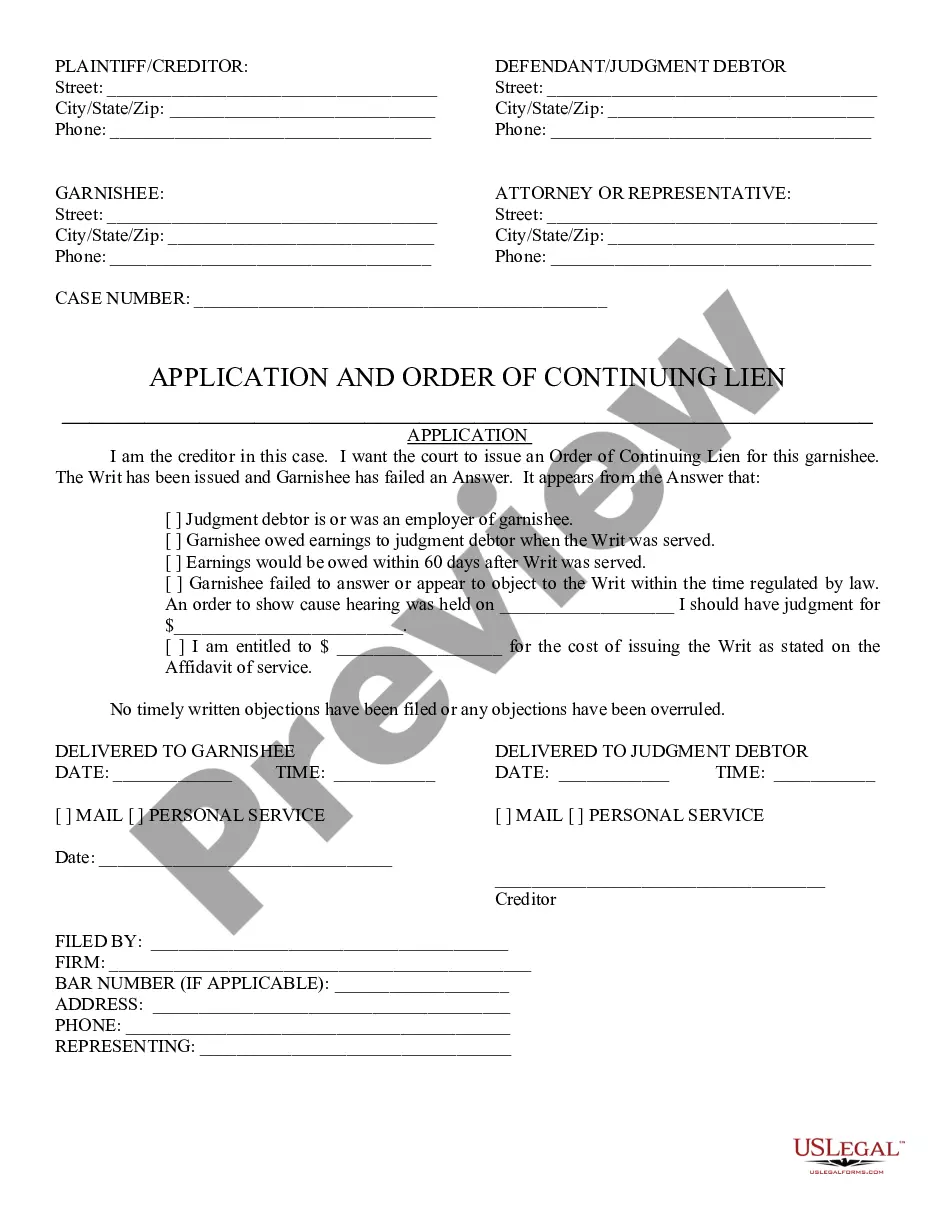

- Use the Review option to review the shape.

- Look at the description to actually have selected the correct form.

- When the form isn`t what you`re seeking, make use of the Research industry to find the form that meets your needs and needs.

- Whenever you discover the appropriate form, click on Acquire now.

- Choose the prices program you want, complete the required information to produce your money, and buy your order utilizing your PayPal or bank card.

- Choose a convenient data file format and acquire your backup.

Locate every one of the file themes you may have bought in the My Forms menus. You can aquire a extra backup of Iowa Writ of Replevin or Repossession any time, if possible. Just select the essential form to acquire or printing the file template.

Use US Legal Forms, the most substantial selection of legitimate kinds, in order to save time and steer clear of faults. The service delivers professionally created legitimate file themes that can be used for a variety of uses. Generate your account on US Legal Forms and commence generating your lifestyle easier.

Form popularity

FAQ

The replevin remedy is quick. The hearing on the writ will typically take place within 50 days of filing the lawsuit. The writ should be to the sheriff within 10 days after the hearing. The writ itself is good for 60 days, and the sheriff generally makes more than one attempt at recovery.

An action of replevin shall be commenced by the filing of a verified complaint which describes the property to be replevied and states that the plaintiff in such action is the owner of the property so described, or that he or she is then lawfully entitled to the possession thereof, and that the property is wrongfully ...

A replevin action is a little known but powerful area of the law. In its simplest terms, replevin is a procedure whereby seized goods may be provisionally restored to their owner pending the outcome of an action to determine the rights of the parties concerned.

1.305(1) Upon any individual who has attained majority and who has not been adjudged incompetent, either by taking the individual's signed, dated acknowledgment of service endorsed on the notice, or by serving the individual personally; or by serving, at the individual's dwelling house or usual place of abode, any ...

For example, a bank might file a replevin action against a borrower to repossess the borrower's car after he missed too many payments. See Debtor and Creditor Law. 2. A writ authorizing the retaking of property by its rightful owner (i.e., the remedy sought by replevin actions).

A writ of replevin is a prejudgment process ordering the seizure or attachment of alleged illegally taken or wrongfully withheld property to be held in the U.S. Marshal's custody or that of another designated official, under order and supervision of the court, until the court determines otherwise.

Replevin is a legal action to regain rightful possession of goods or personal property. It is not an action for damages, but the court ?shall also award damages? for cost incurred due to the wrongful possession of the property. Iowa Code § 643.17.

Replevin, also known as "claim and delivery," is an action to recover personal property that was wrongfully taken or detained. Unlike other forms of legal recovery, replevin seeks the return of the actual thing itself, as opposed to monetary damages (the more commonly sought-after remedy).