Iowa Employment Application for Taxi Driver

Description

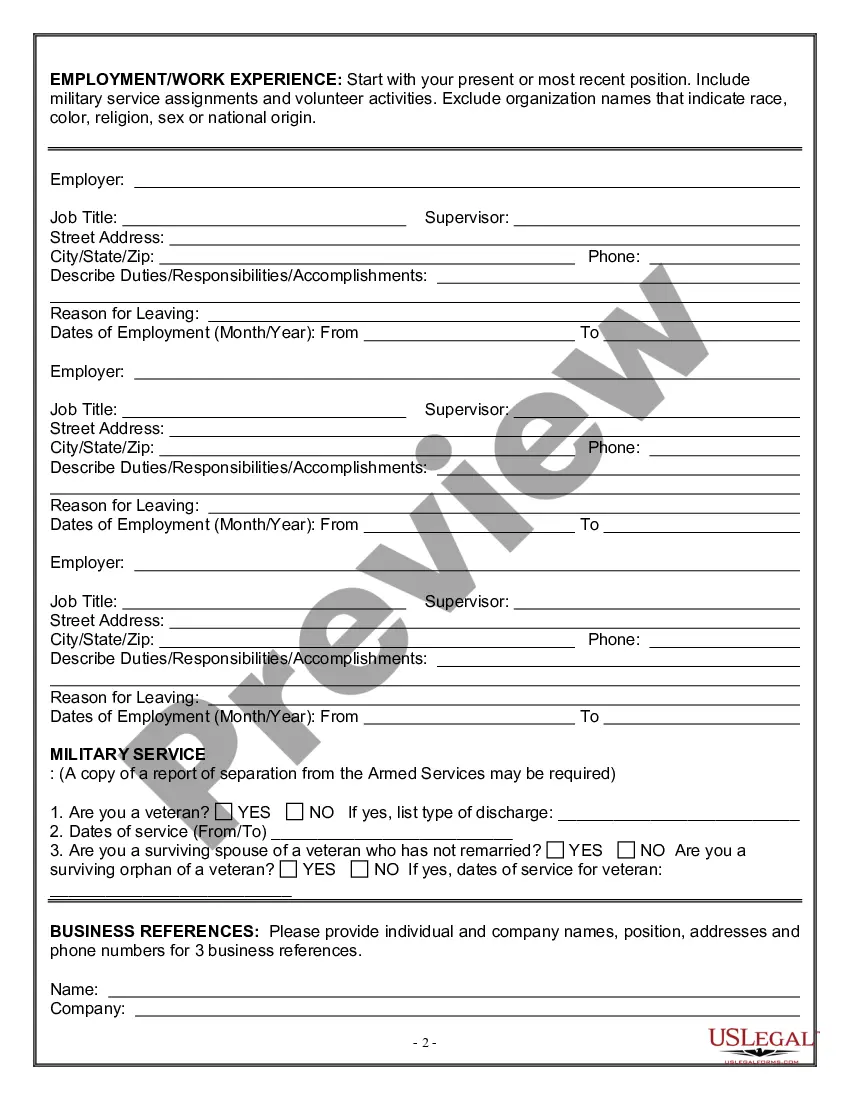

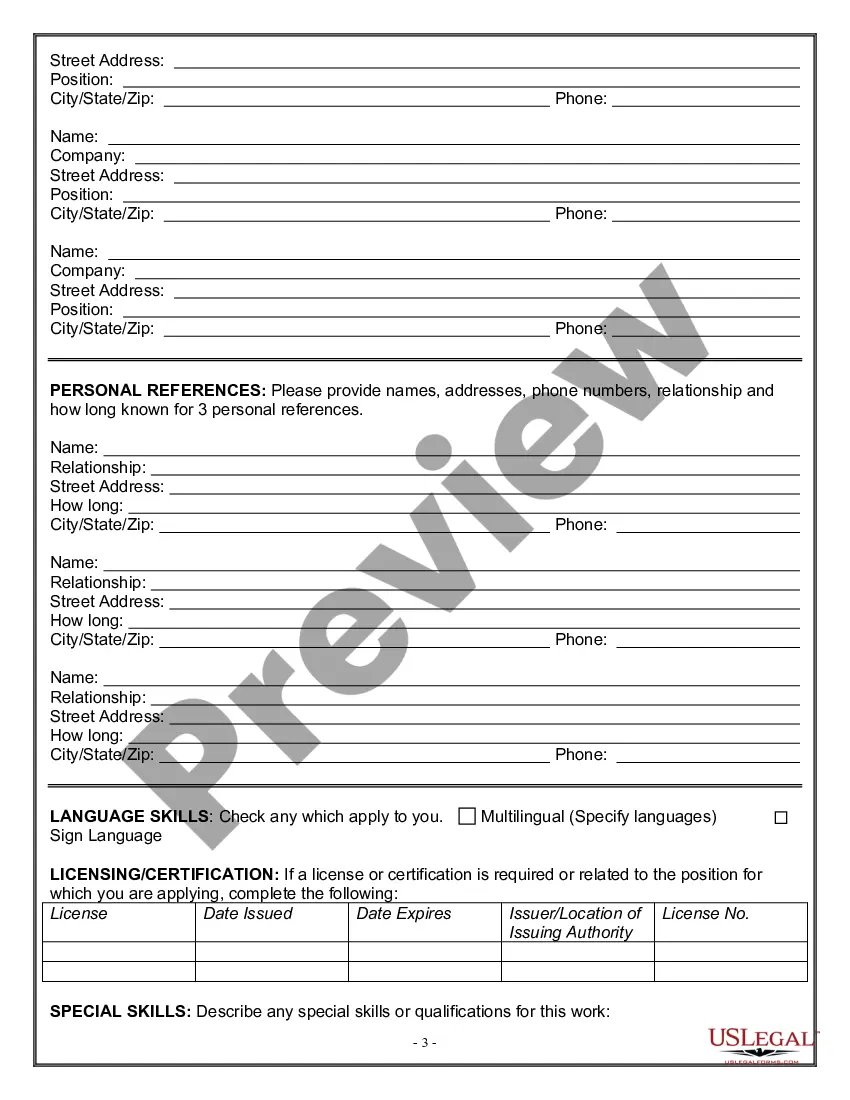

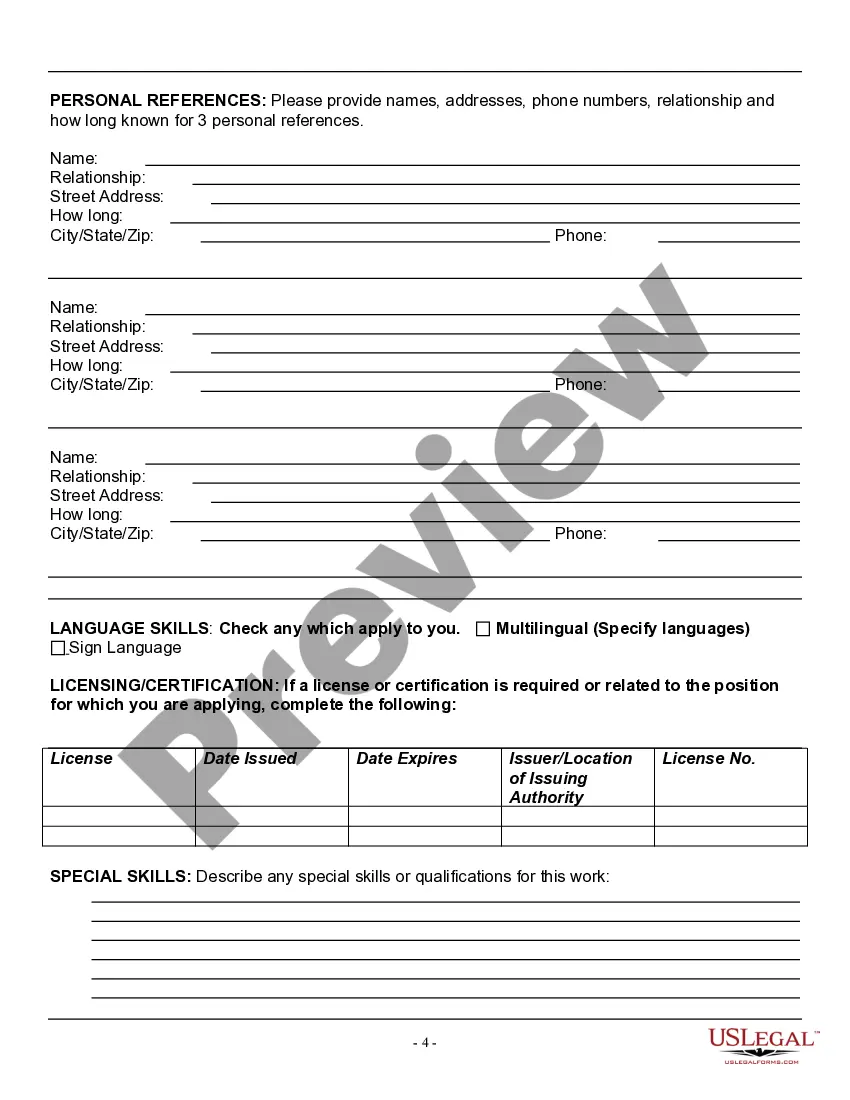

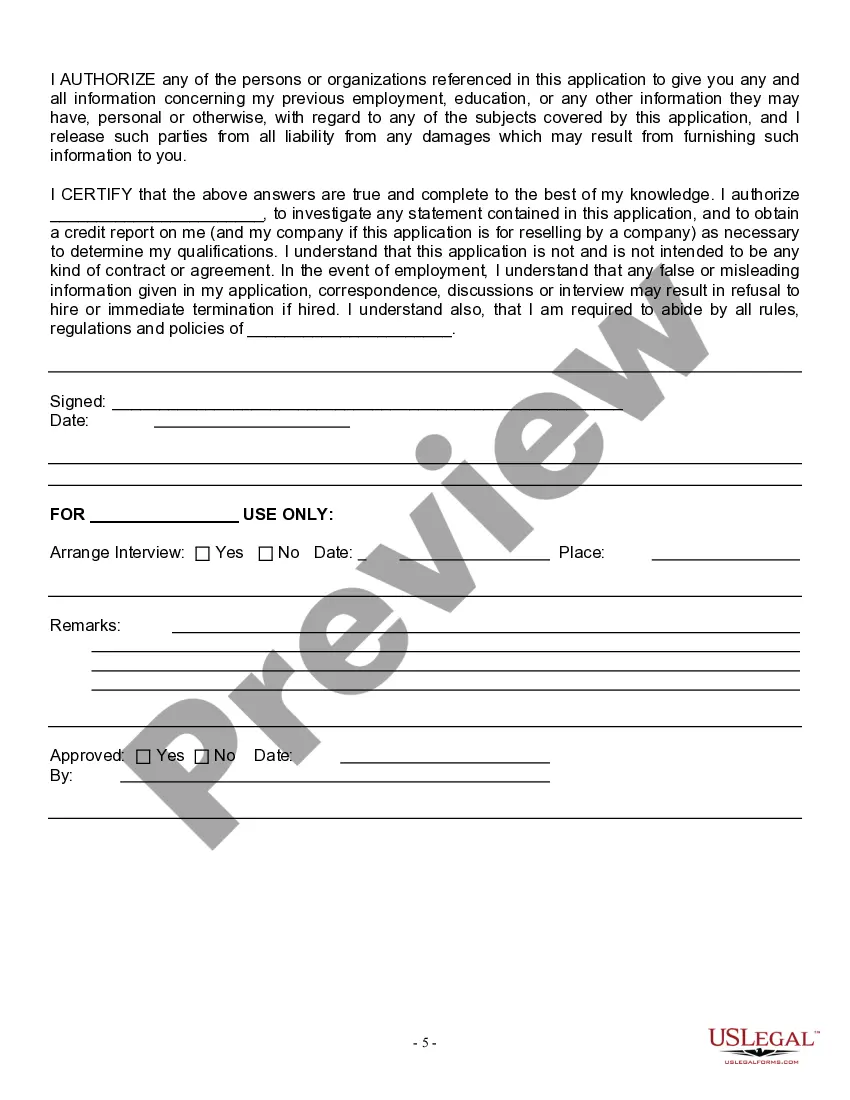

How to fill out Employment Application For Taxi Driver?

Are you in a position where you require documents for either organizational or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating ones you can trust is not simple.

US Legal Forms provides thousands of form templates, such as the Iowa Employment Application for Taxi Driver, designed to comply with state and federal regulations.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Iowa Employment Application for Taxi Driver at any time, if necessary. Simply click the desired form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can obtain the Iowa Employment Application for Taxi Driver template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is for your specific city/county.

- Utilize the Preview button to review the document.

- Check the description to confirm that you have chosen the correct form.

- If the form is not what you are looking for, use the Search area to find the form that fits your needs and criteria.

- When you have located the appropriate form, click Get now.

