This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

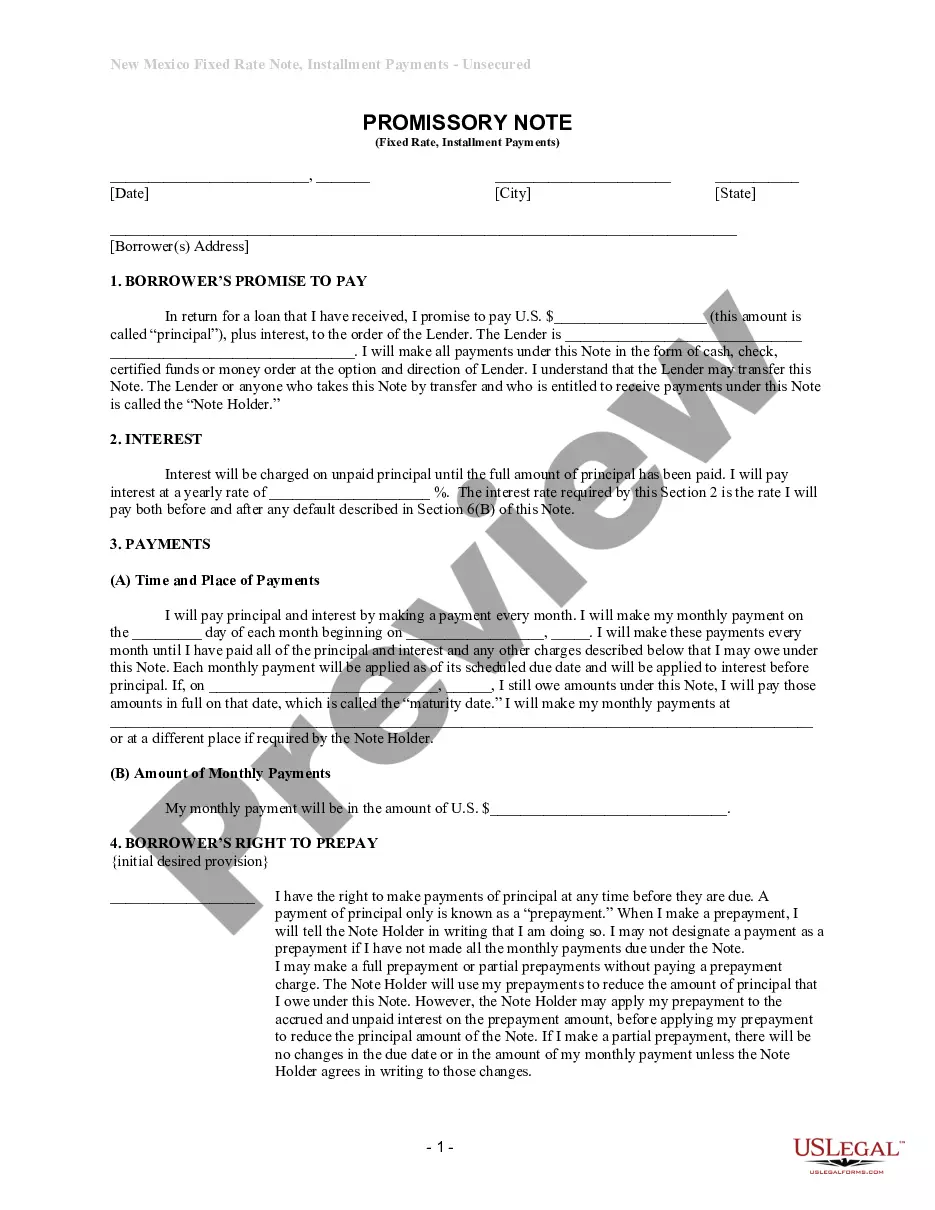

Kansas Installment Promissory Note with Acceleration Clause and Collection Fees

Description

How to fill out Installment Promissory Note With Acceleration Clause And Collection Fees?

You have the capability to devote time online searching for the appropriate legal document format that satisfies the state and federal criteria you require.

US Legal Forms provides thousands of legal templates that can be reviewed by experts.

