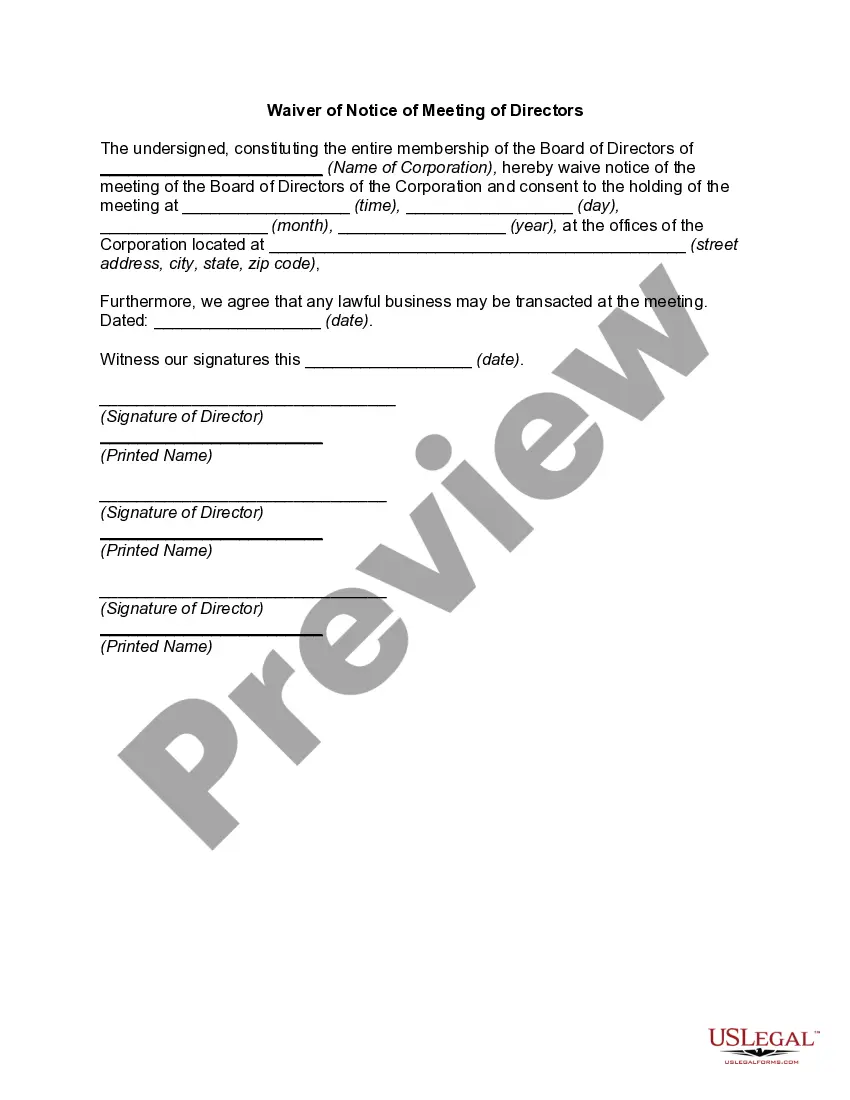

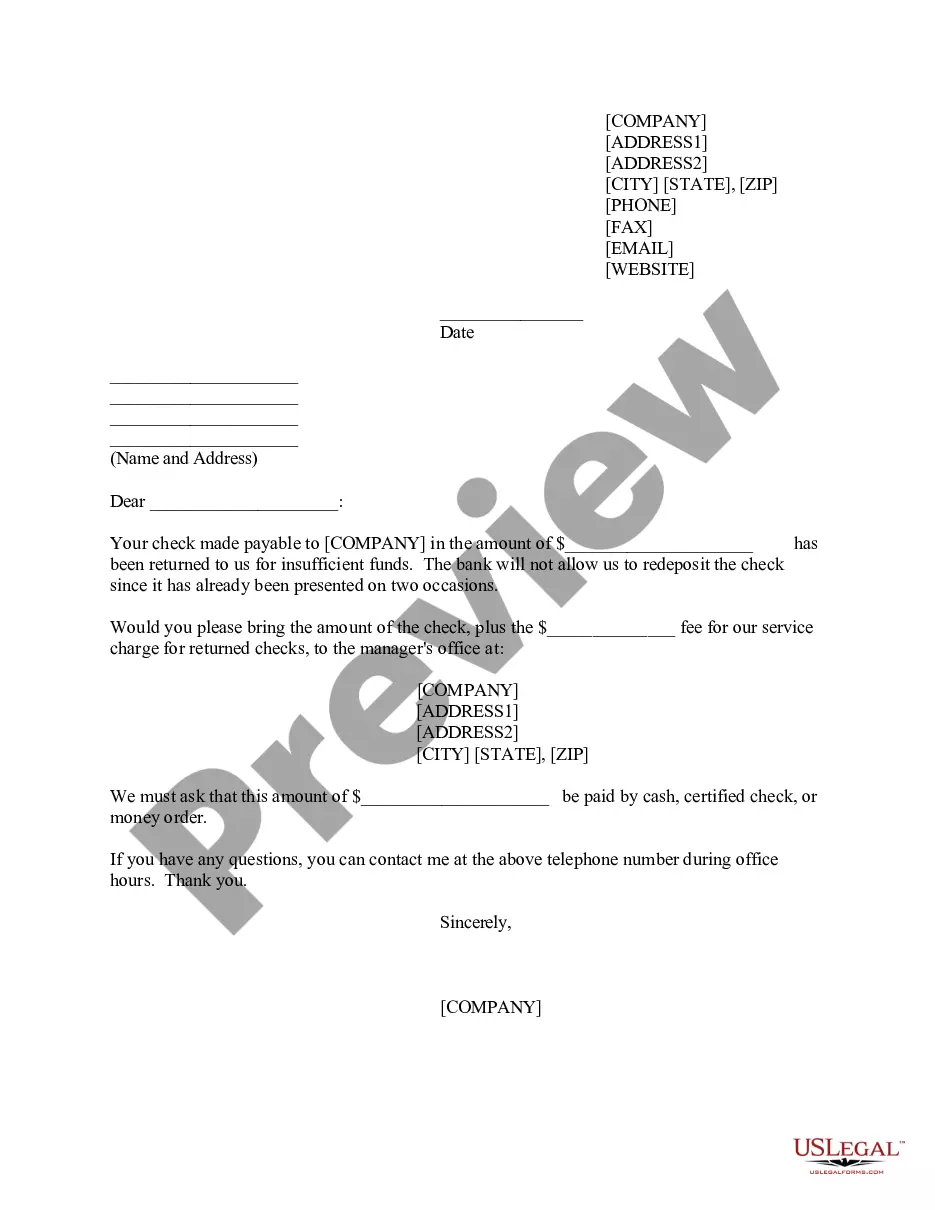

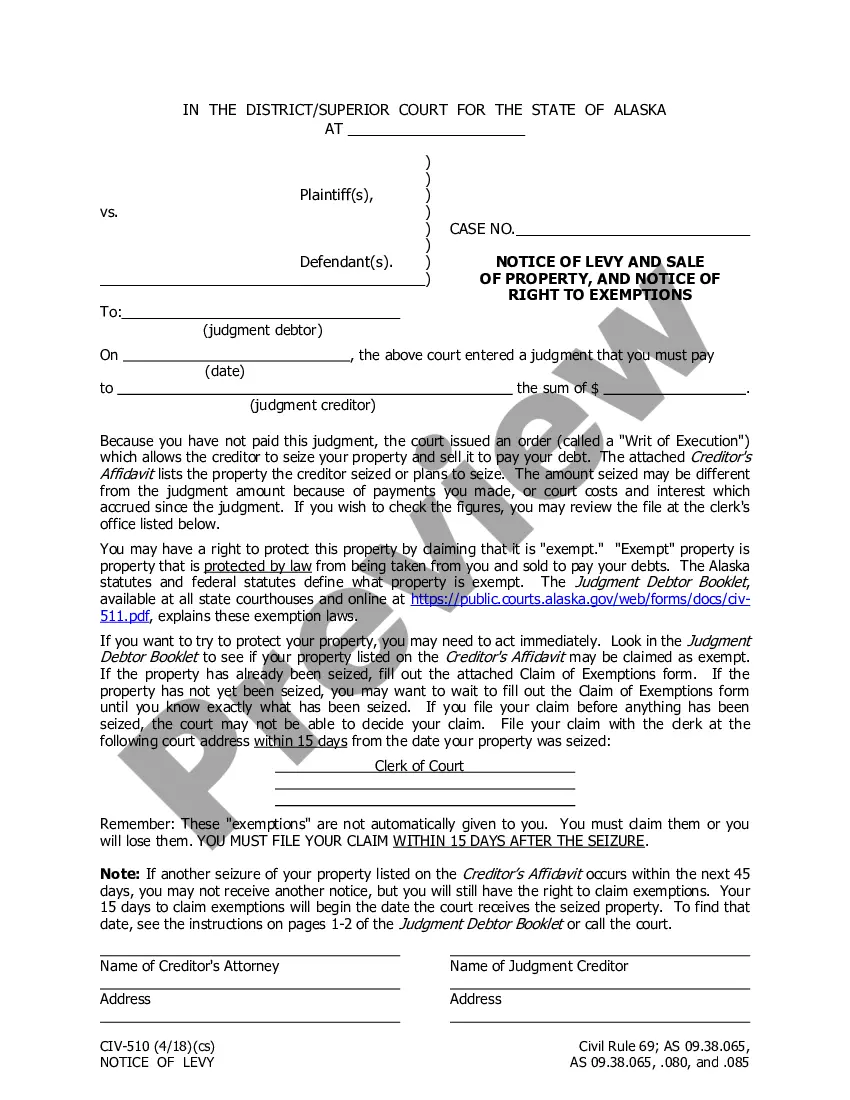

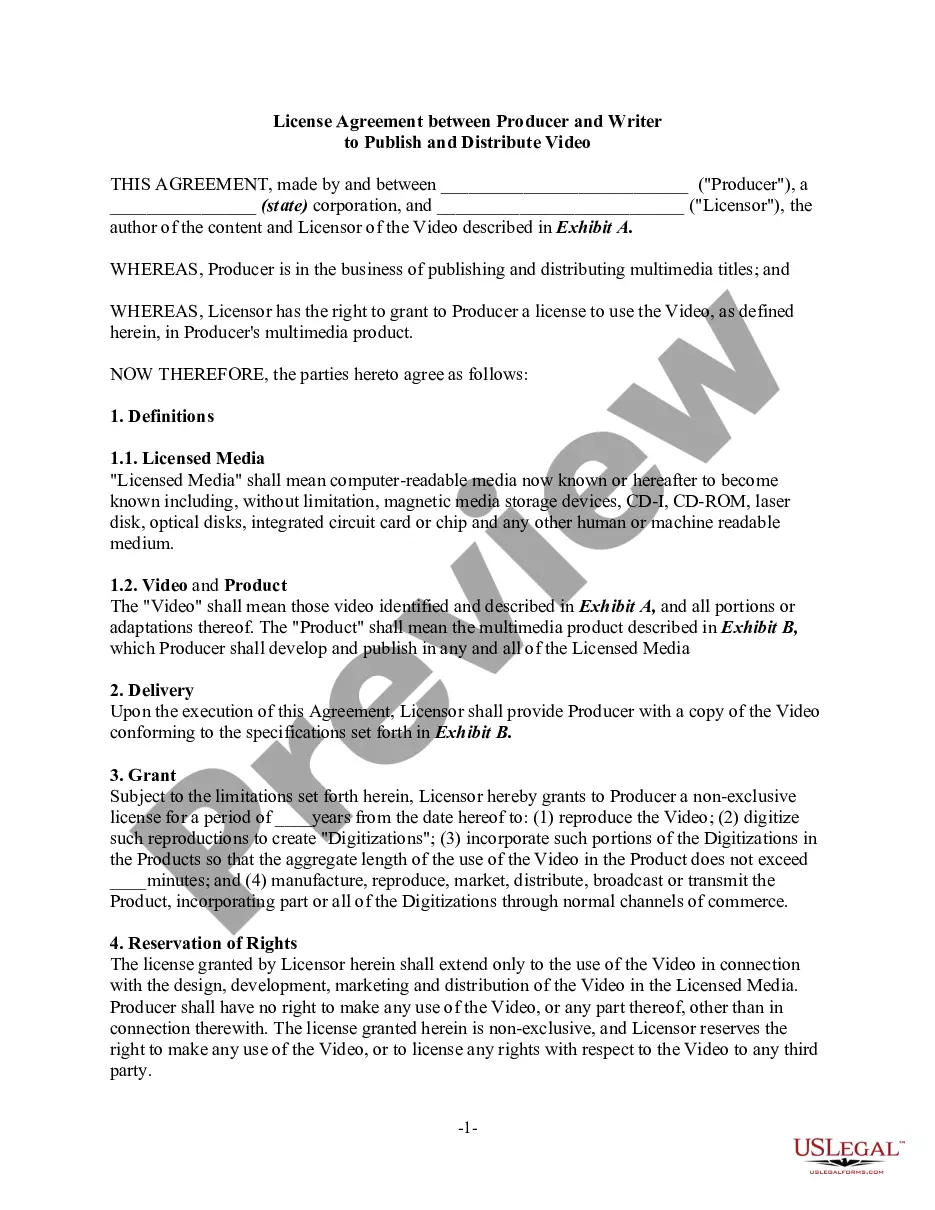

Form with which the secretary of a corporation notifies all necessary parties of the date, time, and place of the annual meeting of the board of directors.

Iowa Notice of Annual Meeting of Board of Directors - Corporate Resolutions

Description

How to fill out Notice Of Annual Meeting Of Board Of Directors - Corporate Resolutions?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, regions, or keywords. You can find the latest versions of documents such as the Iowa Notice of Annual Meeting of Board of Directors - Corporate Resolutions within moments.

If you already have a monthly subscription, Log In and obtain the Iowa Notice of Annual Meeting of Board of Directors - Corporate Resolutions from your US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded documents in the My documents section of your account.

Process the transaction. Use a credit card or PayPal account to finalize the payment.