- Choose the pricing option you prefer, fill in the necessary information to create your account, and complete the purchase with your PayPal or Visa or Mastercard.

Form popularity

FAQ

Minimum Requirements:Have a chauffeur's license with a Class D endorsement or able to obtain one before driving.Have no more than three (3) moving violations.Have no more than one (1) fault accident in the prior three (3) years.Have no alcohol or drug convictions in the prior five (5) years.More items...

Be at least 21 years of age. Hold a full UK driver's license. Undergo a CRB check. Demonstrate proof that they have the right to live and work in the UK.

You are considered a self-employed taxi driver if you work for yourself and set your own hours. Even if you use someone else's vehicle for your job and use the services of a dispatcher, in the eyes of HRMC you are considered an independent contractor.

Taxi refers to for-hire automobile travel supplied by private companies. Taxi service is an important Transportation Option that meets a variety of needs, including Basic Mobility in emergencies, general transportation for non-drivers, and mobility for Tourists and visitors.

As a taxi driver, you are considered self-employed if you set your own hours and no one supervises how you do your job. Even if you rent your cab from a fleet and use a dispatcher, you are considered an independent contractor. You will need to take every possible deduction on your taxes to lower your tax bill.

The two most widely used forms for self-employed taxi drivers are CWF1 which is used for newly self-employed workers, and SA1 which is used if you're currently filing any other tax returns, such as if you're a buy to let landlord.

Most Uber and Lyft drivers report income as sole proprietors, which allows you to report business income on your personal tax return.

Whether you are working in a black cab or for a private taxi firm, the vast majority of taxi drivers are self-employed. A good way to start out as a taxi driver is through working for a taxi firm on a freelance basis.

Taxi & private hireApply for a taxi driver licence.Apply for a taxi vehicle licence.Information for fleet owners.Learn the Knowledge of London.Taxi top advertising.Apply for a private hire driver licence.Apply for a private hire vehicle licence.Apply for a private hire operator licence.More items...

As a taxi driver, you are considered self-employed if you set your own hours and no one supervises how you do your job. Even if you rent your cab from a fleet and use a dispatcher, you are considered an independent contractor. You will need to take every possible deduction on your taxes to lower your tax bill.