Iowa Demand for Collateral by Creditor

Description

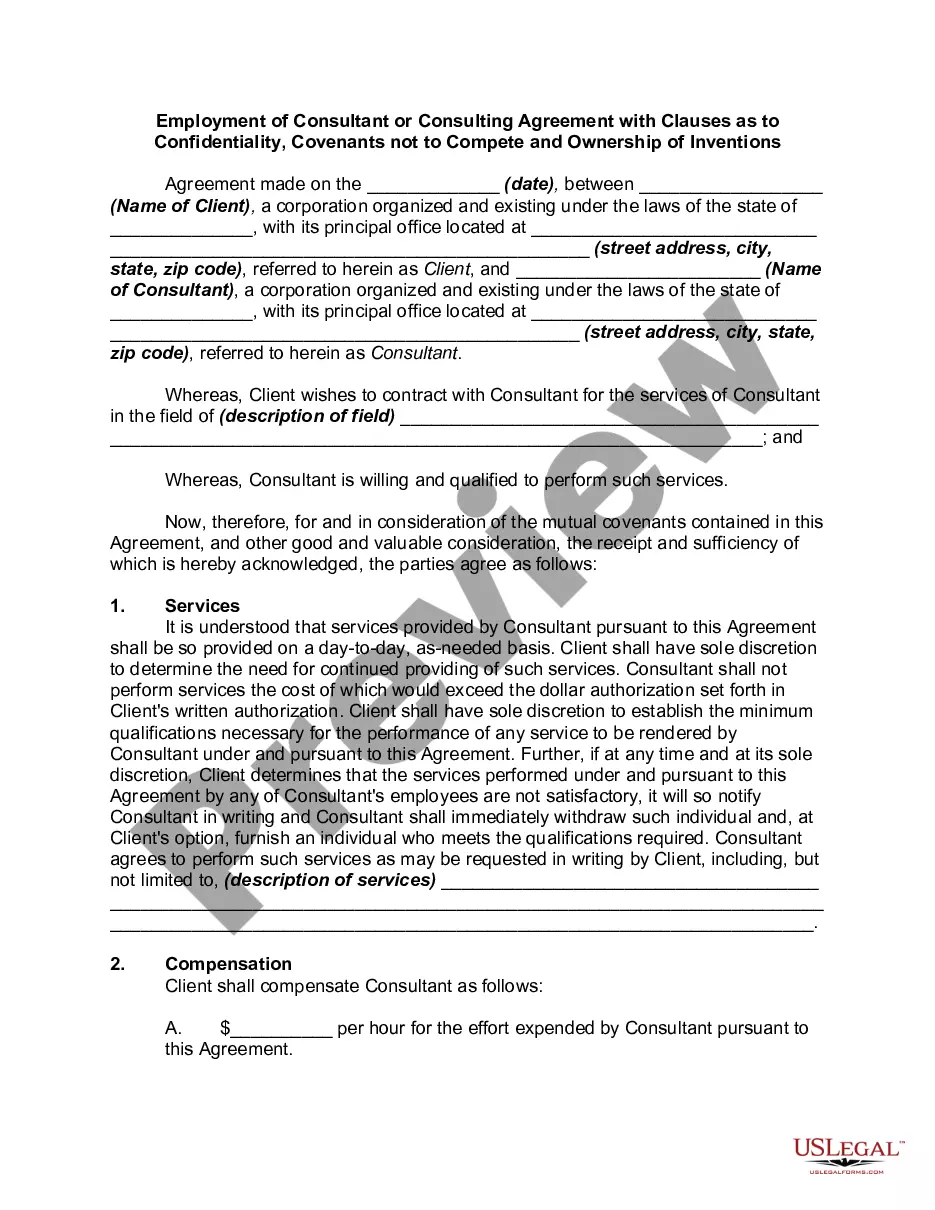

How to fill out Demand For Collateral By Creditor?

You might spend hours online looking for the authentic document format that fulfills the federal and state requirements you need.

US Legal Forms offers a vast array of authentic templates that are examined by professionals.

You can easily download or print the Iowa Demand for Collateral by Creditor from the service.

If available, take advantage of the Preview button to check through the document format as well.

- If you currently possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Afterward, you can complete, modify, print, or sign the Iowa Demand for Collateral by Creditor.

- Every authentic document format you acquire is yours permanently.

- To retrieve another version of any purchased template, go to the My documents tab and click on the corresponding button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for your county/city of choice.

- Review the template outline to confirm you have chosen the appropriate type.

Form popularity

FAQ

The State Small Business Credit Initiative (SSBCI) program provides funding to support state-level business financing programs. This initiative helps small businesses, particularly those that are underserved, to access capital and grow. By utilizing insights from the Iowa Demand for Collateral by Creditor, businesses can navigate federal and state resources for optimal funding opportunities.

In Iowa, small business grants are designed to support entrepreneurs and small business owners in their projects and expansions. These grants do not have to be repaid, making them an appealing option for funding. By exploring the Iowa Demand for Collateral by Creditor, business owners can learn how to leverage these grants effectively to strengthen their financial position.

A UCC filing in Iowa is generally valid for five years. To maintain your security interest, you must file a continuation before this period ends. This is particularly important for creditors relying on the Iowa Demand for Collateral by Creditor, as it helps protect your lawful rights.

In Iowa, a UCC fixture filing is valid for five years, similar to a standard UCC filing. Creditors can file a continuation statement to extend this period, ensuring their interests in fixtures remain secure. Utilizing resources like US Legal Forms can help you navigate these filings effectively under the Iowa Demand for Collateral by Creditor.

A UCC 3 is a termination statement that effectively ends a previously filed UCC-1 financing statement. Once filed, it remains valid as long as the original UCC-1 filing is active. For optimal management of your interests under the Iowa Demand for Collateral by Creditor, stay informed about any actions you take regarding UCC filings.

Filing a UCC in Iowa is a straightforward process. You need to prepare the UCC-1 Financing Statement, include the required information, and submit it to the Iowa Secretary of State’s office. Using a platform like US Legal Forms can simplify this process, providing templates and guidance tailored to the Iowa Demand for Collateral by Creditor.

UCC filings are typically valid for five years from the date of filing. However, creditors can extend this period by filing a continuation statement before expiration. This is essential for maintaining priority under the Iowa Demand for Collateral by Creditor, as it ensures your interest remains protected.

Yes, you can continue an expired Uniform Commercial Code (UCC) filing by filing a continuation statement. This process ensures your security interest remains valid and protects your rights under the Iowa Demand for Collateral by Creditor. Remember to file the continuation within the specified time frame to avoid lapses.

Iowa Code 537.5105 addresses the judgment and remedies available to a creditor in consumer credit transactions. This code outlines the legal recourse creditors can pursue when debts remain unpaid. Understanding this code is significant for both creditors and debtors who wish to comprehend their rights. For effective navigation through these legal structures concerning Iowa Demand for Collateral by Creditor, consider consulting reputable legal platforms.

In Iowa, the statute of limitations on medical debt is typically ten years. During this period, creditors can take actions related to recovery. Yet, knowing your rights and potential defenses is essential when facing such debts. For more detailed information about handling medical debts and understanding Iowa Demand for Collateral by Creditor, options like UsLegalForms can be beneficial.