Iowa Certificate of Trust for Testamentary Trust

Description

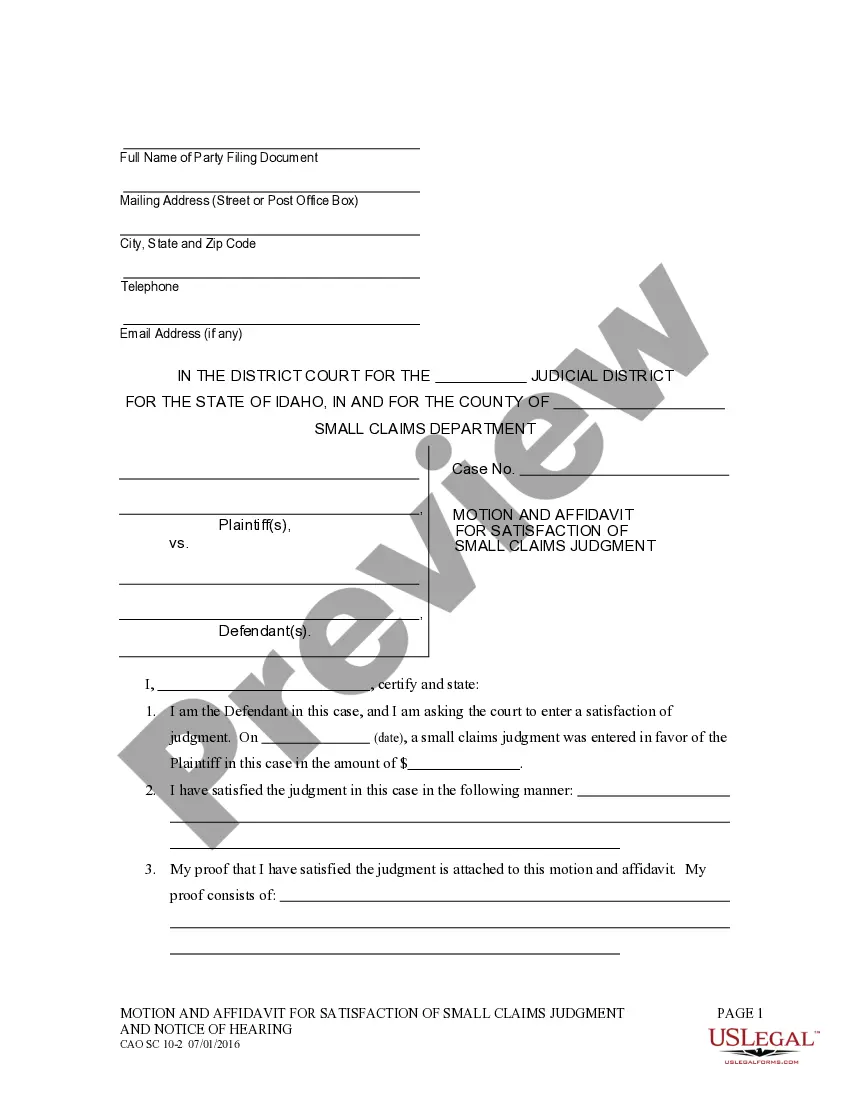

How to fill out Certificate Of Trust For Testamentary Trust?

US Legal Forms - one of the biggest libraries of lawful varieties in the USA - provides an array of lawful papers themes you are able to down load or produce. Utilizing the web site, you can get a huge number of varieties for company and person purposes, sorted by categories, claims, or keywords.You can find the most up-to-date versions of varieties much like the Iowa Certificate of Trust for Testamentary Trust in seconds.

If you currently have a monthly subscription, log in and down load Iowa Certificate of Trust for Testamentary Trust through the US Legal Forms library. The Acquire button will show up on each and every form you see. You get access to all earlier delivered electronically varieties from the My Forms tab of your respective bank account.

If you wish to use US Legal Forms initially, here are simple instructions to get you started:

- Be sure you have chosen the proper form for your personal town/region. Click on the Preview button to review the form`s content material. Read the form information to ensure that you have chosen the correct form.

- In case the form doesn`t suit your needs, utilize the Lookup field near the top of the screen to get the the one that does.

- When you are satisfied with the shape, verify your option by visiting the Acquire now button. Then, opt for the costs strategy you like and give your qualifications to sign up for the bank account.

- Approach the deal. Use your Visa or Mastercard or PayPal bank account to accomplish the deal.

- Find the format and down load the shape in your device.

- Make modifications. Fill out, change and produce and indication the delivered electronically Iowa Certificate of Trust for Testamentary Trust.

Every single format you included with your money lacks an expiry time which is your own eternally. So, if you would like down load or produce an additional copy, just visit the My Forms area and click on in the form you want.

Get access to the Iowa Certificate of Trust for Testamentary Trust with US Legal Forms, the most substantial library of lawful papers themes. Use a huge number of specialist and express-particular themes that meet your small business or person needs and needs.

Form popularity

FAQ

4604 Certification of trust. 1. A trustee may present a certification of trust to any person in lieu of providing a copy of the trust instrument to establish the trust's existence or terms or the trustee's authority.

A certification of trust is a document certifying that a trust was established, exists, and is under the management of a certain trustee. Certifications of trust prove the trustee's legal authority to act as such. Certifications of trust also serve as an abbreviated version of the trust.

§633A. 2202 - Modification or termination by settlor and all beneficiaries. §633A. 2203 - Termination of irrevocable trust or modification of dispositive provisions of irrevocable trust by court.

Once a declaration of trust has been executed, subsequent declarations can be issued to confirm current terms or amend the existing agreement. Depending on the jurisdiction, the declaration of trust can also be referred to as a trust agreement or a trust document.

A certificate of trust ? also called a ?trust certificate? or ?memorandum of trust? ? is a legal document that's often used to prove (or ?certify?) a trust exists and to provide information about its important terms.

The trust agreement is the parent document that details anything and everything regarding the trust, including its agreements. Meanwhile, the certificate of trust is used in tandem to keep nonessential information confidential.

A Certification of Trust is a legal document that can be used to certify both the existence of a Trust, as well as to prove a Trustee's legal authority to act. It's shorter than the actual Trust document, and it can offer pertinent information without making every aspect of the Trust public.

To make a living trust in Iowa, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.