Iowa Mobile Home Purchase Agreement

Description

How to fill out Mobile Home Purchase Agreement?

Are you presently in the situation where you require documents for either business or personal reasons almost constantly.

There are numerous legal document templates available online, but finding ones you can trust isn't easy.

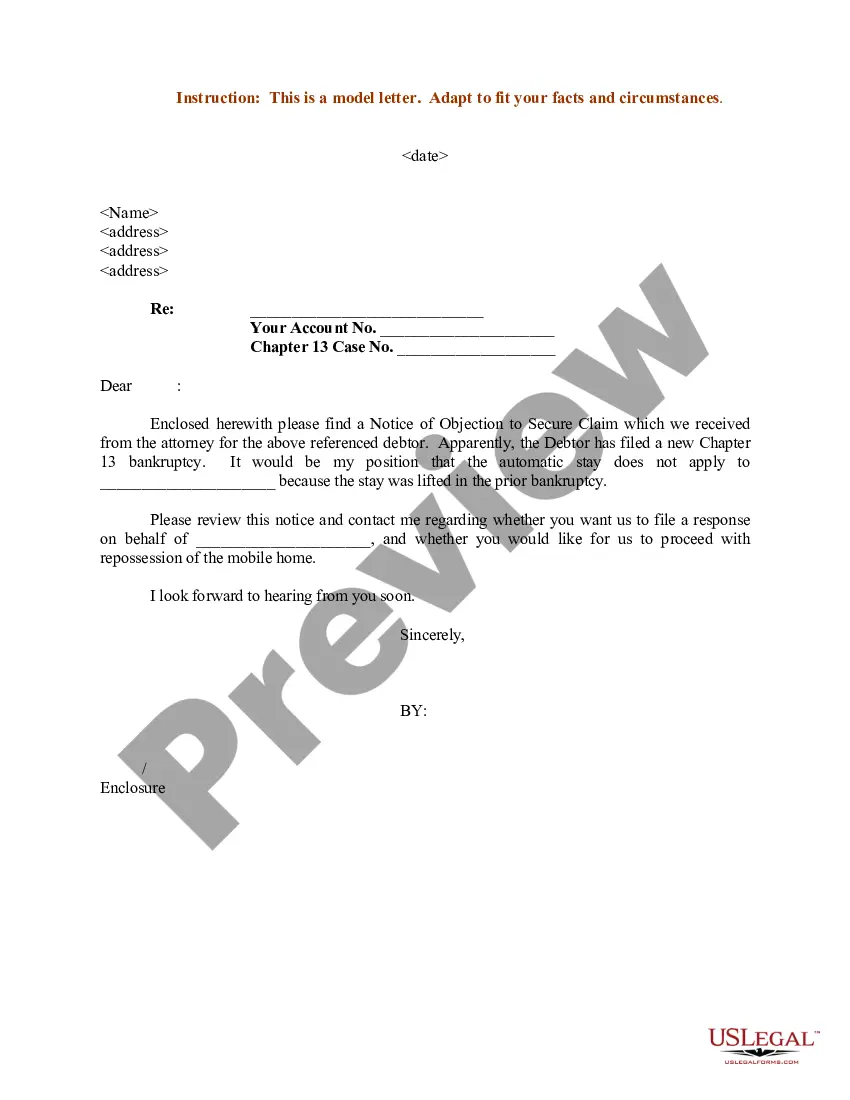

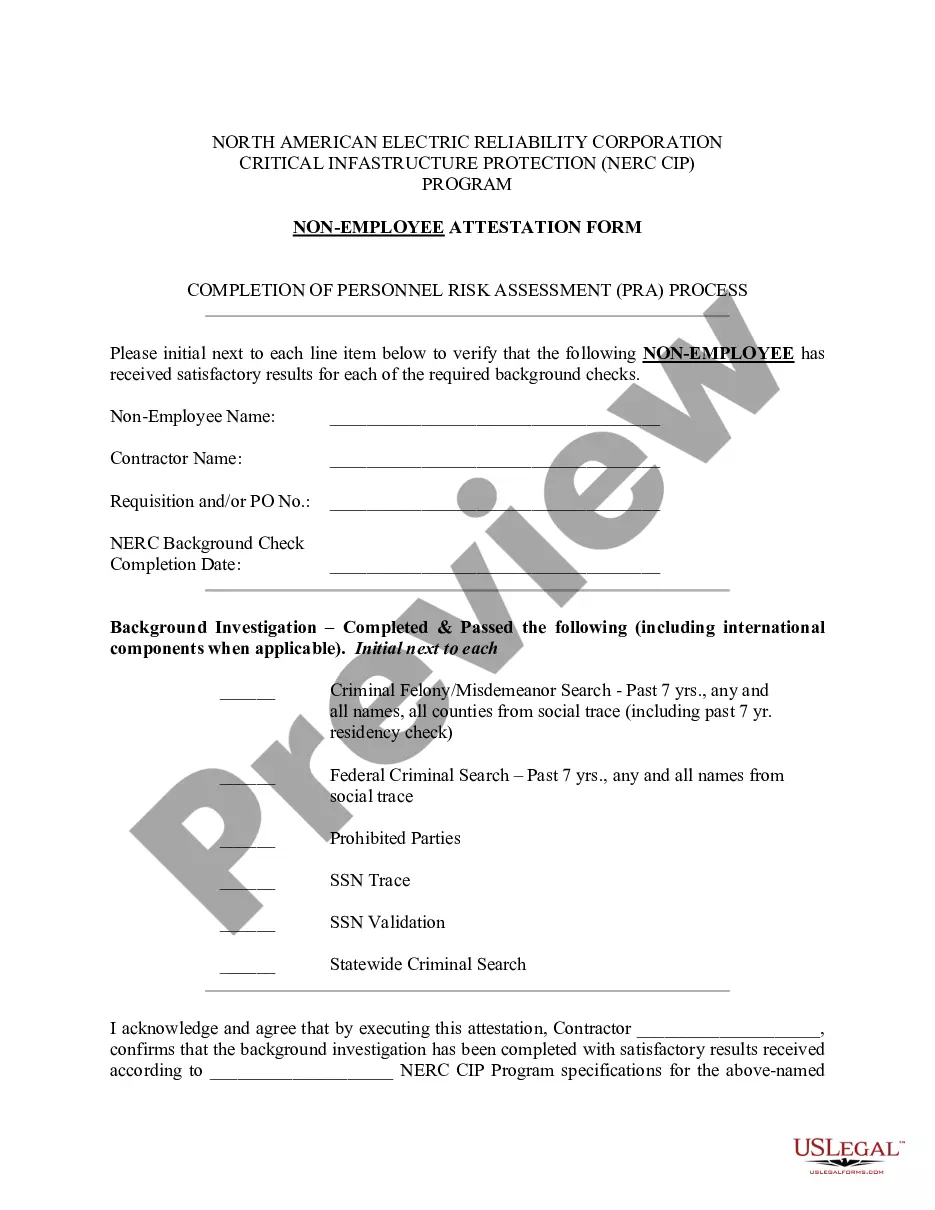

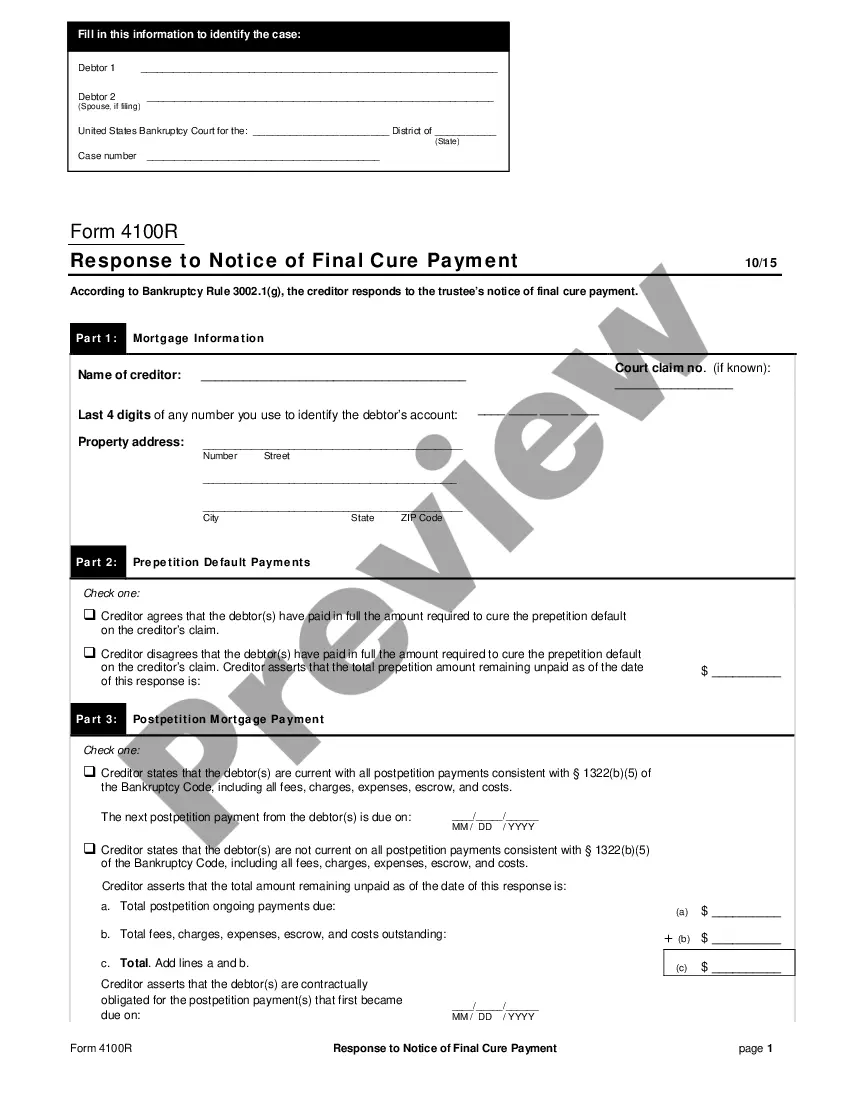

US Legal Forms offers a wide array of form templates, such as the Iowa Mobile Home Purchase Agreement, that are designed to comply with federal and state regulations.

Once you find the appropriate form, click Get now.

Select the payment plan you desire, fill out the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Iowa Mobile Home Purchase Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these guidelines.

- Find the form you need and ensure it is for the correct city/state.

- Use the Preview button to view the form.

- Check the details to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Search box to find the form that suits your needs.