It is easy to download or print the Kansas Installment Promissory Note with Acceleration Clause and Collection Fees from the platform.

Firstly, ensure you have selected the correct template for the county or city of your choice. Review the document description to confirm you have picked the right template. If available, use the Preview button to view the template as well.

- If you possess a US Legal Forms account, you can sign in and click the Obtain button.

- Subsequently, you can fill out, modify, print, or sign the Kansas Installment Promissory Note with Acceleration Clause and Collection Fees.

- Every legal template you acquire is yours indefinitely.

- To obtain another copy of the purchased document, go to the My documents section and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple steps outlined below.

Form popularity

FAQ

A handwritten promissory note can be legal, provided it includes the essential terms and is signed by both parties. However, legal validity may vary by jurisdiction and the specific circumstances surrounding the agreement. To ensure your handwritten note meets all requirements, consider crafting a Kansas Installment Promissory Note with Acceleration Clause and Collection Fees through a proven service like US Legal Forms. Their templates can help you avoid pitfalls and enhance the enforceability of your note.

Yes, you can write your own promissory note as long as it includes all necessary elements, such as the amount, terms, and signatures. However, it's essential to ensure that it complies with state laws and regulations, especially for more complex agreements. Using a reliable platform like US Legal Forms can help you create a comprehensive Kansas Installment Promissory Note with Acceleration Clause and Collection Fees to ensure legal validity. This way, you protect your interests and avoid potential disputes.

A simple promissory note may include the borrower's name, the lender's name, the principal amount, the interest rate, and a repayment schedule. For instance, if you borrow $1,000 with an interest rate of 5%, the note would clearly state how and when you will repay it. A Kansas Installment Promissory Note with Acceleration Clause and Collection Fees would add more details regarding penalties for late payments. Examples like this serve to protect both the lender and borrower.

The acceleration clause in a promissory note is a provision that permits the lender to demand full repayment if the borrower defaults or breaches certain conditions of the agreement. In the context of a Kansas Installment Promissory Note with Acceleration Clause and Collection Fees, this clause serves to protect the lender's interests by allowing swift action in case of non-compliance. It ensures that borrowers understand the importance of adhering to their repayment schedule.

To collect on a promissory note, first, contact the borrower to discuss payment options. If necessary, remind them of the terms in the Kansas Installment Promissory Note with Acceleration Clause and Collection Fees. If the borrower remains unresponsive, you might consider legal action to pursue the debt, ensuring compliance with state laws throughout the process.

Enforcing a promissory note legally typically involves filing a lawsuit or sending a collection notice for non-payment. With a Kansas Installment Promissory Note with Acceleration Clause and Collection Fees, your chances of successful enforcement improve because of the clear terms and obligations involved. You may also consider utilizing platforms like uslegalforms, which can provide templates and resources to help you navigate the enforcement process smoothly.

To accelerate a promissory note, the lender must issue a written notice of default to the borrower, stating the intention to demand the full balance due. In the context of a Kansas Installment Promissory Note with Acceleration Clause and Collection Fees, this process facilitates quicker recovery of owed funds. Make sure to follow any state-specific requirements to enforce this clause properly.

An acceleration clause in a promissory note allows the lender to demand the full outstanding balance if the borrower defaults on payments. This clause can provide security in a Kansas Installment Promissory Note with Acceleration Clause and Collection Fees, ensuring funds are recoverable promptly. It protects the lender's interests, especially if payments cease unexpectedly.

Yes, you can demand a promissory note if the terms allow for it, typically through the acceleration clause of the document. Claiming the full amount due often occurs following a breach of agreement by the borrower. Knowing how to properly execute this process is vital for lenders, especially when dealing with a Kansas Installment Promissory Note with Acceleration Clause and Collection Fees. If you need assistance, uslegalforms can provide the necessary resources to draft and enforce these documents effectively.

To accelerate a promissory note, the lender must formally notify the borrower of their intent to demand full repayment before the original due date. This usually occurs if the borrower defaults on the terms outlined in the Kansas Installment Promissory Note with Acceleration Clause and Collection Fees. The notification may include the reasons for acceleration, ensuring transparency and compliance with the law. It's vital to follow the proper legal procedures to enforce this clause effectively.