Iowa Guaranty of Promissory Note by Individual - Corporate Borrower

Description

How to fill out Guaranty Of Promissory Note By Individual - Corporate Borrower?

Are you currently in the location where you will require documents for either business or personal use almost all the time.

There is a range of legal document templates accessible online, but finding forms you can trust isn't easy.

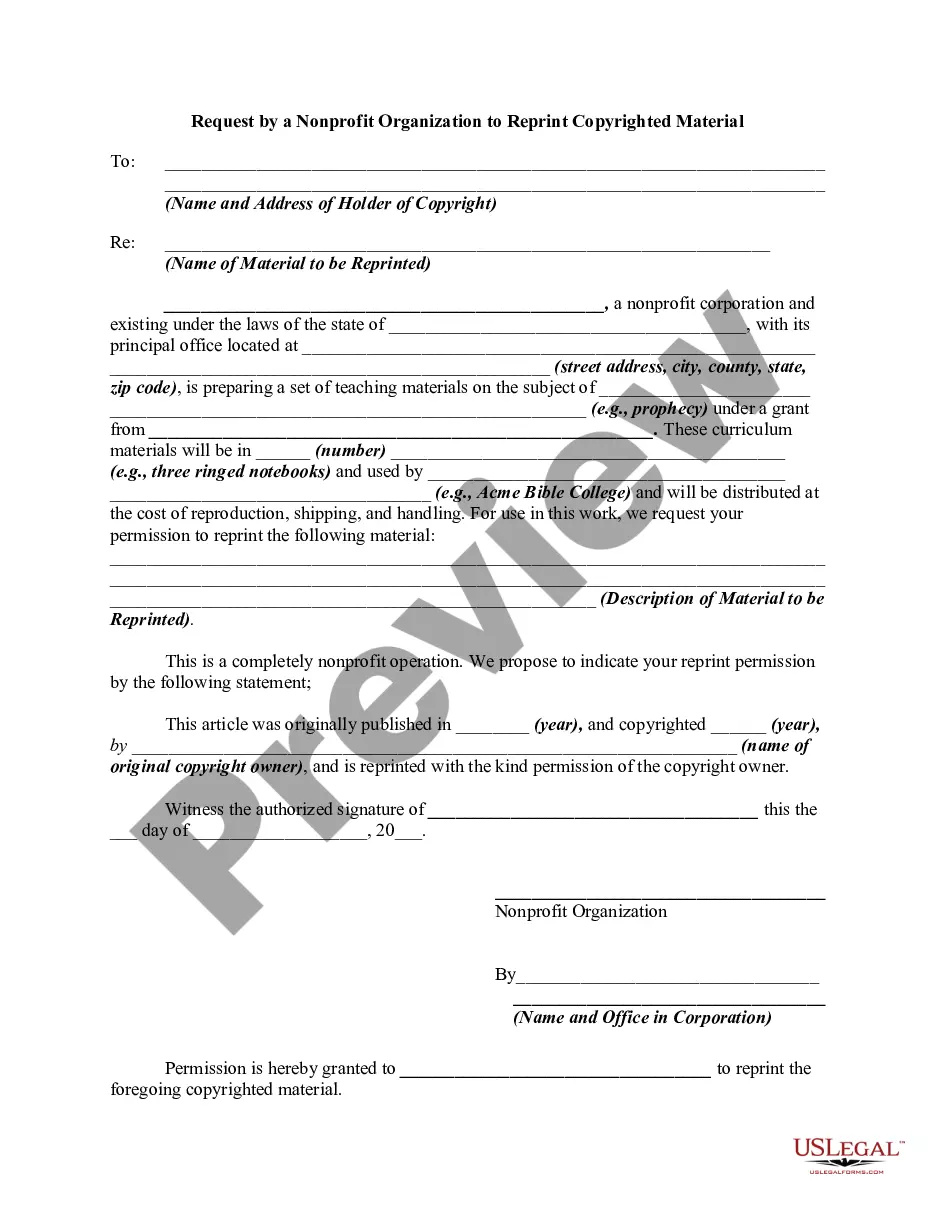

US Legal Forms provides a vast selection of document templates, such as the Iowa Guaranty of Promissory Note by Individual - Corporate Borrower, that are designed to meet federal and state requirements.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Iowa Guaranty of Promissory Note by Individual - Corporate Borrower whenever needed. Simply select the desired document to download or print the form template. Use US Legal Forms, the most comprehensive collection of legal forms, to save time and reduce errors. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Iowa Guaranty of Promissory Note by Individual - Corporate Borrower template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is for the correct city/state.

