Iowa Sample Letter for Partnership Buyout

Description

How to fill out Sample Letter For Partnership Buyout?

It is feasible to spend several hours online searching for the legal document template that meets the state and federal criteria you require.

US Legal Forms offers a vast array of legal documents that can be evaluated by professionals.

You can easily download or print the Iowa Sample Letter for Partnership Buyout from my service.

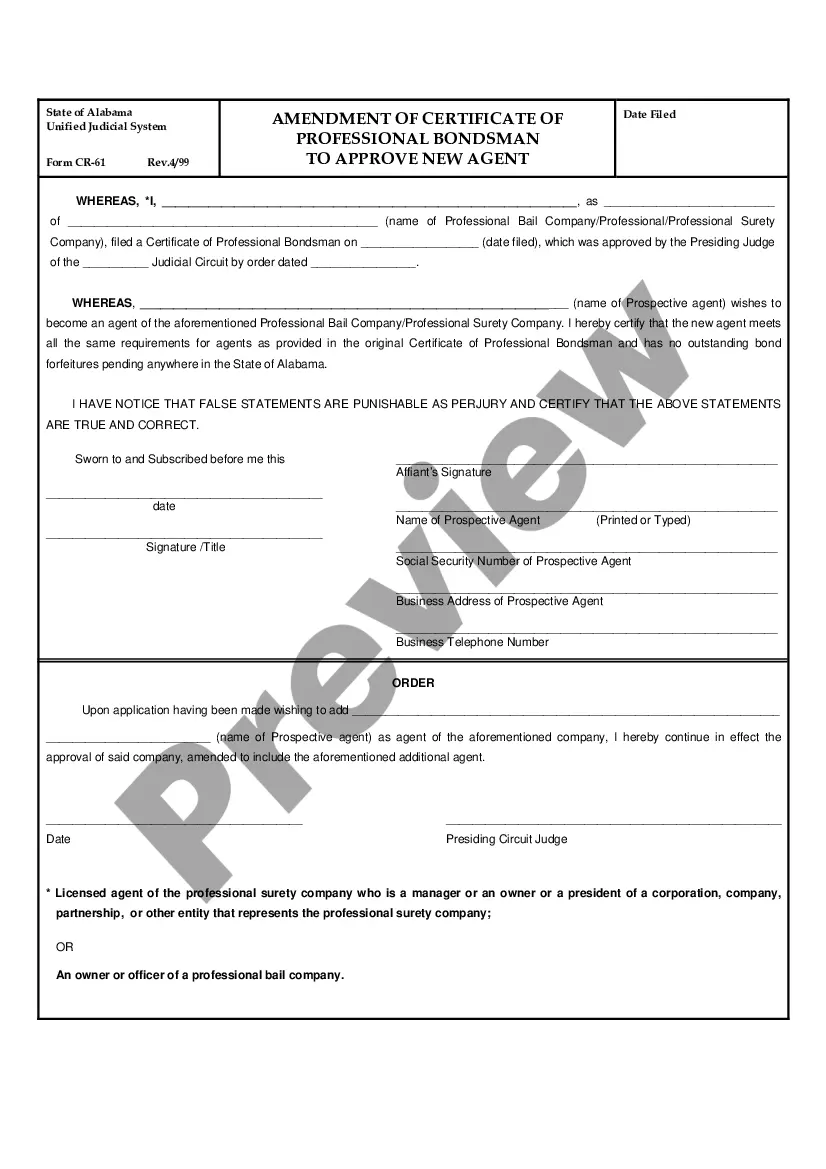

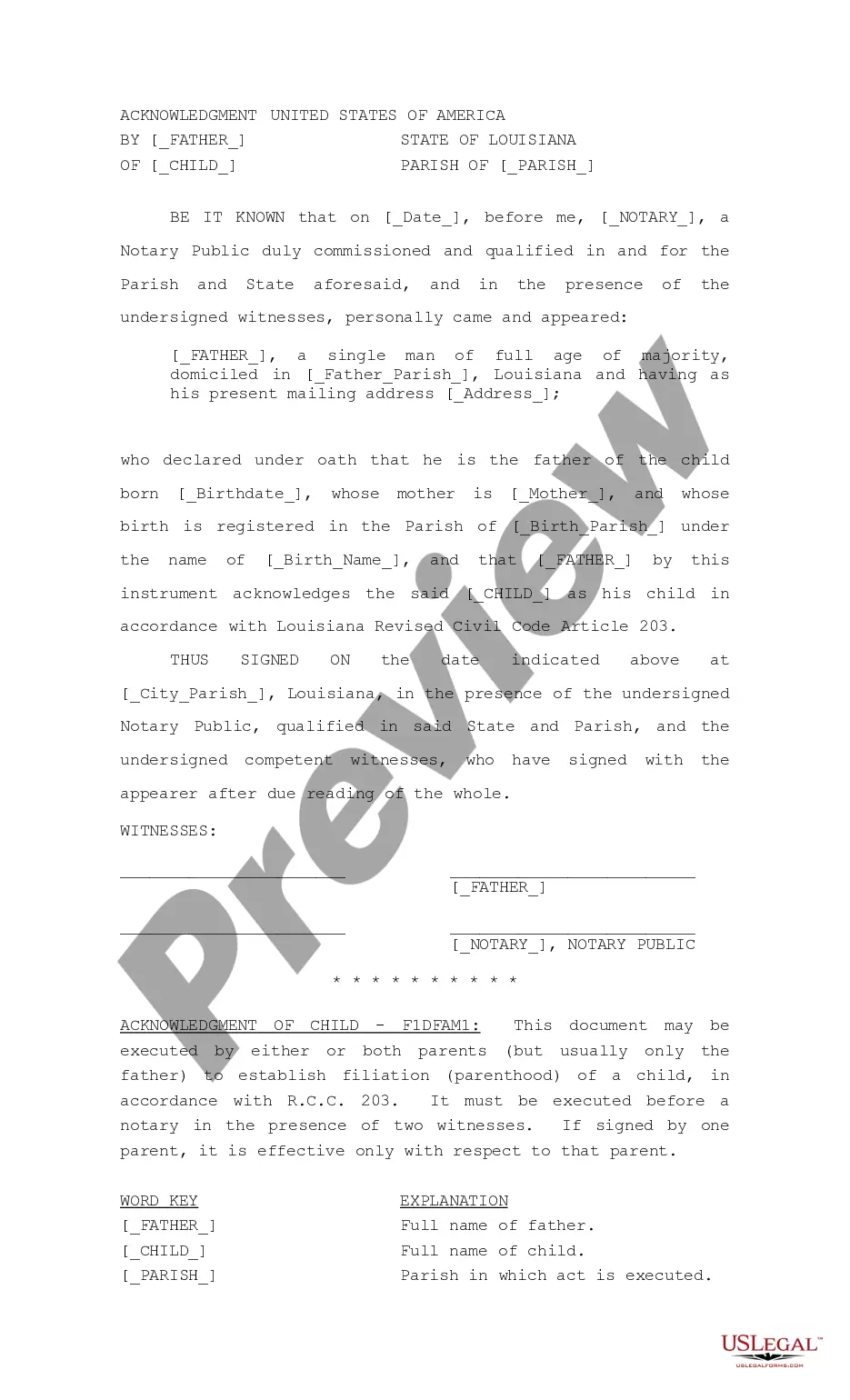

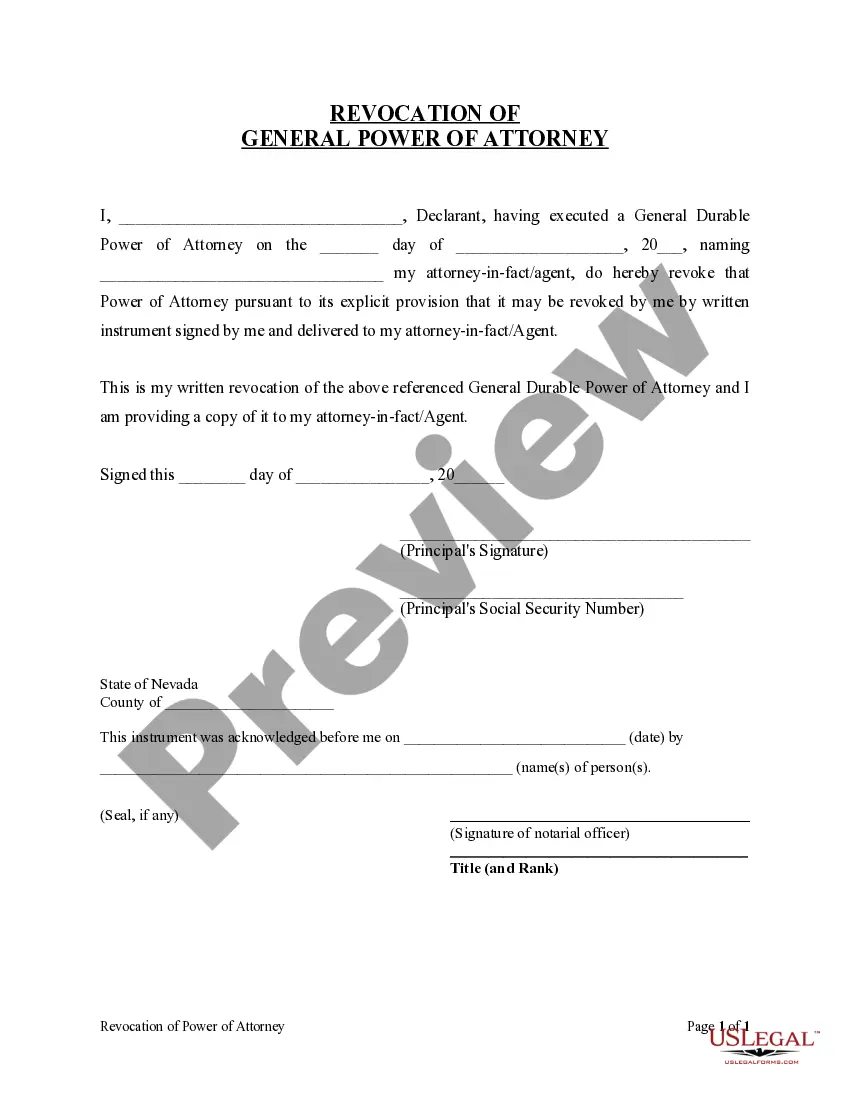

If available, use the Review button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Iowa Sample Letter for Partnership Buyout.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Review the form description to make sure you have chosen the right one.

Form popularity

FAQ

Schedule A for Iowa 1065 is a form that partners use to report their income and deductions from partnerships operating in Iowa. This schedule is crucial for detailing the specific contributions and distributions each partner receives, ensuring transparency during partnership buyouts. If you're involved in a buyout, utilizing an Iowa Sample Letter for Partnership Buyout can help clarify terms and expectations among partners. For a smooth process, consider using uslegalforms, which provides templates and resources to help you draft necessary documents effectively.