Form popularity

FAQ

Bring forms to your local MVD in the county to pay transfer tax and transfer ownership. Only buyer(s) must be present at MVD to transfer title, however ideally buyer and seller go to MVD together to transfer title to help expedite any last-minute issues that arise at the MVD. All forms should already be signed.

Modular homes appraise the same as their on-site built counterparts do; they do not depreciate in value.

Iowa Property Tax Credit for Senior and Disabled Citizens Description: Incorporated into the Homestead Tax Law to provide property tax or rent relief to elderly homeowners and homeowners with disabilities. Eligibility: Must be 65 or older or totally disabled, and meet annual household low income requirements.

71.25% for the 2019 Assessment. 67.5% for the 2020 Assessment. 63.75% for the 2021 Assessment.

Iowa Mobile, Manufactured, and Modular Home Tax Homes located outside of mobile home parks and manufactured home communities are assessed and taxed as real estate. Tax Rate: 20¢ per square foot if the home is located in a mobile home park or manufactured home community.

If the owner of a home located in a manufactured home community or mobile home park sells the home, obtains a tax clearance statement, and obtains a replacement home to be located in a manufactured home community or mobile home park, the owner shall not pay taxes for the newly acquired home for the same tax period that

Use eTags© to Quickly Complete Your DMV Service. Renewals, Title Transfers and More, All Online! In Iowa, all applications for a new title are processed at your local County Treasurer's Office.

In Iowa, a vehicle title transfer costs $25. If you recently purchased your vehicle, be prepared to pay the sales tax that is based on the price you paid for the vehicle, local usage taxes, and processing fees.

Realty Versus Personal Property For relocation assistance purposes, a mobile home is considered to be personal property, unless the mobile home has been permanently affixed to the site and is now considered part of the real estate.