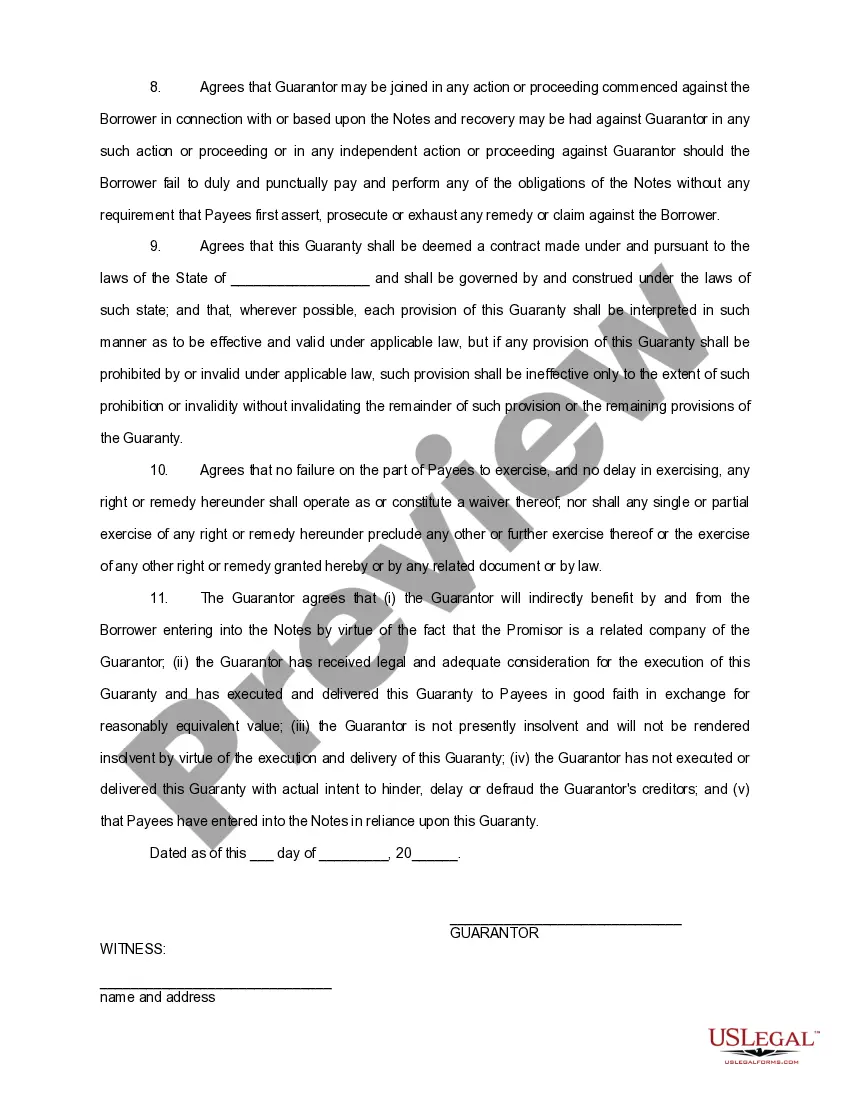

- Use the Preview option to review the form.

- Check the description to make sure you have selected the right document.

- If the document is not what you are looking for, utilize the Search feature to find the form that suits your needs.

- Once you find the appropriate document, click Get now.