Non-residents of Iowa generally need to file an Iowa nonresident income tax return if they earn income from Iowa sources. This includes wages, dividends, or income from partnerships based in Iowa. Staying informed about these filing requirements aligns with preparing an Iowa Sample Letter for Partnership Buyout. For clarity and assistance, consider the resources available through UsLegalForms.

Buying out a partner requires mutual agreement on the value and terms of the buyout. This process often involves negotiation, determining a fair valuation of the partner's interest, and drafting legal documents to formalize the agreement. An Iowa Sample Letter for Partnership Buyout can facilitate this process by clearly outlining intentions and terms. UsLegalForms offers helpful templates to guide you.

Certain entities and individuals qualify for exemptions from Iowa withholding. Generally, nonresident individuals whose income falls below specific thresholds may be exempt. It is vital to determine your status to ensure compliance, especially when drafting an Iowa Sample Letter for Partnership Buyout. For accurate information, consult UsLegalForms, which can provide guidance.

Yes, Iowa has specific nonresident withholding requirements for partnerships. If a partnership has nonresident partners with income generated within Iowa, withholding may be necessary. Understanding these rules is crucial when preparing an Iowa Sample Letter for Partnership Buyout. Utilizing resources from UsLegalForms can help clarify these obligations.

Writing a letter of intent for a business partnership involves clearly stating the intentions of each party involved. You should outline the terms of the partnership, expectations, and any financial considerations. Additionally, including your intention to draft an Iowa Sample Letter for Partnership Buyout later can provide clarity. UsLegalForms offers templates that simplify this process.

Yes, Iowa requires nonresident withholding in certain situations. This withholding applies when a nonresident is a partner in a partnership that has income sourced to Iowa. It is essential to understand this to ensure compliance, especially when considering an Iowa Sample Letter for Partnership Buyout. To navigate these requirements effectively, many find the assistance of platforms like UsLegalForms beneficial.

Accounting for a partner buyout involves recording the transactions that take place during the buyout process. Ensure that the financial statements accurately reflect the changes in ownership and any adjustments to equity. An Iowa Sample Letter for Partnership Buyout can serve as a reference for financial documentation in this process.

To calculate a buyout, consider the company's total value, any outstanding debts, and the departing partner's ownership percentage. This calculation helps ensure a fair transaction for both parties. Using an Iowa Sample Letter for Partnership Buyout can help you enforce the calculated terms formally.

Calculating the buyout value involves determining the fair market value of a partner's share in the business. This may require assessing the company's financial health, paying off any liabilities, and evaluating the contribution of the departing partner. In this context, an Iowa Sample Letter for Partnership Buyout is useful for documenting the agreed-upon value.