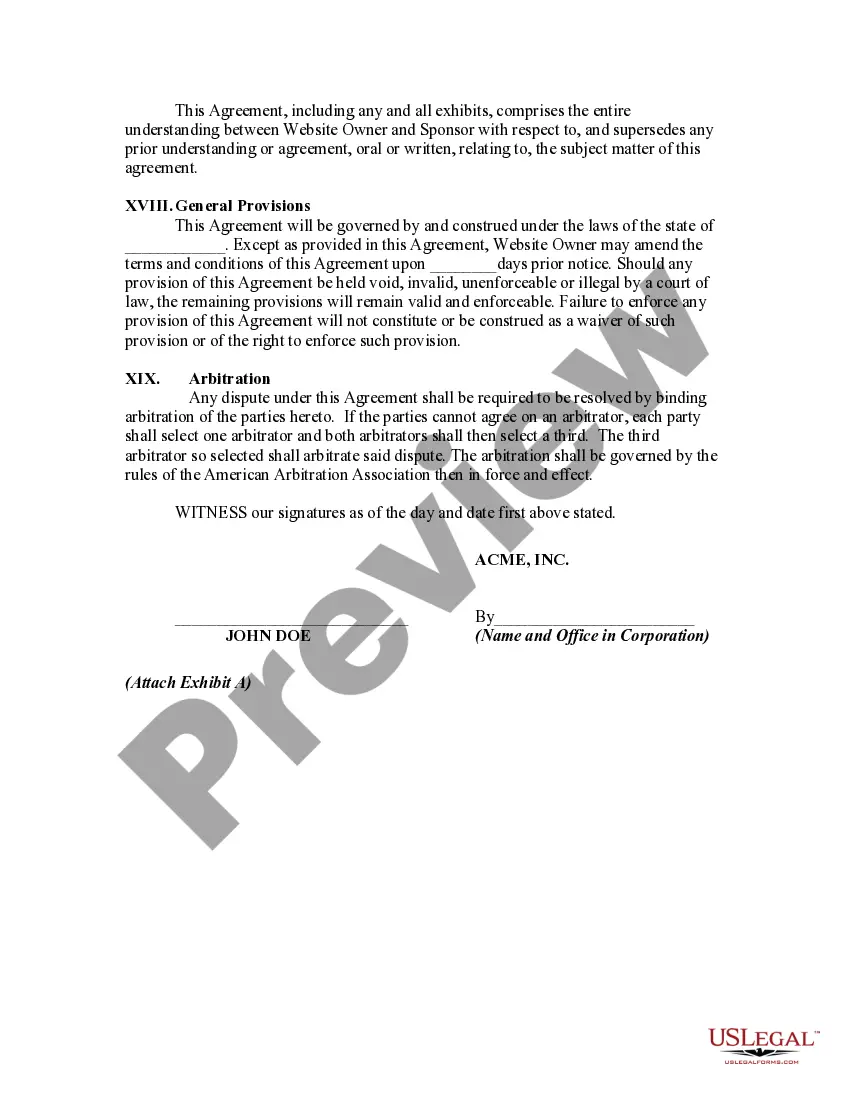

Iowa Agreement between Website Owner and Sponsor

Description

How to fill out Agreement Between Website Owner And Sponsor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or create.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You will find the latest form templates, such as the Iowa Agreement between Website Owner and Sponsor, in mere seconds.

If the form does not meet your requirements, use the Search box at the top of the page to find one that does.

If you are satisfied with the form, confirm your selection by clicking the Acquire now button. Then, choose the payment plan you prefer and provide your information to register for the account.

- If you hold a membership, Log In to download the Iowa Agreement between Website Owner and Sponsor from the US Legal Forms library.

- The Download option will be available on every form you view.

- You can access all previously downloaded forms from the My documents tab in your account.

- To use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your region/state.

- Click the Review option to examine the form’s details.

Form popularity

FAQ

In Iowa, property taxes do not automatically stop at a specific age. However, seniors may qualify for special exemptions that can reduce their tax burden. Keeping this in mind can aid in drafting an Iowa Agreement between Website Owner and Sponsor, particularly concerning property-related assets.

In general, new construction services are not subject to sales tax in Iowa. However, certain materials used in construction might incur tax. It is important to clarify these details in your Iowa Agreement between Website Owner and Sponsor to avoid unexpected tax obligations.

In Iowa, nexus is established when a business has a physical presence, such as an office, warehouse, or employees. Additionally, substantial online activity, such as sales, can trigger nexus. Understanding these rules is essential when creating an Iowa Agreement between Website Owner and Sponsor to ensure compliance with state tax laws.

Nexus rules vary by state but generally include having a physical location, employees, or making a certain number of sales within the state. For Iowa, these rules ensure businesses collect appropriate sales tax on transactions. Clarifying nexus rules is important before establishing an Iowa Agreement between Website Owner and Sponsor.

Nexus requirements outline the conditions under which a business must collect sales tax. Typically, a business must establish a physical presence or significant activities in a state to create nexus. Engaging in an Iowa Agreement between Website Owner and Sponsor may create nexus, so understanding these requirements is vital for compliance.

As of my last update, the sales tax in the state of Iowa is set at 6%. However, certain local jurisdictions may impose additional local taxes, increasing the total sales tax rate. When forming an Iowa Agreement between Website Owner and Sponsor, it’s wise to factor in these potential taxes for financial planning.

Nexus restrictions refer to the obligations a business has concerning tax collection based on the business's connection to a state. In Iowa, having nexus can mean that a business is responsible for collecting and remitting sales tax. It is crucial to understand these restrictions when entering into an Iowa Agreement between Website Owner and Sponsor, as they can impact the project's financial responsibilities.