Select the format and download the document to your device. Make modifications. Complete, edit, print, and sign the downloaded Iowa Notice of Annual Meeting of Board of Directors - Corporate Resolutions. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the document you need. Access the Iowa Notice of Annual Meeting of Board of Directors - Corporate Resolutions with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

- If you want to use US Legal Forms for the first time, here are essential tips to assist you in starting.

- Ensure you have selected the correct form for your city/region. Click on the Review option to examine the form's details.

- Check the form description to verify that you have chosen the appropriate document.

- If the document does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, choose the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

The revised Act governs all new and existing domestic and foreign corporations on January 1, 2022. Incorporation under the revised Act, as before, requires the filing of Articles of Incorporation with the Secretary of State.

The legal life of a corporation is perpetual. Corporations are a separate legal entity from the owners or shareholders, and as long as the corporation is in legal status, it is considered active.

Corporate opportunity refers to the fiduciary duties of senior executives and directors of corporations to not take business opportunities away from the corporation for their own benefit.

The following elements must be shown to prove200b usurping: 1) the opportunity was presented to the director or officer in his or her corporate200b capacity; 2) the opportunity is related to or connected with the200b corporation's current or proposed200b business; 3) the corporation has the financial ability to take advantage of

The answer is b. The stockholders, themselves, do not have the right to declare dividends to be paid to the...

A professional corporation shall be organized only for the purpose of engaging in the practice of one specific profession, or two or more specific professions which could lawfully be practiced in combination by a licensed individual or a partnership of licensed individuals, and for the additional purpose of doing all

Usurping of a Corporate Opportunity In other words, if an officer or director of a corporation is presented with a business opportunity that is in the same or a related business as the one in which the corporation is involved, they cannot simply pursue that opportunity for their own personal benefit.

With the enactment of HF 844, Iowa joins the majority of states that have enabling statutes allowing for benefit corporations.

Step 1: Name Your LLC. Choosing a company name is the first and most important step in starting your LLC in Iowa.Step 2: Choose Your Iowa Registered Agent.Step 3: File the Iowa LLC Certificate of Organization.Step 4: Create an LLC Operating Agreement.Step 5: Get an EIN and Complete Form 2553 on the IRS Website.

Who Can File? Any shareholder or group of shareholders own- ing $2,000 or more of a company's stock for a minimum of a year can introduce a proposal.