Iowa Corporate Resolution for Nonprofit Organizations

Description

How to fill out Corporate Resolution For Nonprofit Organizations?

Are you currently in a situation where you require documents for either business or personal needs almost every day.

There are numerous legitimate document templates available online, but finding ones you can trust isn't easy.

US Legal Forms offers a vast array of template documents, including the Iowa Corporate Resolution for Nonprofit Organizations, designed to meet federal and state regulations.

Once you find the correct form, click on Purchase now.

Choose your desired pricing plan, enter the necessary information to set up your account, and pay for your order using PayPal or a credit card.

- If you are familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Iowa Corporate Resolution for Nonprofit Organizations template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct area/state.

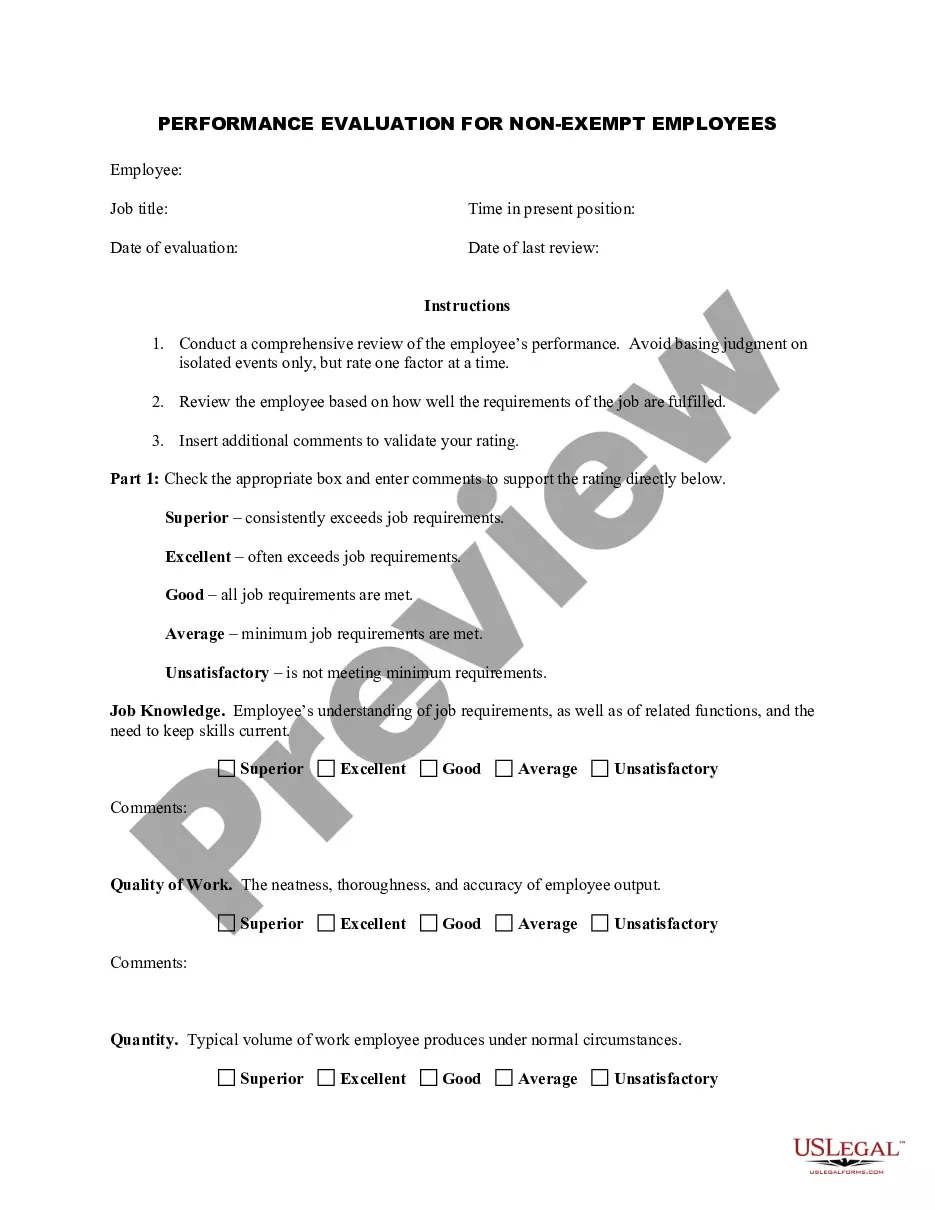

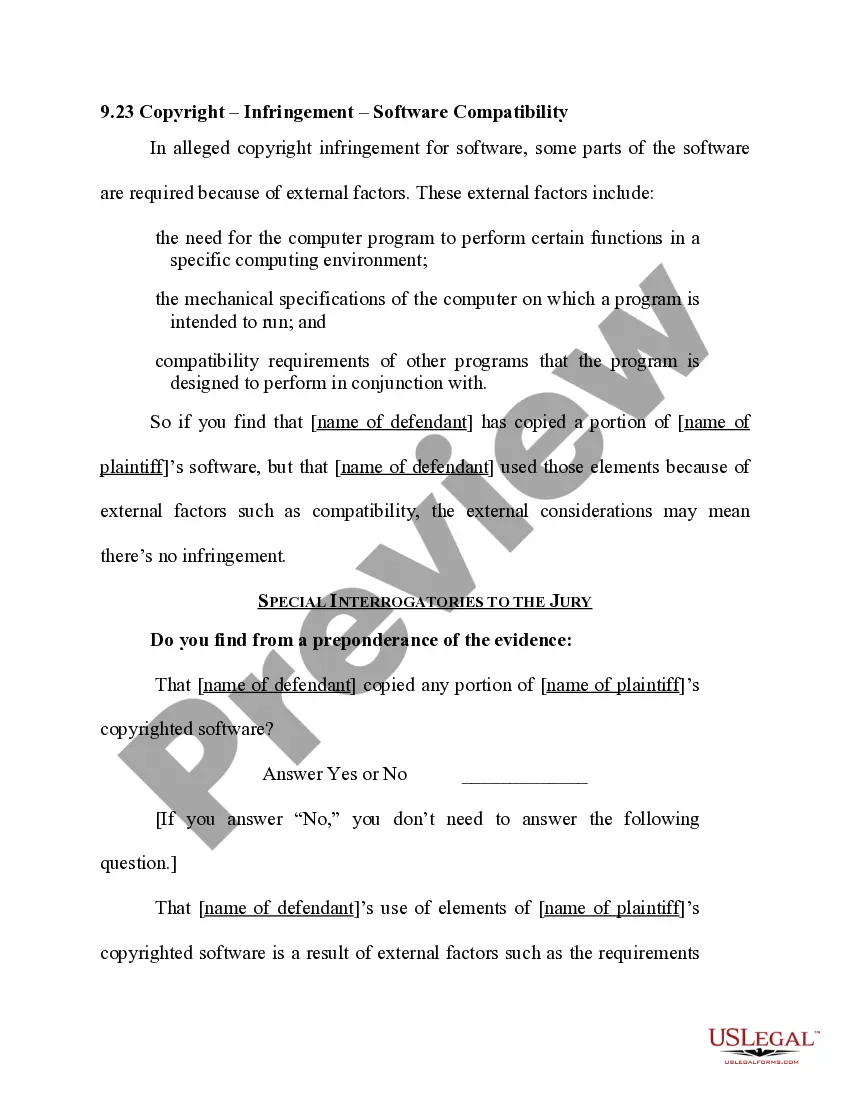

- Use the Review option to check the document.

- Read the description to confirm you have selected the right form.

- If the document is not what you're looking for, use the Lookup field to find the form that fits your needs.

Form popularity

FAQ

The nonprofit organization structure is divided into 3 main functional areas: Governance, Administration, and Programs.Governance. A nonprofit's board of directors is the governing board of the organization.Administration.Programs.

Labeling a vote a resolution means that the board believed the issue was important enough to separate it from standard voting issues. A resolution is considered an official board action and it requires a quorum. Board directors must document all official board actions, including resolutions, in their meeting minutes.