- Choose the pricing plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

Form popularity

FAQ

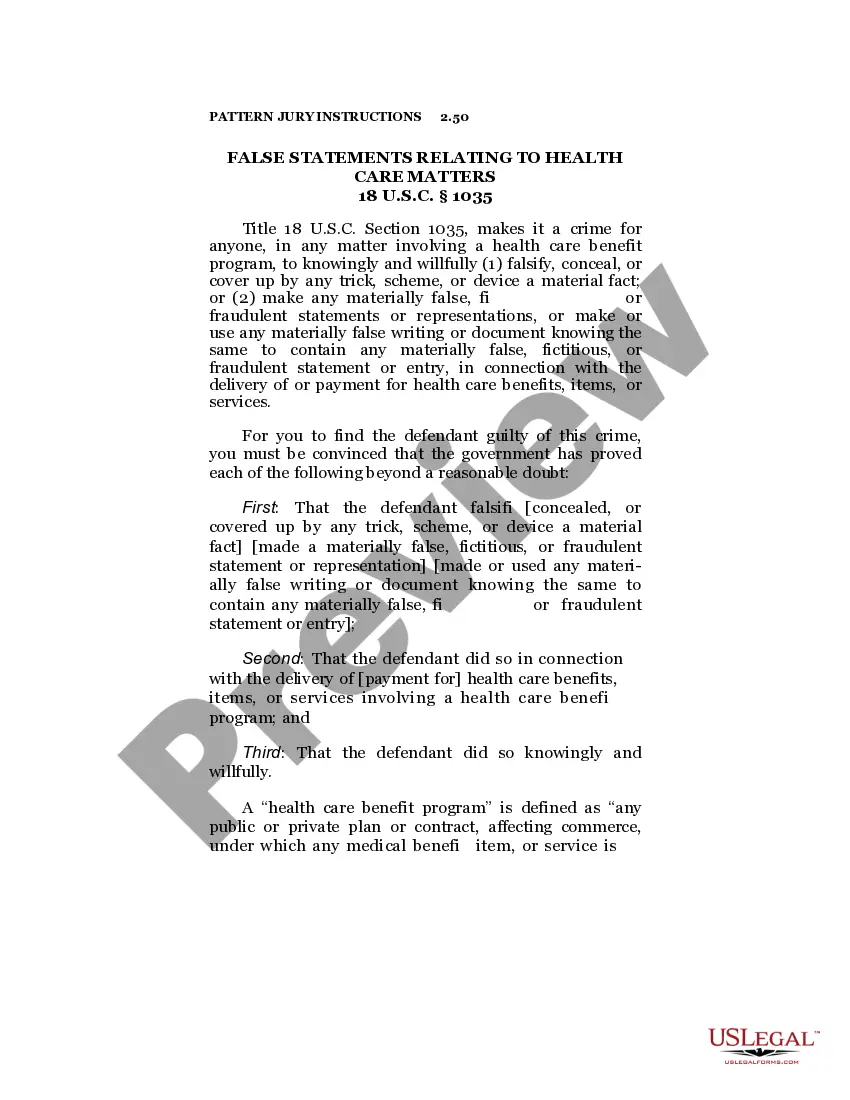

Another important distinction to remember is that a co-borrower is primarily liable for the debt from its inception. In contrast, a guarantor is not liable unless the underlying borrower defaults and, depending on the terms of the guaranty, the lender pursues collection efforts against the borrower.

A promissory note is a legal document signed by a debtor who promises to pay a debt in a form and manner as described in the document. A personal guaranty, as defined at businessdictionary.com, is an agreement that makes one liable for one's own or a third party's debts or obligations.

To be enforceable as a personal guaranty, the signatory must sign the guaranty in his or her personal capacity and not as the president or CEO of the company receiving the loan, which is its own legal entity, separate and apart from the people that run and operate it.

Having a co-applicant can make an application more attractive since it involves additional sources of income, credit, or assets. A co-applicant has more rights and responsibilities than a co-signer or guarantor.

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

The most important difference between a cosigner and a guarantor is that a cosigner is immediately responsible for paying rent, just as the tenant is. A guarantor is only responsible for paying rent when the tenant fails to do so themselves.

The Benefits of a Personal GuaranteeThe asset (promissory note) is protected by the collateral (the guarantor's promise to pay, and the ability to sue the guarantor personally for noncompliance with the terms of the promissory note). As with any collateral, a personal guarantee gives the asset more security.

Guarantee Obligation as to any Person (the guaranteeing person), any obligation, including a reimbursement, counterindemnity or similar obligation, of the guaranteeing Person that guarantees or in effect guarantees, or which is given to induce the creation of a separate obligation by another Person (including any

Similarly, the terms co-maker or joint-maker involve two or more individuals signing documents that state that each of them will repay loans and is liable to ensure that the full amount of the repayment is paid.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.