Iowa Personal Property Inventory

Description

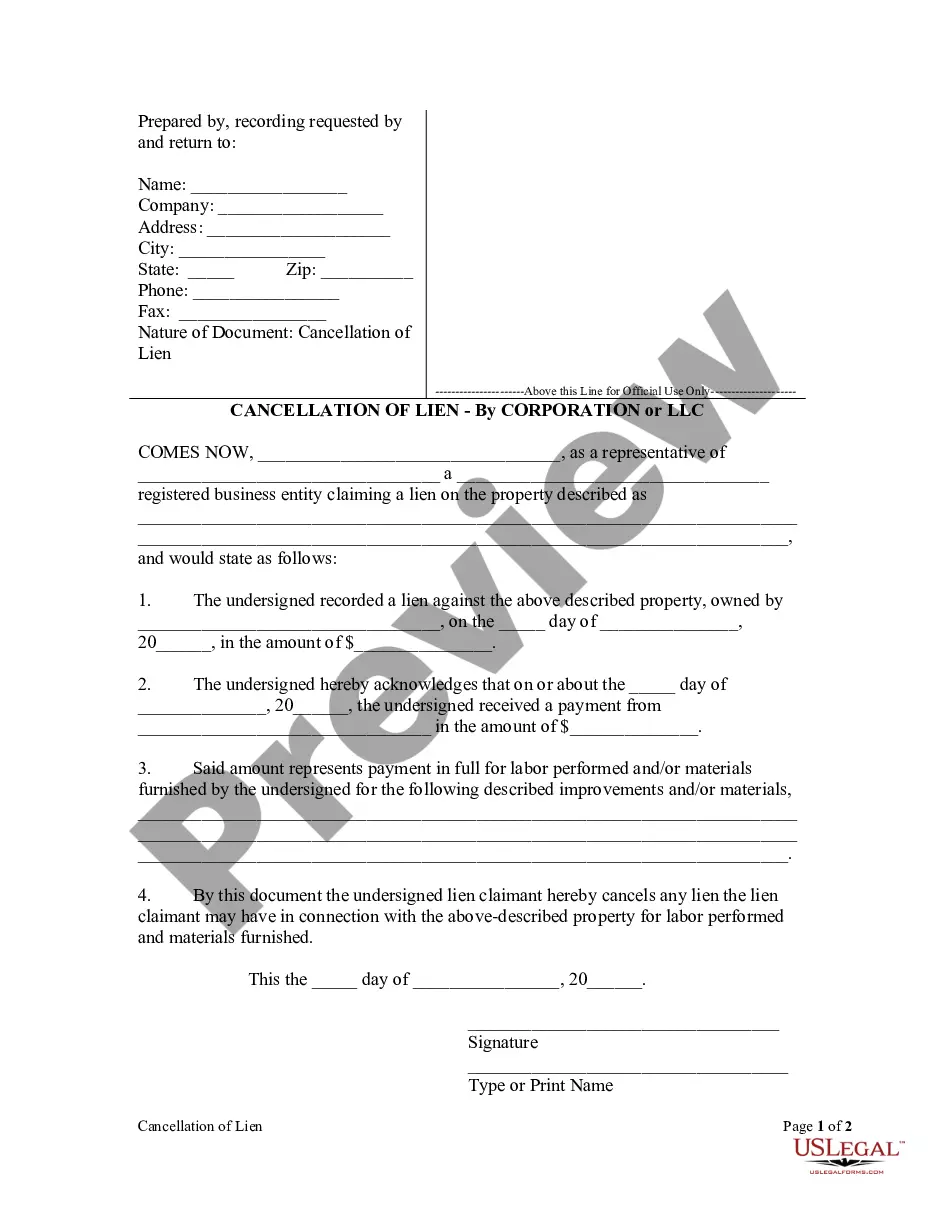

How to fill out Personal Property Inventory?

If you want to compile, acquire, or generate official document templates, use US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly and convenient search feature to find the documents you require.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select your preferred pricing plan and enter your details to create an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Iowa Personal Property Inventory. Each legal document format you purchase is your property indefinitely. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Compete and acquire, and print the Iowa Personal Property Inventory using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to obtain the Iowa Personal Property Inventory with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to access the Iowa Personal Property Inventory.

- You can also retrieve forms that you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/region.

- Step 2. Use the Review option to examine the content of the form. Don’t forget to review the description.

- Step 3. If you are not happy with the form, use the Search box at the top of the screen to locate different versions of the legal form template.

Form popularity

FAQ

To make a personal property inventory, begin by listing all items in your home. Organize them by category, and use detailed notes for each item, such as condition and estimated value. Utilizing platforms like US Legal Forms can help you create an efficient Iowa Personal Property Inventory that meets your needs.

Filling out an inventory for a decedent's estate requires you to gather all personal property left behind. List each item methodically, including its value and location. Ensure your documentation reflects a detailed Iowa Personal Property Inventory, as this will be essential for the probate process.

Making a personal inventory begins with collecting all property and grouping similar items together. Use a checklist to record important information like serial numbers and photos, which enhance your Iowa Personal Property Inventory. This process proves beneficial during estate planning or insurance purposes.

In Iowa, filing a small estate affidavit with the court is generally required if the value of the estate is below a certain threshold. This process simplifies the transfer of personal property and ensures that all assets are accounted for. Preparing an accurate Iowa Personal Property Inventory can streamline this affidavit process.

To inventory your belongings, start by walking through each room in your home. Make a list of all items, noting their condition and estimated value. This thorough approach helps create a clear Iowa Personal Property Inventory, useful for insurance claims or estate planning.

Making an inventory of your possessions provides peace of mind and organization in your life. It gives you a solid overview of what you own, which can facilitate the decluttering process. Additionally, having an Iowa Personal Property Inventory ensures you are prepared for emergencies, helping you manage your assets effectively when it matters most.

Creating a personal property inventory improves your ability to protect high-value items in your home. It enables you to quickly identify what you own, making it easier to evaluate insurance needs. By investing time in an Iowa Personal Property Inventory, you ensure that valuable items remain adequately covered in case of a loss.

One significant reason for preparing a personal property inventory is to keep track of your assets for estate planning purposes. A comprehensive inventory allows you to make informed decisions regarding your belongings, ensuring that your treasured items go to the right heirs. An Iowa Personal Property Inventory also minimizes disputes among family members by providing a clear allocation of your possessions.

The primary purpose of a personal inventory is to catalog and document your belongings in a systematic manner. This not only aids in protecting your assets but also helps you maintain an organized household. By creating an Iowa Personal Property Inventory, you enhance your ability to recover from unexpected events, making it easier to file claims and receive reimbursements.

Preparing a personal property inventory provides a clear record of your possessions, which simplifies the insurance claims process. In the event of theft or damage, having an accurate inventory streamlines communication with your insurance provider. Furthermore, an Iowa Personal Property Inventory helps you to assess the value of your belongings, ensuring you have adequate coverage.