The corporation is the most common, and usually best, form for a nonprofit organization.

No, a nonprofit organization is not a C corporation. As mentioned above, nonprofits operate under section 501(c) of the Internal Revenue Code and many of them operate under a tax exempt status. C Corporations pay taxes under Chapter C of the IRS tax code, which is where the name comes from.

Nonprofit organizations can be formed as a corporation, or as an unincorporated business form. 's Nonprofit Organizations section contains information and resources for small business owners who are interested in forming a nonprofit (tax-exempt) organization.

A 501(c)(3) eligible nonprofit board of directors in Iowa MUST: Have a minimum of five board members. Elect the following members: president, treasurer and secretary.

The purpose of the Iowa Principles and Practices for Charitable Nonprofit Excellence is to promote good management practices, ethical conduct, and public accountability for Iowa charitable nonprofit organizations as they perform their crucial community services.

In general, the SEC guidelines permit resolutions only from shareholders who have continuously held at least $2,000 of the company's stock for a year or longer. If a shareholder meets these requirements, then the board can choose to bring up the resolution for a vote at the next shareholder meeting.

Traditionally, when starting a nonprofit, the best choice for legal structure is to form a nonprofit corporation at the state level and to apply for 501(c)(3) tax exemption at the federal level.

Nonprofit corporations often deal with government agencies on issues of public concern, which may involve applying for grants, loans or other governmental approvals. In many situations, the government agency requires a corporate resolution to verify the board's approval for making the government application.